Who is Holly?

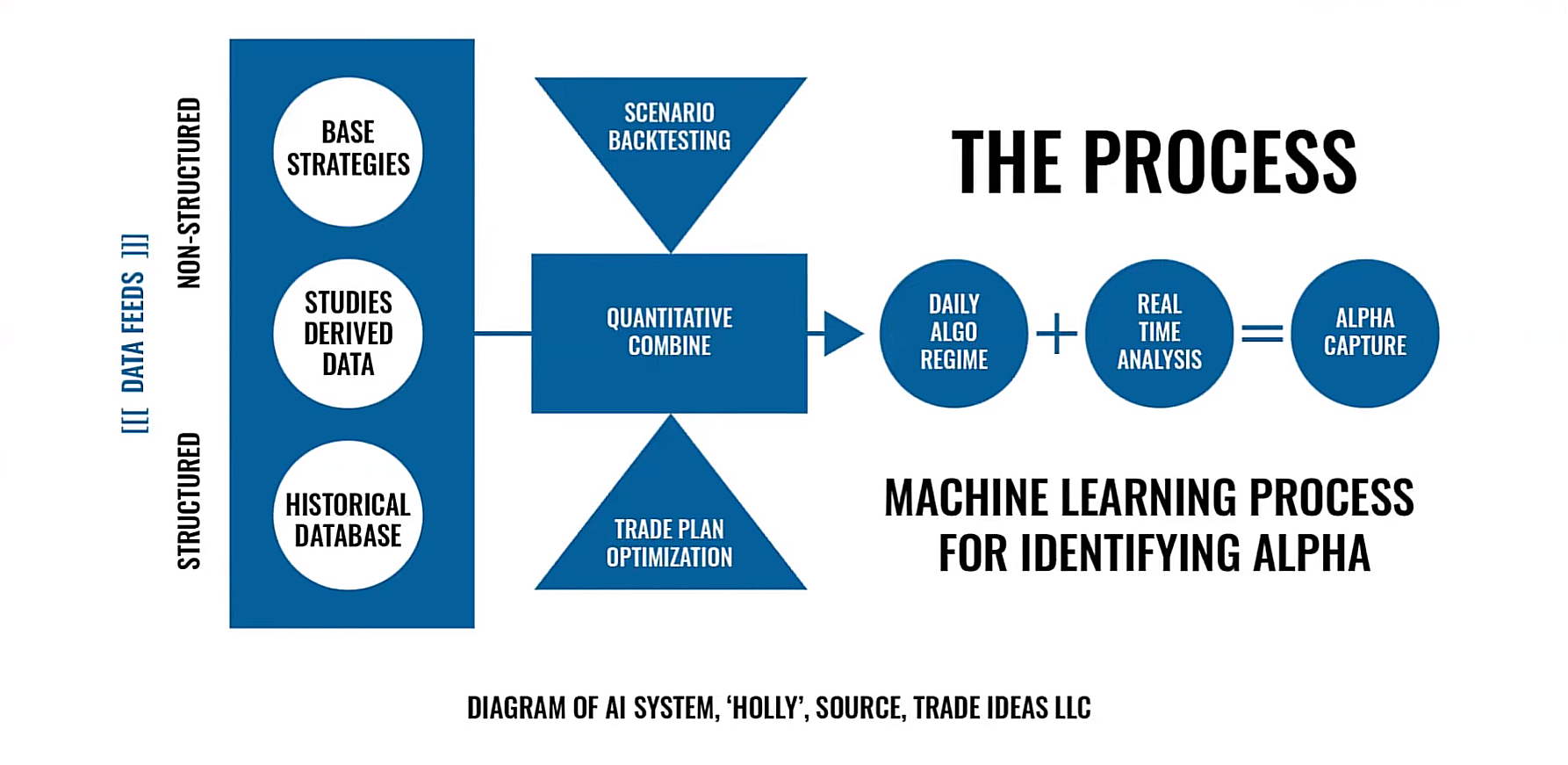

Our Virtual Trade Assistant Holly is designed to provide real-time stock suggestions to our premium clients.

Holly learns from the past and approaches every new day with non-emotional precision. With over 60 carefully curated algorithms in her portfolio, she is a skilled and versatile trader to follow.

Holly's trading signals include entry prices, stops, and targets. You can see her trades as she enters and exits them as well as her success rate.

There are usually between 5 to 25 trades in total per day. Holly is an intraday trader and does not hold positions overnight.

Holly only trades her own algorithms and they are not customizable.

To see Holly Trading in Action, browse through our 📢 Trade Ideas AI Performance Updates 🆕.

What Holly Does

Holly backtests all her over 60 strategies every night. Thereafter, she goes through each strategy one by one and optimizes it. If she, for example, finds that stocks over $20 perform inadequately in a particular strategy, she will remove this price range and run another test to check if the performance has improved.

Holly will repeat the same process with all other parameters until the strategy performs optimally in the backtest. A process that would take a human many days, is performed by Holly over the course of a few hours at night.

After this extensive backtest and optimization process, Holly will analyze what the overall markets are doing.

At the end of the night, she will select only the strategies with the highest statistical chance to deliver profitable trades for the upcoming trading day. These are the strategies that you will find in the AI/Holly Strategy Window in the mornings. On average, Holly enters between 5 and 25 trades per day based on various strategies.

Holly's Strategies

The over 60 strategies our AI employs are described below. The parameters are proprietary and cannot be customized.

The 5 Day Bounce

The trigger for this alert has to cross above resistance while also making a 60 minute high on stocks that are trying to bounce from the lows of their 5-day range. The max price of stocks will be $20. The strategy looks to go long on an oversold reversal strategy. Consult the main AI window for this strategies’ target, hold time and stop type.

Alpha Predators

This strategy looks for momentum stocks under 20 dollars to buy on a pullback trigger as the event to go long. These stocks will be green on many time frames from 5-day to 5 minutes. There are numerous filters looking at moving averages and changes in price over the last hour. We need at least 1 consecutive green candle coming in on the current day. Consult the main AI window for this strategies’ target, hold time and stop type.

Bon Shorty (Short)

A short-selling strategy that looks to jump on momentum. The trigger is a breakdown of resistance as defined by Trade Ideas data for stocks between 15 and 85 dollars. The stock must be down from the previous day. The S&P 500 cannot be up very much in the last 5 minutes. Consult the main AI window for this strategies’ target, hold time and stop type.

Breakout

This long strategy uses the crossing above resistance as the entry event. On higher than normal relative volume, the stock must be between $10 and $150 with at least 125k shares being already traded today. Additionally, the stock will be above the midpoint of the previous day’s range. This strategy ensures that the leading market indicator used has not moved more than 0.5% in either direction over the past 30 minutes. Consult the main AI window for this strategies’ target, hold time and stop type.

Bullish Pullback

Looks for strong stocks pulling back 25% to create the entry trigger. These stocks will include a max price of 100 in the scan and a minimum of 20 dollars (where “Strong Stocks Pulling Back” left off). Consult the main AI window for this strategies’ target, hold time and stop type.

Bullish Trend Change

The strategy is triggered, when stocks over $20 are crossing above resistance with a 60 minute high. Consult the main AI window for this strategies’ target, hold time and stop type.

Buyers Stepping

In A strategy that uses our Fibonacci pullback as the trigger to go long. This is a pullback entry concept. Stocks from 50 cents to 30 dollars will show up on this alert. The pullback entry will be on a stock that is already up nicely on the day and the S&P 500 has to be positive for the day. Consult the main AI window for this strategies’ target, hold time and stop type.

Close to a Cross

This strategy triggers when a stock has a strong intraday move and a very short-term proprietary moving average crosses the 50-Day SMA. These moving average crossovers are followed closely by institutions which can cause huge buying pressure after the alert.

The Continuation

Stocks between 50 cents and 50 dollars make up this strategy. The trigger is a new 30 minute high if the stock had 2 consecutive up days coming into the present day. Thus the name “continuation”. The daily range for this candle will be a wide range above normal. Consult the main AI window for this strategies’ target, hold time and stop type.

Count de Monet

Looks for stocks to go long that are making a resistance breakout to a 5-Day High area. This strategy is focused on stocks under $40 with small to medium-sized float. The S&P 500 needs to have a green 5-minute candle. Consult the main AI window for this strategies’ target, hold time and stop type.

Cuts Like a Knife (Short)

Another short-selling strategy that looks for a breakdown of support (as defined by Trade Ideas data). The trigger to go short is Crossed below Support on stocks up to 100 dollars. The earnings filter is turned on to play stocks that just had earnings in the last day to look for downward momentum to ride from the earnings news. Consult the main AI window for this strategies’ target, hold time and stop type.

Downward Dog (Short)

This is simply a breakdown of a channel (as defined by Trade Ideas data). A short-selling momentum strategy that looks for stocks under 50 dollars. Consult the main AI window for this strategies’ target, hold time and stop type.

Downward Momentum (Short)

A short-selling strategy that looks to pile on the selling. A downward break of the opening 30-minute range is the trigger to go short here. The price of this strategy will focus on stocks between 20 and 100 dollars and the S&P has to be negative in the last 15 minutes. This strategy also looks at a long-term filter to ensure the stock is in a daily downtrend. Consult the main AI window for this strategies’ target, hold time and stop type.

Early Bird

Stocks under $20 that are crossing above an algorithmic resistance level on slightly higher than normal 5-minute volume. The volume today is currently under 1m shares. Ranges for the 10 day, 120 minute and 15 minutes are capped so as it catch the move early. Consult the main AI window for this strategies’ target, hold time and stop type.

Float On

Stocks from 1 to 100 that are crossing above short-term resistance is the trigger for this long side strategy. There are numerous filters for moving average relative strength and only scans for low float stocks under 20 million shares. Market filters also ensure that the S&P 500 is showing strength on the day and in short-term time frames. Consult the main AI window for this strategies’ target, hold time and stop type.

Got Dough Wants to Go

This strategy will focus on large float stocks, mid-high cap stocks that are showing momentum on the daily and the intraday charts. The S&P 500 needs to be positive on the day. The trigger to go long this strategy comes from the 30-minute high event. Consult the main AI window for this strategies’ target, hold time and stop type.

Horseshoe Down

Looks for a gap down in price with an attempt to come back up and fill a portion of the gap. The alert triggers to go short if the price moves back below the prior low of the gap opening. The exact opposite of “Horseshoe Up” Consult the main AI window for this strategies’ target, hold time and stop type.

Horseshoe Up

Looks for a gap up in price with an attempt to come back down and fill a portion of the gap. The alert triggers to go long if the price moves back above the prior high of the gap opening. Consult the main AI window for this strategies’ target, hold time and stop type.

Knocking On Resistance (Short)

A short strategy that looks to fade the upward movement of stocks under 20 dollars using a breakout of the opening range but right into a level of resistance (R1) as defined by Trade Ideas technology. Consult the main AI window for this strategies’ target, hold time and stop type.

Little Big Guy

This strategy focuses on stocks under 8 dollars. The trigger is a minimum 5 hour level of resistance. This strategy has market filters that look at the S&P 500 to make sure it is not too negative on the day. Consult the main AI window for this strategies’ target, hold time and stop type.

Looking for a Bounce

Here the A.I. is looking for a 30-minute opening range breakdown at a certain level of support that will look to bounce off support and go long based on the filters used here. The max price for this strategy is 20 dollar stocks. Consult the main AI window for this strategies’ target, hold time and stop type.

Mighty Mouse

Stocks from 50 cents to 5 dollars that are crossing above resistance as defined by Trade Ideas data is the idea behind this strategy. The stock must be up compared to yesterday and wait 15 minutes before this event triggers. The name Mighty Mouse suggests stocks under 5 dollars that are showing upward opportunities early in the day. Consult the main AI window for this strategies’ target, hold time and stop type.

Nice Chart

Numerous filters make up this long strategy. The trigger is a New High above yesterday’s high but with many more filters looking at market strength, moving averages, and RSI in the short term. The max price for this strategy is 80 dollars. Consult the main AI window for this strategies’ target, hold time and stop type.

Nickelback

Nickelback is basically the same concept as “Quarterback” but only monitors a symbol list of stocks that trade in 5 cent increments in hopes of making a better spread on entry and exit. A pullback of 25% is still needed for the entry trigger. Consult the main AI window for this strategies’ target, hold time and stop type.

No Fear Short Here (Short)

The trigger of this is a locked or crossed market (bid and offer are the same or even crossed). A short-selling strategy that looks at Nasdaq and S&P market filters and downward momentum to trigger a short selling opportunity. The price window for this short momentum strategy is 50 cents to 8-0 dollars. Consult the main AI window for this strategies’ target, hold time and stop type.

Not a Double Bottom (Short)

The trigger for this short sell alert is what appears to be a double bottom but breaks down thru support. Stocks from 10 to 100 dollars make up this strategy and the change is 1 minute period is a significant down move. Market filters do not allow for the S&P 500 to be up too much in the last 15 minutes. Consult the main AI window for this strategies’ target, hold time and stop type.

On Support

This is very similar to the “Looking for a Bounce” strategy as it is looking for a breakdown in the opening 30-minute range. However, this strategy looks at only stock above 20 dollars that are bouncing off support as defined by the filters used. Consult the main AI window for this strategies’ target, hold time and stop type.

Power Hour Long

Looks to buy strong stocks relative to the previous day and only in the last hour of the day. The S&P 500 must be up in the last 10 minutes as a market filter. Consult the main AI window for this strategies’ target, hold time and stop type.

Power Hour Short (Short)

Looks to short weak stocks relative to the previous day and only in the last hour of the day. The S&P 500 must be down in the last 10 minutes as a market filter. Consult the main AI window for this strategies’ target, hold time and stop type.

Pushing Through Resistance

The signal is triggered by a 30-minute opening range breakout to go long. This strategy is set to wait for around 40 minutes after the open before any alert would trigger. There needs to be positive movement in the trailing 15 minute period as well. Consult the main AI window for this strategies’ target, hold time and stop type.

Putting on the Brakes

Similar to “Knocking on Resistance” but for stocks above 20 dollars and more filters to ensure the 5-day range is not too strong. The 30-minute relative weakness in the S&P 500 is also considered. Consult the main AI window for this strategies’ target, hold time and stop type.

Quarterback

Looks for strong stocks that had a significant move upward then pulls back 25% for the entry trigger. Stock prices will be 5 to 100 dollars and relative volume needs to be above normal. The A.I. has added many RSI filters and the stock must be up from yesterday’s close. Consult the main AI window for this strategies’ target, hold time and stop type.

Selling Strength (Short)

This is similar to “Topping Formation” but for stocks above 20 dollars. Market filters require the S&P 500 to not be positive. Consult the main AI window for this strategies’ target, hold time and stop type.

Slippery Slope (Short)

This short selling strategy uses a new 5 minute low as the entry trigger. Stocks between the price of 50 and 200 are monitored for weakness relative to the prior day and also the 10-day and 1-year range with negative momentum coming into the current trading day. Consult the main AI window for this strategies’ target, hold time and stop type.

Staggering Volume

This one is looking for stocks making new highs that are off the chart in terms of relative volume, 5-minute volume, and 1-minute volume. There is a short squeeze component as well using the “days to cover” filter. “Position in Range” filters under 60-minute time frames are also used here. These stocks will be fast movers in general. Stocks above and under 5 dollars are in play with this strategy.

Strong Stock Pulling Back

This strategy is triggered by a 25% pullback from highs on stocks that are showing strong volume and price movement relative to the S&P 500 even on a weak day. Stocks under 20 dollars only in this strategy. Consult the main AI window for this strategies’ target, hold time and stop type.

Sunrise Mover

This strategy is set to be active after only 5 minutes into the day and stops being active 45 minutes after the bell. Stocks between 3 and 80 dollars are scanned for a break above short-term resistance as the trigger to go long if the S&P 500 is positive. There are numerous filters added by the A.I. looking at moving average relative strength across the board. Consult the main AI window for this strategies’ target, hold time and stop type.

Tailwind

This long strategy uses a pullback in price to trigger the entry. Stocks that have a complex setup of moving averages and are positive across the board on those moving average and volume filters are considered. The max price of this strategy is 60 dollars. Consult the main AI window for this strategies’ target, hold time and stop type.

Topping Formation (Short)

This is a short-selling strategy that looks to fade an overbought situation with a new 5 day high being the trigger to go short. The price window will be stocks between 10 and 20 dollars. Market filters require the S&P 500 to not be positive. Consult the main AI window for this strategies’ target, hold time and stop type.

Trend Play

Uses a proprietary moving average ribbon to identify when a stock is in a strong trend. For this play to trigger both on the daily and intraday charts need to be aligned with the same trend using the same metric. This makes stocks interesting to long-term players which will in a lot of cases push the price for shorter-term players.

Trend Play Short (Short)

Same as the Trend play (see above). But this strategy is looking for downtrends that can trigger a short sell signal.

The Vault

A long strategy that looks for oversold conditions in stocks between 9 and 30 dollars. The current price is likely near the low of the 10-day range. The event is triggered by crossing back thru yesterday’s resistance. This strategy has many additional filters; too many to list here.

Volume Doesn't Lie

This strategy looks for stocks that are up at least 4% and doing at least 2 times normal volume. The volume is the trigger and the theory is that the price action will continue in the same direction as the gap. This was originally designed for multi-day holds, but was reconfigured for Holly (so keep that in mind). Consult the main AI window for this strategies’ target, hold time and stop type.

Wake Up Call

This strategy looks for stocks to buy under 20 dollars making new highs with low float size. There are numerous filters for intraday moving averages and price action filters in the last 15-30 minutes that the A.I. has added. The stock needs to be up a bit in the last 5 minutes before it triggers as well. Consult the main AI window for this strategies’ target, hold time and stop type.

Yesterday Hammer Today Strength

This is searching for your textbook hammer candle to have happened yesterday. This pattern shows sellers being rejected after trying to push the price lower. The alert triggers after a stock has shown strength in the current trading day and has pushed through resistance.

Engulfing

This watches the current day's action to see if a possible engulfing candle is forming (today's low lower than yesterday's and today's high higher than yesterday's). This looks to trigger after both sides of that equation are made and we are showing some intraday strength.

AVWAP Bounce

The strategy uses a multi-day Vwap to find stocks that are not only bouncing off today's VWAP but yesterday's as well.

The Guiding Hand (Long)

Both of these are looking at the same thing just reversed. We are looking at stocks that are gapping and the basing sideways looking for a short-term moving average to catch up to price and push it higher.

Balloon Under Water/The Anvil (Short)

These are revisions to the mean algos that are looking for stocks that have drifted away from what our algos are looking at for “fair value”. It looks to take the other side of the move after momentum has shifted.

The Guiding Hand (Short)

Both of these are looking at the same thing just reversed. We are looking at stocks that are gapping and the basing sideways looking for a short-term moving average to catch up to price and push it higher.

Bon Shorty 2.0

The original user-generated AI algorithm is back. Just like Holly grails version, this is looking for a stock that was weak yesterday selling off today. Also known as a second-day play.

Pushing The Spring

This looks for a tight consolidation on the daily chart and a breakout the following day.

Pulling The Arrow Back

Looking at yesterday's trading we are looking for sellers failing to keep prices low yesterday causing a late-day bounce. Bullish action the following day is often great confirmation of the next move.

Failed Bounce (Short)

This is the opposite of pulling the arrow back where we are looking for a rejection of buyers in yesterday's action to continue today.

Bear/Bull Trap (Short)

This is looking for the classic trap pattern. Where a stock will break the high of yesterday just barely and then start to reverse forcing the other side to sell.

Revision To The Mean Long

This algorithm is looking to catch that falling intraday knife. Looking for a quick bounce in a weak stock.

Snap Back Long/Short (Short)

These are looking for reversion to the mean but on a daily basis instead of intraday day.

Separation From The 8

There are many ways to define “overbought”. In this case, we are looking at how much a stock has deviated from its 8 periods moving average.

Breakout long (Short)

Neo’s focus is on high-volume stocks that are currently in the news. For these algorithms, they are looking to take an early move on these stocks in the direction of the trend.

Pullback long (Short)

These algos look for the same Neo signature stocks in the news but are looking for them to base sideways before pushing higher.

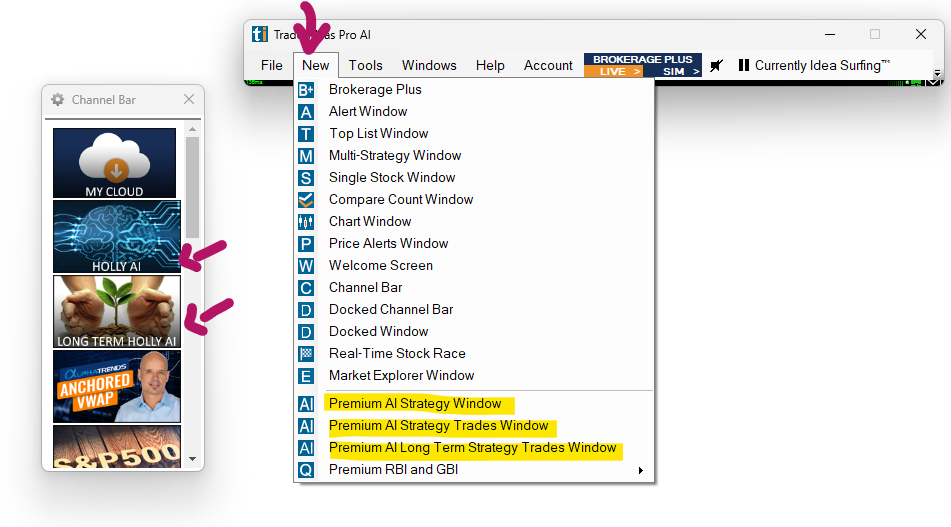

Where to find Holly

You will find our Virtual Trade Assistant Holly in the Channel Bar in the channels named Holly AI and Long Term Holly AI.

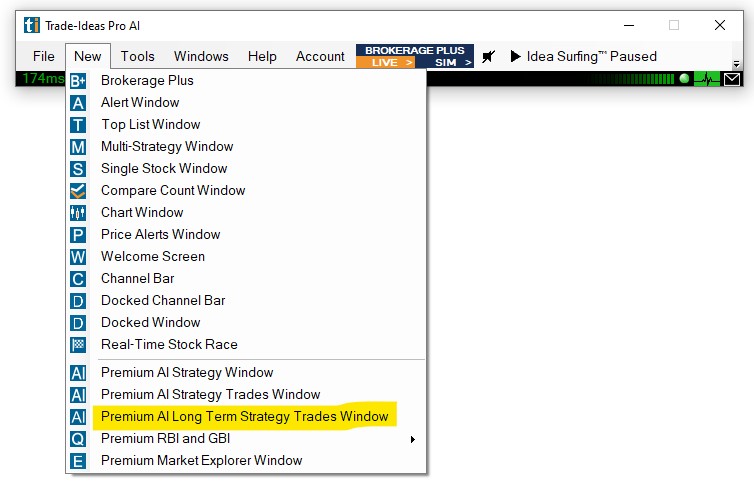

If you would like to include Holly in your own layout, rather than using our preset Holly channels, you can open her individual windows from the Toolbar.

Click on New and select the Premium AI Strategy Window or the Premium AI Strategy Trades Window or the Premium AI Long Term Strategy Trades Window

Holly Windows

Overview: Holly Windows

The AI Strategy Window will list the strategies that Holly, after a long night of backtesting and optimization, has carefully selected for the upcoming trading day.

