The Ultimate Father’s Day Guide: Market Dos and Don’ts From Three Generations of Traders

The Ultimate Father’s Day Guide: Market Dos and Don’ts From Three Generations of Traders

By: Katie Gomez

Happy Father’s Day Traders! In honor of the man who first taught me how to trade – who also learned from his father – I’m sharing some of the best lessons passed down through generations. Whether or not your parents taught you about the markets, this guide offers timeless fatherly advice to help you navigate the dos and don’ts of trading.

Do: Know Your Timeframe

Knowing your time frame was the first thing my dad taught me, and it is something every new trader should discover before doing anything else. Your time frame determines everything from your strategy to your stress levels. Are you a day trader looking to capitalize on minute-by-minute price movements, a swing trader holding positions for days or weeks, or a long-term investor thinking in months and years? Your time frame dictates which technical indicators matter, how much capital you need, and most importantly, how much time you can realistically dedicate to monitoring the markets.

A day trader needs to be glued to their screen during market hours, while a swing trader can check positions a few times a day. Mismatching your lifestyle with your trading time frame is a recipe for disaster, like trying to day trade while working a full-time job. Know your schedule and your goals, and align your trading strategy accordingly. Start with retail trading and work your way up from there, depending on your goals.

Don’t: Listen to Gurus

One of the worst mistakes my dad taught me, especially growing up in the age of social media, is following the advice of self-proclaimed “trading gurus.” Gurus are the “rich” people you see plastered across social media platforms telling you that you can be as rich as they are if you do what they do (buy their program, follow this trend, invest in this stock, etc.).

Red Flags to Watch Out For:

- Flashy lifestyle displays – Photos with luxury cars, mansions, stacks of cash, or private jets

- “Get rich quick” promises – Claims like “Turn $100 into $10,000 in 30 days!” or “I made $50K this week, and so can you!”

- Pressure tactics – Limited-time offers, such as “Only 10 spots left” or “expires at midnight,” are used to rush your decision.

- Vague strategy explanations – They talk about their “secret system” but never explain the actual methodology in free content

- Focus on selling rather than teaching – Every post leads to a paid course, mentorship, or subscription service.

- No background in actual finance – They appeared out of nowhere without any credible trading or financial education history, just a pretty face or celebrity.

Do: Practice Before You Play

Simulators are the best playground for newer traders. The biggest hurdle to overcome as a trader is our emotions and attachment to the money we risk; therefore, the obvious solution is to practice with fake money before risking the real thing. I was taught to treat trading like a game, and just like any sport I played growing up, I knew I had to practice before I played.

