Strategy Session: Moved Up on Lite Volume? Fade It.

Strategy Session: Moved Up on Lite Volume? Fade It.

Apr 18, 2006

A helpful article by Andy Swan on DayTradeTeam’s site got us thinking about the warning signs that go off when stocks head upwards but on lighter than normal volume.

DTT’s article suggests this is the beginning of a losing battle for a stock’s demand and thus a signal that a decline is immenient.

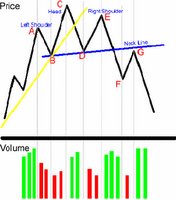

Andy’s article concerns the Head and Shoulder Reversal Pattern and lists 6 characteristics needed to confirm this pattern (shown below):

Key points to the Head and Shoulders Reversal:

- A prior trend must be in place for a reversal to occur.

- Uptrend continues, but on weaker volume (B to C).

- Heavy selling pushes point D below the trend line.

- The right shoulder is formed, lower than the head and on light volume.

- The neck line must be broken decisively to complete the pattern.· A return

move is very common, on light volume. Short at or near the neck line.

The Strategy: Fade the Up on Lite Volume Move

You should read and follow their advice in the article if you want to look for this specific indicator. The strategy we developed is more aggressive and shows a trader opportunities to fade upward moving stocks that are out of gas (i.e., when demand gives way to oversupply). With regard to the Key points above, the strategy signals as soon as the first 2 conditions are met.

How It’s Modeled:

The set-up includes these filtering conditions:

- Minimum Price is set at $10

- The spread between bid and ask cannot be larger than 10 cents

- The candidate stocks must trade on average at least 300,000 shares/day

- The candidate stocks must be in a previous and current uptrend: a minimum of 2 up days prior to today and in the top 20% of its daily range

and most importantly:

- The candidate stocks must be trading less than their normal, current volume – at least 35% below average at the time the signal is triggered

Subject to these filters above, the alerts will trigger whenever the stock: makes a check mark, crosses daily high resistance for the past 3 days, OR runs up in price with higher than normal acceleration.

Who Could Benefit:

This is one of the few ‘Strategy Sessions’ that uses the Maximum Current (or Relative) Volume filter to highlight stocks with weak volume patterns. Traders who base their trading decisions on volume will appreciate this strategy as a good contrarian spotter. Swing traders and intraday traders will also see opportunities in line with their holding preferences.

This strategy is not recommended during a strong bull market. It works best when the market is sideways or weak.

Note: If these stocks take a real dive as a result of showing up on this strategy, you could consider using a previous strategy called, “Oversold, Phoenix” to catch any bargains as they roar back.

Note: A similar strategy that tries to fade up moves can be found here. Keep in mind this strategy uses RSI and different alerts to find its opportunities. You may appreciate the different approach.

Footnotes:

- Link to DTT’s site for Andy Swan’s article, Head and Shoulders Reversal Patterns (TA)

- Configure this strategy for your own use here.

- Link to other Strategy Sessions here.

- Remember that these set-ups are sketches meant to give you an idea how to model your own trading plan. Use this ‘as is’ or modify it to your own liking as many others do. Know, however, that Trade-Ideas.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, alerts and all other features are for research purposes only and should not be construed as investment advice.

- June Seminar Footnote – To gain a full understanding of how this strategy and others can help you in your trading plan, we suggest you attend our training seminar in June. There we will focus on all the advanced aspects of our software needed to give you an edge against larger, more capitalized participants. We just opened the sign up page so that you can officially pay for and reserve your spot (conference limited to 100 existing subscribers). https://trade-ideas.54solutions.com/Seminar/