Posts Tagged ‘Strategy-Session’

4 Steps to Get the Jargon Out of Your Strategy

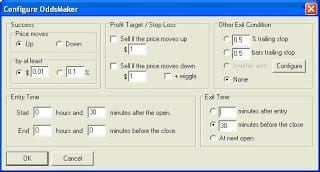

We were recently asked by Technical Analysis of Stocks & Commodities magazine (a review of our event-based backtesting tool The Odds Maker appears in the July 2007 issue) what’s the biggest stumbling block faced by new users when trying to work with The Odds Maker. We answer the question below. How Jargon Harms Learning The…

Read MoreWhat to Do When You’re Suspicious of Low Volume Rises in the Market

TraderMike’s commentary on the markets yesterday included this observation, “I’m always suspicious of low volume rises and this time is no different, especially for the S&P 500 which has been making lower highs and lower lows for the last month or so.” I agree. In fact we’ve created a couple of strategies in Trade-Ideas that…

Read MorePlay Both Sides of the Fed Decision

In light of the Fed decision, I am posting links to some of our previous Strategy Sessions that work best when the market is about to absorb key information: The Fed Watcher – uses the unusual number of prints trigger to pinpoint key activity and incorporates some advice dished by TheKirkReport and Toni Hansen; the…

Read MoreTrade Like TraderMike

TraderInterviews.com discusses strategies and techniques with Trader Mike, one of the best known traders and commentators out there. Just some of the gems from this interview (Specs: 15 mins, 01 secs): Why he likes shorting stocks more than going long Thoughts about how blogging helps him be a better trader What are the minimum filters…

Read MoreBe Like Rick (Part 3): Learn Technique on Our Time – Save Yours for the Improved Trading

We conclude our 3-part series featuring the experiences of Rick B. who came to Trade-Ideas a bit frustrated with what a trading tool could do to improve his performance. Intrigued by our open invitation to spend one-on-one time with everyone who subscribes to Trade-Ideas via a scheduled, personal training session, Rick B. learned powerful ways…

Read MoreBe Like Rick (Part 2): Learn Technique on Our Time – Save Yours for the Improved Trading

Good movies often portray characters who go through transformations. They are different at the end of the film from where they were at the beginning. Here is the continuation of Rick B.’s trans-formative experience with Trade-Ideas. Part 1 of the story begins here. The Trade-Ideas rep suggested that I get set up with a private…

Read MoreA New Contributor with an Experienced Voice

Please welcome Jamie C. Hodge, a new contributor to this blog, who will provide occasional commentary on the markets and his trades. I say occasional because Jamie is first and foremost a trader. His best nuggets of wisdom are usually not written but verbally delivered throughout the trading day. We’ll try to capture that wisdom…

Read MoreStocks Up Exactly 8 Days

From TickerSense yesterday: “This is just the 64th time since 1900 that the DJIA has been up 8 days in a row … The last time the Index had an 8-day winning streak was in March of 2002.” I’m not suggesting a correlation between the DJIA and the following lists of stocks, but to carry…

Read More20-Day Stock Gainers & Losers: Maximizing Buying Power

If you don’t already read Charles Kirk’s The Kirk Report, you should. It’s a bevy of information very relevant and useful to the active trader. Yesterday and today The Captain describes a source for finding 20-Day High Percentage Gainers and Losers. Because Kirk regularly mentions Trade-Ideas’ scans as a good resource, I don’t think it’s…

Read MoreStrategy Session: Finding Consolidation Breakouts

Question from IM Support today: Subscriber: (3:47:59 PM): do you have any scans for setups that have like a 30 day high, then consolidates for about 5 days and then breaks out of that consolidation? Some of the details of his request are changed to protect his idea. The tricky part of this request is…

Read More