8 Common Day Trading Mistakes and How to Avoid Them

8 Common Day Trading Mistakes and How to Avoid Them

By Shane Neagle

Can day trading really turn you into an overnight financial success? This tantalizing question draws countless individuals to the high-stakes world of stock trading every day. Seduced by stories of rapid wealth and easy gains, many enter this arena with high hopes and ample enthusiasm.

Yet, the reality of day trading is often starkly different from these lofty expectations. Accessible as it may seem – requiring nothing more than an internet connection, a basic computer or smartphone, and some initial capital – day trading is far from a guaranteed path to quick riches. New traders soon confront a complex, fast-paced environment where profits are not as easily gleaned as they might have imagined.

Understanding the common mistakes in day trading is crucial for anyone venturing into this field. These missteps, frequently ignored in the haste to take advantage of market fluctuations, play a pivotal role in determining a trader’s success or setback. In this article, we explore these common oversights, providing essential guidance to steer clear of them. This discussion aims to pave the way for a more thoughtful and knowledgeable journey through the unpredictable terrain of day trading.

Starting Without Simulation Trading Practice

Venturing into the world of day trading without prior simulation practice is akin to setting sail in uncharted waters without a map. The allure of immediate market participation often overshadows the critical step of gaining experience through simulation. This oversight can expose new traders to unnecessary risks, as they invest real money without a foundational understanding of market dynamics.

