6 Strategies for Maximizing Profits in Day Trading

6 Strategies for Maximizing Profits in Day Trading

Jan 10, 2024

By: Shane Neagle

Have you ever pondered what elevates certain day traders above the rest?

Within the stock market’s ever-changing realm, where fortunes pivot in mere moments, traders relentlessly seek that elusive mix of risk and reward. It transcends mere pursuit of rapid gains; it’s an exercise in refining a craft, a skill honed over time.

Embark on an exploration of six pivotal strategies poised to revolutionize day trading practices. The journey begins with the nuances of momentum trading – it’s akin to capturing the perfect wave at its crest. The narrative then shifts to the critical impact of news on trading fortunes, revealing strategies to harness this power. The guide offers an intensive look at scalping, a method marked by quick, yet modest wins, and the discernment needed to capitalize on breakout opportunities. Further, it delves into the strategic utilization of pullbacks and demystifies the long-term approach of trend trading. These techniques are not mere strategies; they are integral components of a comprehensive toolkit for day trading prowess.

Are you prepared to elevate your trading endeavors? Irrespective of your experience level, this guide is laden with practical wisdom and actionable advice, poised to guide you through the stock market’s unpredictable currents. Embark on this journey to transform each trading opportunity, merging the adrenaline rush of the market with astute, strategic planning.

Mastering Momentum Trading

Mastering momentum trading stands out as a sophisticated waltz with the market’s rhythms. This method transcends mere identification of active stocks; it’s an intimate understanding of the market’s pulse, moving in unison with its intricate beats.

