Trading Insights & Opportunities: December 12th Outlook

Trading Insights & Opportunities: December 12th Outlook

Hello, traders. This is Andy with Trade-Ideas, offering your snapshot of the market for December 12th, a relatively calm Tuesday. We’re looking at a market that is currently rather flat, following the release of the Consumer Price Index (CPI) numbers. We saw a bit of a surge in the gap up, which then pulled back. But now, we’re sitting in flat territory. So, what are the setups giving us opportunities today? Let’s examine these closely.

Chinese Market: TA Altal Education Group

First up on our list is this Chinese name, TAL Yesterday, this company showed a notable pop and held its ten-period moving average. As you will notice in the chart below, I have set a price alert for a five-day high on this stock.

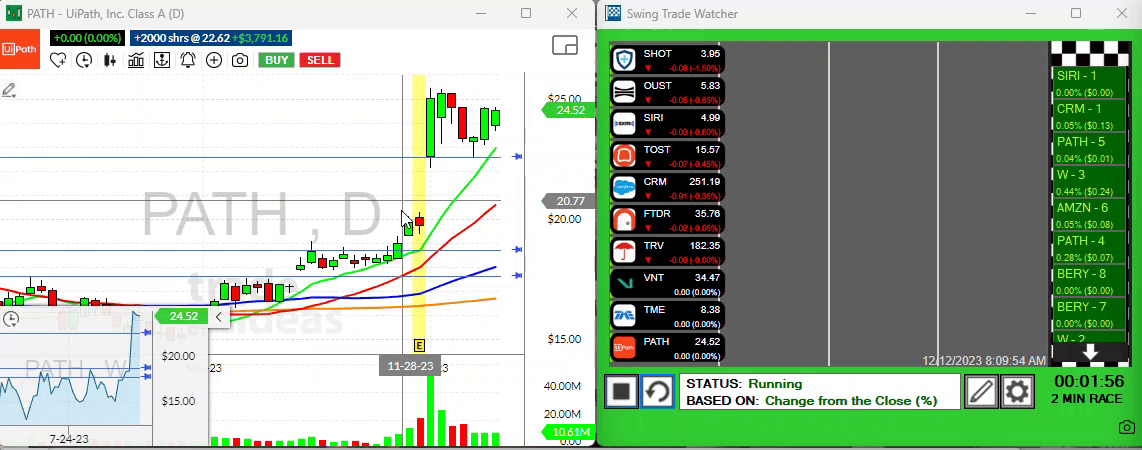

Path: A Persistent Performer

Moving along, we have Path, a stock I’ve been closely tracking for a couple of weeks now. I also added to my position following its bar reversal, after that beautiful hammer pattern arrived. You’ll notice below how it’s setting up a nice wedge formation here. It indicates potential upward movement, perhaps even taking out the month high there in Path.

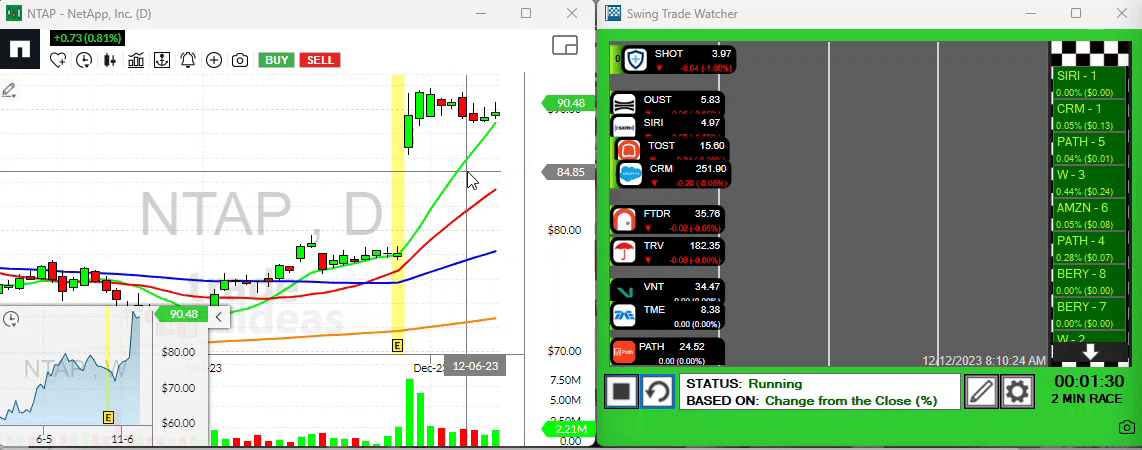

NTAP: Exhibiting Strong Patterns

Let’s turn our attention to NTAP, another compelling setup. The earnings marker, highlighted in yellow in the image below, creates an interesting landscape. It shows a well-executed gap up, and impressively, hasn’t pulled back much at all since. This indicates some really strong market sentiment. Entry into this is quite subjective, but setting a price alert close to that monthly high can help monitor potential entry points.

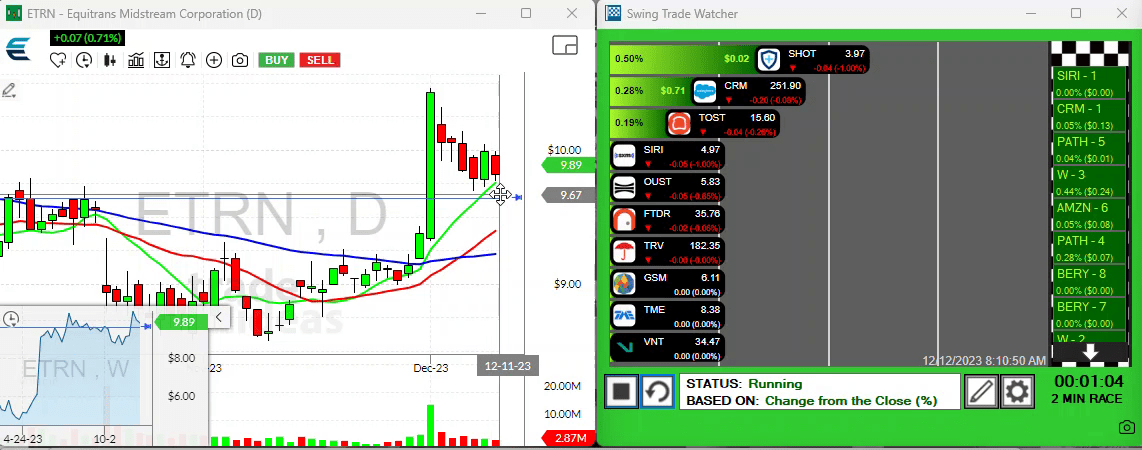

ETRN: A Momentum Play

ETRN is our momentum play for the day. The prominent green bar is noteworthy. It’s now pulling back, forming a beautiful wedge in alignment with the ten-period moving average. This might be forcing the action in just a day or two. Setting your price alert just above that ten can aid reactiveness.

That’s all for today, traders. But remember there are several more setups in play. If you’re looking for added trade ideas, be sure to stay tuned to our channel. So until our next update, stay vigilant and trade wisely. I’ll be back with more insights tomorrow.