5 Strategies for Effective Trade Exit: Knowing When to Cash Out

5 Strategies for Effective Trade Exit: Knowing When to Cash Out

By: Shane Neagle

The manner you exit a transaction can occasionally be just as crucial as how you entered it in the fiercely competitive world of day trading. For traders, striking a careful balance between stopping losses and locking in gains is critical, and using successful exit strategies is key to doing so. Regretfully, many traders devote more of their attention to perfecting their entry points and less time to planning their exits. This lack of attention can erode potential profits or even transform what could have been profitable trades into losses.

One of the most difficult parts of trading is closing a position as it frequently requires overcoming a maze of psychological and emotional obstacles. Either sticking onto positions for too long or abandoning them too quickly, traders may find themselves motivated by the fear of missing out on more gains or the hope that a losing position will come around. The effects of badly executed exits can seriously impair a trader’s performance, lessening the influence of well-thought-out entry methods and strict risk management procedures.

Acknowledging the critical role of strategic exits, this article explores five essential strategies designed to improve traders’ timing on exiting the market and overall trading efficacy. Each strategy is crafted not just to maximize potential gains but also to mitigate the risks that come with the inherently unstable nature of day trading. By mastering these exit strategies, traders can handle market complexities with greater assurance and accuracy, ensuring that their decisions on when to exit trades bolster their overall trading objectives.

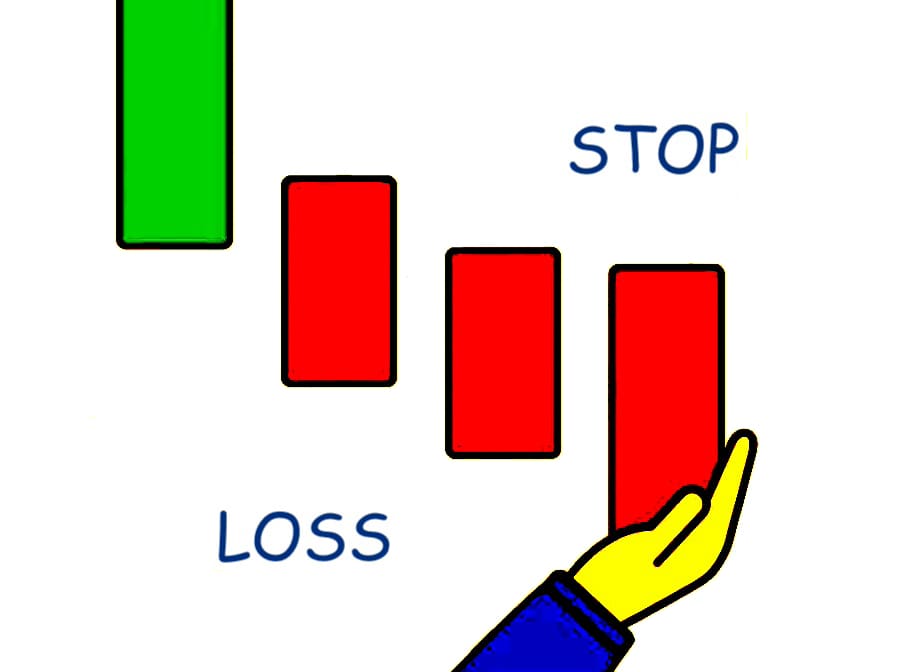

Setting Stop-Loss Orders

Stop-loss orders are a critical component in the toolkit of any day trader, serving as an automatic mechanism to curtail significant financial losses. A stop-loss order is essentially a directive given to a broker to sell a security once it hits a predetermined price, thus limiting a trader’s loss on an investment. For day traders, who often encounter swift price changes, stop-loss orders are indispensable for enforcing trading discipline and managing risks effectively.

Preventing losses from going over a predetermined financial limit is the primary purpose of a stop-loss order in an exit strategy. Because day traders sometimes face abrupt, large price fluctuations and make rash decisions under pressure, this trait is crucial to their success. By deciding ahead of time the greatest loss they are ready to accept on a transaction, traders can prevent debilitating losses that might exceed their risk tolerance by employing a stop-loss order.