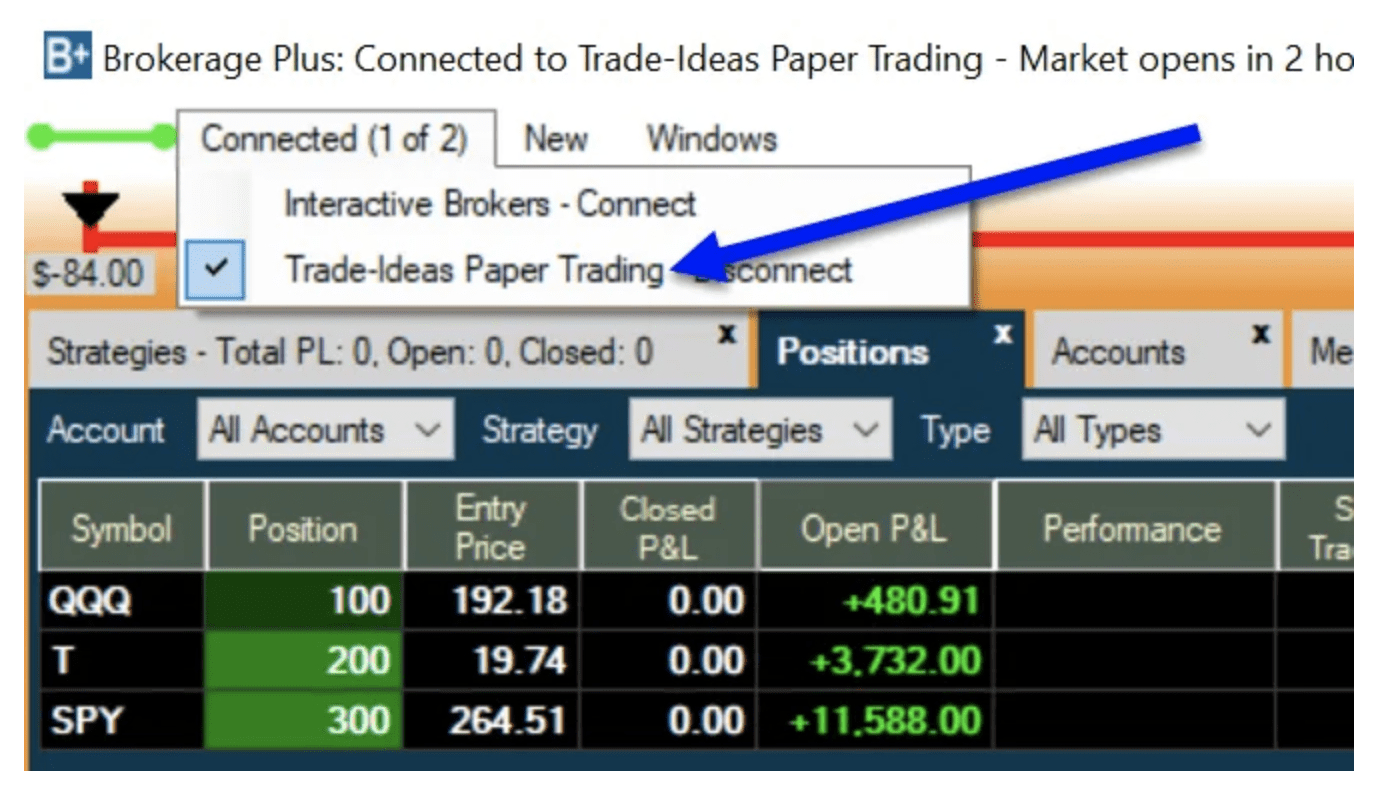

Simulated trading practice, or paper trading is an invaluable tool for beginners. It offers a risk-free environment where one can experiment with various trading strategies, learn to interpret market signals, and understand the intricacies of different financial instruments. By engaging in paper trading, aspiring traders gain the opportunity to test their hypotheses, refine their approach, and build confidence, all without the risk of actual financial loss.

The benefits of this preparatory step cannot be overstated. Paper trading provides a practical learning experience, where theoretical knowledge meets the realities of market fluctuations. It allows traders to witness firsthand how market conditions, news events, and economic reports can impact asset prices. This experience is vital in developing the agility and acumen needed to make informed decisions when real money is at stake.

Moreover, simulation trading serves as a platform to test one’s emotional and psychological readiness. The pressures of day trading – rapid decision-making, dealing with gains and losses, and managing stress – can be overwhelming. Through paper trading, individuals can gauge their emotional responses and resilience, key factors that significantly impact trading performance.

Another aspect often overlooked is the opportunity to test and tweak trading platforms and tools in a simulated environment. This familiarity with trading interfaces, analytical tools, and order types becomes crucial in executing swift trades effectively in the live market.

In summary, bypassing paper trading is a gamble that neglects the safe practice ground it offers. It’s a fundamental step in preparing oneself not just technically, but mentally and emotionally for the rigors of day trading. As we delve into the world of day trading, remember that the time invested in simulation trading is an investment in your future success as a trader.

Lacking a Comprehensive Trading Strategy

Entering the day trading market without a comprehensive trading strategy is much like navigating an unknown city without a map or GPS; it often leads to aimless wandering and unnecessary pitfalls. A well-thought-out trading plan is not just a tool; it’s a trader’s roadmap, offering direction and helping to navigate the often unpredictable financial markets.

The necessity of a trading plan cannot be overstated. It serves as a guide for making informed decisions, setting clear entry and exit points, and identifying the right moments to capitalize on market movements. This strategic blueprint helps traders maintain focus and objectivity, especially in a market that can be swayed by emotional reactions and impulsive decisions.

A robust trading plan also plays a critical role in emotion management. The high-stress environment of day trading can lead to decisions driven by fear or greed, rather than rational analysis. A trading plan acts as a buffer against such emotional responses, ensuring that all trades are based on predefined criteria and strategic reasoning.

In essence, lacking a comprehensive trading strategy in day trading is akin to setting off on a journey without a clear destination or route. It’s an essential element that not only dictates the course of trading actions but also provides a sense of security and confidence, allowing traders to navigate the markets with a clear vision and purpose.

Trading without a Journal

Overlooking the significance of maintaining a trading journal is a common misstep that hinders many traders’ progress. A trading journal is not merely a record of transactions; it is a critical tool for objective self-evaluation and strategy refinement. It offers a mirror to reflect on past actions, decisions, and their outcomes, providing invaluable insights for future trades.

In the age of digital technology, keeping a trading journal has become more efficient and effective. Traders can utilize digital tools like screenshots with annotations for detailed record-keeping. This method allows for a more precise and comprehensive overview of trades, capturing not just the numbers, but also the visual context of each transaction.