To see Holly’s trading in action, head to the AI Strategy Trades Window. All the trades that Holly enters during the day will appear here.

For detailed insight into the AI Strategy Window, head to this section.

For detailed insight into the AI Strategy Trades Window, head to this section.

For detailed insight into the AI LongTerm Strategy Trades Window, head to this section.

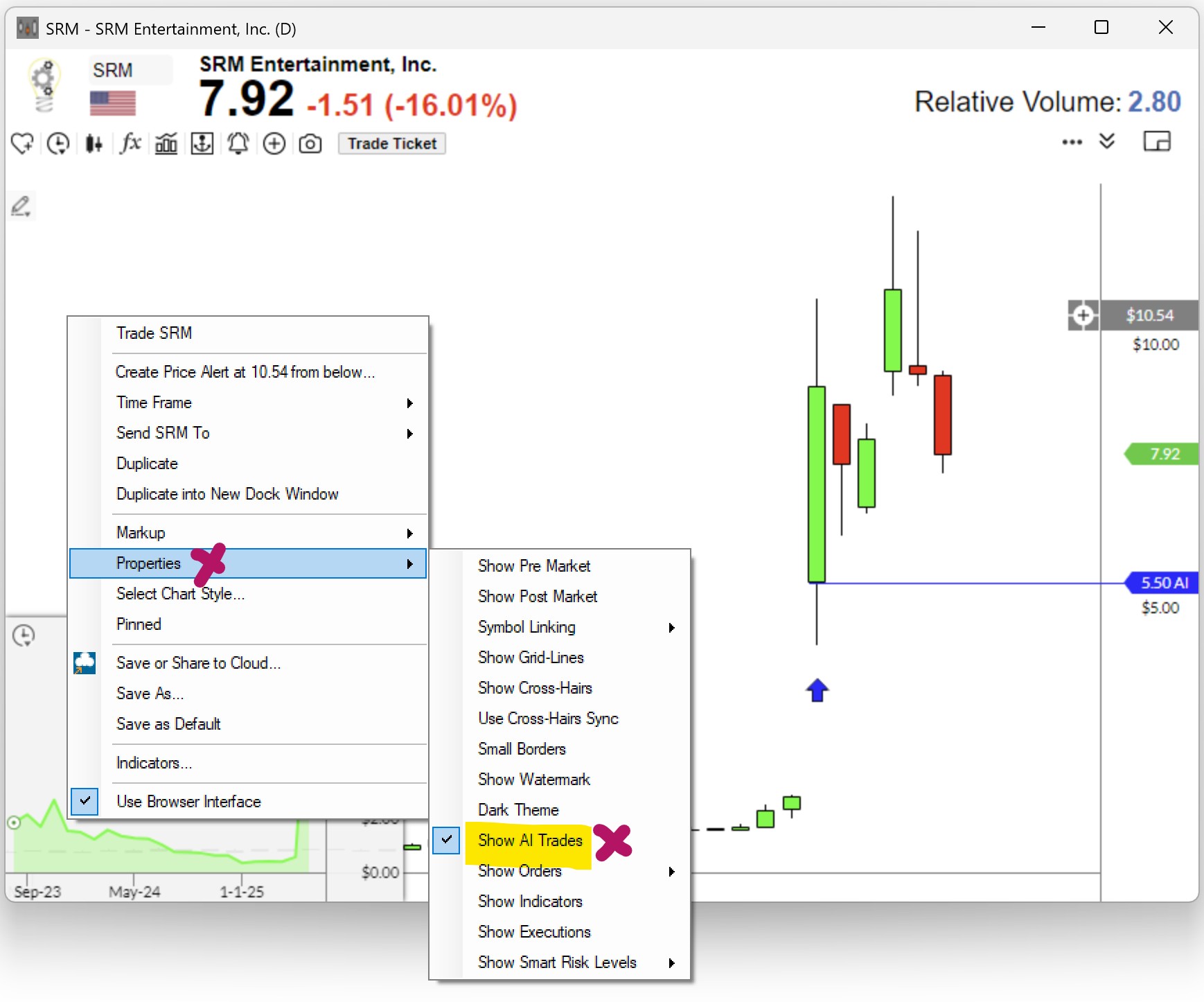

Show AI Trades

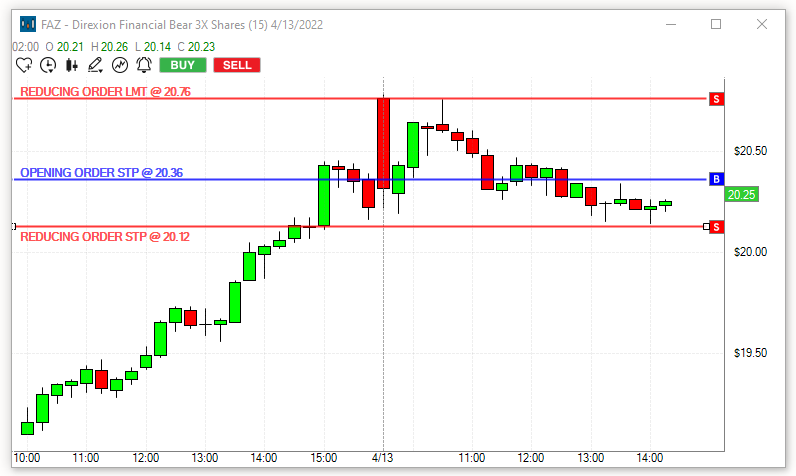

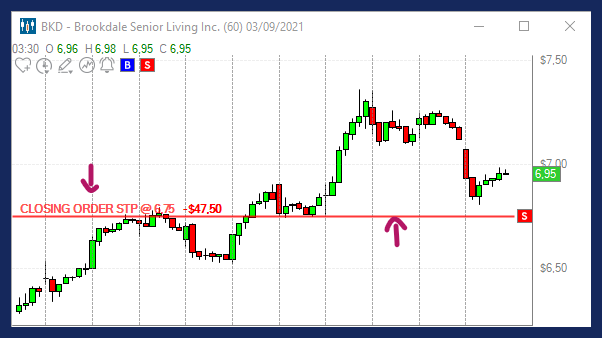

The trades of Holly will not only be presented to you in the AI Strategy Trades Window but also on the charts.

To enable this feature, right-click into your Chart, select Properties, and then Show AI Trades.

The AI trades will be displayed in a quick and easy-to-grasp visual format:

-

An upward-pointing arrow indicates the entry bar of a Long Trade.

-

A downward-pointing arrow indicates the entry bar of a Short Trade.

-

The blue line represents Holly's Entry Price.

-

A red line indicates the Stop Price.

Holly Visuals on Charts:

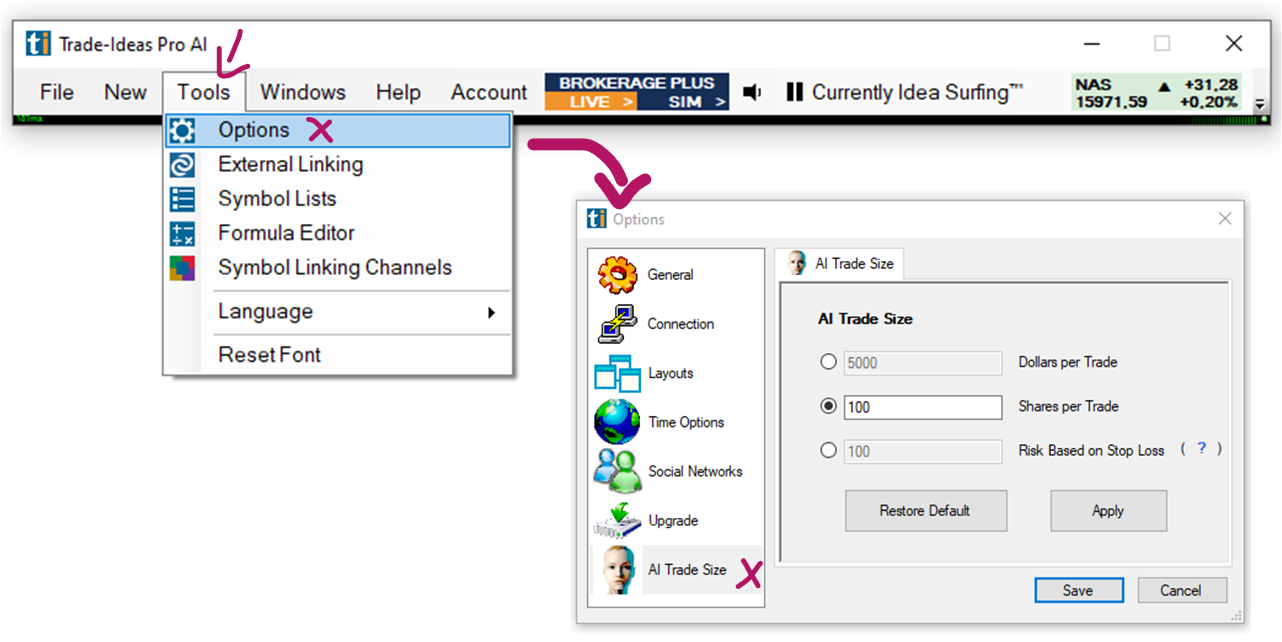

AI Risk Size Explained

By Default, the AI Risk Size is set to 100 shares per trade.

This setting can be adjusted to reflect your personal investment style. From the Toolbar choose Tools, select Options, and then AI Trade Size.

Here you have the choice between defining Holly’s entry parameters based on:

-

Dollars

If you entered $2000 as the amount and the stock price is $20, Holly will buy 100 shares. If the stock price is $40, she will only buy 50 shares.

-

Shares

You can enter a fixed number of Shares per trade to buy or short.

-

Risk

If you choose to risk $100 and Holly’s algorithmic stop loss per trade is $0,20, she will buy 500 shares per trade.

-

Default

By Default, the AI Profit & Loss is based on 100 shares per trade.

These settings will be used to calculate the Profit & Loss in both AI Windows.

AI Holly Strategy Window

The AI Strategy Window will list the strategies that Holly, after a long night of backtesting and optimization, has carefully selected for the upcoming trading day.

You will find it in the Toolbar under New, as well as in the Trade Ideas AI Channel.

AI Strategy Window Overview:

Filters

The two filter dropdowns on the top right-hand side of the AI Strategy Window, enable you to filter by active, inactive, long, and short strategies, as well as individual strategies.

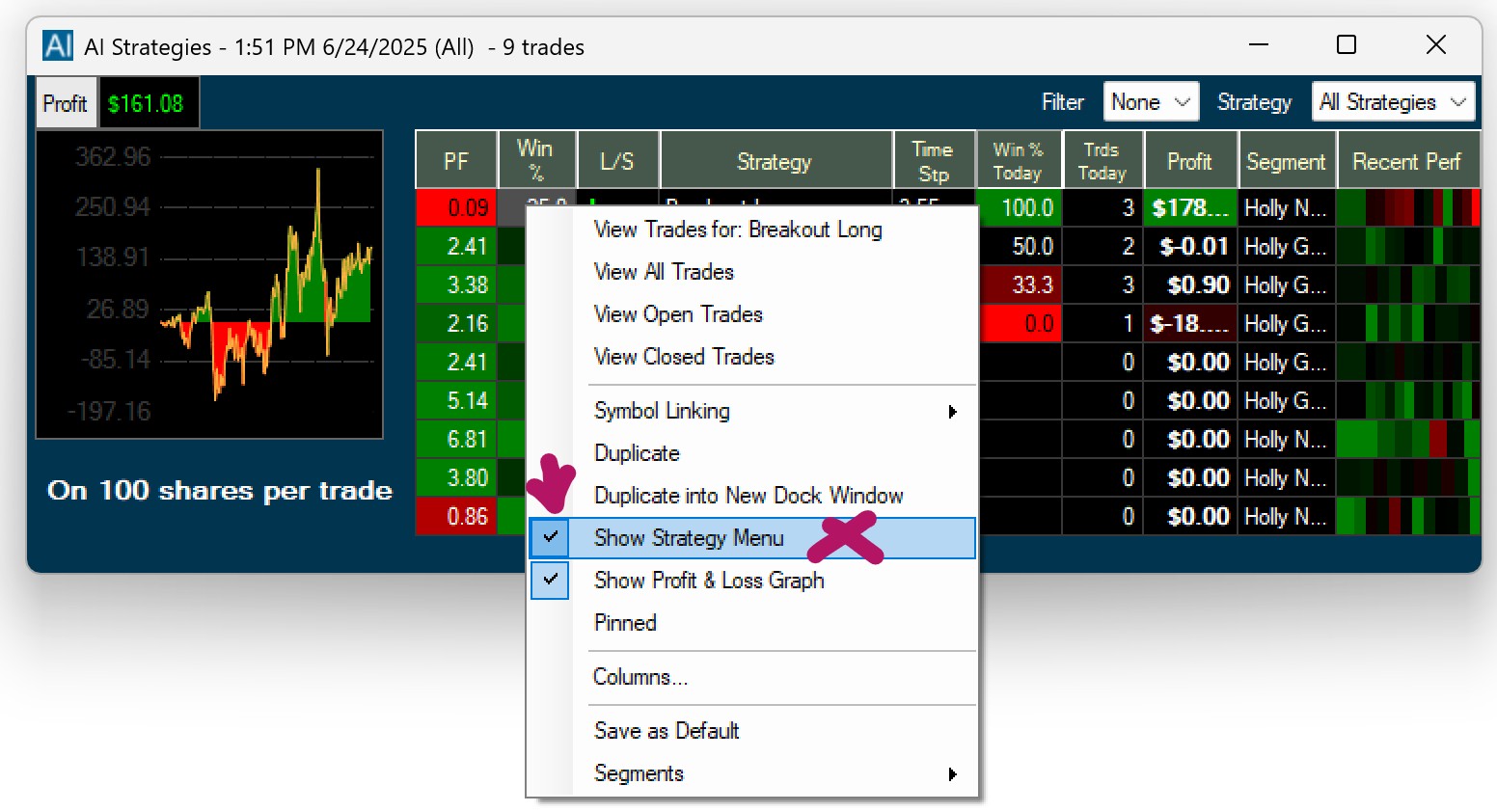

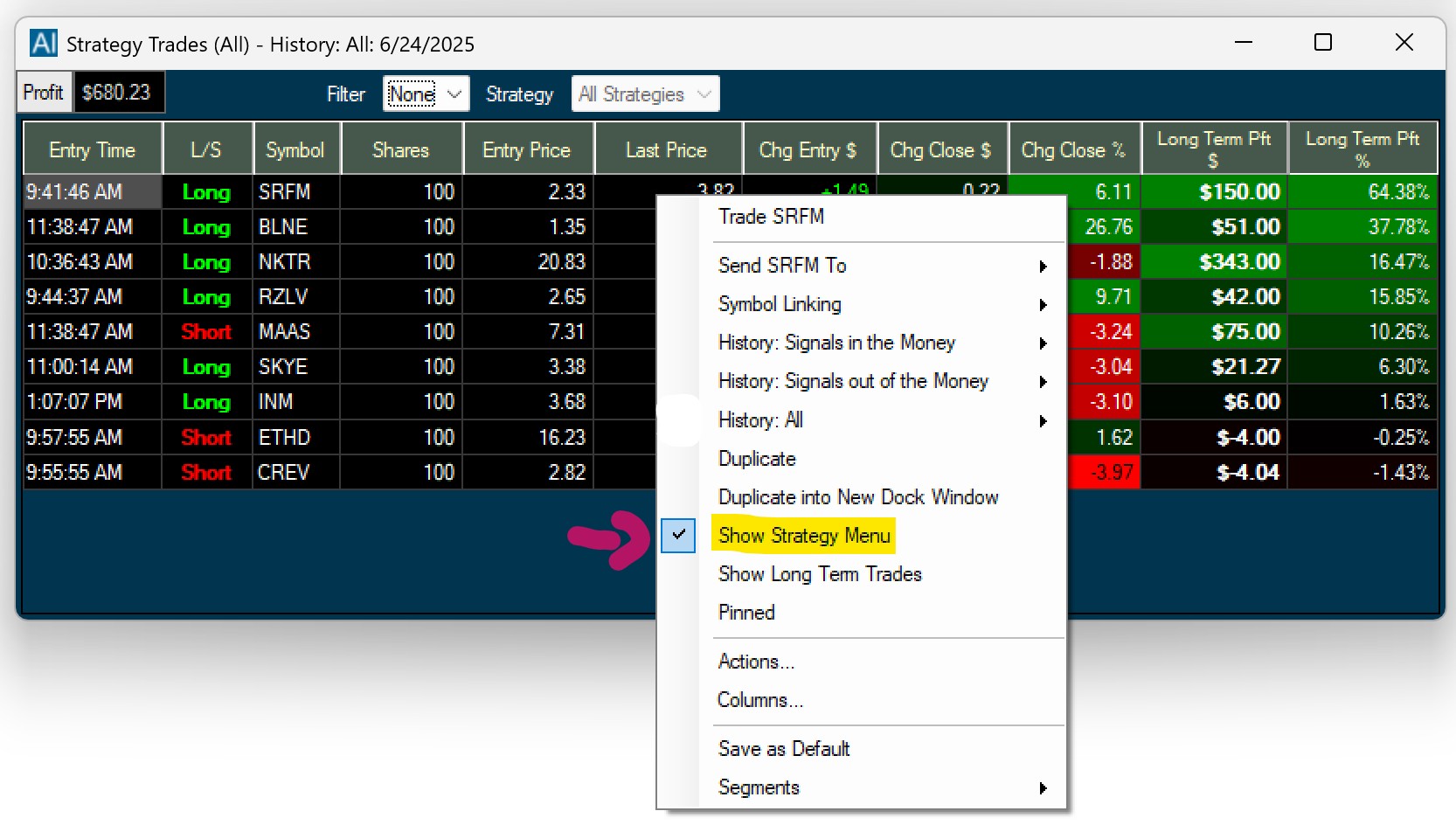

The filters are part of the Strategy Menu, which you can choose to show or hide. Simply right-click into the AI Strategy Window and check/uncheck the option Show Strategy Menu.

