How to use Stop Limit and Stop Market Orders as Entry Orders

In B+ Basics we recommended using either a Limit or a Market Order as your Entry Order type, but there are two more options, a Stop Limit and a Stop Market Order.

The B+ Intermediate section will discuss these additional Entry Order options for One-Click Order Templates.

Stop Limit Orders Explained:

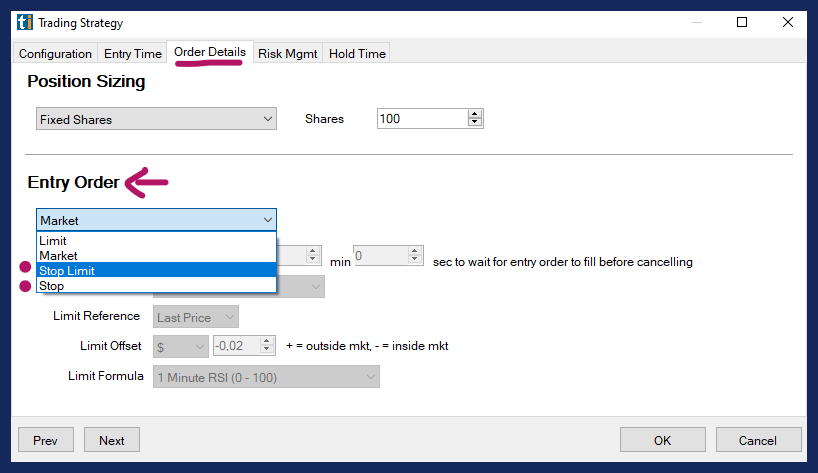

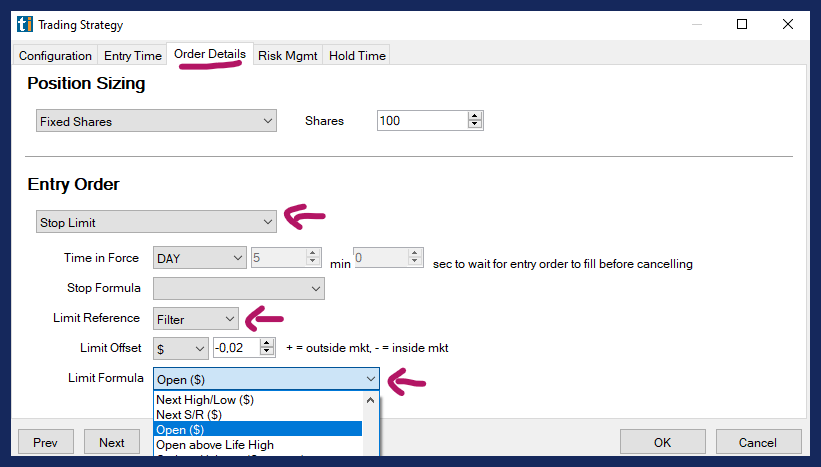

To use a Stop Limit or a Stop Market Order as One-Click Order Entry or a Custom Trading Strategy, right-click in the Strategies Tab of Brokerage Plus and choose New/Edit Trading Strategy. Then, head to the Entry Order Section of the Order Details Tab.

Order Details Tab

Here, you’ll have the option to choose your Entry Order Type.

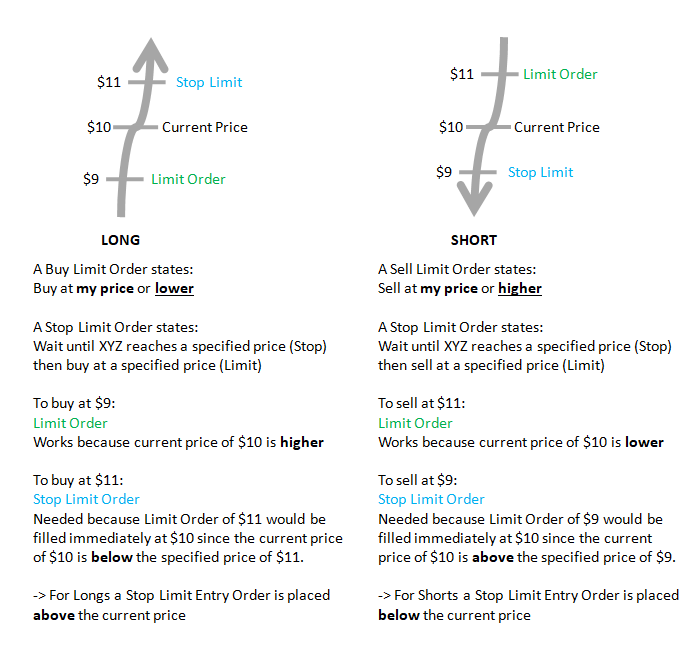

A Stop Limit Order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the Stop Price is reached, a Stop Limit Order becomes a Limit Order that will be executed at a specified price or better.