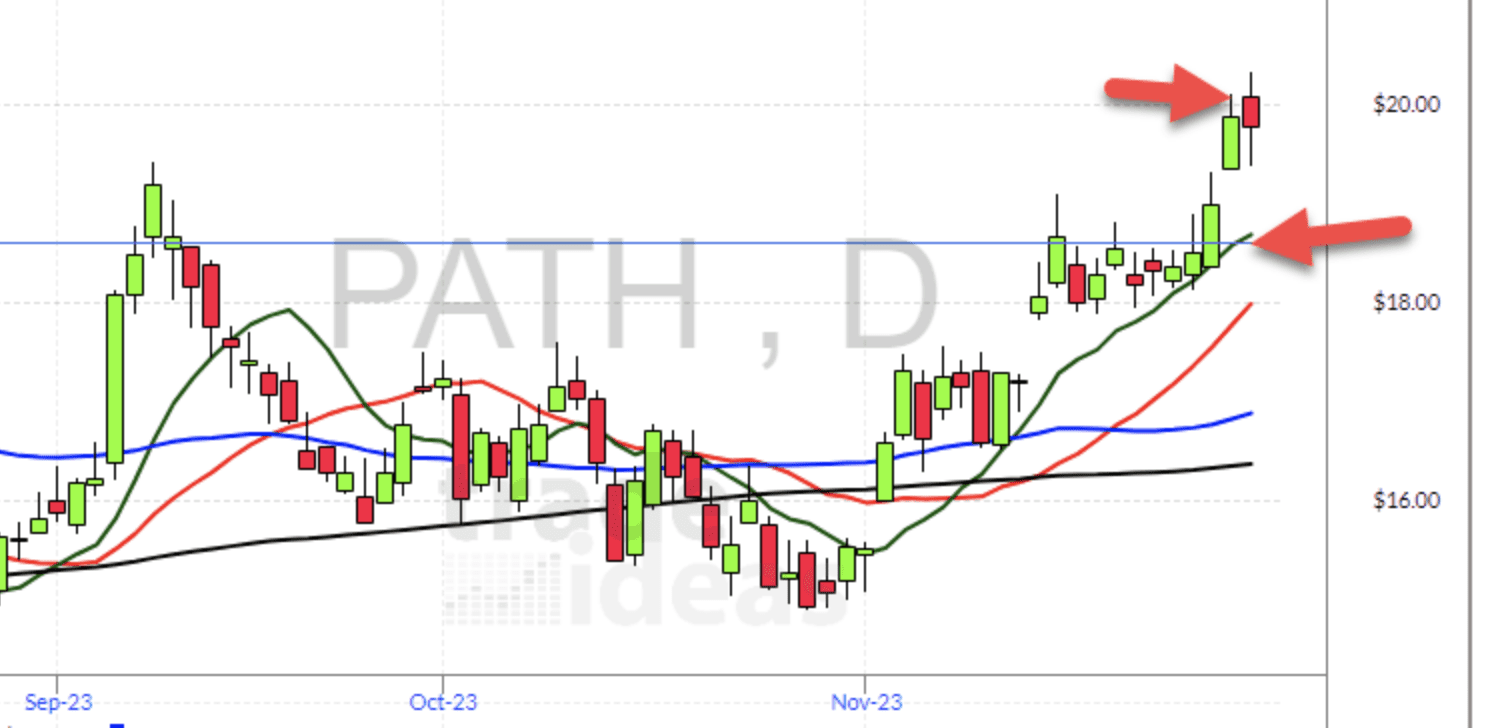

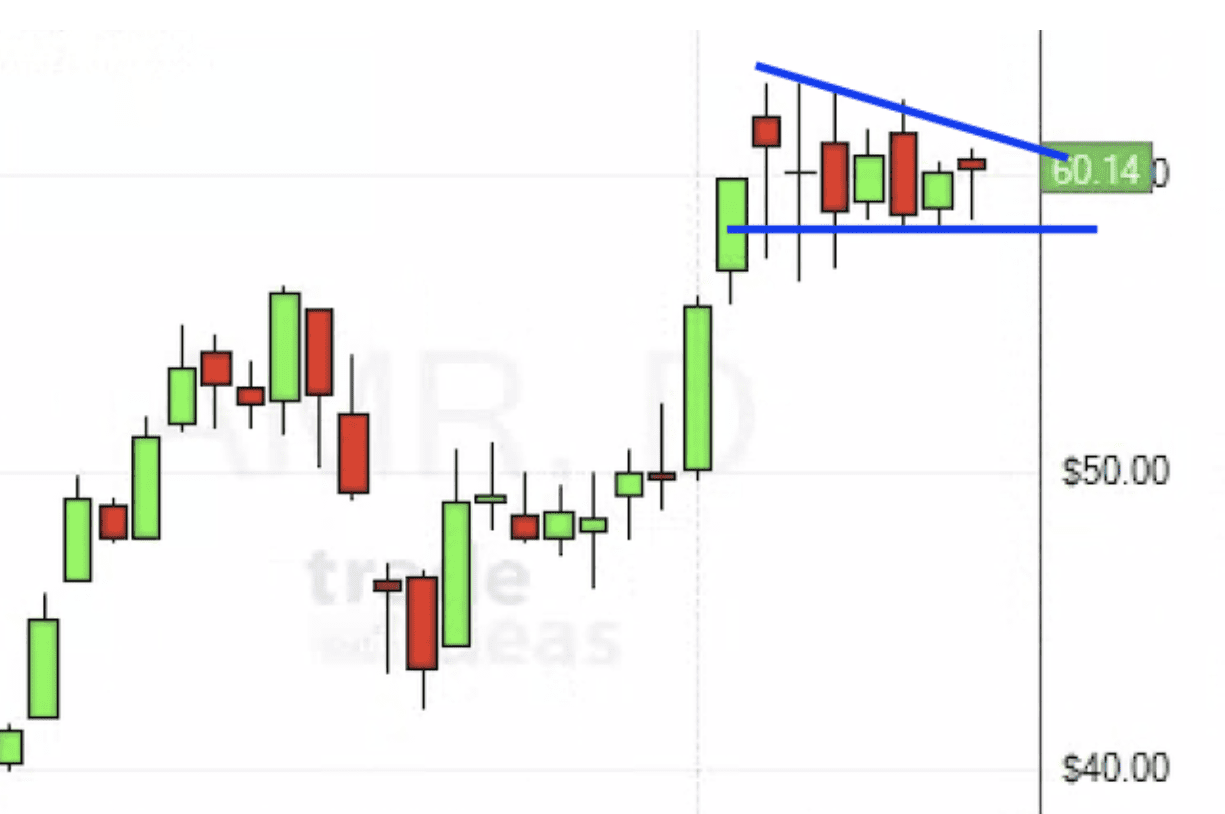

A crucial aspect of maintaining a trading journal is documenting instances of applying the basic principle of “buy low, sell high.” This involves recording the specific market conditions, indicators, and the thought process behind buying a stock at what is perceived to be its low point and selling at a higher point. Such documentation helps traders understand the patterns and triggers that lead to successful trades, and equally importantly, the missteps in unsuccessful ones.

By routinely updating a trading journal and critically analyzing its contents, traders can continually refine their strategies. This practice transforms experiences, both positive and negative, into powerful lessons, steering traders towards more informed and strategic decision-making in the volatile world of day trading.

Conforming to Popular Market Trends

One of the subtler yet significant dangers in day trading is succumbing to the herd mentality, a phenomenon where traders blindly follow popular market trends. This approach, though seemingly safe due to its popularity, can lead to critical missteps. Conforming to what everyone else is doing without independent analysis or understanding can be akin to navigating a ship in dense fog – it’s easy to lose direction and run aground.

The temptation to mimic the masses is clear; it feels safer to move with the crowd, and there’s a deceptive reassurance in mimicking the actions of others. However, this approach neglects to consider that market trends are shaped by numerous intricate elements and are prone to swift changes. Strategies that suit the majority might not resonate with a singular trader’s objectives, willingness to take risks, and specific approach to trading.