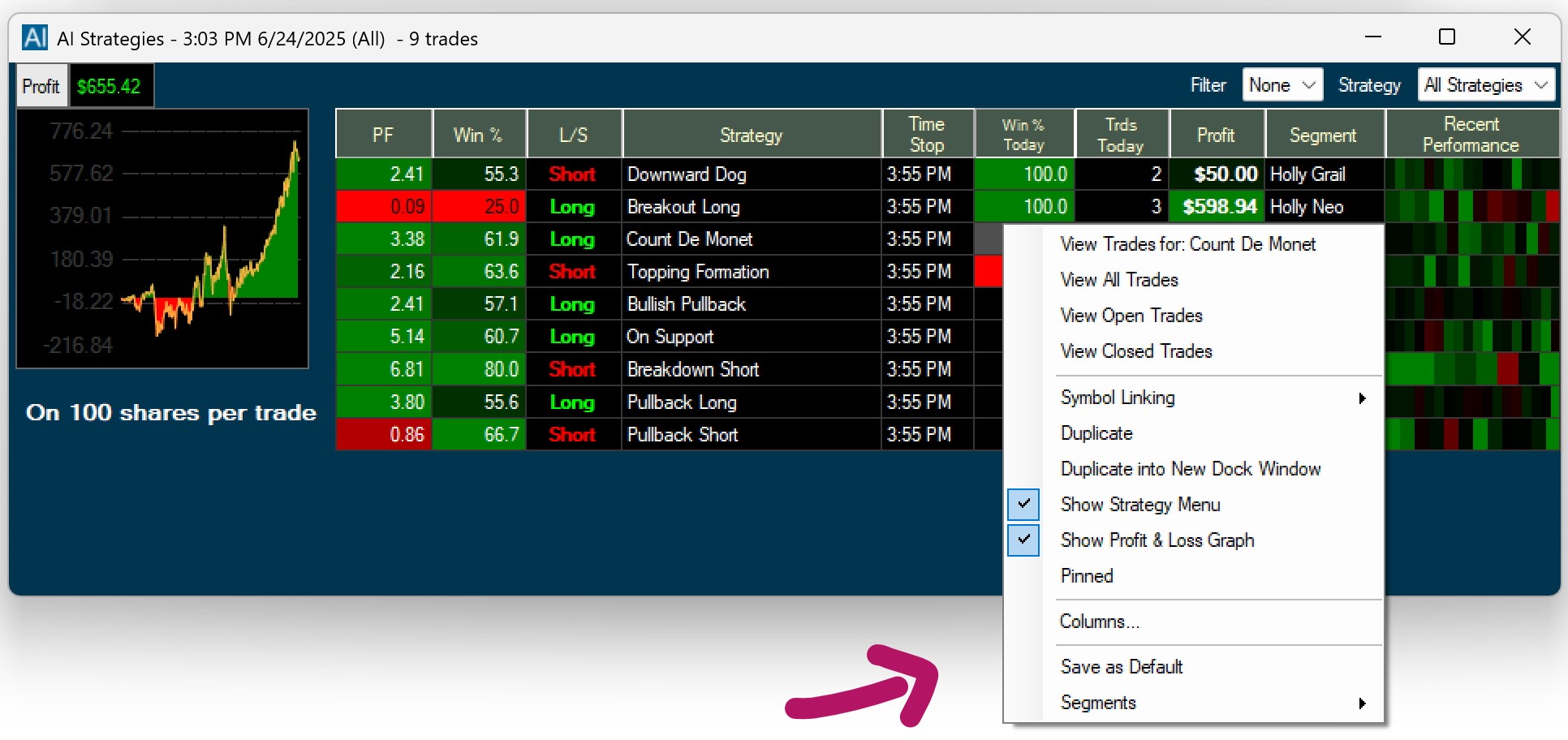

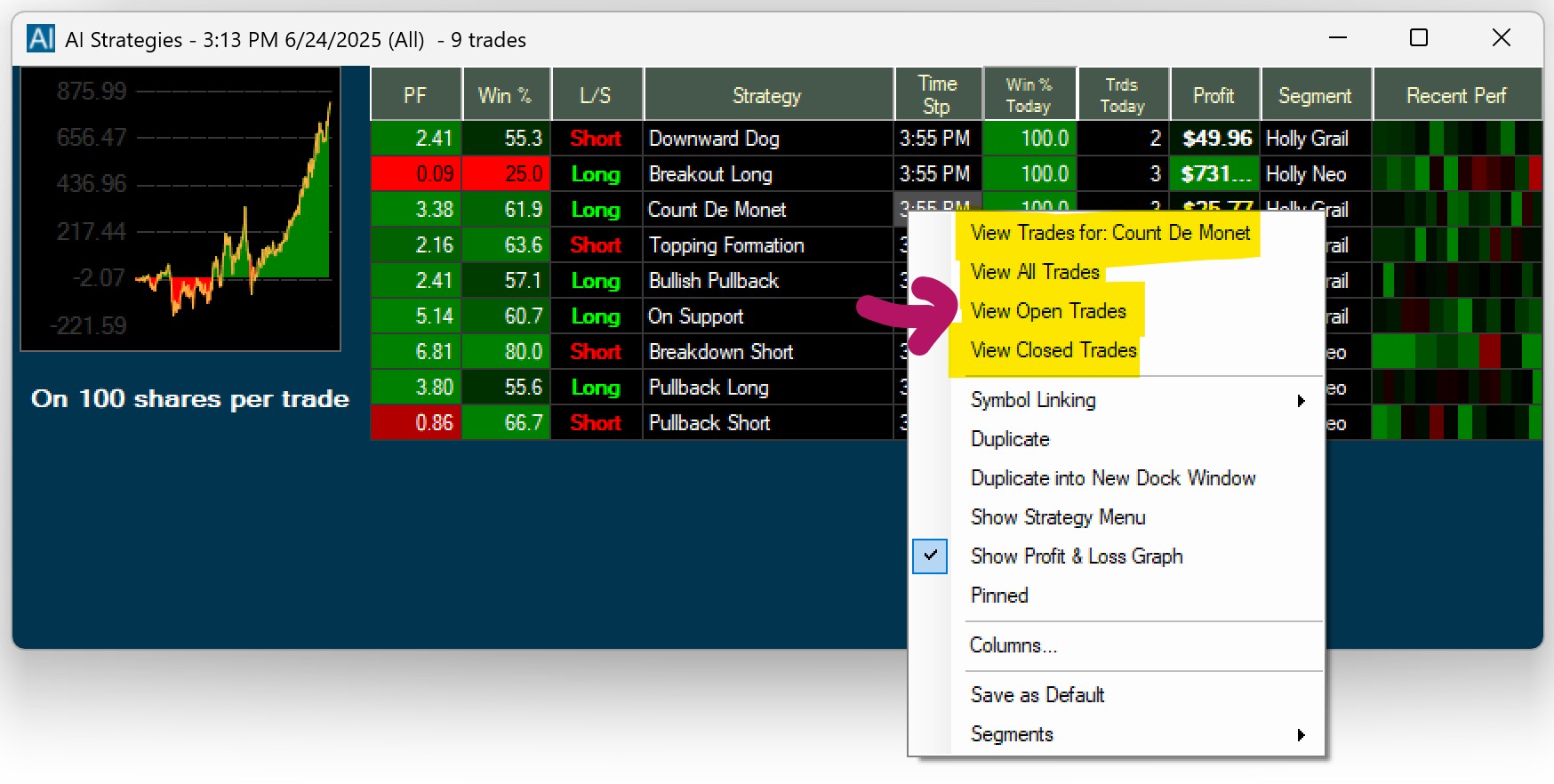

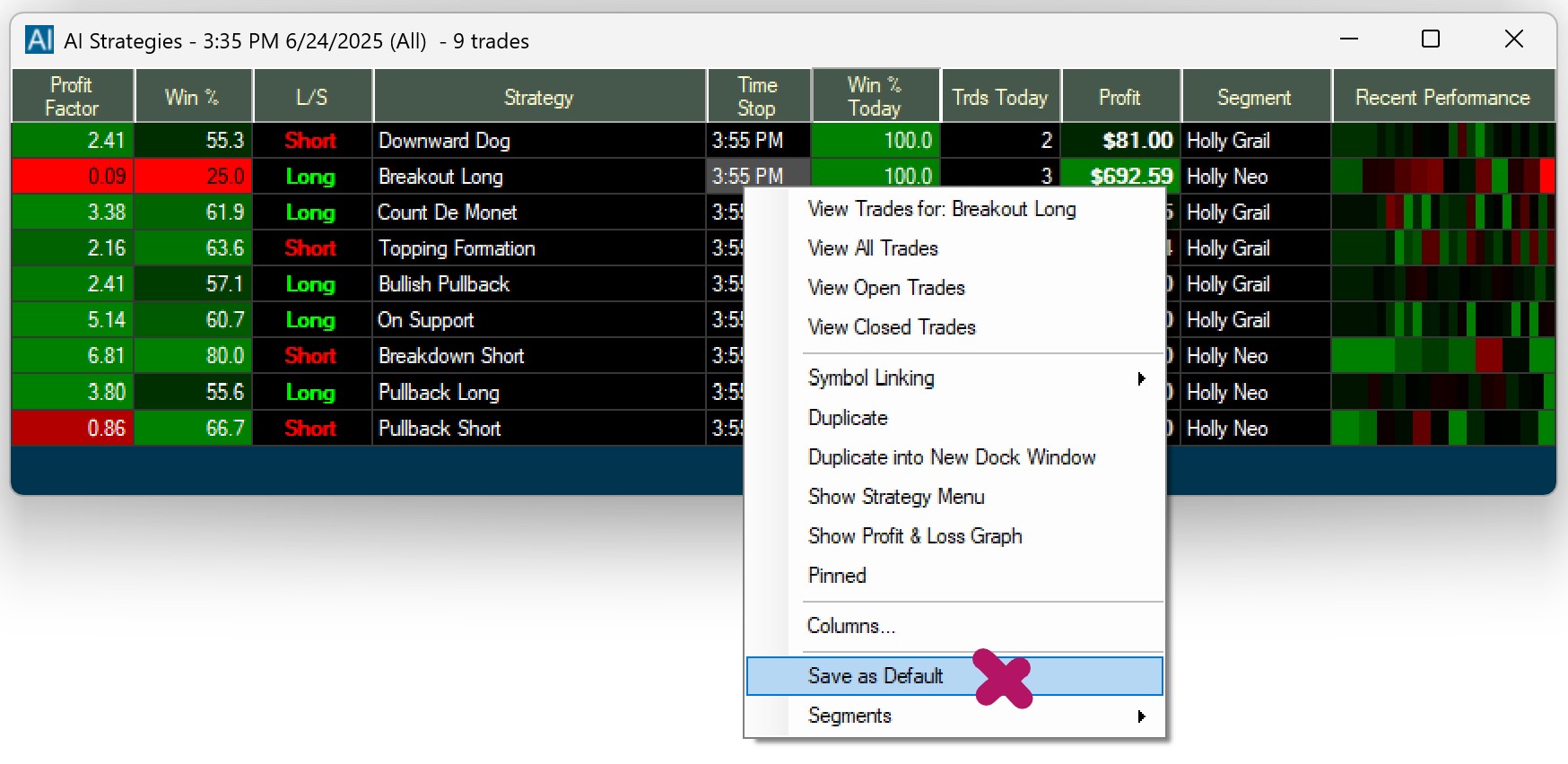

Right-Click Menu

The Right-Click Menu is the main way to control and configure most of the Trade Idea windows and the Holly AI Windows are no exception.

View Trades

The Right-Click-Menu gives you the option to only view the trades of a specific strategy, or to view all trades, only the open trades or only the closed trades.

Selecting any of these options will open a new AI Strategy Trades Window that contains your trade selection.

Duplicate

To copy your current window, use the Duplicate function. Simply right-click into your AI Strategy Window and select Duplicate from the dropdown.

You will get an exact copy of the current window, which you can modify while keeping the original window intact.

Duplicate into New Dock Window

To open a copy of a free-floating window in a new Dock, right-click into the free-floating window and select Duplicate into New Dock Window.

An exact copy of your free-floating window will now be opened in a new Dock.

Duplicate into XYZ Dock

To load a copy of a free-floating window into an already open Dock, right-click into the free-floating window and select Duplicate into XYZ Dock, where XYZ stands for the Name of that particular Dock.

An exact copy of your free-floating window will now be added to the chosen Dock.

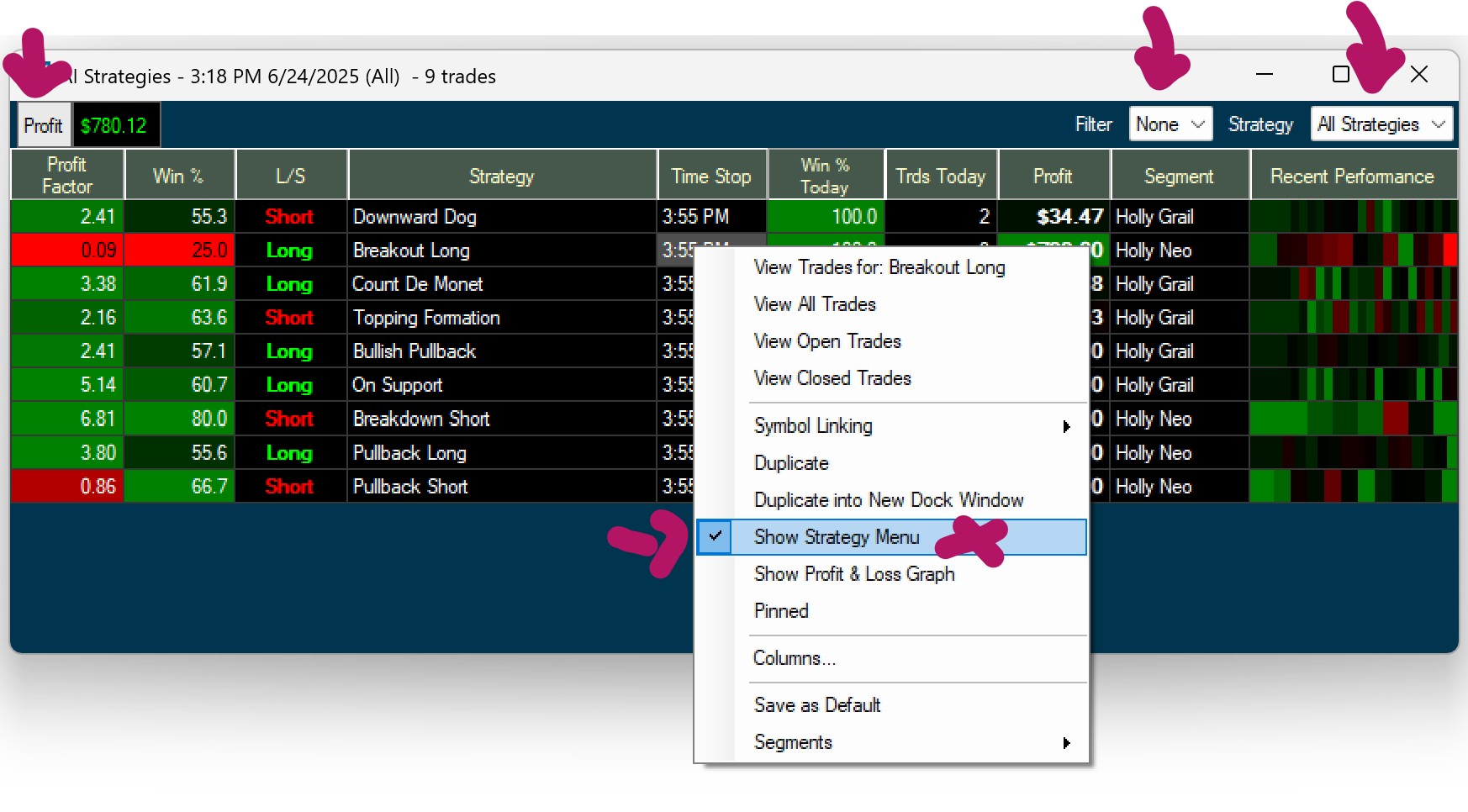

Show Strategy Menu

You can choose to show or hide the Strategy Menu, which contains the Profit & Loss display on the top left-hand side of the window as well as the two filter options on the top right-hand side.

Simply right-click into the AI Strategy Window and check or uncheck Show Strategy Menu.

Show Profit & Loss Graph

The Profit & Loss Graph displays the Total Profit & Loss based on the AI Risk Size. You can choose to show or hide the Profit & Loss Graph.

Simply right-click into the AI Strategy Window and check or uncheck Show Profit & Loss Graph.

Pinned

To keep a single Trade Ideas window on your screen permanently, even when switching layouts, or toggling through channels, right-click into the specific window, and select Pinned from the dropdown. The Pinned Feature, is available for all Trade Idea Windows, including Scans, Charts, Compare Count, and the Holly AI Windows.

Once a window is pinned, it does not follow the behavior of the other windows.

This is useful if you would like to include one or more windows of a channel in a custom layout, without saving the individual windows to the Cloud first.

It is important to note, that this window will stay open until you decide to unpin it. When accidentally saved within a layout, It might load multiple times, when closing and re-opening this layout. At worst, you will have multiple versions of the window all running on top of each other in the same position. This can put a strain on system resources and drastically impact software performance. The pinning option should therefore be used very carefully and consciously. A window should always be unpinned after the desired action is completed.

To do this, right-click into the window and remove the checkmark on Pinned.

To see all pinned and unpinned windows, or to close them, go to the Toolbar, select Windows, and choose, Close All Unpinned, or Close All Pinned.

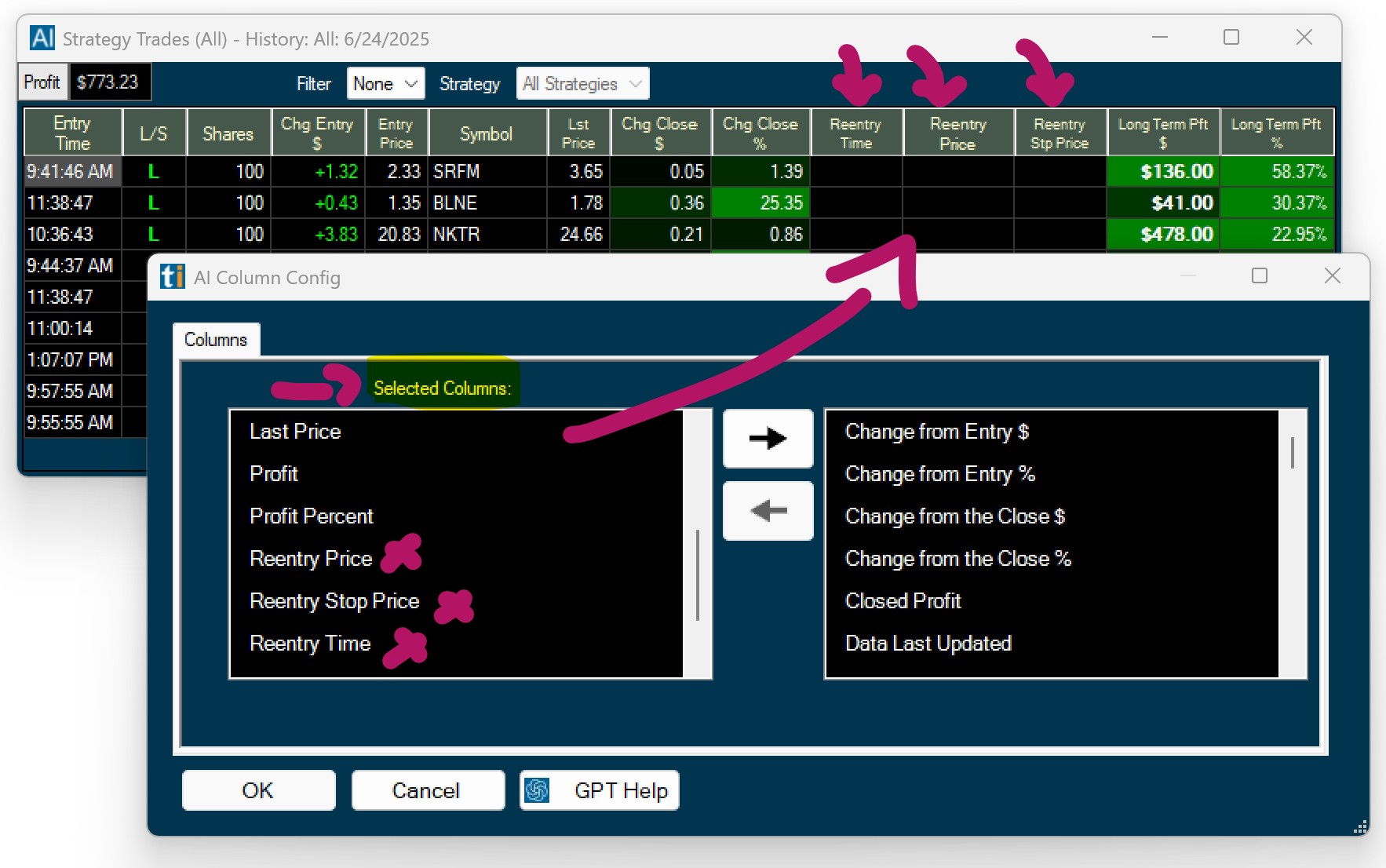

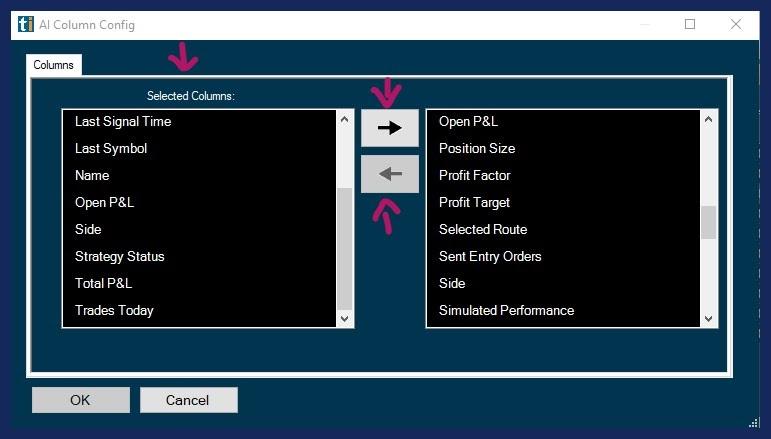

Columns

The columns can be reorganized via left-click drag and drop. The individual columns can also be extended or compressed by using your mouse.

To add more columns right-click into the window and select Columns.

The left-hand side shows the already listed columns, the right-hand side shows the columns that can be added.

Select additional columns by highlighting them with a left mouse click.

Click the arrow pointing to the left to move them to the Selected Columns field.

To remove any of the already selected columns, highlight the column, then click the arrow pointing to the right.

Click OK when you are done.

Save as Default

You can save a window and its configuration as the default version of this window type by right-clicking and choosing Save As Default. Whenever you now open a new window of this type from the New Tab of your Toolbar, the window configuration that you saved as default, will load.

The Load Window option, which you can find in the File Tab of the Toolbar, provides access to all the default versions of your Trade Ideas windows. The default layouts of your Chart, Single Stock, Brokerage Plus, and AI Windows are saved in the TradeIdeasPro folder on your local computer.

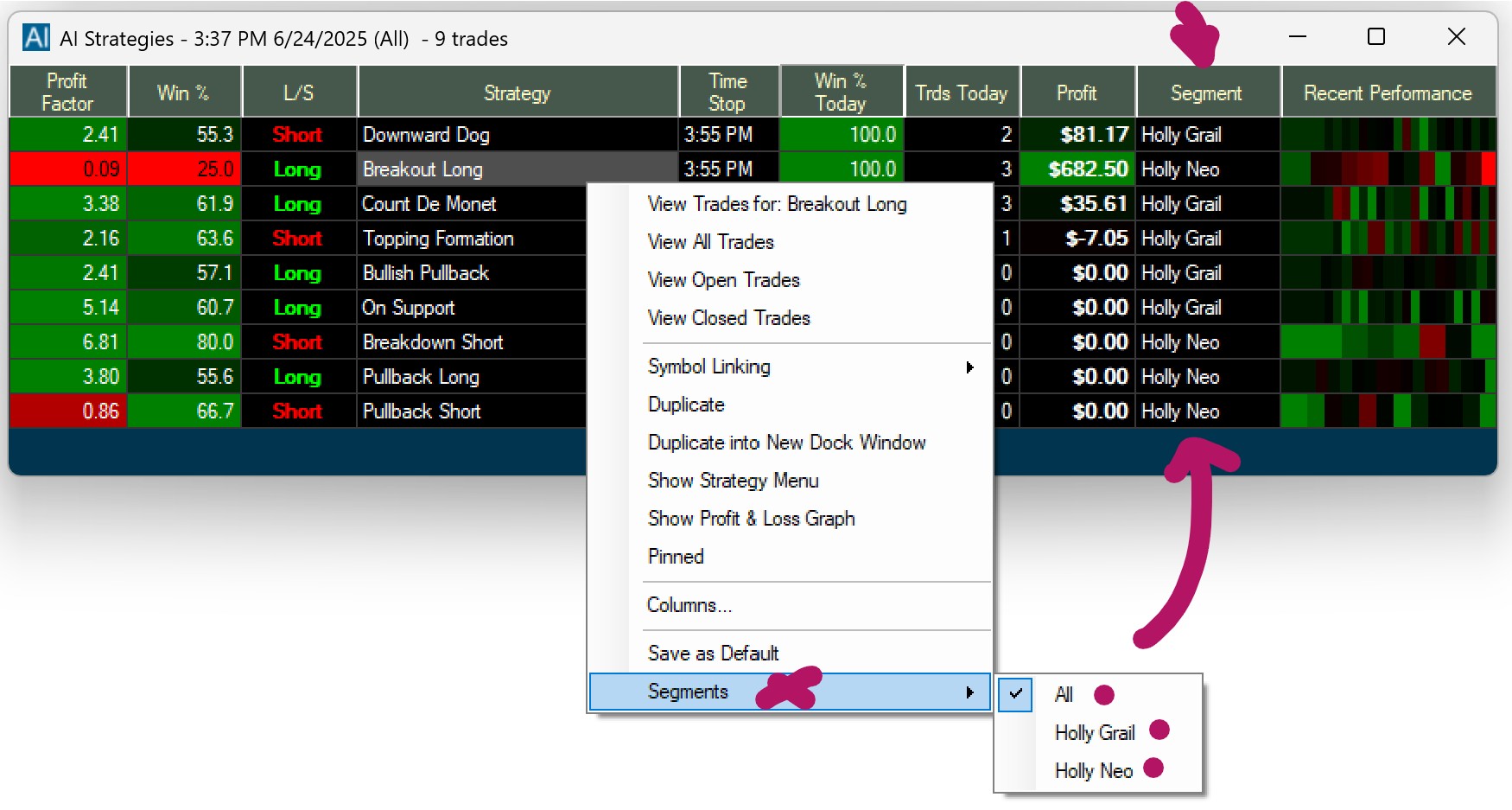

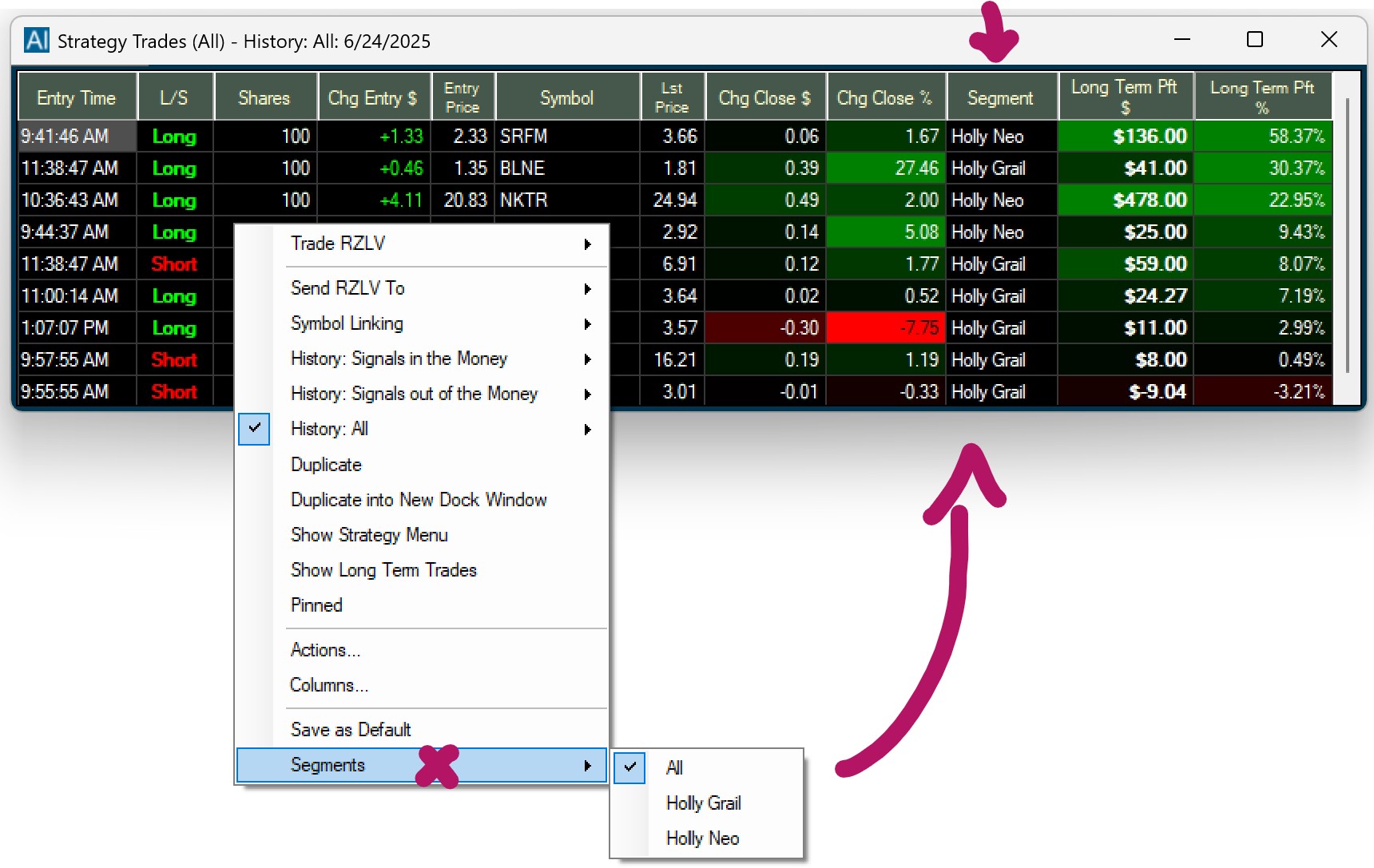

Segments

Holly consists of three Segments, namely Holly Grail, Holly 2.0, and Neo, which have different strategies assigned.