A Stop Order is an order to buy or sell a stock once it reaches a specified price. When the Stop Price is reached, a Stop Order becomes a Market Order.

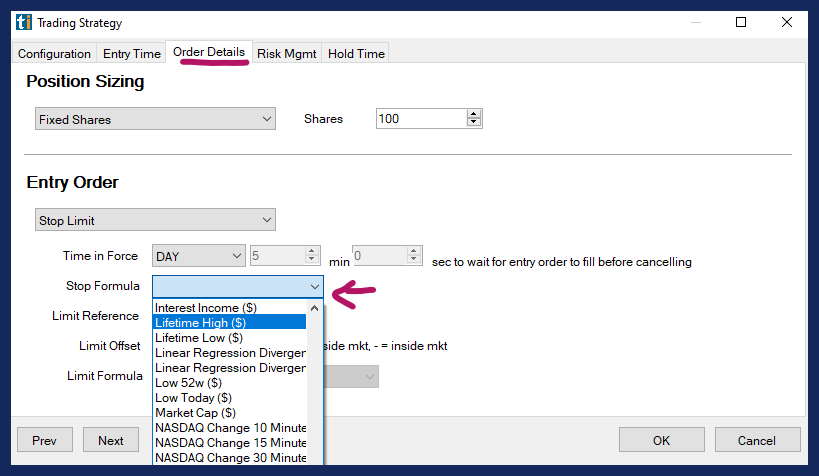

Stop Formula

When choosing a Stop Limit Order or Stop Order, you need to define the Stop Price at which the attached Limit Order or Market Order gets submitted.

To define the Stop Price, select a Trade Ideas Filter or your own Custom Formula from the Stop Formula dropdown.

Please note, that the filter calculation needs to result in a static Dollar or Percentage Value.

Trade Ideas does not hold any orders, all orders are immediately sent to the brokerage. For this reason, orders cannot be based on a value that requires constant monitoring and recalculation like a moving average or a bar stop.

