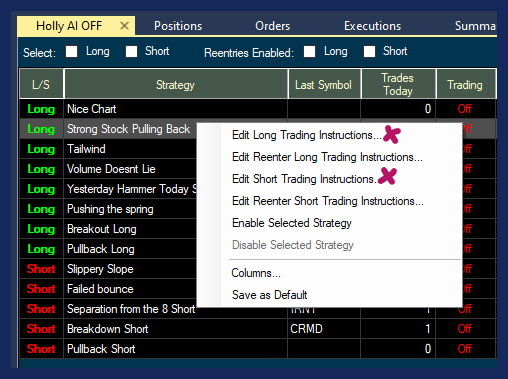

Edit Long Trading Instructions / Edit Short Trading Instructions

To create Trading Instructions, right-click into the Holly AI Tab and choose Edit Long Trading Instructions to configure Holly's Long Strategies and Edit Short Trading Instructions to configure Holly's Short Strategies.

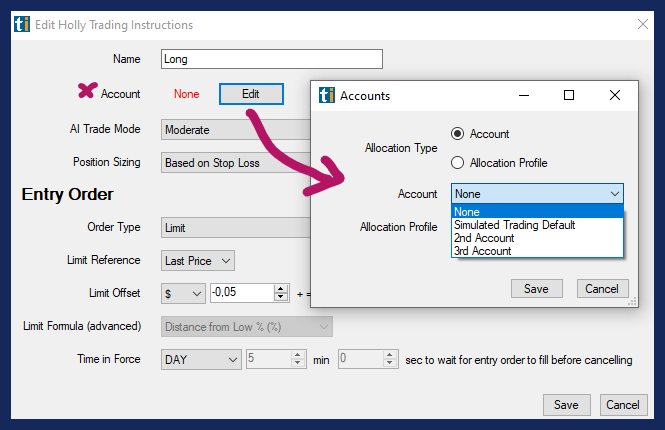

Account

Select the Edit button next to Account. As Allocation Type, select Account, then choose the connected Account and click Save.

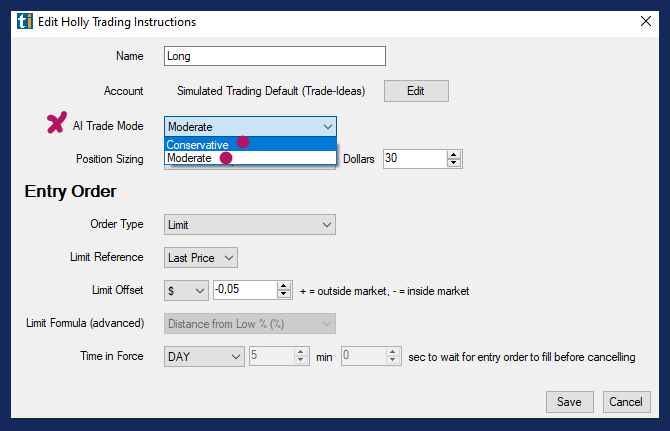

AI Trade Mode

From the dropdown, you can choose Moderate or Conservative. Due to the risks associated with not placing a Stop Loss, the Aggressive Mode is not an option in Holly Auto-Trading.

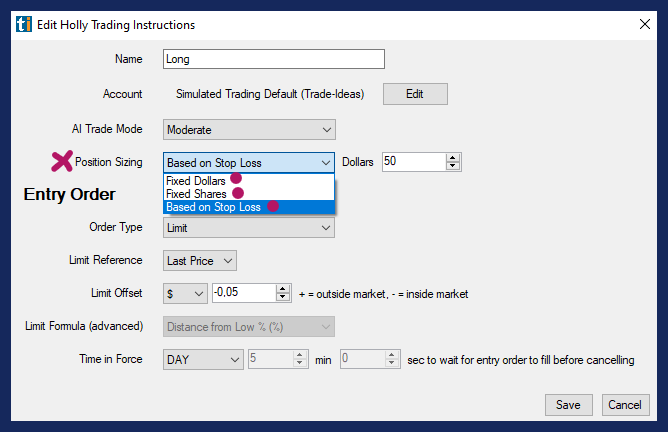

Position Sizing

Next, you can select how Holly calculates your position size.

You can base the position size on Fixed Dollars. If you entered $2000 as the amount and the stock price is $20, Holly will buy 100 shares. If the stock price is $40, she will conversely only buy 50 shares.

You can enter a fixed number of Shares per trade to buy or short.

To base your position size on a Stop Loss in Dollars, enter the total amount you are willing to risk. If you choose to risk $100 and Holly’s algorithmic stop loss per trade is $0,20, she will buy 500 shares per trade.