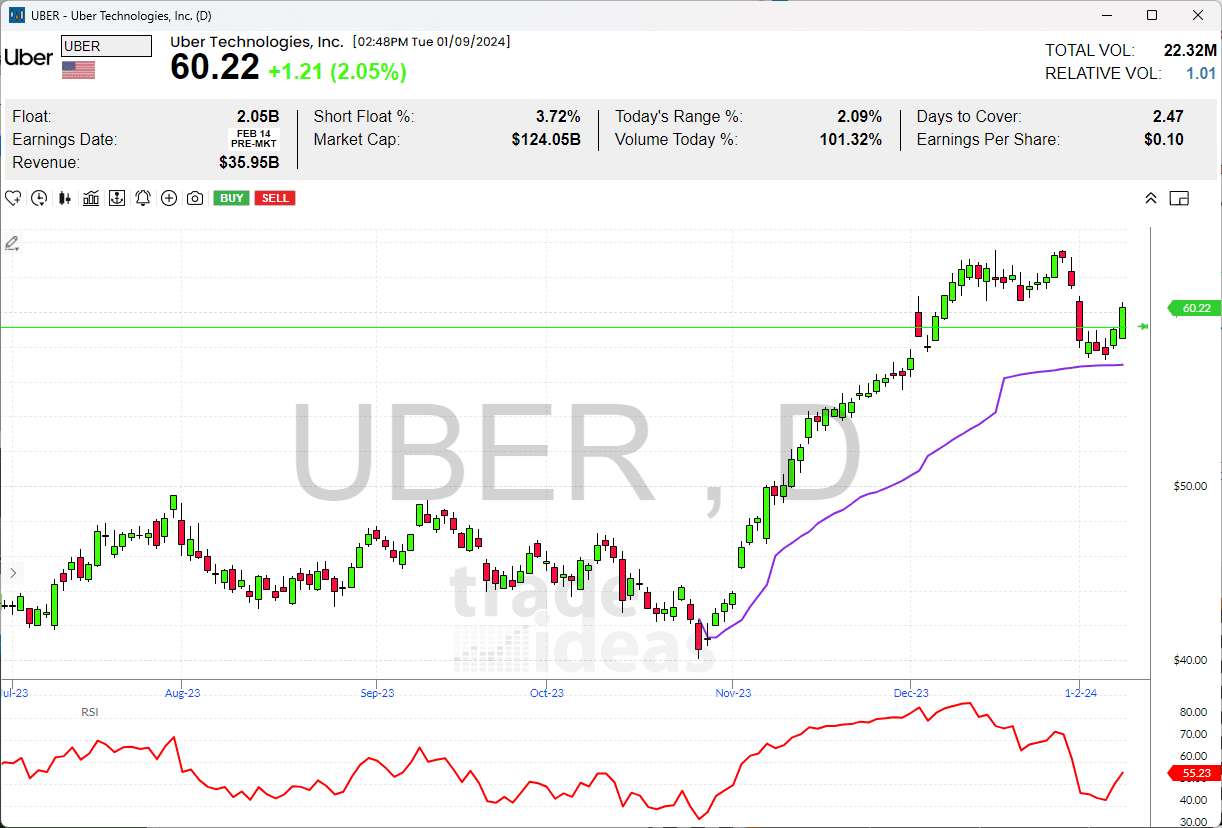

At the heart of momentum trading lies the strategy of leveraging stocks that exhibit significant price movements, propelled by high trading volumes and robust market indicators. The art is in detecting these stocks as they begin their ascent or descent, akin to a maestro timing the crescendo or diminuendo in a symphony. It’s about joining the movement at the opportune moment – avoiding premature entry before the momentum builds up, and evading the risk of staying too long as the momentum wanes.

Picture a scenario where a technology firm unveils a revolutionary product. The ensuing media buzz sends the stock on an upward trajectory. Here, a momentum trader, reminiscent of an eagle-eyed hunter, seizes the opportunity, investing in the stock as it ascends and exiting before it reaches its zenith. This approach is a delicate balance, requiring sharp instincts coupled with the boldness to act decisively.

The potential for high returns in momentum trading is intertwined with considerable risks. It’s critical to recognize that this strategy is a calculated endeavor, not mere speculation. Implementing robust risk management techniques, like setting precise stop-loss orders and having a clear exit plan, is crucial. This safeguards traders from the tumultuous shifts that can occur in the market, emphasizing the need to discern when to engage and when to observe from a distance.

Take, for instance, the cryptocurrency surge in 2017. Traders who adeptly synchronized their strategies with the market’s momentum achieved impressive gains. In contrast, those who overstayed their welcome encountered significant downturns as the momentum reversed. This historical reference underscores the vital role of timing and risk management in momentum trading.

Mastering momentum trading is a journey towards a potent strategic edge in a trader’s toolkit. It demands acute market insight, quick decision-making, and steadfast discipline in managing risks. For traders who can harmonize with the market’s ebbs and flows, the potential rewards are significant, echoing the gratifying harmony of a perfectly executed dance with the market’s ever-changing tunes.

Navigating News Trading

In the intricate world of day trading, the art of navigating news trading is comparable to a skilled captain steering through unpredictable ocean currents. News and events are the tides and winds that shape the market’s course, where a trader’s ability to interpret and respond to these dynamic information streams can mark the boundary between profitable ventures and ventures fraught with risk.

At its essence, news trading involves basing trading decisions on an array of news releases, economic reports, and significant global occurrences. The critical skill here is the rapid and accurate interpretation of such news, deciphering its probable impact on market movements. Imagine a trader as an experienced navigator, adept at reading the sea’s moods and ready to adjust course with agility. The announcement of a major corporate innovation or critical government economic data is akin to a sudden change in wind direction, demanding immediate and strategic response to harness market fluctuations.

Yet, navigating the realm of news trading is fraught with challenges. The vast sea of information can be overwhelming, with news varying in significance and reliability. Distinguishing impactful news from mere distractions is an acquired skill, much like discerning a lighthouse from a mirage at sea.

