Posts Tagged ‘stocks’

October Sector Rotation Strategy: Energy and Healthcare Stocks for Fall Profits

By: Katie Gomez October marks a turning point in the market that traders should pay close attention to, as institutional money flows create predictable sector rotation patterns waiting to be exploited. Traders who invest their focus in the right sectors might experience their most lucrative quarter yet. While the broader market often struggles with volatility,…

Read MoreSwing Trading vs. Day Trading: Understanding the Differences and Benefits

In the world of trading, where all is lost and gained in a split second, risk management is a key value. Loss of capital has always been a big fear for the newbies in this task. Therefore, as they explore the intricacies of the market, risk management becomes more and more evident. This blog addresses…

Read MoreOctober Effect: Trading Volatility Season Smart

By: Katie Gomez October carries a notorious reputation in financial markets as the month when portfolios can disappear overnight, etched into trader psychology by the crashes of 1929, 1987, and 2008. While retail investors often view October with dread, experienced traders recognize this volatility as the market’s annual wealth transfer mechanism. October is a time…

Read MoreYou Can’t Turn Your Back on the (Money) Machine: Updates from Internal Testing

By: Katie Gomez Automated trading programs have completely transformed the market and how we trade, but we can’t turn our back on the machine entirely. Living in a generation that offers immediate gratification on a silver platter (Amazon Prime, ChatGPT, Uber Eats) has made it increasingly difficult to hold onto our grit. When all our…

Read MoreSmall Cap September: Why Forgotten Stocks Often Outperform in Fall Markets

By: Katie Gomez Luckily, the “worst” trading month is almost over, but there might be a silver lining to come out of September yet. As most traders fixate on mega-cap earnings and Fed announcements, they’re missing one of the year’s most reliable yet overlooked opportunities: September’s quiet emergence as small-cap season. Historical data reveal a…

Read MoreSimulated Trading: A Beginner’s Guide to Risk-Free Practice

Most traders struggle because they don’t have a structured way to practice. Reading about strategies isn’t enough. On paper, a plan looks simple. In practice, the pressure of real money changes decisions. Small mistakes add up, and what should be a repeatable process quickly turns into guesswork. Simulated trading is how you bridge that gap.…

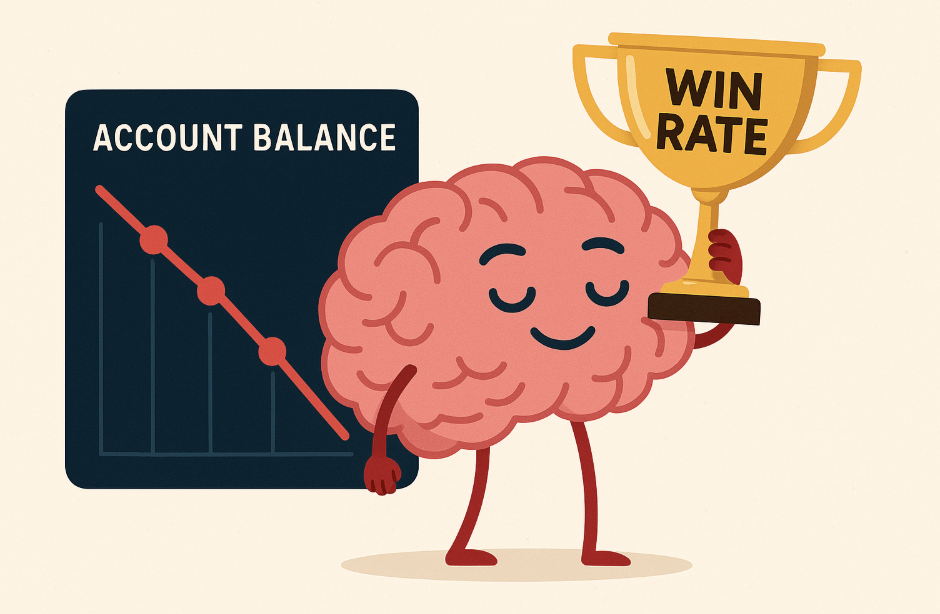

Read MoreWhy a 90% Win Rate Isn’t the Flex You Think It Is: The Real Metrics That Matter in Trading

By: Katie Gomez That trader bragging about their 90% win rate on social media? They might actually be losing money. While they’re busy posting screenshots of their “winning streak,” their account balance could be bleeding red. Traders have been conditioned to worship at the altar of win rates, especially nowadays, where our sole focus is…

Read MoreTrump’s External Revenue Revolution: How Tariffs Are Building America’s Parallel Economy

By: Katie Gomez For the first time since 1913, America is shifting from taxing its own citizens to having foreign competitors fund its government—and it’s creating opportunities that most traders have yet to recognize. What we’re witnessing isn’t just another policy adjustment; it’s a fundamental restructuring of how the United States generates revenue, moving away…

Read MoreCash is King: Why Going Liquid Beats Forced Investing in Volatile Markets

By: Katie Gomez In the relentless world of trading, there’s unspoken pressure that whispers constantly: you must always be invested, always have skin in the game – as if stepping aside somehow makes you less of a trader. This toxic mindset has destroyed more trading accounts than any market crash, especially when volatility spikes and…

Read MoreHow Momentum Trading Works: A Beginner’s Guide

Most traders struggle with one thing: knowing when to act. Buy too early, and you sit through dead time. Buy too late, you get caught at the top. Momentum trading solves that by focusing only on stocks that are already moving with strength. The idea isn’t to predict, it’s to participate while the move lasts,…

Read More