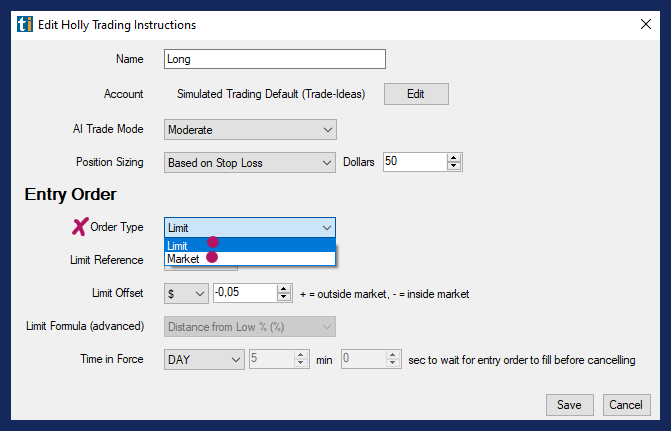

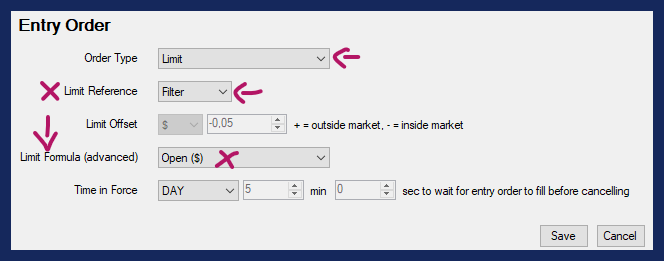

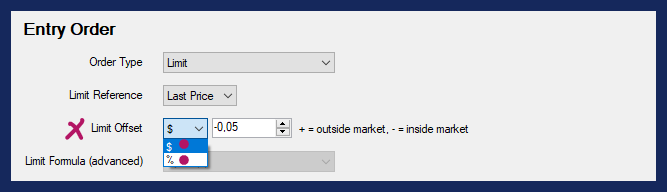

Entry Order

Choose a Limit Order, if you would like to keep control over the entry price.

Choose a Market Order, if getting into the trade is more important to you than the exact entry price. Learn about Market Orders before making this choice and be particularly careful using this order type when trading fast-moving stocks and stocks with large spreads.

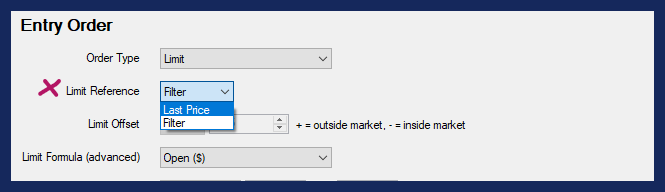

Use Last Price as Limit Reference, unless you are familiar with custom formulas and filters as entry orders.

When using the Trade Ideas Filter or your own Custom Formula from the Limit Formula dropdown, please note that the filter calculation needs to result in a static Dollar or Percentage Value.

Trade Ideas does not hold any orders, all orders are immediately sent to the brokerage. For this reason, orders cannot be based on a value that requires constant monitoring and recalculation like a moving average or a bar stop.

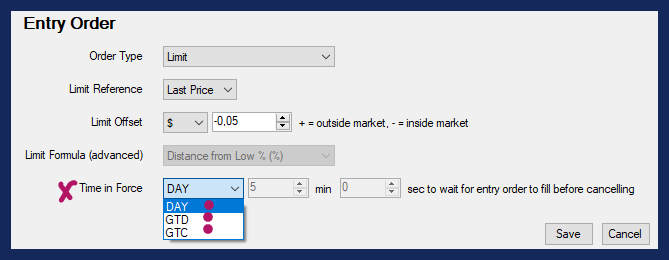

Limit Offset

The Limit Offset gives you the ability to control how aggressive or passive your Entry Order will be, it simply allows a bit of wiggle room. If you set the Limit Offset to 0, you are stating that your limit price for the order will be the exact price of the alert.

If you enter a negative Limit Offset, like - $0.02, you are prepared to pay up to 2 cents more per share (long) or 2 cents less (short). This approach is best for prioritizing the likelihood of being filled over a rigid price level.

If you enter a positive Limit Offset, like $ 0.01, you are waiting for the price of the stock to become 1 cent “cheaper” (long) or 1 cent higher (short). You are stating that you are prepared to wait for the stock price to move in your direction, rather than to pay a little extra to get in easier or quicker.

Please note, these rules are the same for long and short orders. With a negative Limit Offset you are willing to lose some profit potential in an effort to get filled, with a positive Offset you are stating that you'll wait for the price to come to you, even if that means a lesser possibility of being filled.

Time in Force

Lastly, you can set the Time in Force for your Entry Oder, which is its expiration time.

GTD means Good Till Day. Select the number of minutes and seconds, you would like your order to stay open before it gets canceled due to not having been filled.

If you select GTC, which means Good Till Cancelled, your order will remain open, until you manually cancel it.