To switch to a specific Holly Segment, select Segments and make your choice.

AI/Holly Strategy Trades Window

To see Holly’s trading in action, open to the AI Strategy Trades Window. All the trades that Holly enters during the day will appear here.

Whenever Holly enters a new trade, the entire entry row will flash.

You will find it in the Toolbar under New, as well as in the Trade Ideas AI Channel.

AI/Holly Strategy Trades Window:

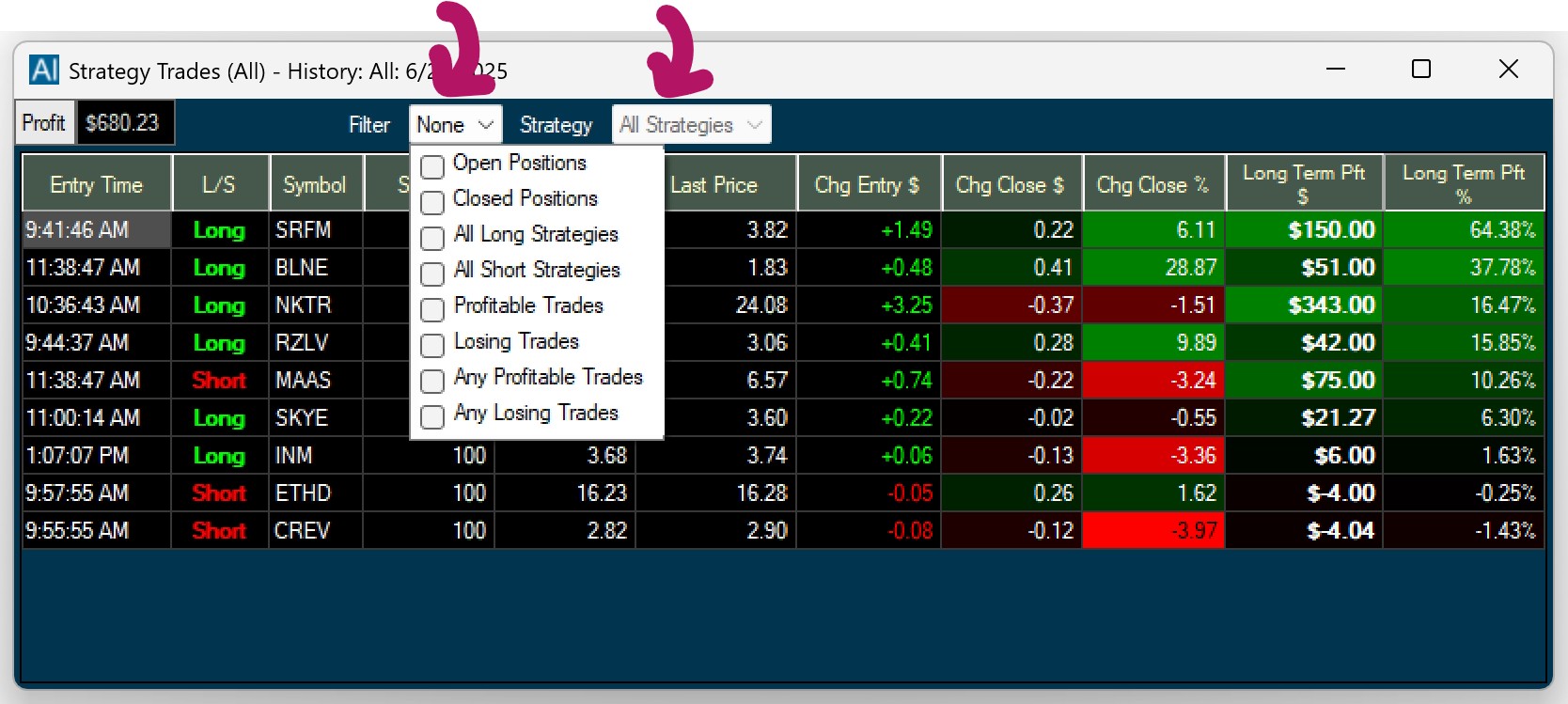

Filters

The two filter dropdowns on the top right-hand side of the AI Strategy Trades Window, enable you to filter by open/closed positions, all long/short strategies and profitable/losing trades, as well as individual strategies.

The filters are part of the Strategy Menu, which you can choose to show or hide.

Simply right-click into the AI Strategy Trades Window and check/uncheck the option Show Strategy Menu.

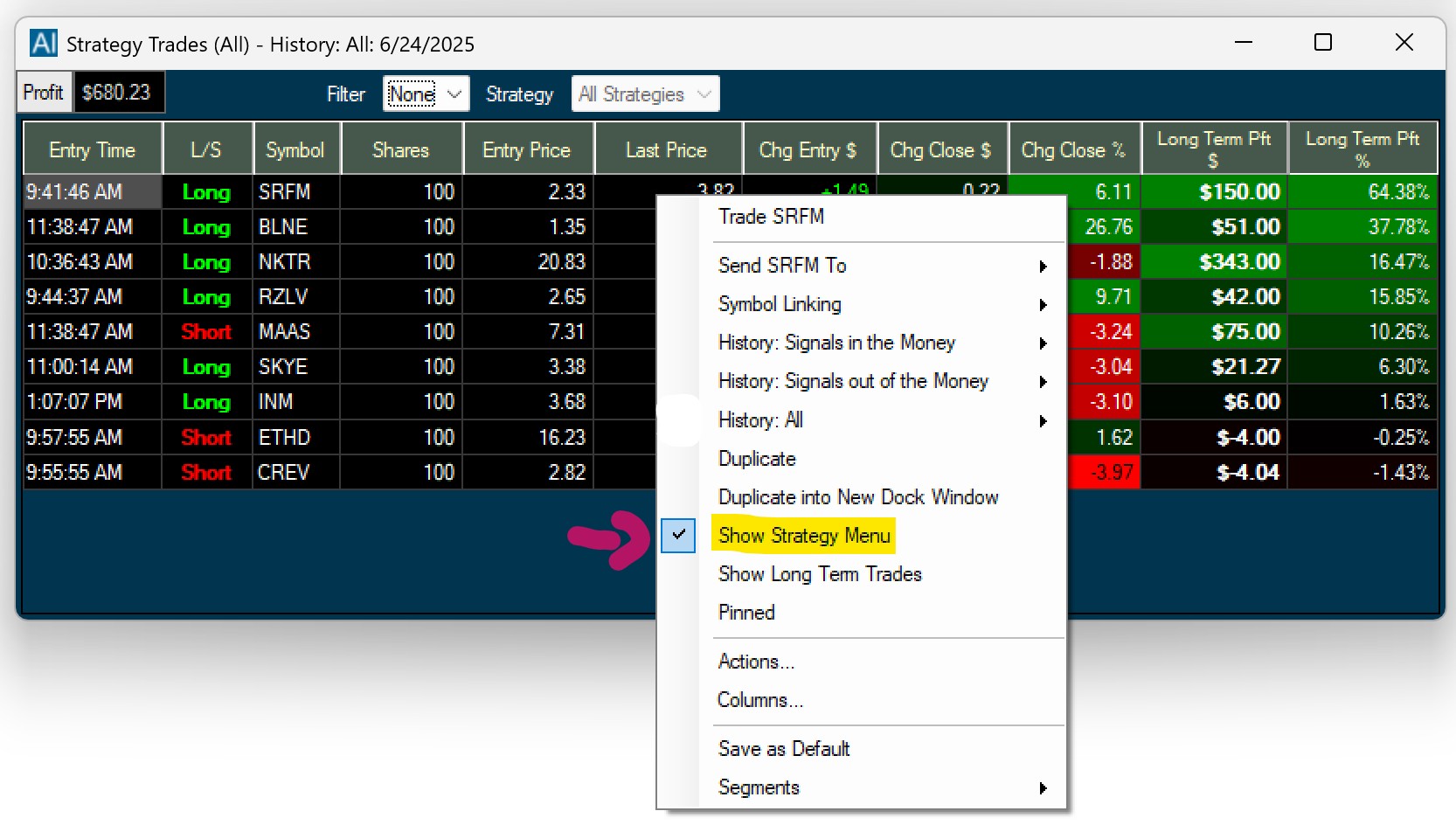

Right-Click Menu

The Right-Click Menu is the main way to control and configure most of the Trade Idea windows and the Holly AI Windows are no exception. Right-click into any Trade Ideas Window, and you will see a host of options revealed that enable you to adjust a window's settings.

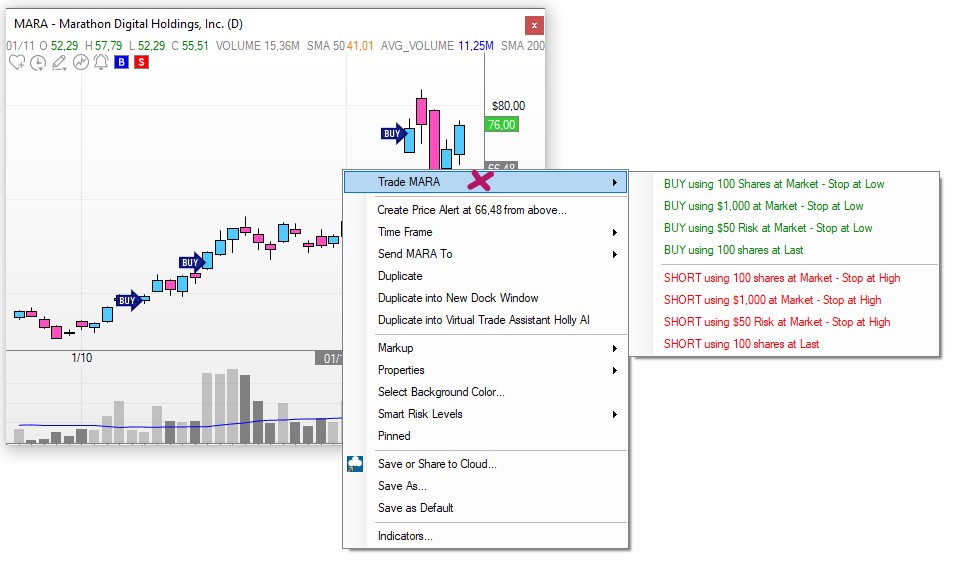

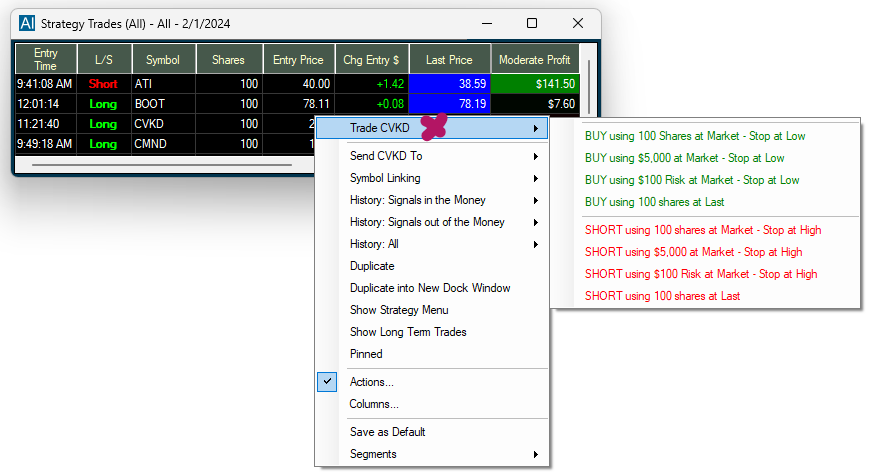

Trade XYZ

Our Brokerage Plus Module enables you to send orders based on Holly's strategies directly to participating brokers or our simulator.

As a first step, open the Brokerage Plus Module by clicking, Brokerage Plus Sim in the Toolbar. This will automatically connect you to our Simulator.

You can confirm that you are connected to our Simulator, by clicking Connect in the top left-hand corner. If the connection bar and the chosen connection option are green, the connection has been established. To connect to a participating Brokerage Platform, follow the instructions in the Brokerage Plus How to connect Holly section.

Once connected, right-click the symbol you would like to trade within the AI Strategy Trades Window and select Trade XYZ.

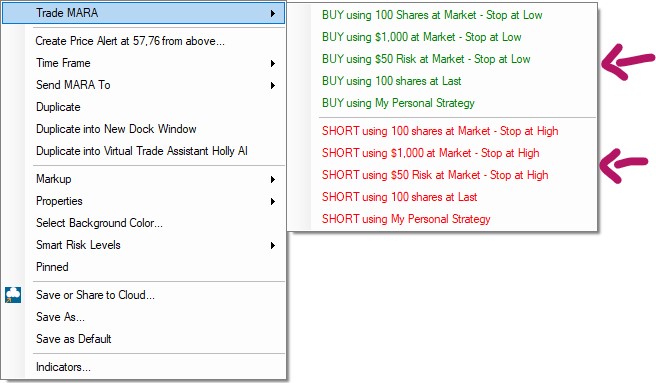

You have a few preset Order Entry Templates to choose from, but you easily can modify them, or create your very own One-Click Orders including stops and targets from scratch.

For more info head here: One-Click-Trading Strategies

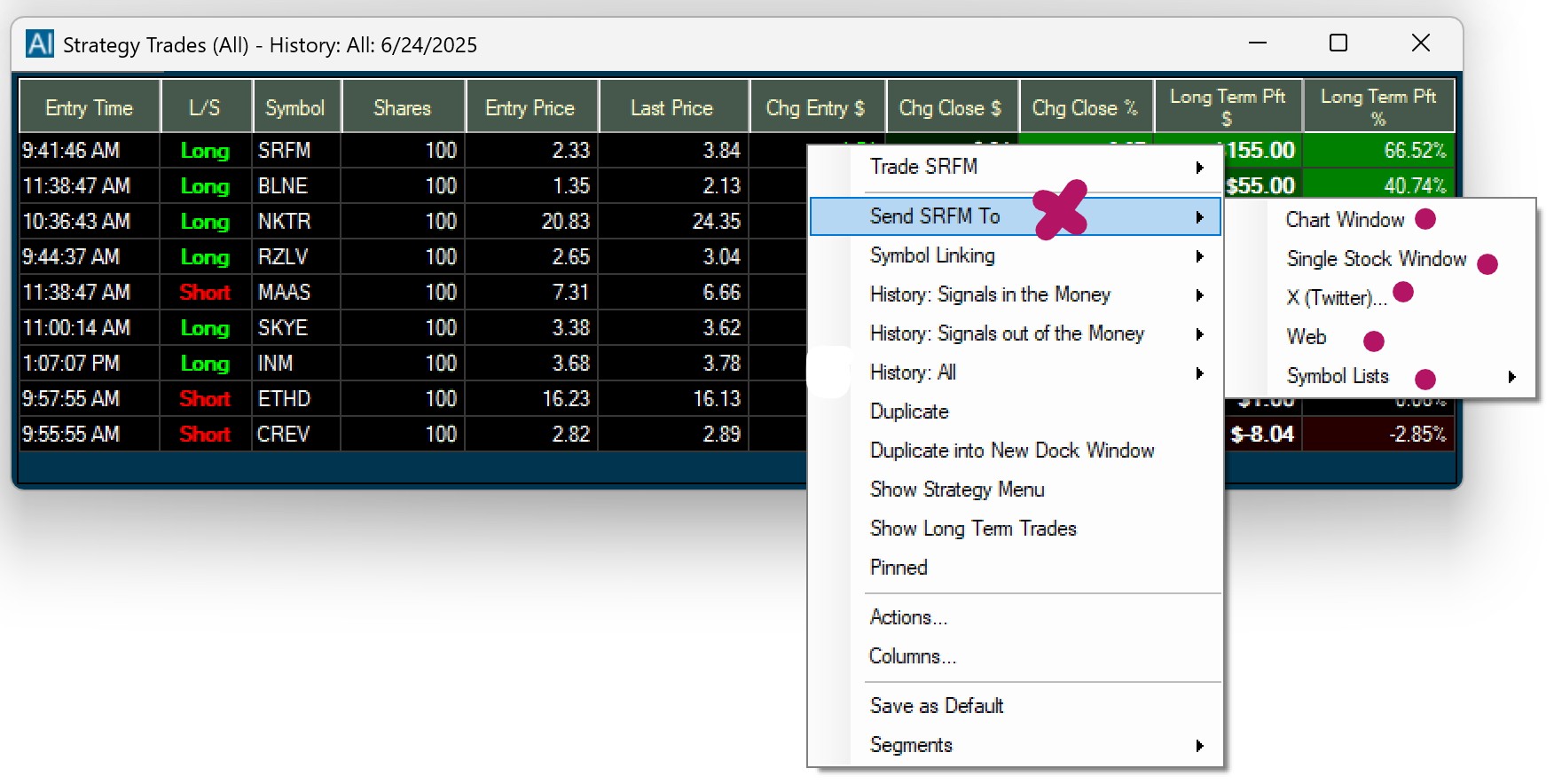

Send XYZ to…

The Send to Feature that you can access via right-click into the AI Strategy Trades Window, enables you to lookup more info for a stock, add it to a watchlist, or share it with others.

You can send the chosen symbol to a chart window, a single stock window, to Twitter, or the Web. By selecting Send to Web, you can find info about the stock on Yahoo Finance, Finviz, and many other web-based platforms.

Lastly, you can send the stock symbol to one of your symbol lists or create a new symbol list.

This is particularly helpful if you would like to bookmark the stock and continuously monitor it independent of Holly.

For more details about the Send to Feature have a look at this section

To learn more about Symbol Lists, head to the Symbol List section.

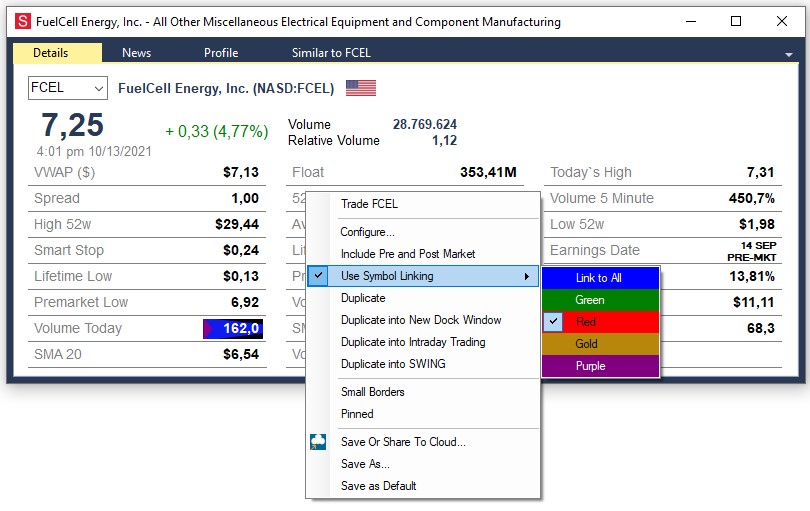

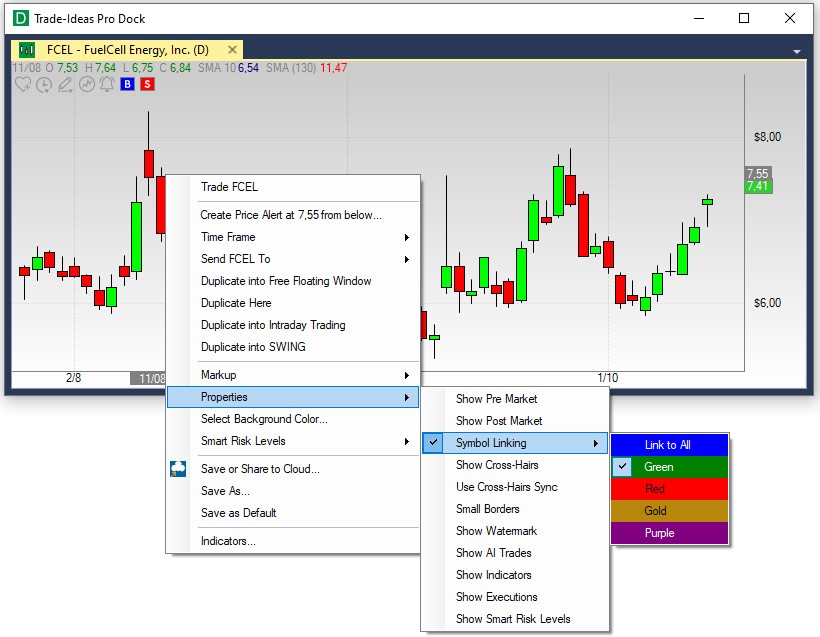

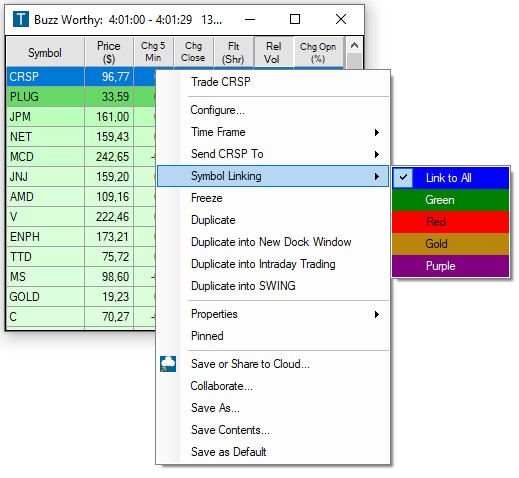

Symbol Linking

Most Trade Idea Windows, including Alert, Top List, Multi-Strategy, and Compare Count Windows as well as the Holly AI Windows, RBI, GBI, and Price Alerts can be symbol-linked to a Chart or Single Stock Window. This means that when changing your windows stock symbol, your symbol-linked Chart or Single Stock Window will automatically change as well, and display the specific stock’s data.