Beyond advanced trading platforms and detailed market analysis tools, traders are increasingly turning to free electronic signature solutions. These tools are instrumental in swiftly executing and confirming trading orders in response to breaking news, akin to a captain making swift sail adjustments in response to a sudden gust. This technology streamlines processes, reduces paperwork, and ensures fluid transactions, empowering traders to react to news with the speed and precision of a seasoned sea captain adjusting to the ocean’s whims.

Mastering news trading demands a fusion of vigilance, critical analysis, and technological adeptness. It’s about meticulously filtering the deluge of information, pinpointing the relevant, and acting with calculated speed and accuracy. In the dynamic, often tumultuous realm of day trading, being well-informed and capable of quick, informed decision-making based on news is crucial in navigating the course to trading success.

The Art of Scalping

In day trading, the strategy of scalping emerges as a rapid, tactical endeavor, comparable to a high-stakes game where each decision is both swift and calculated. Scalping, a distinct day trading technique, involves executing a multitude of trades within a compressed time frame, each trade targeting modest gains. This method is anchored in the trader’s ability to make quick, decisive moves, seizing opportunities from minor price fluctuations caused by order flow changes or variations in spreads.

Central to the art of scalping is the principle of immediate action. Scalpers, akin to expert archers poised to release their arrow, must be prepared to engage the instant an opportunity arises. Operating in intervals that could range from a few seconds to several minutes, scalpers aim to capitalize on minuscule shifts in stock prices. This technique demands an extraordinary level of focus and discipline, necessitating continuous market surveillance and readiness to initiate buy or sell orders instantly.

A more intricate variant of this is a strategy known as gamma scalping, which capitalizes on the rate of change in a financial instrument’s price, aiming to exploit short-term market dynamics for profit.

Beyond the need for rapid reflexes, effective scalping hinges on a meticulously crafted strategy and robust risk management. Implementing strict stop-loss orders is imperative in this environment of frequent trading. Considering the slender margins for profit per trade, even a handful of substantial losses can nullify the gains of an entire day. Thus, a disciplined approach to managing risk is as crucial as the trading activity itself.

When it comes to scalping – there are two major obstacles frequently challenging traders: the propensity for overtrading and the lure of emotion-driven decisions. Such tendencies can be detrimental, chipping away not only at the trader’s financial bedrock but also at their confidence in their trading skills. To steer through these choppy waters, many seasoned scalpers have found solace in automated trading systems. These systems act like a guiding compass, keeping traders on course with their strategic plans and insulating them from the high waves of emotional trading decisions.

Another vital consideration in scalping is the selection of an appropriate trading platform. A platform capable of accommodating high-speed trades and providing immediate market data is essential. Any delay in execution can transform what might have been a profit into a loss, rendering the platform choice a critical component of a scalper’s toolkit.

In summary, scalping in day trading is a refined skill, melding the accuracy of prompt execution, disciplined risk control, and the ability to adapt quickly in a market that is in constant flux. For traders who can master these facets, scalping offers a potentially rewarding, though demanding, trading approach.

Breakout Trading

Breakout trading, a strategy in the day trading landscape, is defined by its keen focus on spotting and leveraging stocks as they break free from their previous trading confines. This approach can be likened to an astute tracker in the wild, patiently waiting for the ideal moment when their target, in this case, a stock, is poised to make a significant move either up or down.

The core of breakout trading revolves around identifying stocks that are pushing past their usual price boundaries, often marked by critical support and resistance levels. These levels act as unseen thresholds; once breached by a stock price, the stock typically continues its journey in that direction, unveiling potentially profitable opportunities for traders. Pinpointing these crucial breakout moments necessitates a meticulous examination of stock charts, searching for specific formations like triangular patterns, flags, or phases of consolidation.

In the realm of breakout trading, the precision in setting entry and exit points is of paramount importance. The ideal entry point is usually positioned slightly above or below the breakout point to ensure the trade commences only after the breakout is authenticated. Conversely, exit points are generally predetermined by set profit targets or stop-loss orders, serving as a safeguard to manage risk effectively. For instance, a trader may initiate a trade as a stock climbs above a resistance level and place a stop-loss marginally below the breakout point, guarding against the risk of a false breakout.

