Change From 10 Period SMA (2m)

Table of Contents

- Understanding the Change From 10 Period SMA 2m Filter

- Change From 10 Period SMA 2m Filter Settings

- Using the Change From 10 Period SMA 2m Filter

- FAQs

Understanding the Change From 10 Period SMA 2m Filter

The "Change From 10 Period SMA 2m Filter" is a dynamic tool for traders who focus on very short-term market trends. It compares the current stock price to its 10-period Simple Moving Average (SMA) on a 2-minute chart. This filter is ideal for day traders seeking to capitalize on rapid price movements by providing a snapshot of the stock's momentum over the last 20 minutes. Here’s how it operates:

Simple Moving Average (SMA)

10-Period SMA on a 2-Minute Chart: This SMA calculates the average closing price of a stock over the last 10 two-minute periods, totaling 20 minutes. It's designed to smooth out the price data to help traders identify the immediate trend direction.

Calculation: The filter's values are represented as a percentage (%). The formula is: Percent Change = ((Last Price - SMA) / SMA) * 100

A positive value suggests that the current price is above the moving average, indicating upward momentum. Conversely, a negative value shows the current price is below the average, hinting at downward momentum.

Change From 10 Period SMA 2m Filter Settings

Setting up the "Change From 10 Period SMA 2m Filter" is straightforward in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

To isolate stocks that are currently above their 10-period SMA on a 2-minute chart, adjust the minimum value to 1.

-

To focus on stocks currently below their 10-period SMA on a 2-minute chart, set the maximum value to -1.

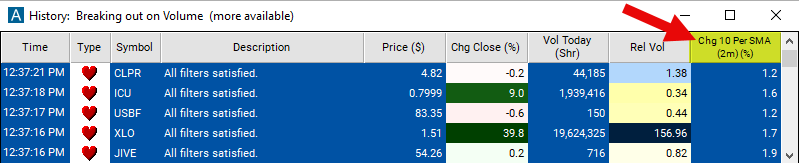

Using the Change From 10 Period SMA 2m Filter

The "Change From 10 Period SMA 2m Filter" enables a variety of trading strategies, particularly suited for those trading on very short timeframes. Examples include:

Momentum Trading: Traders might enter long positions in response to a significant positive change, leveraging the detected upward momentum. Similarly, a marked negative change could signal an opportunity for short selling.

Reversion to Mean Strategies: Significant departures from the 10-period SMA may indicate an overextended price move, with a potential reversal or return to the SMA likely, offering counter-trend trading opportunities.

Scalping: Given the filter's focus on short-term fluctuations, it is particularly useful for scalping, where traders look to profit from small changes in price, entering and exiting trades quickly.

Dynamic Stop Loss and Take Profit: The 10-period SMA serves as a guide for setting dynamic stop loss and take profit levels, adapting to the stock's latest volatility and trend strength.

FAQs

How does the "Change From 10 Period SMA (2m)" differ from longer SMA periods?

- The "Change From 10 Period SMA (2m)" offers a more immediate view of price action and trend direction, making it more reactive to recent price changes than filters based on longer SMA periods. This responsiveness is key for traders making quick decisions based on the latest market movements.

Is the "Change From 10 Period SMA (2m)" appropriate for all traders?

- This filter is most beneficial for day traders and scalpers who operate on short timeframes. While useful for these styles, its effectiveness for longer-term traders may be limited without additional, longer-term analyses.

What does a consistent change from the 10-period SMA on a 2-minute chart signify?

- Sustained positive changes indicate strong bullish momentum, suggesting potential buying opportunities. Ongoing negative changes suggest bearish momentum, potentially highlighting opportunities to sell or short. Traders should seek confirmation from other sources to validate these signals.

How to adjust the filter for stocks with different volatility levels?

- Adjusting the sensitivity of the percentage change threshold allows traders to better filter signals based on a stock's volatility. For more volatile stocks, setting a higher threshold can help mitigate the risk of false signals.

Filter Info for Change From 10 Period SMA (2m) [2SmaLa10]

- description = Change from 10 Period SMA (2m)

- keywords = Fixed Time Frame Moving Average

- units = %

- format = 1

- toplistable = 1

- parent_code =

Change from 10 Period SMA (5m) [5SmaLa10]

Change from 10 Period SMA (5m) [5SmaLa10] Change from 10 Period SMA (15m) [15SmaLa10]

Change from 10 Period SMA (15m) [15SmaLa10] Change from 10 Period SMA (60m) [60SmaLa10]

Change from 10 Period SMA (60m) [60SmaLa10]