The antidote to this pitfall is developing and relying on one’s own analysis and trading plan. Independent analysis involves a deep dive into market data, understanding the underlying factors driving market movements, and making decisions based on personal research and insights. A personal trade plan, on the other hand, is a tailor-made strategy that aligns with one’s unique trading objectives and risk appetite.

By resisting the temptation to follow the crowd and instead focusing on independent analysis and a customized trading plan, traders can navigate the markets more effectively and make decisions that are in their best interest, rather than being swayed by the prevailing market sentiment.

Overutilizing Leverage in Trading

While a powerful tool, leverage in trading can be a double-edged sword. It involves the use of borrowed funds to increase potential returns on investment, offering the tantalizing prospect of magnified profits. However, this increased potential for gain comes with a proportional increase in risk, particularly the risk of amplified losses, which is often overlooked in the pursuit of greater returns.

The primary risk associated with overutilizing leverage is that it magnifies both gains and losses. A small market movement can lead to disproportionately large losses compared to the trader’s initial investment, potentially resulting in severe financial strain. It’s a common scenario where traders, lured by the possibility of substantial profits, find themselves facing devastating losses instead.

Caution and moderation are key when using leverage. It’s essential for traders to understand their own risk tolerance and to have a clear strategy for leveraging that aligns with their overall trading plan. This strategy should include setting limits on the amount of leverage used and having a solid plan for managing losses, should they occur.