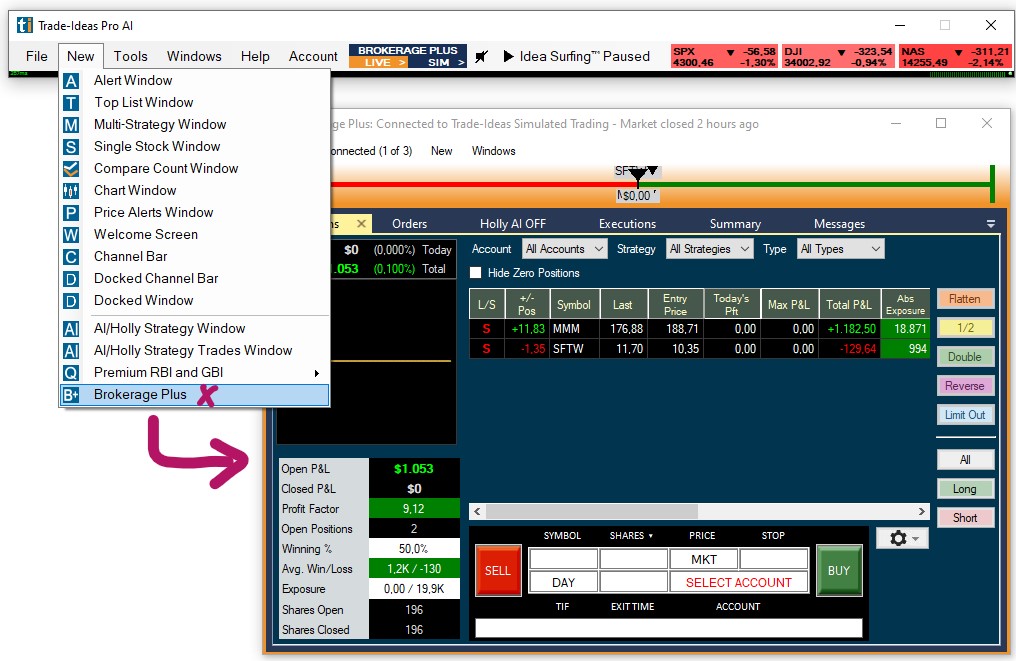

Simulators are a way to gain confidence because you’re learning how to cultivate strategy, follow a plan, set your risk parameters, and make all the mistakes you want without paying a dime. The Trade Ideas trading simulator is ideal for new traders, as it offers a safe and realistic environment for honing skills, testing new approaches, and familiarizing oneself with the Trade Ideas platform before risking real capital.

Don’t: Follow the Herd

Many newer traders, including myself, have struggled with trusting their own instincts and building confidence in the decisions they make. The fear of missing out (FOMO) kicks in hard when you see post after post about how everyone is making money on the latest meme stock or hot crypto find. But the reality is, by the time something becomes popular enough for everyone to be talking about it, you’re often already too late. The smart money has already moved in, taken their profits, and moved on. When retail traders start flooding into a position en masse, it’s usually a signal that the move is nearing its end. Think about it – if everyone is buying, who’s left to buy and push the price higher?

Do: Ask For Help or Mentorship

However, avoiding following the herd does not mean detaching yourself entirely; staying informed and seeking help from more experienced traders goes a long way, especially when you’re first starting out on your trading journey. A successful trader knows the difference between following others’ paths and learning from successful traders to help you carve your own. Do your due diligence to find a program, mentor, or advisor that suits your needs.

Don’t: Panic Sell

Panic selling is based on one of the most powerful emotions a trader can act upon: fear. Unlike “diamond hands” (traders who greedily hold onto stocks and never sell), panic sellers or “paper hands” are known for dropping a stock at the first sign of trouble.

Panic selling can be especially detrimental to a trader’s career when it occurs at the bottom of a dip or during temporary market volatility that would have been resolved within days or weeks. Even worse, it creates a vicious cycle where you buy high (when you’re feeling confident and greedy) and sell low (when fear takes over).

Every trader has fought off panic selling urges at least once in their career, that feeling of visceral fear leading you down a rabbit hole, casting thoughts like: “That could have been my savings,” or “Why did I even get into trading,” and the spiral continues to erode your confidence and make it harder to trust your analysis in future trades.

Do: Sell half

As an impulsive person, selling half was the best advice my dad ever gave me. When you are paralyzed between selling and keeping, selling half is the antidote. It satisfies the strong urges of both greed and fear as you straddle FOMO and panic selling. This strategy provides psychological relief by taking some profits off the table while maintaining upside exposure if the stock continues to rise.

If the position keeps going up, you’re still participating in the gains with your remaining half. If it drops, you’ve already secured some profits and reduced your risk. It’s a perfect compromise that removes the all-or-nothing pressure that leads to poor emotional decisions. This technique has saved me countless times from both the agony of watching big profits disappear and the mistake of panic selling at the worst possible moment. Traders can implement this by setting predetermined exit strategies and stop-loss levels before entering a trade, thereby removing emotion.

Play the long game

But the best advice he gave me was simple: play the long game. In long-term investing, panic selling, fear, and greed are rendered even more redundant, as the losses you focus on are merely a drop in the bucket compared to the grand scheme of things. There is no such thing as “get-rich-quick,” slow and steady wins the race in the stock market. Though it might be tempting to get results fast, never use scared money or money you can afford to lose (rent, bills, utilities). Trading is not gambling; it is a way to help you gain financial confidence and freedom. Practice, do your research, and get the help you need to find your way. Invest in help outside of yourself, and remember that chasing immediate gratification is not the key to success.

Whether you’re just getting started or looking to refine your strategy, Trade Ideas offers the tools and education to help you trade with discipline, not emotion. With a built-in simulator, powerful data tools, and real-time mentorship, it’s the best place to learn, practice, and grow.