Consider a trader who buys shares for $50 per, anticipating a price gain. Given the volatility of the market, the trader places a stop-loss order at $45. Should the unexpected economic news cause the market to fall and drive the company’s price lower, the stop-loss order kicks in when the stock hits $45, instantly liquidating the shares and capping the trader’s loss at 10% of the initial investment. If the trader waits for more stock price declines before manually stepping in, the losses might balloon significantly without this stop-loss.

Thus, stop-loss orders function almost like insurance—they don’t prevent a loss, but they do help manage and contain potential losses. Integrating stop-loss orders into their trading plans allows traders to safeguard their investments by maintaining control over their potential losses, ensuring that one poor trade doesn’t threaten their entire trading capital.

Using Technical Indicators for Exit Signals

Precisely determining when to close a deal is essential to increasing profits and controlling risks in the world of day trading. To identify these crucial exit moments, traders commonly employ technical indicators like moving averages and the Relative Strength Index (RSI). These tools excel at identifying possible market reversals or weakening trends, offering a systematic approach to making exit decisions.

For instance, moving averages simplify price data into a single trend line, which helps clarify the trend direction. A typical strategy involves exiting a trade when the price drops below a moving average, which may signal an emerging downward trend. Similarly, the RSI, which tracks the velocity and magnitude of price movements, helps identify overbought or oversold conditions. An RSI score above 70 might suggest that the market is overbought and could reverse, which would be a cue to consider exiting a position, whereas a score below 30 indicates a potentially oversold market, prompting a trader to exit a short position.

Moreover, the security of the platforms used to access and analyze these indicators is paramount. It is essential that trading platforms employ online privacy and data security to ensure the safety of trading data from unauthorized breaches or leaks. Tools focused on privacy help protect personal and transaction data, thus securing traders’ strategies and financial details.

The significance of robust security practices cannot be ignored. Weak data protection can compromise trading decisions and lead to significant financial losses, particularly if sensitive data falls into the wrong hands. Thus, maintaining the efficacy and privacy of trading activities requires the implementation of strict security measures, with sub-accounts sometimes being necessary for effective separation of funds. Traders may trade with confidence knowing that their personal information and financial assets are secure when they combine technical analysis with dependable security mechanisms.

Implementing Trailing Stops

Trailing stop orders offer a sophisticated twist on traditional stop-loss orders, dynamically adjusting to stock price movements to balance risk management with profit maximization. Unlike fixed stop-loss orders, trailing stops track the market price at a predetermined distance or percentage, allowing traders to safeguard accumulated gains while potentially expanding their position.

The operation of trailing stop orders is simple yet effective. For instance, if a trader purchases a stock at $100 and places a trailing stop 10% lower, the initial stop-loss would be positioned at $90. The trailing stop automatically adjusts to maintain the 10% difference at $108 should the stock price increase to $120. In the event that the stock price starts to drop, the stop-loss is placed at $108 to protect the trader from significant losses while retaining a portion of the profits.

Consider a practical scenario: a trader acquires shares at $50 each, anticipating an increase. By setting a 5% trailing stop, as the stock price escalates to $70, the trailing stop also rises, recalibrating to $66.50. Should the stock price retract to $65, the trailing stop activates at $66.50. In addition to guaranteeing a profit of $16.50 per share, this method reduces additional possible losses in the event that the price drops much lower.

Understanding the volatility of the asset and the trader’s own risk tolerance are essential for making effective use of trailing stops. When prices fluctuate normally, placing the stop too near might result in an unwarranted sell, while setting it too far could mean losing out on significant profits. In erratic markets, trailing stops are often helpful in securing profits and controlling risk during abrupt price swings.

Time-based Exit Strategies

Instead of only responding to price changes, time-based exit strategies give traders a planned method to terminate positions at predetermined times. Traders can better limit their exposure to market risks by setting exit points at predefined intervals, such as after a fixed length, before important news releases, or at the end of the market. This is especially important when it comes to reducing the risks involved in holding holdings overnight or during periods of volatility trading.