Patience and discipline are indispensable virtues in this trading style. Often, it involves a watchful wait for the perfect timing to enter a trade, sometimes monitoring a stock for extended periods. Discipline plays a critical role in sticking to pre-established entry and exit points, resisting the urge to jump into a trade prematurely or exit belatedly.

A textbook instance of a breakout trade is seen in Apple Inc.’s (AAPL) late 2020 performance. After a prolonged phase of price stabilization, AAPL surged past its resistance level with robust volume, presenting an optimal entry scenario for breakout traders. Those who embarked on this trade and faithfully followed their exit plans reaped substantial benefits from the ensuing upward price movement.

To sum up, breakout trading is a strategy that blends sharp analytical abilities to spot opportunities with the patience to await the right moment and the discipline to maintain strict entry and exit strategies. For traders who can master these elements, breakout trading can be an exceptionally effective tactic to harness significant market moves.

Profiting from Pullbacks

Capitalizing on pullbacks is akin to a skilled artisan meticulously shaping a fine piece of work. This strategy focuses on taking advantage of temporary downturns within an ongoing market trend. These downturns, known as ‘pullbacks’, are crucial windows of opportunity for perceptive traders to make their move.

Identifying these moments of pullback is an art form in itself, much like an experienced sailor reading the subtle shifts of the sea. Traders painstakingly study market behavior, seeking for instances where a stock’s price deviates from an established pattern. It’s a narrow line to tread when using analytical tools like moving averages, trend lines, and Fibonacci retracement levels to distinguish between a brief setback and a full-fledged trend reversal.

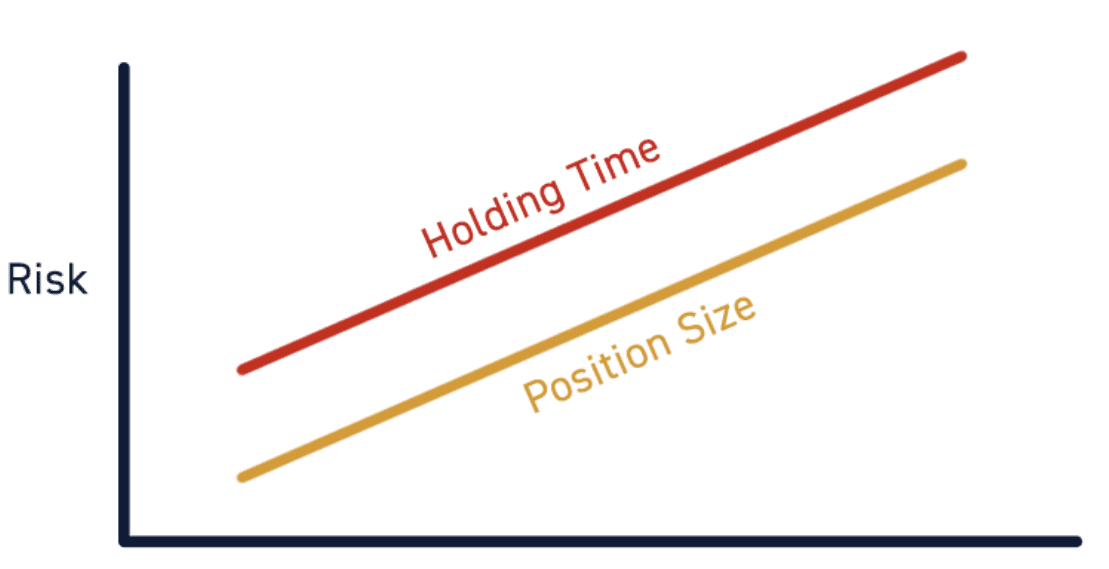

Risk management is the bedrock of successful pullback trading. It’s about strategically placing tight stop-loss orders to minimize losses in case the market takes an unexpected turn. Many traders also adopt a ‘scaling in’ approach, entering the market in smaller, more manageable segments rather than one large bet. This strategy allows for nimble adjustments as the market’s narrative unfolds.