To enable Symbol Linking for a Single Stock Window, right-click into it, and select Symbol Linking. Now, add a Checkmark to the left-hand side of the Symbol Linking option.

To enable Symbol Linking for a Chart, right-click into it, select Properties, and then Symbol Linking. Now, add a Checkmark to the left-hand side of the Symbol Linking option.

By default, all symbol-linked Windows belong to the blue, Link to All, Color Group.

The assigned color will always display in the top left-hand corner of each window.

You can create up to 4 additional Linking Groups and by doing so, link selected windows to a specific Chart or Single Stock Window, which is very useful when monitoring various scans.

There are two ways to create a Linking Group:

- Option 1

You can assign windows to a specific Color Group individually. To do so, right-click into your window, select Symbol Linking, and choose a color from the dropdown. The selected window will now display the Color Group in the top left-hand corner.

Next, right-click into your Single Stock Window and select Symbol Linking.

Add a Checkmark to the left-hand side of the Symbol Linking option, then select a Color Group from the Symbol Linking dropdown.

Your Single Stock Window will now be linked to all the windows that belong to the same Color Group and update accordingly whenever you change the stock symbol in one of these windows.

Follow the same process with your Chart, right-click into it, select Properties, and then Symbol Linking. Now, add a Checkmark to the left-hand side of the Symbol Linking option. Thereafter, choose a Color Group.

Please note, that the Single Stock Window and Chart will also be linked to the Blue Color Group since this is the default Link to All Group.

- Option 2

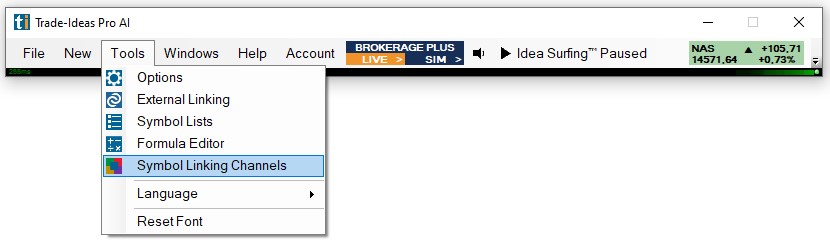

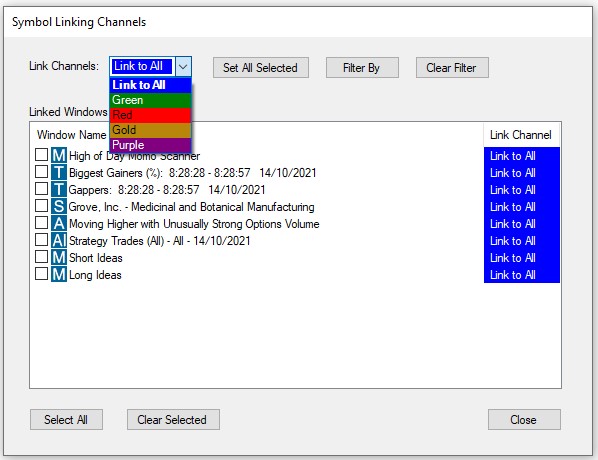

To establish a Linking Group for a number of windows at once, go to the Toolbar, open the Tools Tab, and select, Symbol Linking Channels.

The next window will display all the Trade Ideas windows currently in use.

By default, each window is assigned to the blue, Link to All, Linking Group.

To establish a new Linking Group, select the windows that will be part of the new Linking Group by adding a checkmark.

You can select all windows at once by choosing, Select All, at the bottom.

You can clear your selection by selecting, Clear Selected, at the bottom.

Once you have selected the windows, open the Link Channels dropdown in the top left-hand corner. Select a color for your new Linking Group, then choose, Set All Selected, to assign the windows.

All the selected windows will now display the color of the Linking Group you have assigned them to.

To see all windows that are assigned to a specific Linking Group, choose the Group Color from the Link Channels dropdown, then select, Filter By. To see all available windows, select, Clear Filter.

Once you have assigned the windows, select Close.

All the windows that you assigned to a Linking Group will now display the Group Color in the top left-hand corner.

Any Single Stock Window or Chart that has been assigned to the same Color Group will update accordingly, whenever you change a stock symbol in one of the other Linking Group windows.

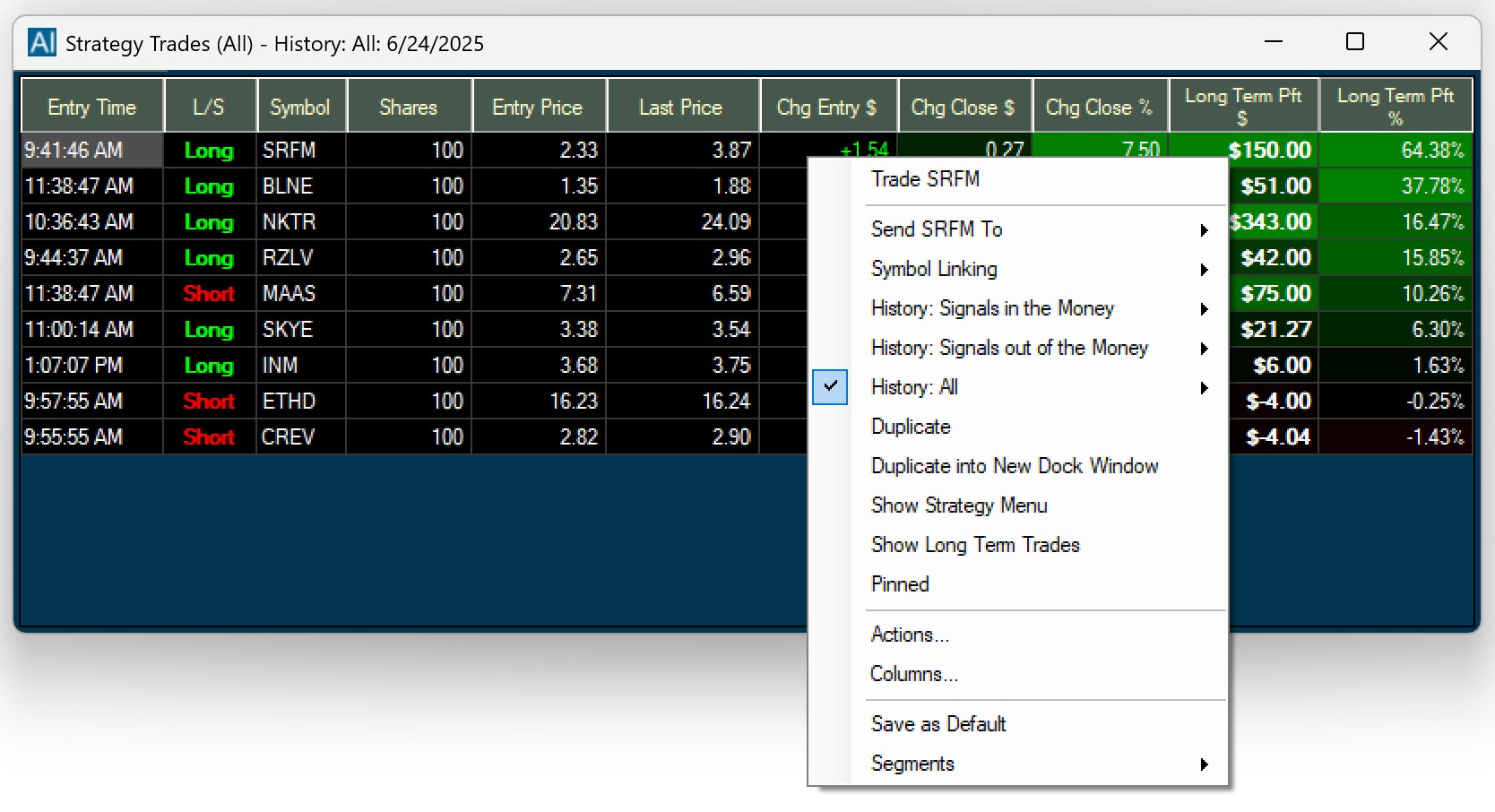

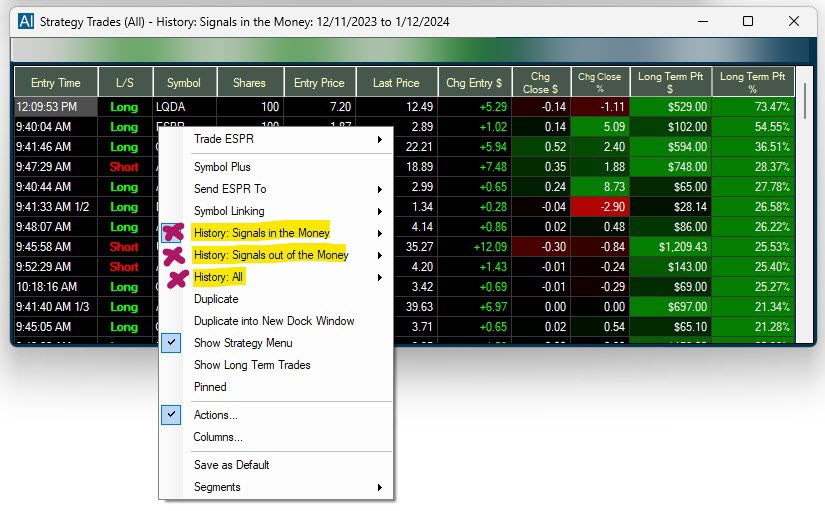

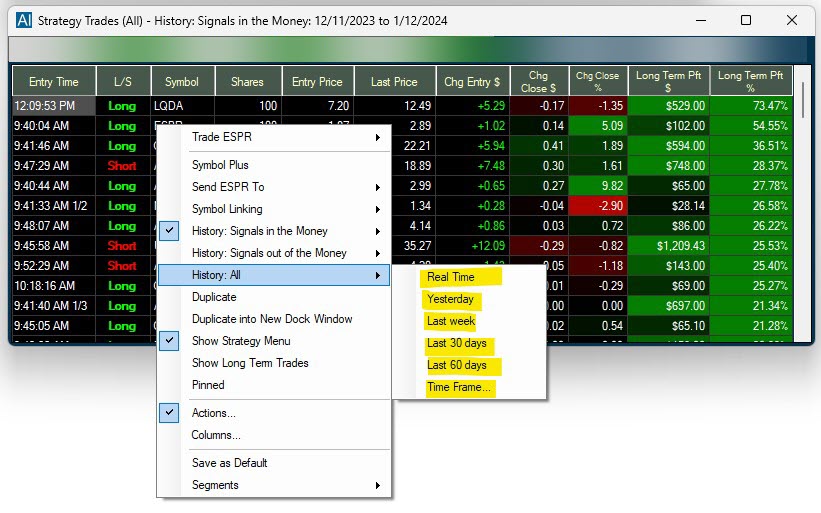

Holly AI History & Performance

The History Feature allows you to analyze Holly’s past trades. You can select specific days or a time period.

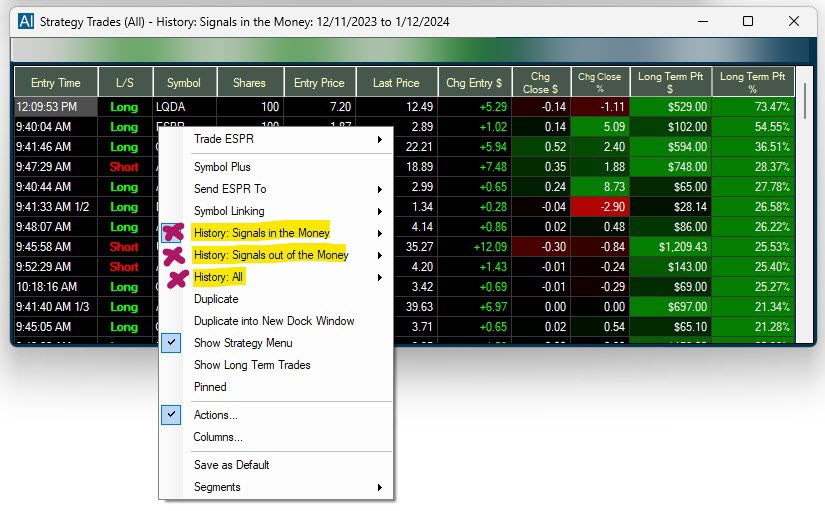

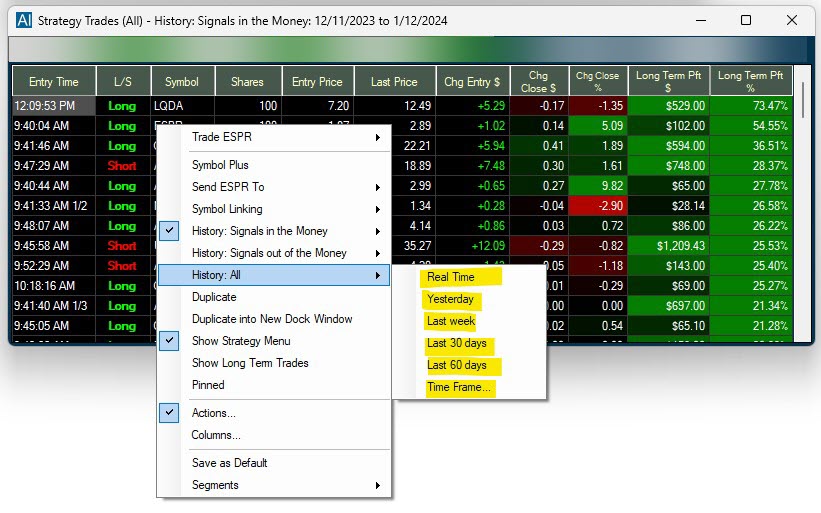

To access the function, right-click into the AI Strategy Trades Window and select one of the following three options:

- History: Signals in the Money

The Signals in the Money Window allows you to see Holly’s past trades for the chosen time period ranked by long-term profit in percent with the highest return at the top and ending at 0%.

- History: Signals out of the Money

The Signals out of the Money Window allows you to see Holly’s past trades for the chosen time period ranked by long-term profit in percent starting at 0% and descending into negative values.

- History: All

The All History Window allows you to see all Holly’s past trades for the chosen time period ranked by long-term profit in percent starting at the highest percentage return and ending at the lowest percentage return.

Each option allows you to refine the results by selecting specific days or a time period for your review.

You can sort the output of these History Windows by specific columns.

To transfer the column entries into a spreadsheet, highlight the rows either by clicking and holding down your left mouse key while moving over the rows or by pressing the Control and A key on your keyboard. To copy your selection, press the Control and C key on your PC’s keyboard. Finally, press the Control and V key to paste the selected rows into your spreadsheet.

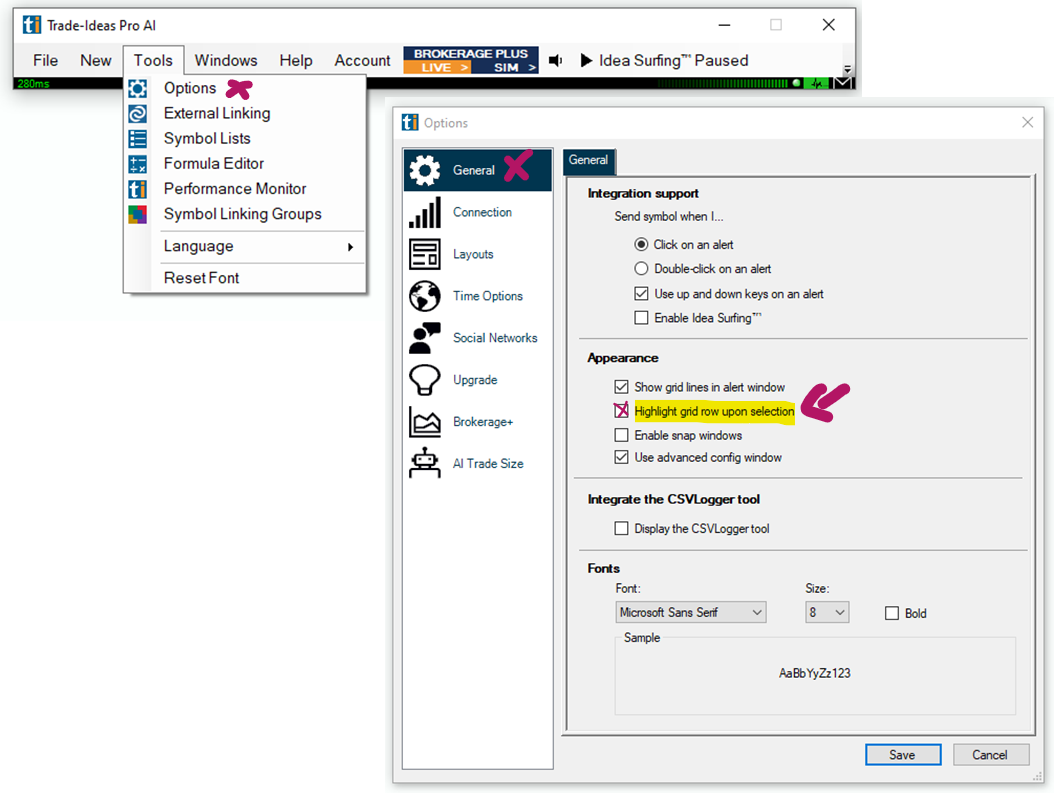

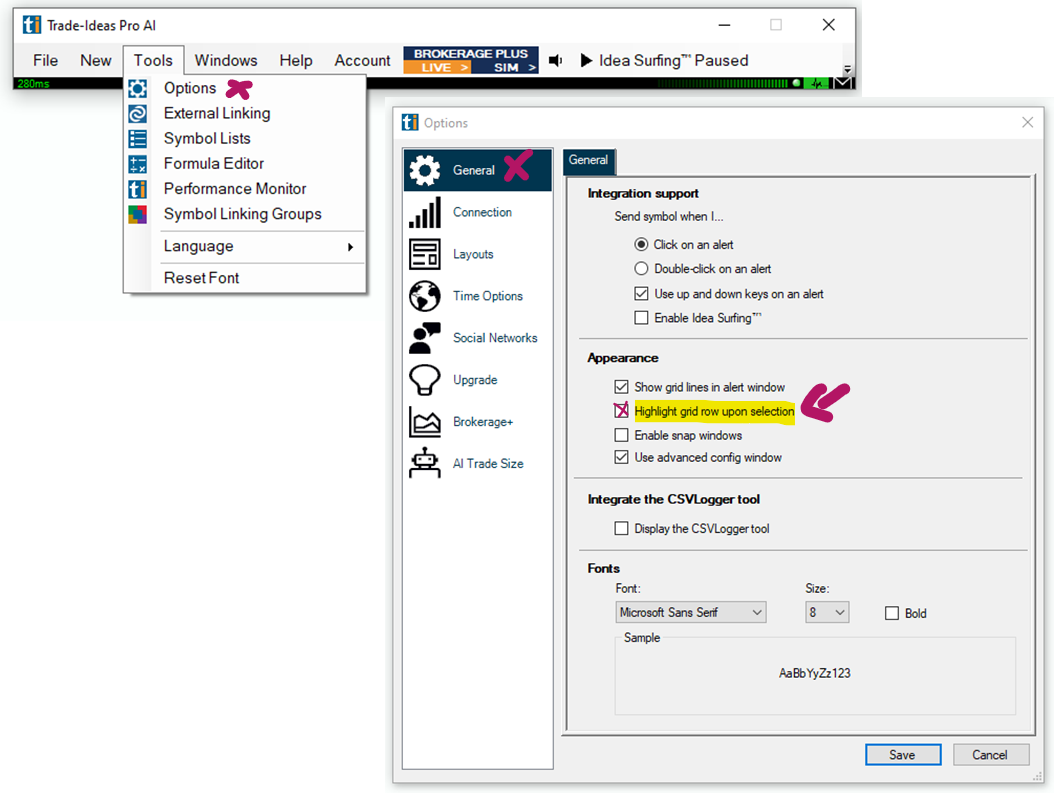

Go to the Toolbar, select Options, Layouts, and then Highlight grid row upon selection to highlight entire rows with one mouse click. If this setting is disabled, you can highlight single columns.

To see some of Holly AI's great past trades have a look at our Holly Records Page

Duplicate

To copy your current Trade Ideas Window, use the Duplicate function. Simply right-click into your AI Strategy Trades Window and select Duplicate from the dropdown.

You will get an exact copy of the current window, which you can modify while keeping the original window intact.

Duplicate into New Dock Window

To open a copy of a free-floating window in a new Dock, right-click into the free-floating window and select Duplicate into New Dock Window. An exact copy of your free-floating window will now be opened in a new Dock.

Duplicate into XYZ Dock

To load a copy of a free-floating window into an already open Dock, right-click into the free-floating window and select Duplicate into XYZ Dock, where XYZ stands for the Name of that particular Dock. An exact copy of your free-floating window will now be added to the chosen Dock.

Show Strategy Menu

You can choose to show or hide the Strategy Menu, which contains the Profit & Loss Top Menu on the top left-hand side of the window as well as the two filter options on the top right-hand side.

Simply right-click into the AI Strategy Trades Window and check or uncheck Show Strategy Menu.

Pinned

To keep a single Trade Ideas window on your screen permanently, even when switching layouts, or toggling through channels, right-click into the specific window, and select Pinned from the dropdown. The Pinned Feature, is available for all Trade Idea Windows, including Scans, Charts, Compare Count, and the Holly AI Windows.

Once a window is pinned, it does not follow the behavior of the other windows.

This is useful if you would like to include one or more windows of a channel in a custom layout, without saving the individual windows to the cloud first.

It is important to note, that this window will stay open until you decide to unpin it. When accidentally saved within a layout, It might load multiple times, when closing and re-opening this layout. At worst, you will have multiple versions of the window all running on top of each other in the same position. This can put a strain on system resources and drastically impact software performance. The pinning option should therefore be used very carefully and consciously. A window should always be unpinned after the desired action is completed.

To do this, right-click into the window and remove the checkmark on Pinned.

To see all pinned and unpinned windows, or to close them, go to the Toolbar, select Windows, and choose, Close All Unpinned, or Close All Pinned.

Actions - Sound Notifications

Whenever Holly enters a new trade, the entire entry row will flash, giving you a visual clue.

To enable additional Sound Notifications, right-click into the AI Strategy Trades Window and select Actions.

-

Check Play Sound in the new popup window.

-

Then click Set Up Sound.