Closing positions at the conclusion of the market is a popular strategy employed by day traders. The advantage of this technique is that it removes the possibility of overnight market fluctuations brought on by unexpected developments in the economy, in geopolitics, or in investor sentiment after the market shuts. Closing positions at the end of the trading day helps traders secure profits and reduce exposure to these unpredictable elements.

Consider a scenario where a trader buys shares in a technology company early in the day, spurred by positive sector news. As the trading day unfolds, the stock’s value increases substantially. Rather than risk holding the stock overnight and potentially facing adverse news that could devalue the stock, the trader opts for a time-based exit, choosing to sell at market close. This move locks in the day’s gains and circumvents the risk of price drops due to after-hours news.

When there is a lot of market volatility, such during earnings seasons, when stock values might move significantly after results releases, time-based tactics are also quite helpful. Exiting positions before such volatile events can prevent large, unexpected losses.

Adopting time-based exits demands discipline and a well-defined trading plan that specifies the timing of exits, irrespective of the current profits or losses. This methodical approach helps traders maintain objectivity and adhere to a strategy that supports their broader risk management objectives.

Profit Target Exits

A tactical method that helps traders maintain profits and steer clear of the typical error of holding onto a position for a lengthy period of time is setting specified profit objectives for each transaction. In essence, a trader’s profit objective is the price at which they want to sell a security in order to make a profit. Setting a defined exit strategy based on financial goals and market data, as opposed to acting on impulse driven by market fluctuations, is a crucial strategy for managing emotions when trading.

Profit targets are particularly valuable in day trading, where price movements are rapid and fleeting. By setting profit targets, traders can make informed exit decisions that are consistent with their risk-reward criteria. This strategy ensures that profits are captured before the market has a chance to retract those gains, a frequent hazard in the dynamic trading environment.

Imagine a situation where a trader purchases shares for $100 per with the goal of earning a 10% profit. As a result, $110 would be the profit objective. Once the price hits $110, the position is automatically sold, securing the profit. This approach was effectively demonstrated when a trader invested in a tech startup before a product launch, expecting the price to rise. The trader bought shares at $200 and set a profit target of $240, marking a 20% increase. As anticipation around the product release grew, the share price rose and met the target during the trading session. Achieving the profit target prompted the trader to exit at $240, thus locking in the profit. Soon after, the stock’s price fluctuated and eventually fell due to mixed product reviews, affirming the wisdom of exiting at the target.

Using profit targets ensures that trading decisions are made based on a predefined strategy and thorough analysis, rather than on emotional impulse or speculation. This disciplined approach helps traders stick to their trading plan, promoting a structured trading regime, and aligning each transaction with their broader financial goals. Such strategies are essential for sustaining profitability and achieving consistent results in day trading.

Conclusion

In wrapping up, the importance of mastering a variety of exit strategies cannot be overstated for traders looking to thrive in the dynamic world of day trading. From the implementation of stop-loss orders to the setting of precise profit targets, these strategies form a comprehensive approach to both securing profits and mitigating losses. By adopting these methods, traders ensure they maintain a disciplined approach, enabling them to execute exits that are not only timely but also in line with their strategic trading goals.

Each exit strategy discussed addresses specific needs and suits various trading situations and preferences. Whether it involves utilizing the automatic safeguards of stop-loss and trailing stop orders, the strategic timing of time-based exits, or the objective-oriented nature of profit target exits, traders are equipped with an array of tools to enhance their trading operations. Effective integration of these strategies requires ongoing practice and should be tailored to fit individual trading styles and risk thresholds.

To sum up, the capability to select and apply the right exit strategy in response to different market conditions can markedly improve a trader’s performance and potential earnings. Therefore, traders are advised to practice these strategies in a simulated environment, which provides a safe space to refine skills and boost confidence without financial risk. This preparatory step is crucial, as it arms traders with the necessary expertise and tools to navigate the actual trading landscape successfully.