What is Momentum Trading?

What is Momentum Trading?

By Katie Gomez

If your career involves following the stock market, you know how it works. The market can rise and fall in seconds, so your moves must be sharp, instinctual, and efficient. One of the best strategies you can follow as a trader is understanding the importance of momentum and how to use it to your advantage. Most stock traders would identify themselves as ‘adrenaline junkies.’

Many traders thrive off the adrenaline rush, which is why the stock market is comparable to a casino; like gambling, the action of trading stimulates the user. To avoid getting lost in the sea of emotions and fast-paced changes, you must learn to work with the momentum and direction of the market and create a strategy. In this article, I will address why momentum trading is a good strategy and explain how you become a momentum trader.

So how does momentum trading work?

Momentum trading is just what it sounds like; see what stock has been gaining or losing momentum and buy/sell accordingly. Traders have long used this impulse-based strategy to capitalize on the momentum from a specific stock to time entering a trend at the right moment. Momentum trading allows traders to get in on it at the peak time and follow the stream of momentum in whichever predicted direction. Unlike other more complicated trading strategies, momentum trading is easy to practice because all you have to do is follow existing trends.

Are there different versions of momentum trading?

You can opt to follow long-term or short-term momentum trading strategies. For instance, position trading is the long-term variation of momentum trading, while day trading is considered the short-term version. In the short-term, momentum trading is essentially assessing the direction of current momentum by analyzing assets in the short term until traders buy assets of whichever securities’ price has risen.

On the other hand, the trademark of long-term position trading is playing the long game. “If long-term momentum investing or trading is to buy low and sell high, then the goal of short-term momentum trading is to buy high and sell even higher…” (Frankel CFP, 2022). Resting between the two extremes is intermediate momentum trading, commonly used by swing traders.

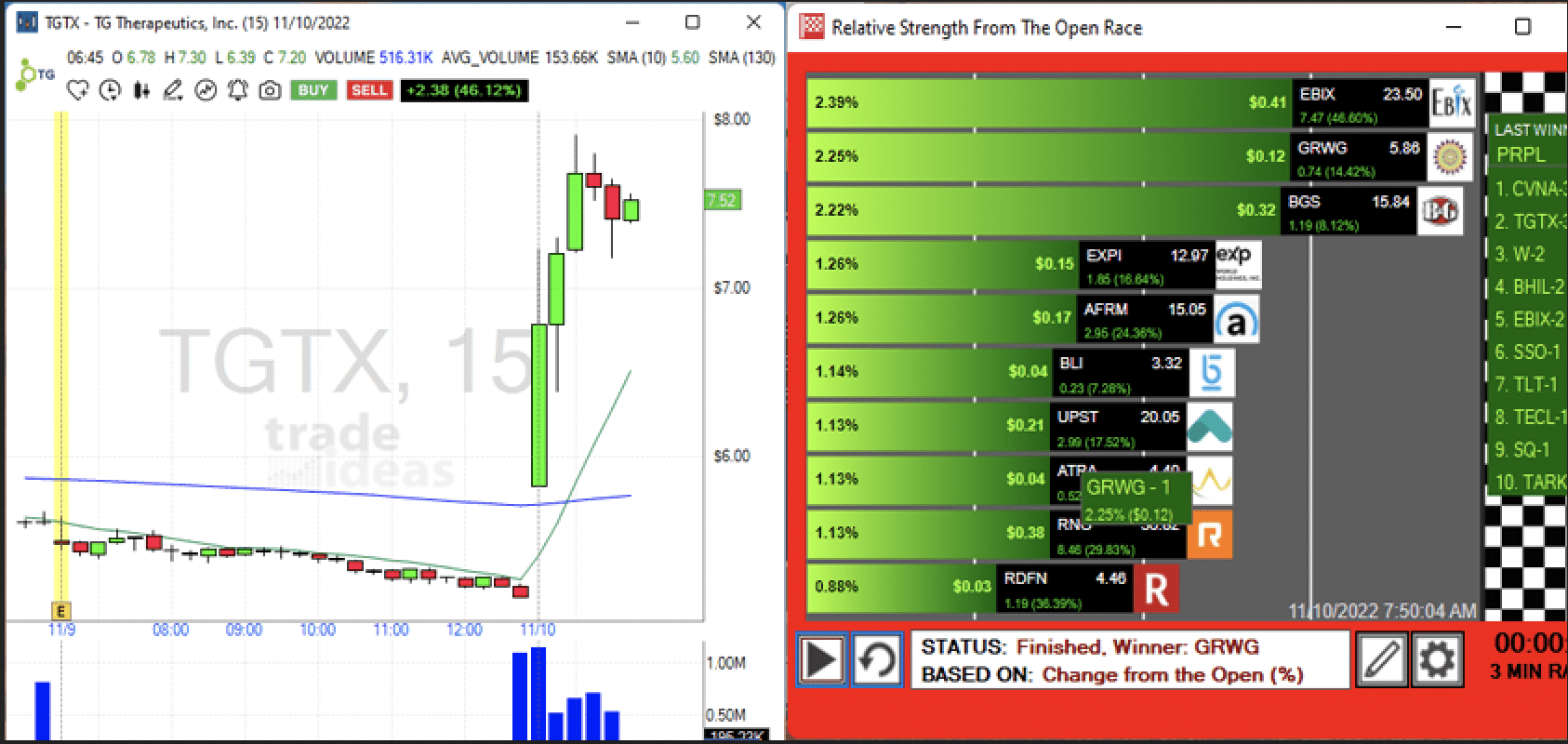

Whichever strategy you pick involves trend following and keen observation. For example, day traders scan for stocks with momentum with filters looking for criteria like company size, volume, or unusually high volatility. Day traders typically use whatever weapons of skill they possess, such as screeners and scanners, to find and filter out specific data (looking at 5% of highs over 52 weeks) or chart patterns to perform technical analysis ( reading candlestick charts).

Whatever momentum trading method you choose, the end goal is the same. You work with volatility to discover new buying opportunities in short-term uptrends until you sell when the securities lose their momentum. If you are a day trader with the time and resources necessary to observe these short-term uptrends, you will find this trading strategy most valuable. However, we still see stocks with consistent ‘long-term momentum’ in position trading, such as Tesla. Traders could argue that TSLA stock has been a momentum stock to follow for years and continues to rise.

Although momentum trading sounds like the perfect strategy for traders, like every other strategy, it has its risks and drawbacks. There is no denying that following momentum in the market can help you predict where the market turns, making high profitability extremely possible. However, we know that momentum can’t last forever, so all examples of it must come to a halt eventually. There are no guarantees in stock trading.

To increase your chances of success in momentum trading, timing is crucial; seconds can make or break your trades. ‘Momentum stocks,’ or stocks that have inexplicably risen dramatically, are typically only seen by day traders because if you blink, you may miss them entirely.

Momentum trading can be a high-risk—and potentially profitable—way to identify stocks to bet on minute-to-minute. Is momentum trading for you? Its success depends on your expectations and what kind of trader you are. To clarify, this strategy is intended for trading, NOT investing. It can be a great way to make money when you have a stock with momentum, but it can also be a detrimental loss if it goes the other way. Momentum trading requires patience, trial and error, and immense attention to detail before you see consistent success.

SUBSCRIBE TO TRADE IDEAS TODAY!

REFERENCES

https://www.fool.com/investing/stock-market/types-of-stocks/momentum-stocks/momentum-trading/

https://www.ig.com/us/trading-strategies/momentum-trading-strategies–a-beginners-guide-190905

https://www.fidelity.com/learning-center/trading-investing/trading/momentum-trading-strategies