-

The next window will display built-in sound options. You can choose an asterisk, a beep, exclamation, a stop, or text to speech. If you choose the Text-To-Speech, a female or male voice will call out each stock symbol that triggers. Verbose will mention more details about the trade. Further below, you can choose a custom sound from your local computer (WAV format only).

-

Once you have selected a Sound Option, click Play to test the audio. Use the Balance and Volume sliders to adjust the sound to your liking.

-

Hit Okay when you are done.

Columns

The columns can be reorganized via left-click drag and drop. The individual columns can also be extended or compressed by using your mouse.

To add more columns right-click into the window and select Columns.

The left-hand side shows the already listed columns, the right-hand side shows the columns that can be added.

Select additional columns by highlighting them with a left mouse click.

Click the arrow pointing to the left to move them to the Selected Columns field.

To remove any of the already selected columns, highlight the column, then click the arrow pointing to the right.

Click OK when you are done.

Reentry Feature

If a stock rallies back up or down after Holly's Stop has been hit, she will re-enter the trade once the price reaches the halfway level between the stop price and her initial entry. Her initial Stop will stay in place. Reentries are treated as new trades and have no impact on the P&L of the initial trade.

You can see Holly’s Reentry Time and Reentry Price by selecting and adding the corresponding columns via the right-click Menu.

Save as Default

You can save a window and its configuration as the default version of this window type by right-clicking and choosing Save As Default. Whenever you now open a new window of this type from the New Tab of your Toolbar, the window configuration that you saved as default, will load.

The Load Window option, which you can find in the File Tab of the Toolbar, provides access to all the default versions of your Trade Ideas windows. The default layouts of your Chart, Single Stock, Brokerage Plus, and AI Windows are saved in the TradeIdeasPro folder on your local computer.

Segments

Holly consists of three Segments, namely Holly Grail, Holly 2.0, and Neo, who all employ different strategies. To switch to a specific Holly Segment, select Segments and make your choice.

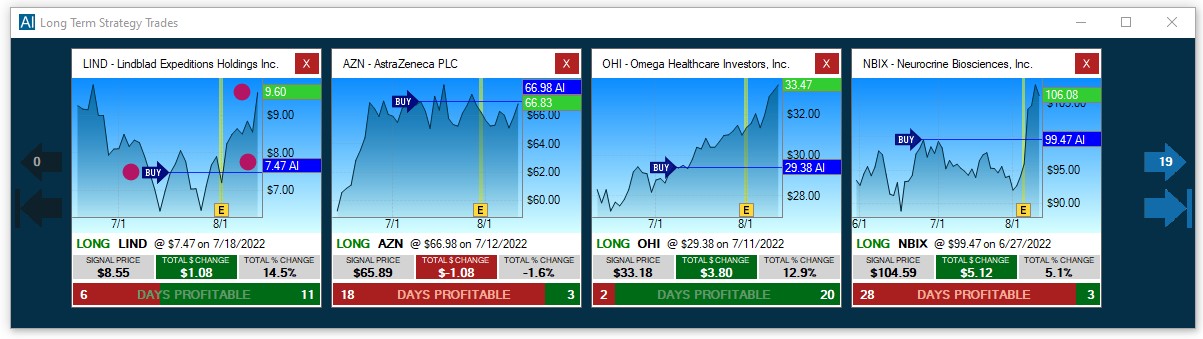

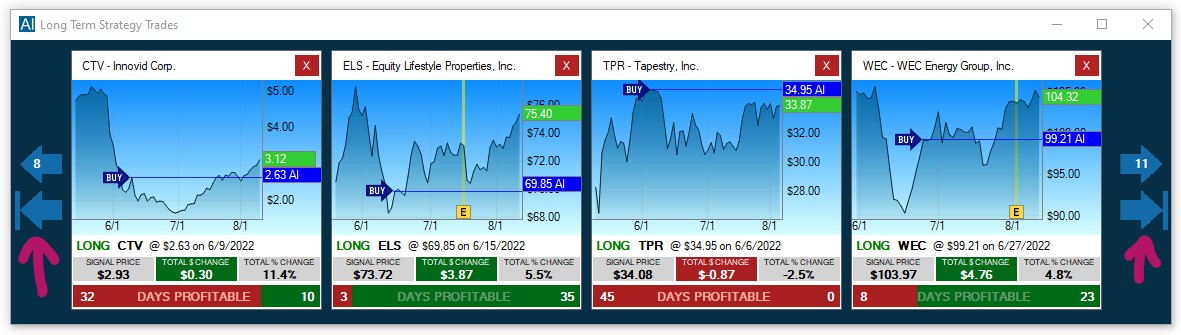

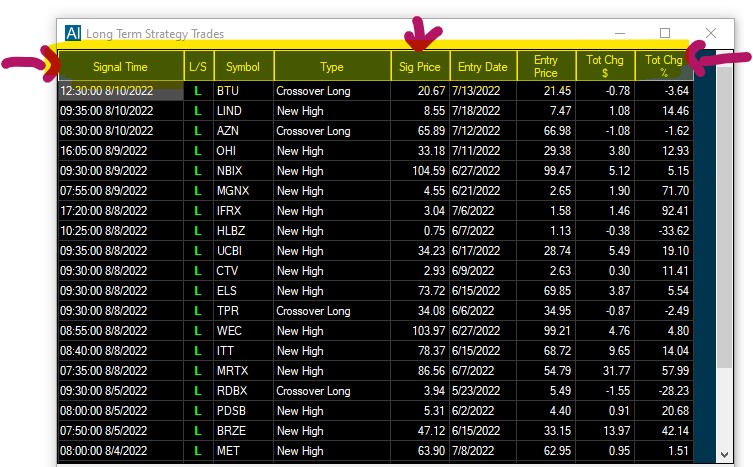

Premium AI Longterm Strategy Trades Window

Holly exits all her trades at the end of each trading day. However, the trade catalysts don’t simply expire when the stock market closes. Some of these triggers offer the potential to catapult a stock over the course of several days or weeks in the direction of the day’s trading signal.

The AI Longterm Strategy Trades Window enables you to see these trades.

Traders can now benefit from Holly’s carefully selected trades beyond the initial trading day, and easily track them.

To load this window, go to the Toolbar, open the File Tab and select Premium AI Longterm Strategy Trades Window:

All stocks listed in the Long Term Strategy Trades Window fit one of the following criteria:

-

When the original trade was a Long Trade, they are either making new highs or are moving from red to green.

-

When the original trade was Short Trade, they are either making new lows or are moving from green to red .

Each thumbnail chart relays the following info:

-

The Direction of the Trade (Buy/Sell)

-

The Original Entry Price

-

The Current Price of the Stock

Below each thumbnail chart you will find the following info:

-

The Direction of the Original Holly AI Trade (Long or Short)

-

The Original Entry Price

-

The Date of the Original Trade

-

The Signal Price, which is the price that triggered the stock being added to the Longterm Holly AI Strategy Trades List

-

The Total Change in $, which is the difference in dollar between the Original Entry Price and the Signal Price

-

The Total Change in %, which is the difference in percent between the Original Entry Price and the Signal Price

-

The Total Number of Profitable Days counted from the Original Entry Date

By default, the thumbnail charts are sorted by Signal Time, from left to right.

Clicking the top arrows on the left and right-hand side enables you to move through the list.

The total number of stocks on the list as well as the current position are displayed on these arrows.

A click on the bottom arrow on the right-hand side will bring you to the last stocks on the list, a click on the bottom arrow on the left-hand side will bring you back to the first entries.

A click on the thumbnail header will load the stock in any symbol-linked chart

To see Holly AI Trade details in your chart, right-click into the chart, select Properties and then Show AI Trades

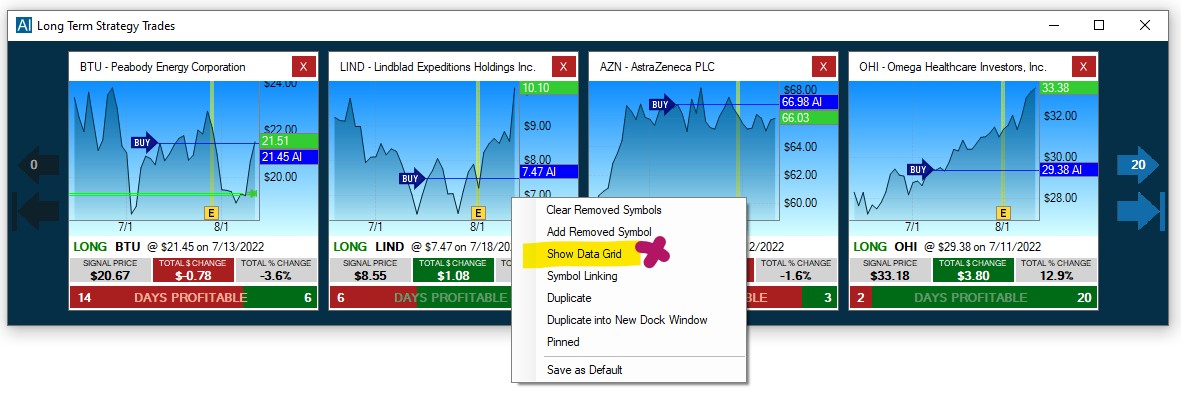

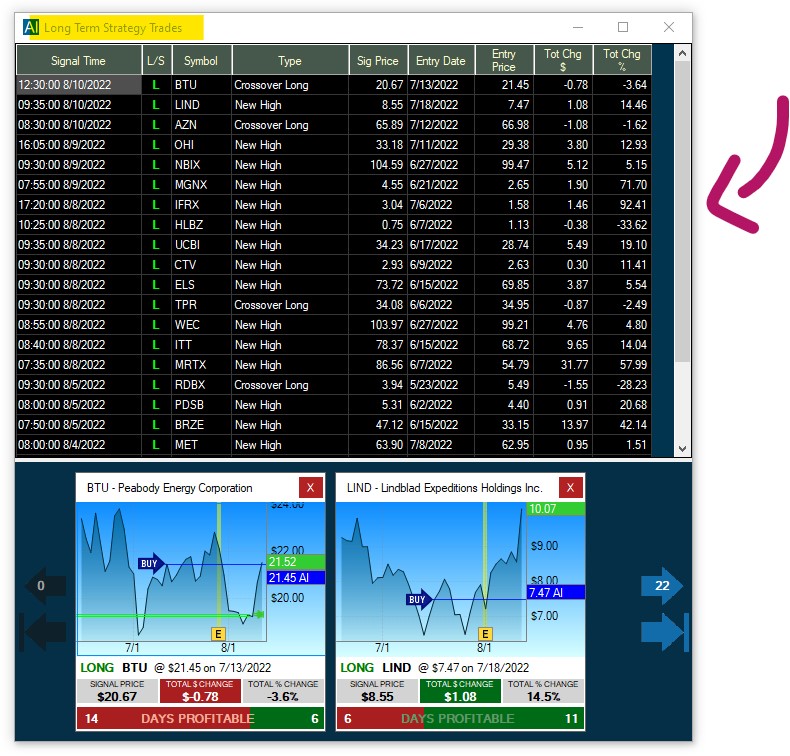

To see all longterm Holly AI trades in grid view, right-click into the Long Term Strategy Trades Window and select Show Data Grid.

This will open the Long Term Strategy Trades Data Grid

By default, the thumbnail charts are sorted by Signal Time Descending from left to right.

A double-click on a data grid colum header will change the sort order of the thumbnails accordingly.

To remove stocks from the list, simply click on the X in the top right-hand corner of the thumbnail chart.

To reverse the symbol removal, right-click into the window and select, Clear Removed Symbols.

To add indivudal removed symbols back to the list, select Add Removed Symbols, then select the specific symbol(s) from the dropdown.

Audible Trade Notifications

Whenever Holly enters a new trade, the entire entry row will flash, giving you a visual clue.

To enable additional Sound Notifications, right-click into the AI Strategy Trades Window and select Actions.

-

Check Play Sound in the new popup window.

-

Then click Set Up Sound.

-

The next window will display built-in sound options. You can choose an asterisk, a beep, exclamation, a stop, or text to speech. If you choose the Text-To-Speech, a female or male voice will call out each stock symbol that triggers. Verbose will mention more details about the trade. Further below, you can choose a custom sound from your local computer (WAV format only).

-

Once you have selected a Sound Option, click Play to test the audio. Use the Balance and Volume sliders to adjust the sound to your liking.

-

Hit Okay when you are done.

Holly AI History & Performance

The History Feature allows you to analyze Holly’s past trades. You can select specific days or a time period.

To access the function, right-click into the AI Strategy Trades Window and select one of the following three options:

- History: Signals in the Money

The Signals in the Money Window allows you to see Holly’s past trades for the chosen time period ranked by long-term profit in percent with the highest return at the top and ending at 0%.

- History: Signals out of the Money

The Signals out of the Money Window allows you to see Holly’s past trades for the chosen time period ranked by long-term profit in percent starting at 0% and descending into negative values.

- History: All

The All History Window allows you to see all Holly’s past trades for the chosen time period ranked by long-term profit in percent starting at the highest percentage return and ending at the lowest percentage return.

Each option allows you to refine the results by selecting specific days or a time period for your review.

You can sort the output of these History Windows by specific columns.

To transfer the column entries into a spreadsheet, highlight the rows either by clicking and holding down your left mouse key while moving over the rows or by pressing the Control and A key on your keyboard. To copy your selection, press the Control and C key on your PC’s keyboard. Finally, press the Control and V key to paste the selected rows into your spreadsheet.

Go to the Toolbar, select Options, Layouts, and then Highlight grid row upon selection to highlight entire rows with one mouse click. If this setting is disabled, you can highlight single columns.

To see some of Holly AI's great past trades have a look at our Holly Records Page

How to use Holly

There is more than one way to incorporate Holly into your trading:

Option 1: Holly Hands-On

Follow Holly's trades by placing orders manually

Option 2: Holly One-Click

Follow Holly's trades via One-Click Trading from the AI Strategy Trades Window or our Charts

Option 3: Holly from Charts

Follow Holly's trades via One-Click Trading from our Charts

Option 1: Trade Holly Hands-On

One easy way of benefiting from Holly's Trading Signals is to monitor her real-time trade suggestions via the AI Strategy Trades Window and then placing the orders manually in your Broker's Account.

This is the way to go, if you have an account at a Brokerage that doesn't connect to our Brokerage Plus Module.

Our External Linking feature makes placing an order manually in your trading account a breeze.

Set up Sound Alerts to get notified whenever Holly places a new trade, then check the chart and trade parameters.

If the stock is in your price range and you like the setup, follow Holly's example and enter the share size, stop loss, and target price manually into your brokerage platform.

Don't get discouraged if you don't manage to enter at the exact same time and price as Holly. Most of her trades are not set to only last seconds. Keep evaluating the trade as it progresses and feel free to take partial profits or to exit earlier or later than Holly.

Always remember, the combination of human and machine is much more powerful than each on their own.

Option 2: One-Click Trading

Our Brokerage Plus Module enables you to trade directly from our Trade Ideas charts or the AI Strategy Trades Window via one-click while sending your orders to participating brokers or our simulator.

This is the way to go, if you would like to trade one of Holly's stock picks, but you would like to apply your own entry and exit parameters to the trade.

-

Step 1: Choose and setup your preferred connection

-

Step 2a: Right-click into the Chart and select Trade XYZ

OR

-

Step 2b: Right-click into the AI Strategy Trades Window and select Trade XYZ

-

Step 3: Select one of the Preset Order Templates or your own Preset Trading Strategy.

To learn all about Preset Order Entry Templates and how to create them, visit this section of the main User Guide.

-

Step 4: Monitor the executed trades in the Positions Tab

Once executed, your trade will be displayed in the Positions Tab of Brokerage Plus, where you can modify targets and stops as well as flatten the trade.

Option 3: Chart Trading

Our Brokerage Plus Module enables you to trade directly from our Trade Ideas charts while sending your orders to participating brokers or our simulator.

-

Step 1: Choose and setup your preferred connection

-

Step 2: Use the Chart Buy and Sell Buttons or our latest Chart Trading Feature Trade Ticket

-

Click once on either the Buy or the Sell Icon

-

A dotted horizontal line will now appear when you move your cursor

-

Move your cursor to the price level in the chart at which you would like to buy/short the stock

-

Click into the chart to place your order

-

Your Default Chart Long Strategy or Default Chart Short Strategy will now automatically be applied.

By default, the Chart Buy and Sell Buttons will submit a Market Order of $5000 worth of shares.

For Long Trades, a Stop Loss Order will be placed at the Low of the Day and for Short Trades, it will be placed at the High of the Day.

Your order will be sent directly to your brokerage/simulator with the configured Entry and Exit parameters.

Your trade will also be displayed in the Positions Tab of Brokerage Plus. Whenever you adjust the Target or Stop, by moving the line on the chart, it will automatically be updated in Brokerage Plus as well.

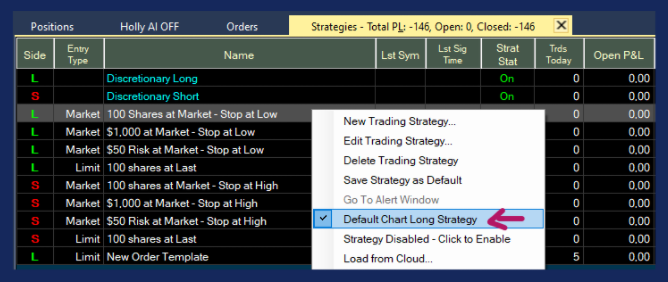

Troubleshooting Tip:

If your Buy and Sell Chart Icons are ready to be used, they will be green/red.

If the Buy and/or Sell Icons are greyed out, you are either not connected to your Brokerage/Simulator or have not enabled a strategy as your Default Chart Long Strategy and/or Default Chart Short Strategy.

If you have already set up a One-Click Order Entry Template or would like to use one of the Preset One-Click Order Entry Templates as your default Chart Trading Strategy, follow these steps.

-

Open the Brokerage Plus Module Learn More

-

Head to the Strategies Tab

-

Highlight the Trading Strategy you would like to use

-

Right-click and check Default Chart Long Strategy or Default Chart Short Strategy.

If you would like to apply personalized Stops and Targets to your Chart Order and have not yet set up a One-Click Order Entry Template, follow the steps in this section first.

Holly Connection

You can trade Holly's picks in our Simulator, in a participating Broker's Simulator, in your Live Account at a participating Brokerage or in any other Brokerage Account you may have.

The three different setups will be discussed in the following sections.

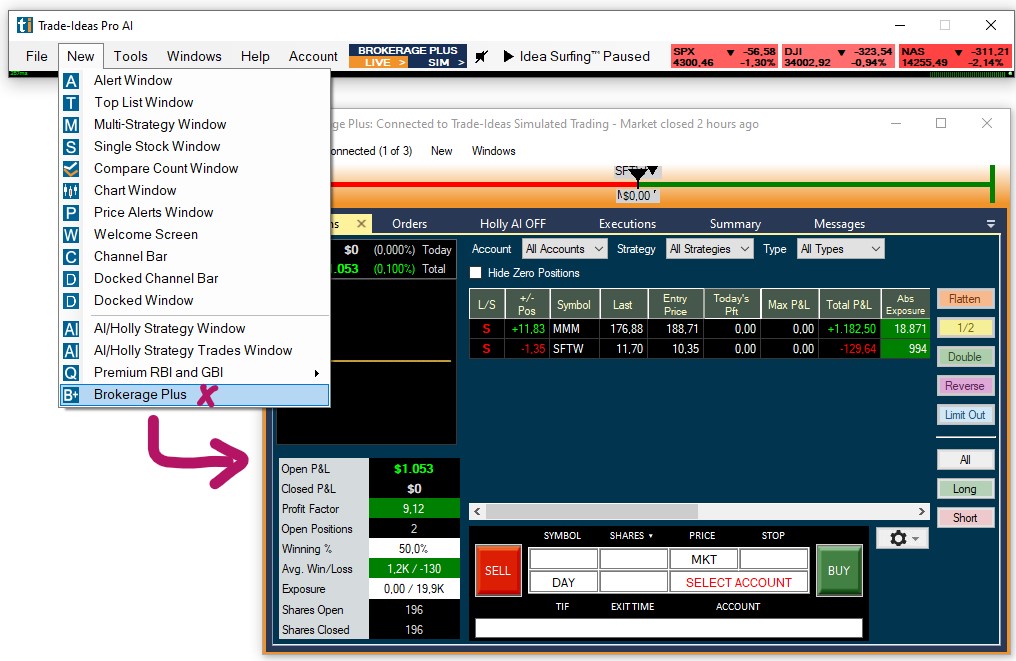

Connect to the Trade Ideas Simulator

To trade Holly's picks in the Trade Ideas real-time Simulator, click the Brokerage Plus Sim button located in the Toolbar. This will establish an immediate connection to our in-house Trade Ideas Simulator.

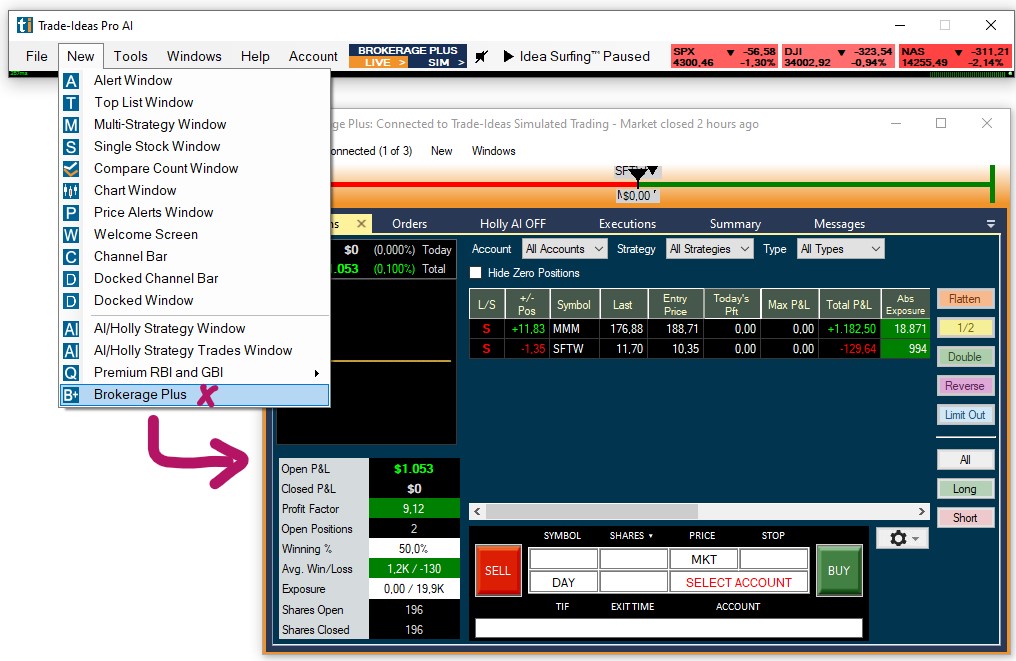

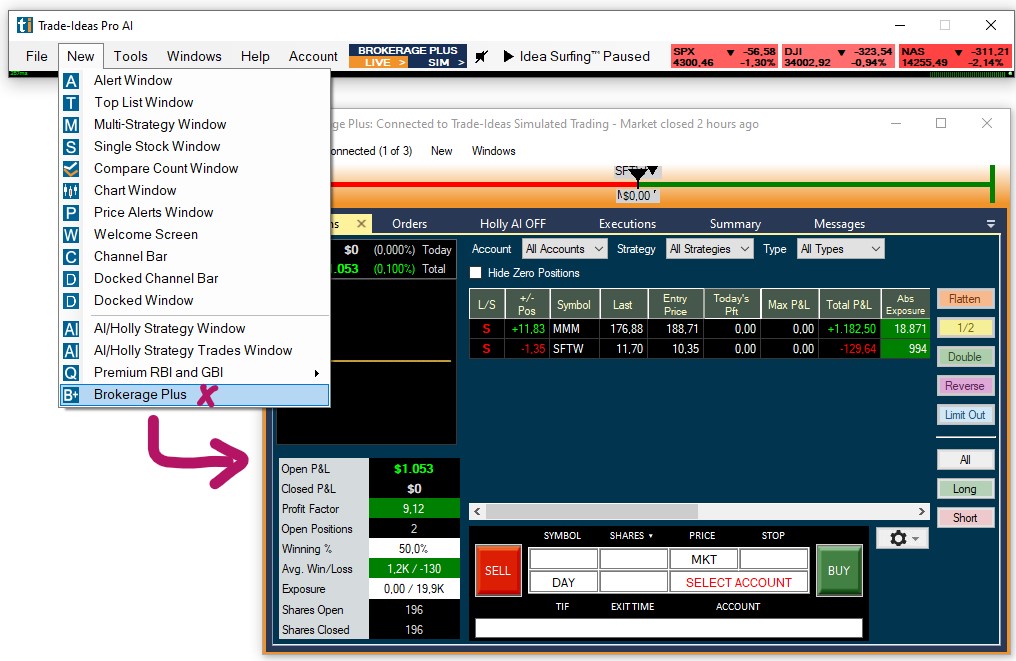

Alternatively, you can access the Brokerage Plus Module from the Toolbar. Simply open the New Tab, and select Brokerage Plus.

