Posts Tagged ‘trading’

4 Steps to Get the Jargon Out of Your Strategy

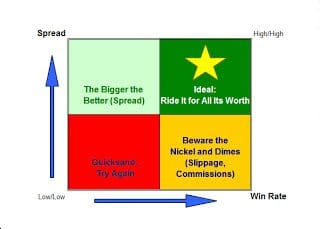

We were recently asked by Technical Analysis of Stocks & Commodities magazine (a review of our event-based backtesting tool The Odds Maker appears in the July 2007 issue) what’s the biggest stumbling block faced by new users when trying to work with The Odds Maker. We answer the question below. How Jargon Harms Learning The…

Read MoreWhat to Do When You’re Suspicious of Low Volume Rises in the Market

TraderMike’s commentary on the markets yesterday included this observation, “I’m always suspicious of low volume rises and this time is no different, especially for the S&P 500 which has been making lower highs and lower lows for the last month or so.” I agree. In fact we’ve created a couple of strategies in Trade-Ideas that…

Read MoreA Nation of Laws, Not Men – Good Idea for a Trading Plan

On this Independence Day it’s important to remember one of the most important differentiating characteristics of our nation from others past and present: We are a nation of laws, not men. We celebrate the fourth in my mind as reminder that our freedoms rest not on the whims of one man’s behavior but on laws…

Read MorePlay Both Sides of the Fed Decision

In light of the Fed decision, I am posting links to some of our previous Strategy Sessions that work best when the market is about to absorb key information: The Fed Watcher – uses the unusual number of prints trigger to pinpoint key activity and incorporates some advice dished by TheKirkReport and Toni Hansen; the…

Read MoreDoes Your Trading Plan Benefit from Continuing Education?

After the Traders Expo in San Diego finished this past weekend, I asked several members of our team what their impressions were and how things went. Traders are not like CPAs, but in one regard they should be One reason I think it’s important to share these thoughts is to help you judge whether or…

Read MoreTrading Events vs. Stocks: an Online Presentation

On the heels of the recent Traders Expo in San Diego last week, I am participating in a virtual online trader’s expo organized by TradersWorld, a financial magazine and conference organizer de jour. My presentation to the online attendees will cover some of what Dan Mirkin and I discussed during our Learning Curve Seminar at…

Read MoreSummer Camp Automation at Trade-Ideas Will Yield an Even Hotter Winter

Between beach trips, the San Diego Traders Expo (you’re coming right?), and cookouts, development on automated algorithmic trading continues. The results (like all our tools) will bring new leveraged abilities to individual traders to level the playing field against anyone in the market. Early “alpha” testing of automating trades begins with strategy development in Trade-Ideas,…

Read MoreTrade Like TraderMike

TraderInterviews.com discusses strategies and techniques with Trader Mike, one of the best known traders and commentators out there. Just some of the gems from this interview (Specs: 15 mins, 01 secs): Why he likes shorting stocks more than going long Thoughts about how blogging helps him be a better trader What are the minimum filters…

Read MoreTrade-Ideas Releases v2.1

The beta release we launched for v2.1 was our most popular and most widely used beta yet in our history. Now the official version is available for everyone. If you are already using Trade-Ideas Pro, a prompt already asked you if you would like to download the latest version. Here’s a recap of why you…

Read MoreCycles of Market Technology: A Quick Brief History

Jaime shows us historical examples of how trading technology and innovation allow individual traders to exploit market inefficiencies and leverage themselves onto the same playing field as the institutions. Below he describes the trends in the kinds of artillery used by market participants and highlights the constant battle between innovators who create advantages in trading…

Read More