Using leverage responsibly involves acknowledging its risks and employing it judiciously. It’s not a tool for reckless speculation, but rather a strategic instrument that, when used wisely, can enhance a well-thought-out trading strategy. The key is to use leverage not as a primary driver of trades, but as a complement to a robust, disciplined trading approach.

Reinforcing Losing Positions

A common yet perilous practice in day trading is reinforcing losing positions – holding onto or even adding to a trade that is moving against you. This approach often stems from a reluctance to accept a loss or an unwavering belief that the market will turn in one’s favor. However, this strategy can lead to significant financial damage, as it compounds losses instead of mitigating them.

The primary issue with reinforcing losing positions is the refusal to acknowledge market signals. Markets are dynamic and continuously evolving entities, often driven by factors beyond a single trader’s control or prediction. When a position starts to lose, it’s often a clear indicator that the initial analysis was off-mark, or that market conditions have shifted unfavorably. Adding to a losing position in the hope of a turnaround is akin to digging a deeper hole, hoping it somehow leads to the surface.

It’s crucial for traders to develop the discipline to cut losses at predetermined points. This means setting and respecting stop-loss orders, which are designed to automatically exit a position at a certain loss level. Accepting small losses as part of the trading process can prevent much larger, potentially devastating losses down the line.

In essence, successful trading is as much about managing losses as it is about securing gains. Recognizing when a trade is not working and having the discipline to exit the position can save a trader from significant financial distress and keep their trading strategy on track.

Risking More Than They Can Afford

The fundamental rules that traders break, both new and seasoned, is that they often fall into the gamble of staking more money than they can responsibly afford in their day trading ventures. Drawn by the promise of significant returns, it’s tempting for traders to allocate substantial portions of their funds to a single trade, hoping for a windfall. Yet, this strategy bears substantial financial risks, particularly when market movements are contrary to expectations.

The real risk in placing too much on one trade is not solely in the monetary loss, but also in the subsequent emotional toll it takes. Suffering a substantial loss can trigger a chain reaction of increasingly risky trades as traders try to recover their losses, often leading to a spiral of poor judgment fueled by emotional distress rather than rational decision-making.

A wise approach is adhering to the guideline of risking a maximum of only 1-2% of one’s total trading account on any single trade. This cautious strategy ensures that a trader remains financially viable even after a few setbacks, allowing for a longer-term, sustainable approach to accumulating profits.

Sticking to this principle demands self-control and a keen awareness of one’s financial boundaries. It underscores the critical role of risk management in day trading, focusing not just on the pursuit of profits, but also on safeguarding against devastating financial losses.

Utilizing Technical Indicators Without Full Understanding

A common pitfall for many day traders is the premature use of technical indicators without a thorough understanding of them. Technical indicators are vital tools in a trader’s arsenal, providing insights into market trends, potential turning points, and optimal entry and exit points. However, using these tools effectively requires more than a superficial acquaintance; it demands a deep and comprehensive understanding.

Diving into the world of technical analysis without adequate knowledge can lead to misinterpretation of market signals and poor trading decisions. It’s akin to trying to read a map in a foreign language – without understanding the symbols and language, the map is of little use. For instance, a trader might misread an indicator signal, mistaking a temporary market fluctuation for a long-term trend, leading to misguided trades.

To avoid this, it’s advisable for traders to start with the basics of technical analysis. Fundamental concepts such as support and resistance levels, as well as moving averages, provide a solid foundation. These simple yet powerful tools can help traders identify key price points and trends in the market.

By starting with these basic tools and gradually building their knowledge and experience, traders can learn to interpret technical indicators accurately and use them to their advantage. A step-by-step approach to mastering technical analysis not only enhances a trader’s skill set but also reduces the likelihood of costly errors due to misinterpretation.

Conclusion

Navigating the realm of day trading is an exhilarating yet intricate endeavor, presenting a unique blend of opportunities and challenges. The errors we’ve discussed are not just pitfalls to avoid but also stepping stones towards a more effective trading strategy. Recognizing and circumventing these common blunders can markedly enhance a trader’s prospects for success in this dynamic market environment.

At its core, excelling in day trading demands a harmonious blend of deep market insight, stringent risk control, and an unwavering commitment to continual learning and adaptation. It’s about making choices that are well-informed, managing one’s emotional responses, and steadfastly following a carefully devised trading plan. True success in this field is measured not only in the gains achieved but equally in the potential losses astutely sidestepped.