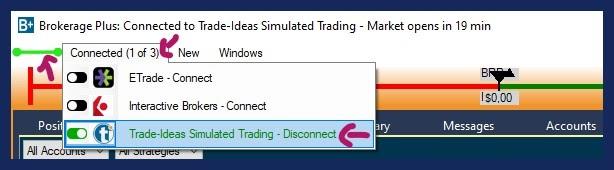

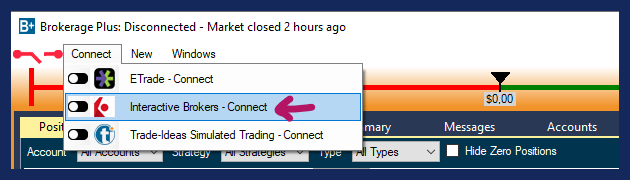

Then, open the Connect Tab of the Brokerage Plus Module and select Trade Ideas Simulated Trading - Connect from the dropdown.

The connection bar will turn green and the Connect Tab will display the number of established connections in brackets.

Once connected to our paper trading, you can trade Holly's signals manually via our Order Entry Panel, trade her stock picks directly from our charts, or trade from the AI Strategy Trades Window by right-clicking and selecting Trade XYZ.

To disconnect, click the Connect Tab, and select Trade Ideas Simulated Trading - Disconnect

Holly and Interactive Brokers

To trade Holly's picks in your Interactive Brokers Paper Trading or Live Account follow the steps in this tutorial. The setup for both accounts is identical except for the port number.

Since Interactive Brokers blocks the API connection of IB Lite Accounts, you will need to have an IB Pro Account to connect to Trade Ideas. Before the Brokerage Plus connection can be established, you need to configure Interactive Broker’s Trader Workstation.

Make sure to have a paid data plan from Interactive Brokers for the exchanges you would like to trade.

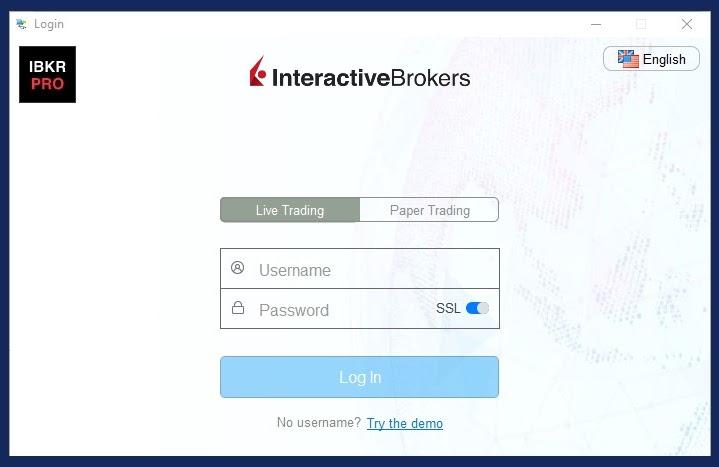

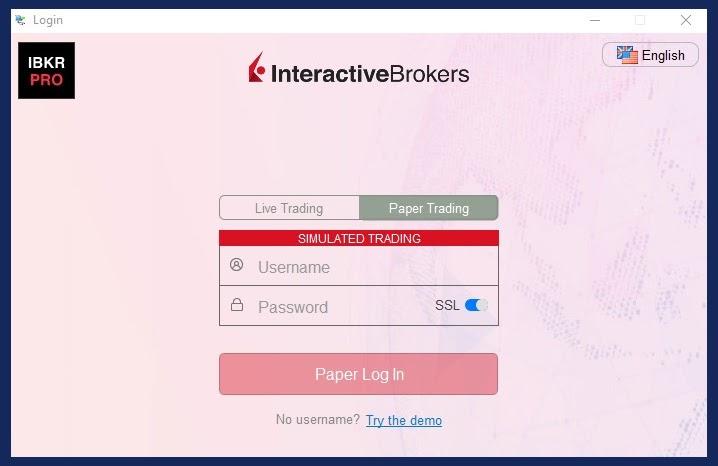

Open and log into Interactive Brokers Trader Workstation, choosing either Live Trading or Paper Trading.

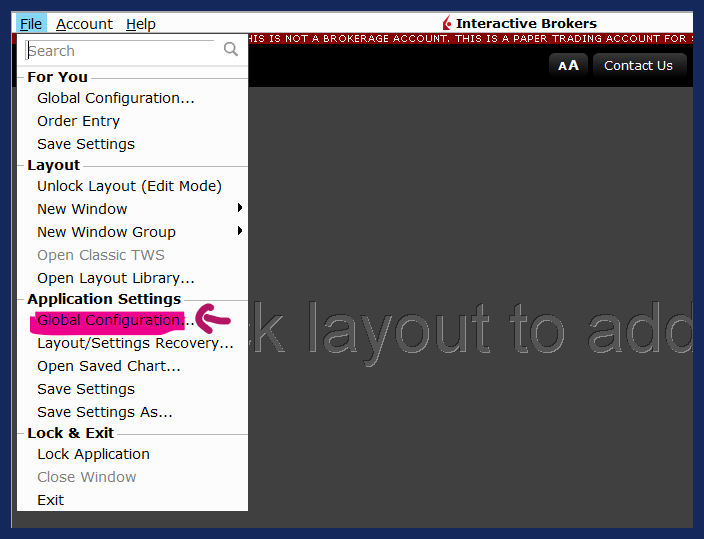

From the Trader Workstation Menu, select File, then Global Configuration.

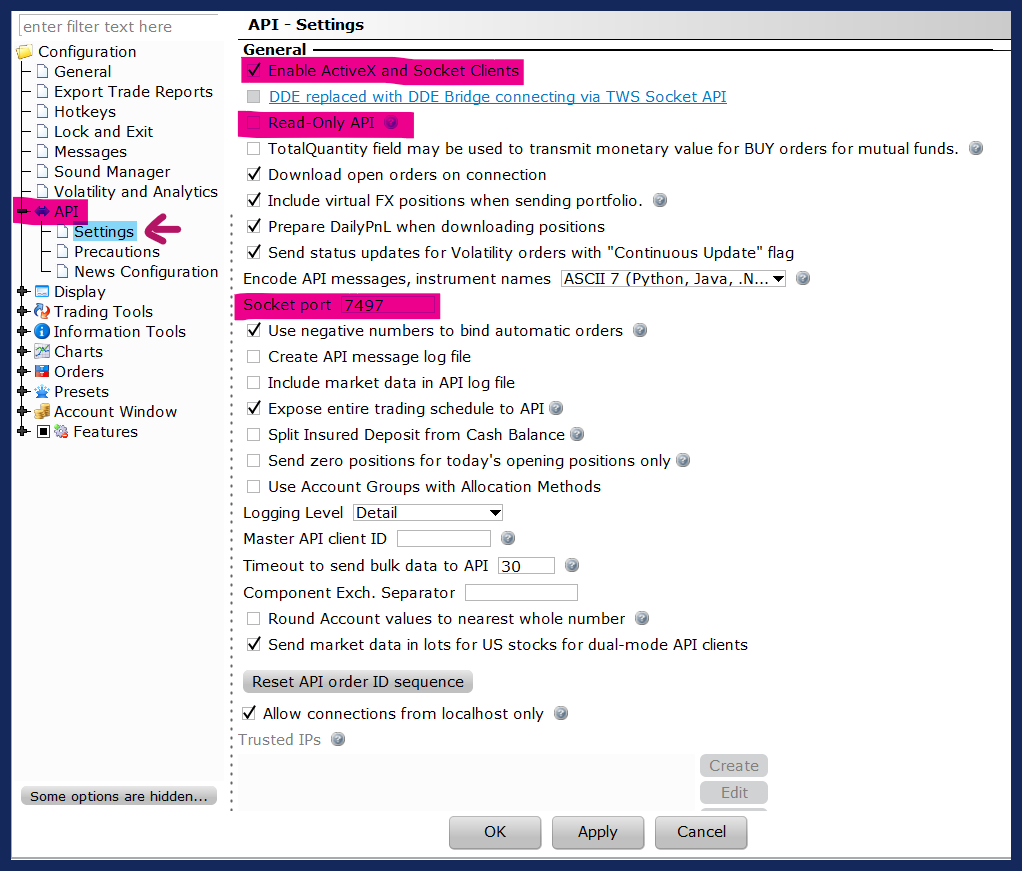

Head to the API section Settings:

Make these three adjustments:

Check: Enable ActiveX and Socket Clients

Uncheck: Read-Only API

Select Socket Port Number 7496 to connect your Interactive Brokers Live Account,

Select Socket Port Number 7497 to connect your Interactive Brokers Simulated Account.

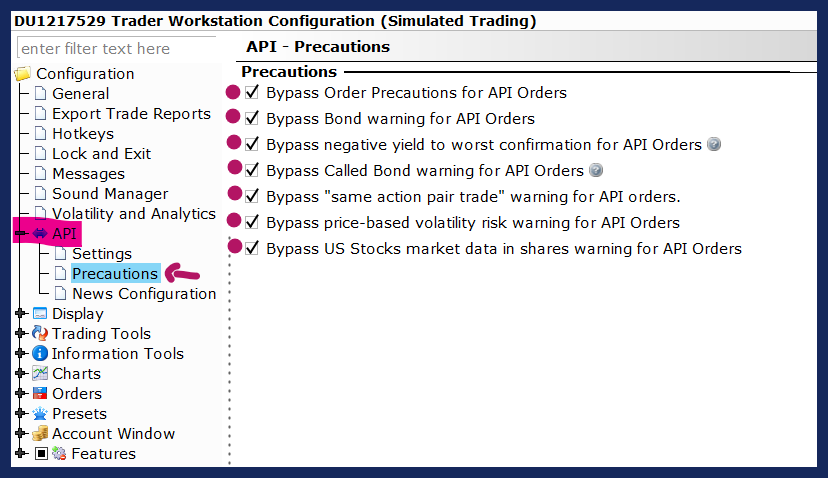

Thereafter, head to the API section Precautions:

Check all Bypass boxes to execute submitted orders immediately, without any further confirmation.

Uncheck all Bypass boxes if you would prefer to confirm the orders sent to Interactive Brokers before they are executed.

Hit Apply when you are done.

Now, open the Brokerage Plus Window from the Toolbar.

Click the Connect Tab in the upper left-hand corner of the Brokerage Plus Window.

Select Interactive Brokers - Connect from the dropdown.

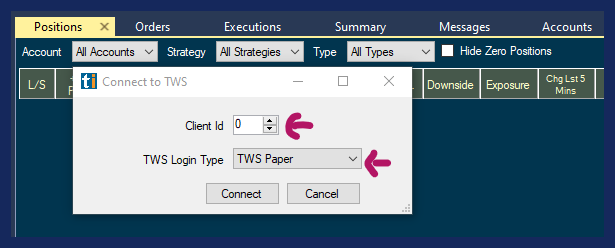

As Client ID enter 0 or 1.

As TWS Login Type, choose TWS Live to connect to your Live Account or TWS Paper to connect to your Simulated Account.

Make sure, the Socket Port in Interactive Brokers' Trader Workstation corresponds (7496 for your IB Live Account and 7497 for your IB Simulated Account).

Click Connect.

You will now see a green connection bar next to the Connect Tab of Brokerage Plus.

Once connected to your IB account, you can trade Holly's signals manually via our Order Entry Panel, trade her stock picks directly from our charts, or trade from the AI Strategy Trades Window by right-clicking and selecting Trade XYZ.

To disconnect, click the Connect Tab, and select Interactive Brokers - Disconnect

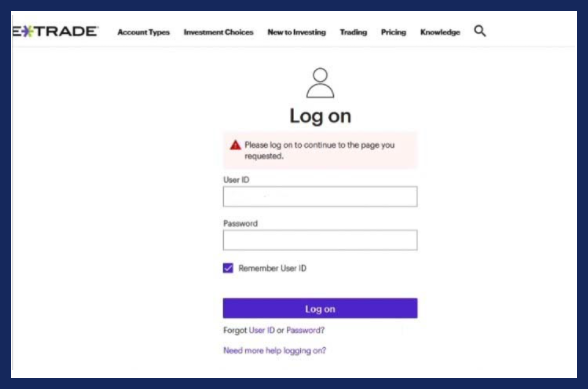

Connect to ETrade

To trade Holly's picks in your ETrade Live Account follow the steps in this tutorial.

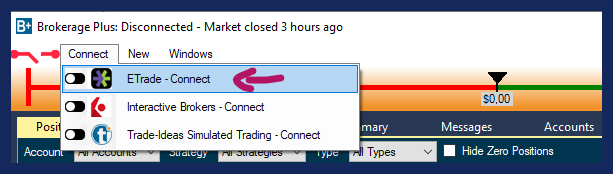

First, open the Brokerage Plus Window from the Toolbar.

Click the Connect Tab in the upper left-hand corner of the Brokerage Plus Window.

Select ETrade - Connect from the dropdown.

This will open the ETrade Login Page in your default web browser.

Log into your ETrade Account with your ETrade username and password.

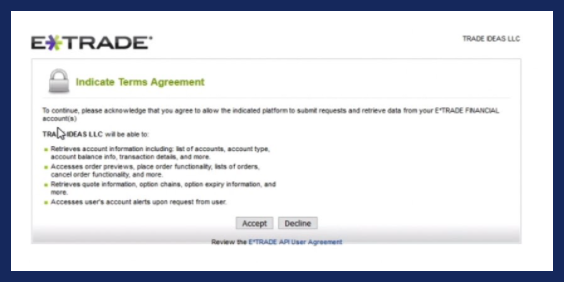

Accept ETrade's connection to Trade Ideas.

Accept ETrade's connection to Trade Ideas:

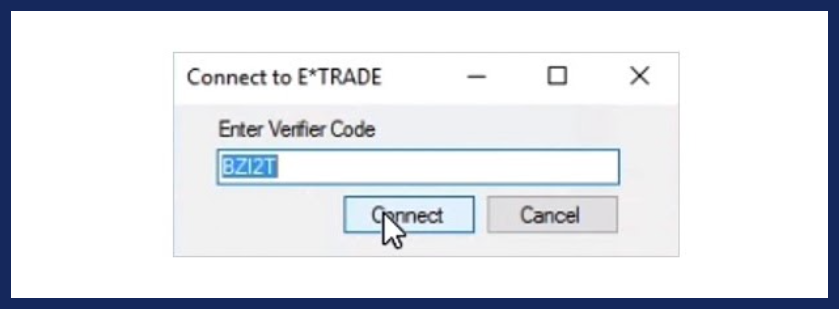

Copy the 6 digit code provided.

Minimize your browser window and paste it into the Connect to ETrade field of our software. Then, click Connect:

You will now see a green connection bar next to the Connect Tab of Brokerage Plus.

Once connected to your ETrade account, you can trade Holly's signals manually via our Order Entry Panel, trade her stock picks directly from our charts, or trade from the AI Strategy Trades Window by right-clicking and selecting Trade XYZ.

To disconnect, click the Connect Tab, and select ETrade - Disconnect

Lastly, make sure to have a data plan from ETrade for the exchanges you would like to trade.

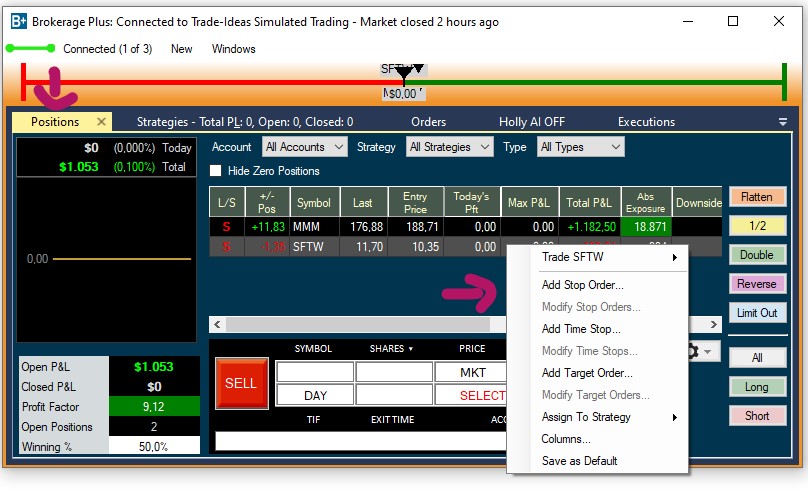

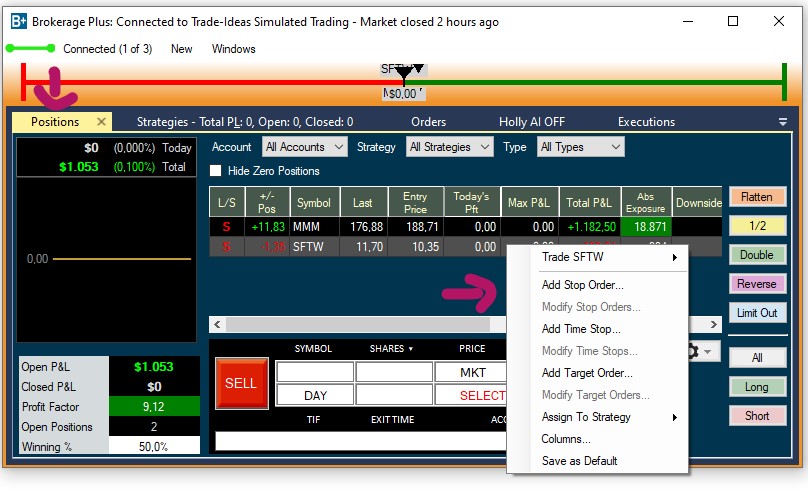

Positions Tab

Once executed, your trades will be displayed in the Positions Tab of the Brokerage Plus Module, where you can monitor and modify them.

To change the parameters of any of your positions, highlight it, then right-click.

This will bring up a dropdown menu with various options.

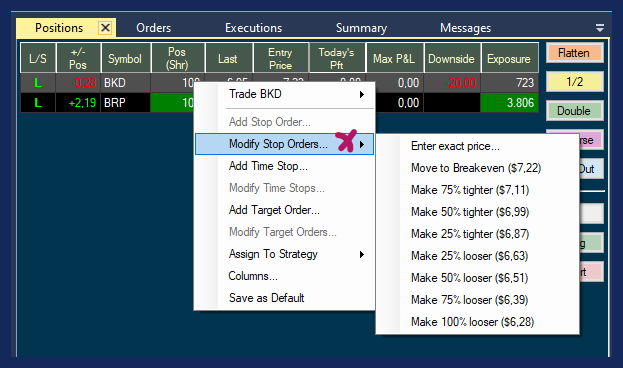

Modify Stop Order

To adjust an already placed Stop Loss, highlight your position, then right-click and select Modify Stop Order. Thereafter, choose a preset value for your Stop Loss or enter an exact price.

Alternatively, you can move your Stop Loss, which is displayed as a line on your chart including the projected loss value, right on the chart.

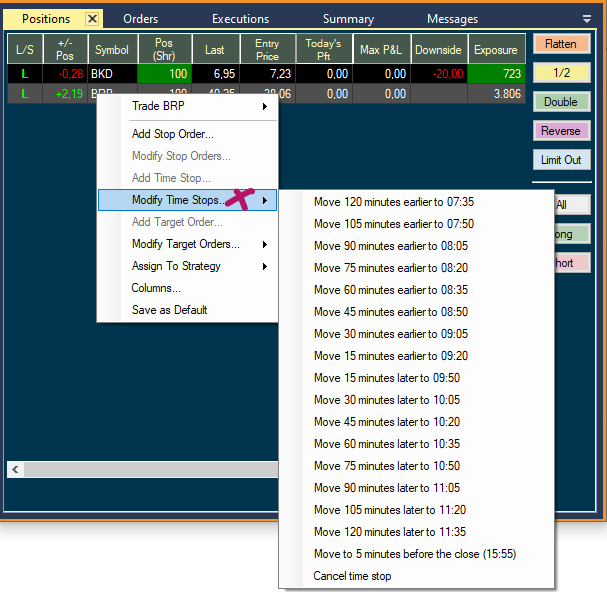

Modify Time Stop

To modify a Time Stop, highlight your position, then right-click and select Modify Time Stop. Thereafter, choose a time.

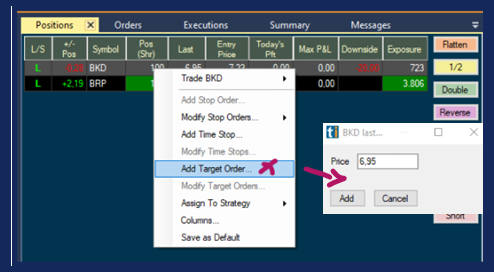

Add Target Order

To add a Target Order to your trade, highlight your position, then right-click and select Add Add Target Order. Thereafter, choose a value. The newly added Target Order will be displayed in a column in the Positions Tab as well as on the chart of the stock as a line together with the projected profit value.

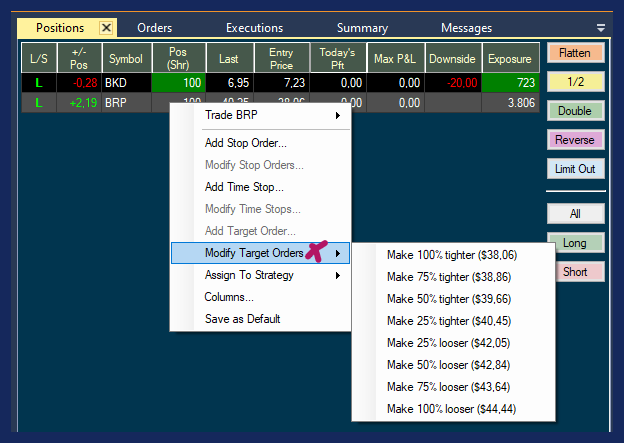

Modify Target Order

To adjust an already placed Target Order, highlight your position, then right-click and select Modify Target Order. Thereafter, choose a preset value.