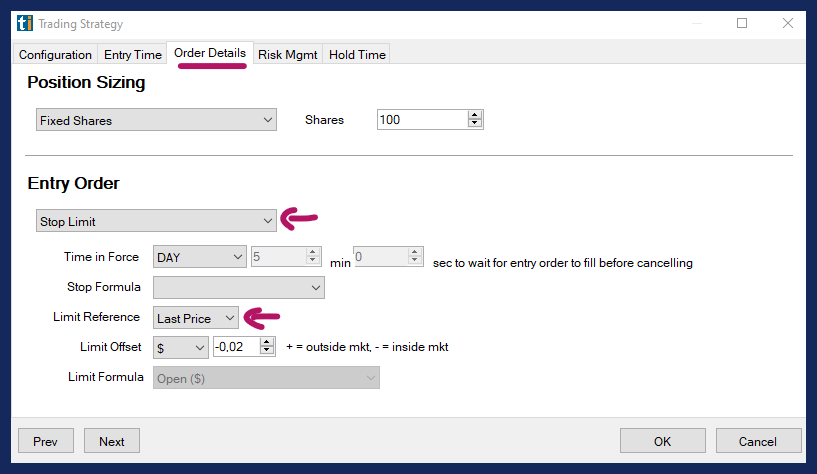

Limit Reference

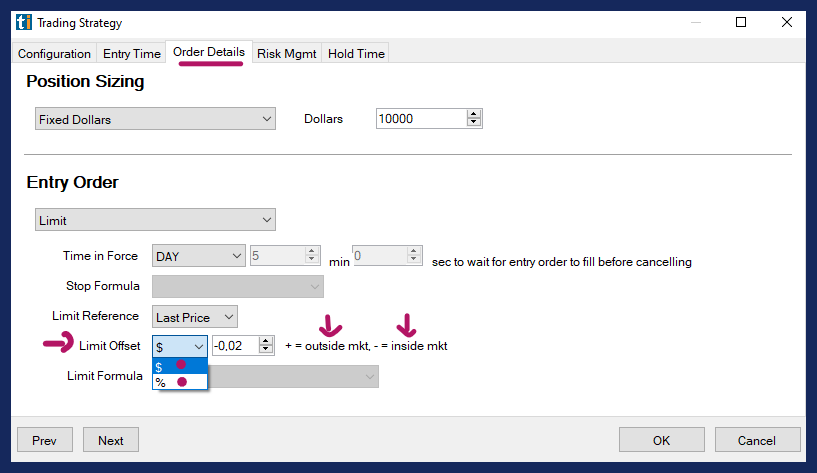

When choosing a Limit or a Stop Limit Order, you have the option to either use the Last Price as Limit Reference or to use the Trade Ideas Filter or your own Custom Formula to define the Limit Price.

When Last Price is selected as Limit Reference, the system will use the price of the stock at the time of placement of the Stop Order.

When using the Trade Ideas Filter or your own Custom Formula from the Limit Formula dropdown, please note that the filter calculation needs to result in a static Dollar or Percentage Value.

Trade Ideas does not hold any orders, all orders are immediately sent to the brokerage. For this reason, orders cannot be based on a value that requires constant monitoring and recalculation like a moving average or a bar stop.

Limit Offset

When placing a Limit Order or a Stop Limit Order, the Limit Offset gives you the ability to control how aggressive or passive your Limit Order will be, it simply allows a bit of wiggle room. If you set the Limit Offset to 0, you are stating that your limit price for the order will be the exact price.

If you enter a negative Limit Offset, like - $0.02, you are prepared to pay up to 2 cents more per share (long) or 2 cents less (short). This approach is best for prioritizing the likelihood of being filled over a rigid price level.

If you enter a positive Limit Offset, like $0.01, you are waiting for the price of the stock to become 1 cent “cheaper” (long) or 1 cent higher (short). You are stating that you are prepared to wait for the stock price to move in your direction, rather than to pay a little extra to get in easier or quicker.

Please note, these rules are the same for long and short orders. With a negative Limit Offset you are willing to lose some profit potential in an effort to get filled, with a positive Offset you are stating that you'll wait for the price to come to you, even if that means a lower possibility of being filled.

Please note, if you have chosen a Filter as your Limit Reference, the Limit Offset will be disabled.

Overview Use of Filters in Orders

As Entry Orders (Limit/Stop Limit)

| L/S | Order Type | Filter Reference | Filter Example | Filter Application | Result |

| Long | Stop Limit | Stop Formula | Today’s High $8 | Exact Filter Value in $ | Stop is placed at $8 |

| Long | Stop Limit | Limit Formula | Today’s High $8 | Price - Filter | If Price is $10 and Filter is $8 Limit = $2 |

| Short | Stop Limit | Stop Formula | Today’s Low $5 | Exact Filter Value in $ | Stop is placed at $5 |

| Short | Stop Limit | Limit Formula | Today’s Low $5 | Price + Filter | If Price is $10 and Filter is $8 Limit = $18 |

As Exit Orders (Stop Loss/Target/Trailing Stop)

| L/S | Order Type | Exit Type | Filter Example | Filter Application | Result |

| Long | Limit | Target | Today’s High $8 | Price + Filter | If Price is $6 and Filter is $8 Target = $14 |

| Long | Stop Market | Stop Loss | Today’s Low $4 | Price - Filter | If Price is $6 and Filter is $4 Stop Loss = $2 |

| Long | Stop Market | Trailing Stop | Today’s Low $6 | Price - Filter |

If Price is $10 and Filter is $6 Trailing Stop = $4 |

| Short | Limit | Target | Today’s Low $6 | Price - Filter | If Price is $10 and Filter is $6 Target = $4 |

| Short | Stop Market | Stop Loss | Today’s High $12 | Price + Filter | If Price is $10 and Filter is $8 Stop Loss = $18 |

| Short | Stop Market | Trailing Stop | Today’s High $8 | Price + Filter | If Price is $10 and Filter is $8 Trailing Stop = $18 |