The journey of Netflix Inc. (NFLX) in early 2021 serves as an exemplary case study in pullback trading. During a period of overall upward trend, NFLX experienced a series of pullbacks. Astute traders, recognizing these as brief retracements in a larger bullish pattern, seized these opportunities. By strategically entering the market during these dips and exiting as NFLX resumed its climb, they not only reaped profits but also navigated the risks effectively.

In essence, pullback trading is about capturing the fleeting chances presented by market downturns, all while keeping a close eye on risk management. For those who have honed their skills in detecting these transient moments of pullback and adeptly managing their trade positions, this strategy can unlock a pathway to consistent gains amidst the dynamic tides of day trading.

Riding the Trend Waves

Mastering the skill of trend trading in the colorful world of day trading is like to an accomplished surfer surfing the ocean’s unrelenting waves. This technique is all about going with the flow of the market and successfully harnessing its directional movements, whether they be upward climbs or negative spirals.

Recognizing and aligning with the dominant currents in the market is the essence of trend trading. Like experienced sailors, traders chart the financial waters by determining the main course of stock fluctuations. To assess a market trend’s strength and longevity, a detailed analysis of the data utilizing techniques such as moving averages, MACD and RSI is needed.

Critical to trend trading is the art of pinpointing precise entry and exit points. Traders typically mark their entry during the nascent phase of a trend, when the market begins to display unmistakable signs of a directional shift. Exit strategies, in contrast, are formed in anticipation of trend exhaustion or reversal. This strategic positioning is crucial to amplify gains and mitigate risks.

The key to excelling in trend trading lies in unwavering discipline. It involves a steadfast commitment to a well-thought-out trading plan, avoiding the snares of momentary market sentiments or baseless speculations. Successful trend traders cultivate an objective stance, making decisions based on hard data over subjective feelings.

Setting precise trading goals, imposing stringent stop-loss orders, and regularly adjusting methods in reaction to market dynamics are all realistic ways to retain discipline. Furthermore, keeping a trading notebook may provide traders with priceless insights that help them reflect on their choices and learn from their experience.

In conclusion, trend trading is akin to navigating the rhythmic waves of the market. It’s about identifying solid trends, judiciously setting entry and exit points, and maintaining strict discipline. For traders adept at these aspects, trend trading offers a promising avenue to capitalize on the market’s natural ebb and flow, potentially leading to rewarding ventures in the exhilarating domain of day trading.

Conclusion

The once-reliable buy-and-hold approach is facing more challenges in the erratic stock market of today. Investors are beginning to doubt the sustainability of these traditional investing strategies due to the quick and erratic changes in the market environment.

The landscape of investing has clearly changed as a result, with many investors now concentrating on more proactive trading strategies like swing trading and day trading. Active strategies are prized for their flexibility, which allows traders to quickly modify their approach in response to market movements and grab opportunities for quick profit.

The prevailing atmosphere of market apprehension is nudging traders away from holding positions over extended periods. Instead, they are increasingly embracing the rhythm of the market’s fluctuations. By adopting the strategies we’ve discussed – from the quick-footedness of scalping to the strategic anticipation in breakout and pullback trading – traders are arming themselves to tackle rapid market shifts and to capture fleeting gains within narrower time windows.

In wrapping up, it’s clear that as the financial markets morph and evolve, so too must the tactics of those who traverse this terrain. This evolution towards more fluid, active trading techniques mirrors the realities of today’s market. It underscores the necessity for versatility and a profound grasp of diverse trading strategies. From navigating the long, undulating waves of trend trading to seizing the short, sharp opportunities in momentum and news trading, the contemporary trader’s toolkit is varied and robust, equipping them to steer through the increasingly unpredictable waters of the modern financial markets.