Alternatively, you can move your Target Order, which is displayed as a line on your chart together with the projected profit value, right on the chart.

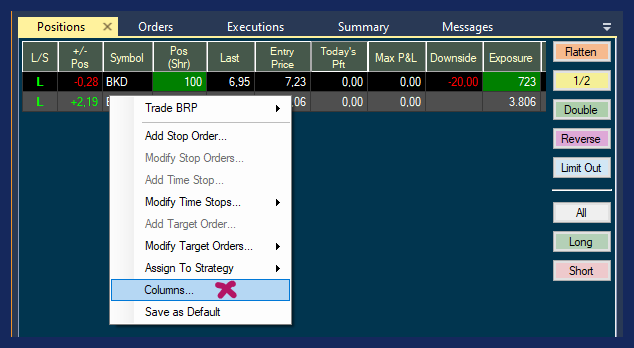

Columns

The columns of the Positions Tab can be reorganized via drag and drop with your mouse. The individual columns can also be extended or compressed by using your mouse. To sort the data by a column, double-click on the column header.

To add more columns right-click into the Positions Tab field and select Columns.

The left-hand side shows the already listed columns, the right-hand side shows the columns that can be added.

Select additional columns by highlighting them with a left mouse click.

Click the arrow pointing to the left to move them to the Selected Columns field.

To remove any of the already selected columns, highlight the column, then click the arrow pointing to the right.

Click OK when you are done.

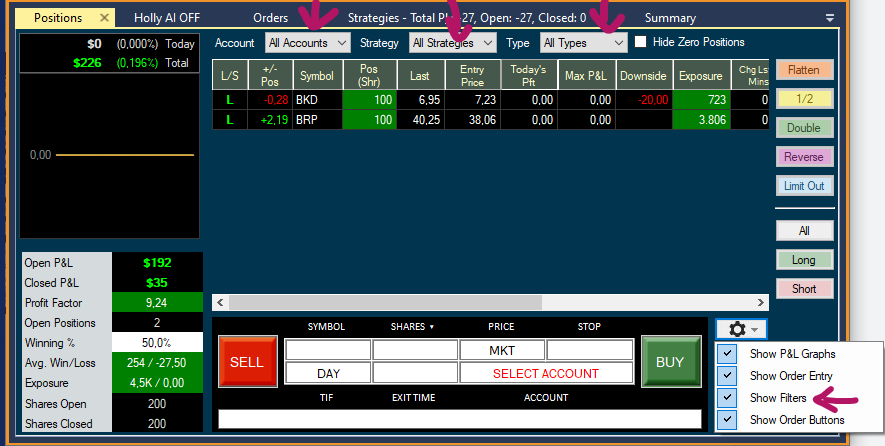

Gear Icon Options

Show Profit & Loss Graph

To display the Profit & Loss Graph as well as other performance statistics about your trades in the Positions Tab, click the Gear Icon in the bottom right-hand corner and select Show P&L Graphs.

The Positions Tab Graph displays the Total Trading Profit & Loss of all your Trades.

Show Order Entry

To display the manual Order Entry Panel in the Positions Tab of the Brokerage Plus Window. Click on the Gear Icon in the bottom right-hand corner and check the option Show Order Entry.

This will open the Order Entry Panel right inside the Positions Tab.

Show Filters

To add Filter functionality to your Positions Tab, click on the Gear Icon in the bottom right-hand corner and check the option Show Filters.

This will add three Filter options to the top of the Positions Tab. You can filter your positions by Trading Account, applied Trading Strategy as well as Open, Closed, Long, and Short.

Next to the three Filter dropdowns, you have the option to show or hide Zero Positions. Zero Positions are your completed trades.

Show Order Buttons

To add Rapid Order Buttons to your Positions Tab, click on the Gear Icon in the bottom right-hand corner and check the option Show Order Buttons.

-

Flatten will close the current positions by initiating a market order.

-

½ will half the number of shares by initiating a market order.

-

Double will double the number of shares by initiating a market order.

-

Reverse will close the current long/short positions and enter into new short/long positions by initiating a market order, which is double in size to the current order but trading in the opposite direction.

-

Limit Out enables you to exit one or all of your trades at once whilst applying a Limit Offset to the price that the stock is currently trading at. Highlight the position you would like to exit, then add the Limit Offset that you would like to apply to the current Bid/Ask price of the stock.

-

All highlights all your positions at once

-

Long highlights all your active Long positions at once

-

Short highlights all your active Short positions at once

Why Holly?

... because Holly Helps Everyone! No matter if you are a new Trader, a seasoned Trader, a Day Trader or a Swing Trader, you will be able to benefit from Holly and gain a definite edge in the market!

Holly and the New Trader

As a new Trader, you can quickly become overwhelmed by all the data streaming in. The immense amount of information is as exhausting as it is exciting. You haven't found your trading style yet and the stock market may seem like a vast ocean of unexplored territory. Navigating all that deep blue on your own might feel overwhelming, but with the help of our investment discovery engine Holly, it really doesn't have to be. Holly dives deep into the stock market and comes back with a map to guide your investment decisions. What would take a trader days or weeks, Holly accomplishes in seconds. She watches the stock market for you and analyzes the data as it comes in. When you log into your customized channel she tells you the trends, recommends the plan for getting in, as well as getting out, and shows you opportunities to make the most of your investment dollars.

As a new trader, you can learn a lot from Holly. See her as a mentor on your side who helps you navigate the markets. Monitor how she executes her trades, which strategies she applies, and which risk modes work best in which market.

Holly and the Seasoned Trader

Apart from utilizing Holly's tried and tested strategies, there is value in monitoring the performance of the different risk metrics. The Moderate Risk Mode outperforming the Conservative Risk Mode, for example, would be a strong signal to hold onto winners instead of taking quick profits. And conversely, if the Conservative Risk Mode is outperforming the Moderate Risk Mode, it is a strong indication that the market is choppy, and one would be best advised to take profits quickly or at least move up the stop in the direction of the trend. Holly’s strategy selection and direction can also give traders a good indication about what kind of a market to expect in the upcoming trading day. If Holly, for example, mainly chooses long strategies, one could take that as a sign to keep a close eye on all shorts.

Holly and the Swing Trader

Holly exits all her trades at the end of each trading day. However, the trade catalysts don’t simply expire when the stock market closes. Some of these triggers offer the potential to catapult a stock over the course of several days or weeks in the direction of today’s trading signal. A swing trader can use Holly’s carefully selected trades to create a watchlist of stocks that are suitable for a swing setup. You can point any of your scans at such a Symbol List and/or use them in combination with Price Alerts.

Have a look at this section of the main User Guide for step-by-step instructions on how to create and use Symbol Lists.

Following a simple routine could put you in a position to leverage the power of Trade Ideas’ Holly to identify statistically significant edges and gain potentially large profits.

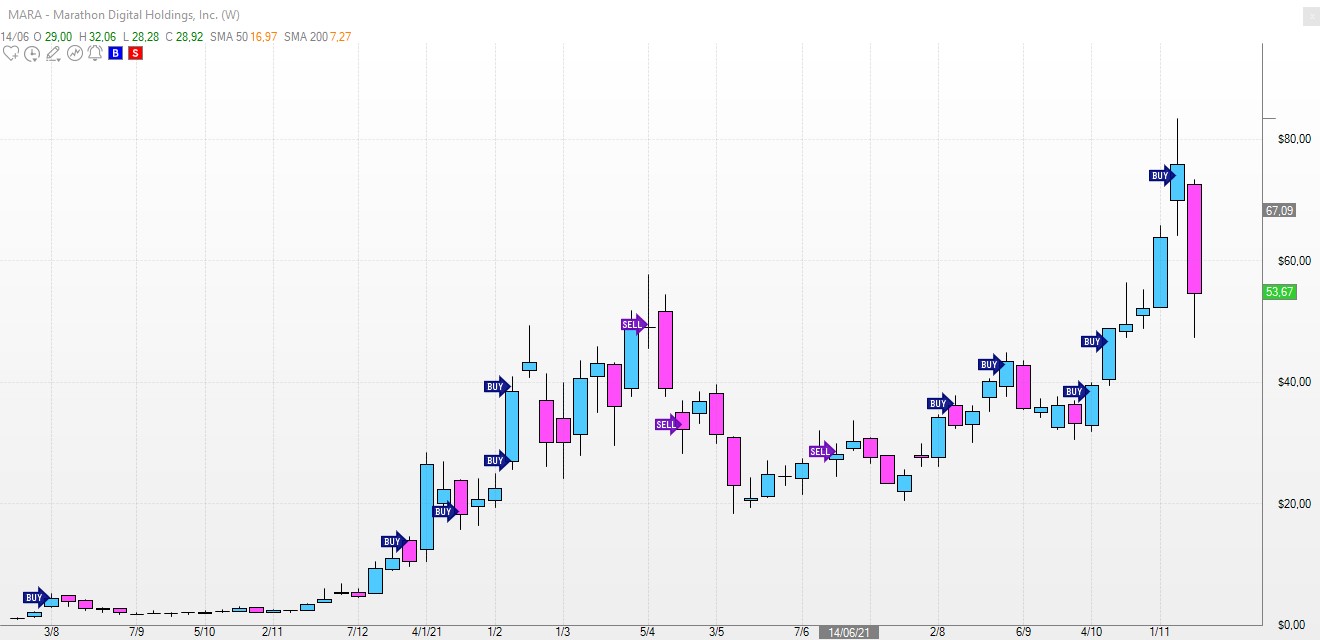

Look at the weekly chart of MARA below for example. Holly traded this stock multiple times over days and weeks, a savvy swing trader looking for good setups, could have potentially ridden this trend all the way up.

Holly AI Performance

To see some of Holly AI's recent trades have a look at our Holly Records Page

Feel free to also browse through the collection of TI AI Updates below:

🆕 Trade Ideas AI Best Trades: 05/03/24

🆕 Trade Ideas AI Best Trades: 05/02/24

🆕 Trade Ideas AI Best Trades: 05/01/24

🆕 Trade Ideas AI Best Trades: 04/30/24

🆕 Trade Ideas AI Best Trades: 04/29/24

🆕 Trade Ideas AI Best Trades: 04/26/24

🆕 Trade Ideas AI Best Trades: 04/25/24

🆕 Trade Ideas AI Best Trades: 04/24/24

🆕 Trade Ideas AI Best Trades: 04/23/24-2

🆕 Trade Ideas AI Best Trades: 04/23/24-1

🆕 Trade Ideas AI Best Trades: 04/22/24

🆕 Trade Ideas AI Best Trades: 04/19/24

🆕 Trade Ideas AI Best Trades: 04/18/24

🆕 Trade Ideas AI Best Trades: 04/17/24

🆕 Trade Ideas AI Best Trades: 04/16/24

🆕 Trade Ideas AI Best Trades: 04/15/24

🆕 Trade Ideas AI Best Trades: 04/12/24

🆕 Trade Ideas AI Best Trades: 04/11/24

🆕 Trade Ideas AI Best Trades: 04/10/24

🆕 Trade Ideas AI Best Trades: 04/09/24

🆕 Trade Ideas AI Best Trades: 04/08/24

🆕 Trade Ideas AI Best Trades: 04/05/24

🆕 Trade Ideas AI Best Trades: 04/04/24

🆕 Trade Ideas AI Best Trades: 04/03/24

🆕 Trade Ideas AI Best Trades: 04/02/24

🆕 Trade Ideas AI Best Trades: 03/28/24

🆕 Trade Ideas AI Best Trades: 03/27/24

🆕 Trade Ideas AI Best Trades: 03/26/24

🆕 Trade Ideas AI Best Trades: 03/25/24

🆕 Trade Ideas AI Best Trades: 03/22/24

🆕 Trade Ideas AI Best Trades: 03/21/24

🆕 Trade Ideas AI Best Trades: 03/20/24

🆕 Trade Ideas AI Best Trades: 03/19/24

🆕 Trade Ideas AI Best Trades: 03/18/24

🆕 Trade Ideas AI Best Trades: 03/18/24

🆕 Trade Ideas AI Best Trades: 03/15/24

🆕 Trade Ideas AI Best Trades: 03/14/24

🆕 Trade Ideas AI Best Trades: 03/13/24

🆕 Trade Ideas AI Best Trades: 03/12/24

🆕 Trade Ideas AI Best Trades: 03/11/24

🆕 Trade Ideas AI Best Trades: 03/08/24

🆕 Trade Ideas AI Best Trades: 03/07/24

🆕 Trade Ideas AI Best Trades: 03/06/24

🆕 Trade Ideas AI Best Trades: 03/05/24

🆕 Trade Ideas AI Best Trades: 03/04/24

🆕 Trade Ideas AI Best Trades: 03/04/24

🆕 Trade Ideas AI Best Trades: 03/01/24

🆕 Trade Ideas AI Best Trades: 03/01/24

🆕 Trade Ideas AI Best Trades: 02/29/24

🆕 Trade Ideas AI Best Trades: 02/28/24

🆕 Trade Ideas AI Best Trades: 02/28/24

🆕 Trade Ideas AI Best Trades: 02/27/24

🆕 Trade Ideas AI Best Trades: 02/27/24

🆕 Trade Ideas AI Best Trades: 02/22/24

🆕 Trade Ideas AI Best Trades: 02/21/24

🆕 Trade Ideas AI Best Trades: 02/20/24

🆕 Trade Ideas AI Best Trades: 02/16/24

🆕 Trade Ideas AI Best Trades: 02/15/24

🆕 Trade Ideas AI Best Trades: 02/12/24

Ahead of the Pack: Today’s TI AI Market Winners TGLS & JMIA

Let’s quickly dive into how the Trade Ideas AI Holly turned market signals into cash for traders today – all before lunch!

Trade 1: TGLS – Swift Short

- Entry at $52.69, dipped to $49.61. 👀

- Profit: $3.08 per share, a quick 5.8% drop.

Just imagine: placing your trade in the morning and watching it hit the target before noon. That's Holly’s precision – spotting and seizing the dip instantly!

Trade 2: JMIA – Rapid Rise

- Bought at $6.51, peaked at $7.00. 🌟

- Gain: $0.49 per share, a speedy 7.5% jump.

Think fast: buying low, selling high, and all within a few hours? That’s a day’s pay, secured early. Holly’s not just watching; she’s acting – fast and effectively.

💡 Why You Need Holly

Miss these? Holly AI is here so you won’t next time. Her algorithms don’t just predict; they perform. With real-time adjustments, she’s your eyes on the market, hands on the trades, and brain on the numbers.

Quick decisions lead to quick gains. Don’t wait – Get Holly Today!

🎯 Act Now or Miss Out

You're reading this because you want in on actions like these. Why settle for less?

Let Holly Guide You – Subscribe Here!

P.S .Remember, while trading can be exciting, it’s not without risks. Holly's here to guide, but your decisions define your path. Ready to trade smarter?

Profit Magnet: The Holly AI Trade That Pulled in Big Bucks!

Let's dive straight into the trade that lit up our screens and should have you thinking seriously about how having a virtual trading assistant could turbocharge your trading strategy.

Outset Medical, Inc. (OM) – A Spectacular 34% Surge!

Today, our beloved Holly AI spotted an exceptional long opportunity in OM, signaling an entry at $3.88. For those who followed, the reward was a staggering high of $5.22 within 45 Minutes of the Entry Signal. That’s a whopping 34.54% climb! 📈

👀 Keep Your Eyes on the Prize

With Holly’s AI-driven insights, spotting such opportunities becomes routine. Here’s what you get when you partner with Holly:

- Early Entry Signals: Jump on opportunities before the crowd catches on.

- Calculated Stop Losses: We keep risks checked, here Holly placed it at $3.42, making sure your hard-earned money is protected.

- Great Profit Potential: As seen today, the sky’s the limit!

💡 Experience Smart Trading Today 💡

PS: Trading is inherently risky and results can vary. Each trader should use their own due diligence before engaging in any trading activity. Our examples are based on real trades, but past performance is not always indicative of future results. Always trade wisely and within your means.

Friday Smart Picks: TI AI Guides on AXTI, NET and OMI’s Movements!

Every trading day brings its own set of challenges and opportunities, and once again, our Trade Ideas AI Holly spotted some slick moves. From rock-solid shorts to a standout long in AXTI, the insights were spot-on. Here’s a quick rundown on how we played the market today and squeezed out those gains. Let’s break it down!

Trade Breakdown 1: OMI

Entry Price: $20.84, Stop Price: $23.87, Day's Low: $19.00

📊 Profit Potential: From the entry to today's low, short sellers could have netted a $1.84/share or 8.8% gain! That's not just numbers; it's your hard-earned cash growing!

👉Start Trading With Holly AI in Your Corner!

Trade Breakdown 2: NET

Entry Price: $75.00, Stop Price: $78.92, Day's Low: $72.68

📊 Profit Potential: A solid $2.32/share gain or, in other words, 3.1% drop for those who acted swiftly on Holly’s signal. Every percent counts in this game!

Long Opportunity: AXTI

Entry Price: $3.47, Stop Price: $3.09, High of Day: $3.68

📊 Profit Potential: An impressive 6.1% rise from entry to exit, highlighting a robust gain on the day.

🌟 Why Holly AI is Your Must-Have Trading Partner

Every trader wishes for a reliable assistant who not only understands market patterns but also anticipates moves before they become obvious to everyone else. That’s what Holly AI brings to your trading desk — a blend of speed, accuracy, and predictive power that transforms opportunities into tangible profits.

👉 Join Us and Start Trading Smarter!

Remember, every trade carries risk, and it’s crucial to stay prepared. Use Holly to enhance your strategy, but always trade wisely. Here’s to making more educated and profitable decisions together!

7 Trades, 6 Wins: Dive into Today’s Top Trade Ideas AI Performers!

Today, we're giving you an exclusive backstage pass to see all of Holly's trades, not just the top performers. Here’s a rapid-fire showcase of how our Trade Ideas AI, Holly, nailed it with 6 out of 7 trades hitting the mark:

Today’s Holly AI Wins

- EBS: +27.16% 🚀 Peak Gain: 47.22%

- PBI: +8.18% 📈 Peak Gain: 10.27%

- ENVX: +5.7% ✨ Peak Gain: 6.24%

- ASPN: +4.59% 🌿 Peak Gain: 6.86%

- ACHC: +2.74% 🏥 Peak Gain**: 3.29%**

- QRVO: 🔽 The one that got away, but it’s not over!

Seeing is believing, and today Holly really showed off! If you want in on this kind of action daily, head here.

Trading is risky, and there are no sure bets, but with Holly AI, you've got top-tier analysis at your fingertips. Don’t miss out on her insights; let her help you spot the next big mover.

✨ Unlock Your Full Potential in Our Premium Circle!

P.S. Trade wisely! Every decision counts and it’s your strategy that complements Holly’s insights. Dive in prepared and never risk more than you can handle. Let's make those smart moves together!

DBRG & ILPT: Today’s AI Power Moves with Holly!

You know how fast the markets can move, but with Holly AI, our virtual trading assistant, you're always a step ahead. Let us dive right into the juicy details of today's two top trades.

🔥 Today's Hot Short: DBRG 🔥

Entry Time: 9:44 AM Entry Price: $15.17 Stop Price: $15.50 Low of Day: $13.79 Profit Potential: 💰 $1.38 per share 💸 (9.1% gain)

Here's the scoop: DBRG was teed up perfectly by Holly right before it took a nosedive. For our Premium members who followed the signal, they saw a drop that translated to a stunning 9.1% gain from our entry point. It's moves like these that show how the Trade Ideas AI isn't just playing the game; she's changing it.

🚀 Today's Top Long: ILPT 🚀

Entry Time: 9:45 AM Entry Price: $3.99 Stop Price: $3.68 High of Day: $4.24 Profit Potential: 💰 $0.25 per share 💸 (6.3% gain)

Next, ILPT showcased Holly's knack for spotting explosive breakouts. Entering at $3.99 with the price peaking at $4.24 offered a sweet 6.3% gain. Holly picked out this gem early in the session, proving yet again how having a sharp AI on your side means you're prepped and ready to capitalize on these spikes.

Why Holly AI?

Wondering how Holly finds these fantastic setups day after day? It's all about the power of machine learning combined with historical market data to sniff out the most profitable opportunities. More trades, more wins, and yes, more fun!

👉 Join Now 🎉

PS: Trading involves risks and it's not always a smooth ride, but with Holly, you've got the best co-pilot. Remember, the market waits for no one and each trade is your decision. Always do your own due diligence.

📈 WGS Up, 📉 POET Down, Profits All Around with Trade Ideas AI!

Let’s zoom through today’s standout Trade Ideas AI trades:

First Up, WGS: Profit Potential 21%💥

This gem popped up on Holly’s radar at $15.05 and soared to a high of $18.24 way before lunch time. That's a whopping 21% climb in less than two hours. If you had grabbed 100 shares, your portfolio could have seen a crisp $319 gain today. Imagine what that could do over a month or a year!

Next, POET: Profit Potential 16%💥

It was all about catching the perfect downward momentum here. Entering at $2.99, just before POET plunged to $2.51 shows a tactical short play, decreasing by 16%. It’s all about timing and Holly’s got it down to an art.

Ready to stop missing out? It’s time to let Holly help you spot and seize these opportunities.

👉 Unlock your trading potential with Holly today!

PS: Remember, while the allure of quick gains is tempting, trading involves risks. Each decision should be weighed carefully, and it’s crucial to never dive in without doing your homework. Holly’s here to add that expert layer of analysis, not replace it.

How We Surfed MULN’s 26% Rise & IBRX’s 14% Boost with Trade Ideas AI!

What a day on the charts, right? Let me cut straight to the chase with a couple of quick wins from today that I thought you'd appreciate.

MULN - Breakout Long - 26% Profit Potential

Time In: 11:05 AM Entry Price: $4.12 High of Day: $5.18 💥 Boom! That’s a 25.73% climb!

Jumped in as MULN was gearing up at $4.12 and rode that wave up to $5.18. The energy was electric, and watching that 25.73% jump was like seeing a perfect wave form right in front of you—total surfer's dream!

IBRX - On Support - 14% Profit Potential

Time In: 11:41 AM Entry Price: $8.33 High of Day: $9.47 🌟 Stellar 13.69% gain!

After a morning gap up and an energetic spike, IBRX pulled back, landing perfectly at the top of the gap. That's where Holly AI grabbed it at $8.33. Like catching the perfect tide, IBRX surged up again, all the way to $9.47. Riding that rebound offered a solid 13.69% gain—it was like hitting the sweet spot on a killer wave!

P.S. Remember, trading’s all about catching the right waves and knowing the ride can be wild. Always wear your risk management life jacket! Don’t forget, every trade is your call. Ride responsibly! 🏄♂️

From Insight to Income: TI AI Drives Profits with RERE & CUBI

Hope you’re all set for a quick rundown of today’s top picks from our AI, Holly! Here’s the scoop on a great long and a sly short that moved the needle today. 🎯

📈 RERE: A Sweet Long Lift!