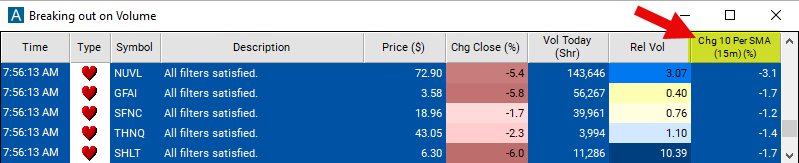

Change From 10 Period SMA (15m)

Table of Contents

- Understanding the Change From 10 Period SMA 15m Filter

- Change From 10 Period SMA 15m Filter Settings

- Using the Change From 10 Period SMA 15m Filter

- FAQs

Understanding the Change From 10 Period SMA 15m Filter

The "Change From 10 Period SMA 15m Filter" is a strategic tool for traders looking at medium-term market dynamics. By comparing the current stock price to its 10-period Simple Moving Average (SMA) on a 15-minute chart, this filter sheds light on the stock's momentum over the last 2.5 hours. Designed for traders who operate on slightly longer timeframes than typical day trading periods, it offers a nuanced view of trend direction and strength.

Here’s the essential functionality:

Simple Moving Average (SMA)

10-Period SMA on a 15-Minute Chart: This calculates the average closing price over the preceding 10 fifteen-minute periods. It aims to mitigate the impact of immediate price fluctuations, thereby clarifying the trend over a medium-term horizon.

Calculation: Values for this filter are expressed as a percentage (%). The calculation formula is: Percent Change = ((Last Price - SMA) / SMA) * 100

A positive figure indicates that the current price exceeds the moving average, signifying an uptrend. A negative figure, conversely, means the current price is below the average, indicating a downtrend.

Change From 10 Period SMA 15m Filter Settings

Adjusting the "Change From 10 Period SMA 15m Filter" is done in the Window Specific Filters Tab found in the Configuration Window of your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

For isolating stocks that are presently trading above their 10-period SMA on a 15-minute chart, adjust the minimum value setting to 1.

-

To focus on stocks currently below their 10-period SMA on a 15-minute chart, set the maximum value to -1.

Using the Change From 10 Period SMA 15m Filter

Implementing the "Change From 10 Period SMA 15m Filter" enables a variety of trading strategies suitable for medium-term market engagement. Among them are:

Momentum Trading: Leveraging a substantial positive change as an indicator to open long positions, capitalizing on detected upward momentum. A significant negative change, alternatively, might suggest a viable opportunity for short selling.

Reversion to Mean Strategies: A pronounced deviation from the 10-period SMA could signal an overextension, with a potential reversion to the SMA likely, thus creating opportunities for opposite-direction trades.

Scalping: Despite its focus on a longer timeframe, the filter remains useful for scalping within the context of medium-term trends, allowing traders to make quick decisions based on more sustained price movements.

Dynamic Stop Loss and Take Profit: The 10-period SMA provides a basis for dynamically setting stop loss and take profit orders, accommodating changing market conditions and trend volatility.

FAQs

How does the "Change From 10 Period SMA (15m)" differ from shorter period versions?

- The 15-minute version offers a more comprehensive view by smoothing out short-term volatility, thus providing clearer signals for medium-term trading decisions compared to its shorter period counterparts.

Is the "Change From 10 Period SMA (15m)" applicable to all types of traders?

- It is particularly advantageous for those engaging in day trading at extended intervals or those who prefer trading strategies that span several hours. Its utility may be less pronounced for long-term investors or very short-term scalpers.

What does ongoing positive or negative change from the 10-period SMA on a 15-minute chart indicate?

- Continuous positive changes denote a solid upward trend, suggesting profitable buying opportunities. Persistent negative changes indicate a downward trend, potentially signaling opportunities for selling or shorting. Cross-verification with other indicators is recommended for enhanced signal accuracy.

How can the filter be adjusted for stocks of different volatility profiles?

- Altering the percentage change threshold allows for customization based on a stock's volatility, enabling traders to filter out noise and focus on more meaningful trend shifts in higher volatility stocks.

Filter Info for Change From 10 Period SMA (15m) [15SmaLa10]

- description = Change from 10 Period SMA (15m)

- keywords = Fixed Time Frame Moving Average

- units = %

- format = 1

- toplistable = 1

- parent_code = 2SmaLa10