Posts Tagged ‘Uncategorized’

What the Odds Say so far

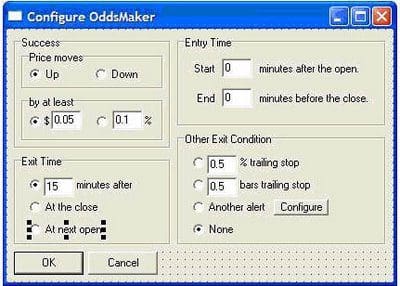

As we have mentioned on previous blog posts, we are running “The Odds Maker” in alpha-testing internally to determine how it’s working, what it is saying, and its overall stability under simulated high-traffic conditions. We receive a lot of emails and comments asking us, “What is working in today’s very crazy market?”. The answer? Extensions…

Read MoreStrategy Session: The Fed Watcher

First there’s an important caveat to declare. The moments leading up to and after a Fed announcement can exhibit a lot of drama and chaos. Only those with a clear grasp of the risks and plan to deal with them (i.e., smaller positions, clear exit strategies, etc.) should participate. In fact many seasoned traders say…

Read MoreStrategy Session: Gaps Above Previous Days High

NOTE: This post updated 1-1-2007 with the following changes: The Gap Above Previous Day’s Highs – market hours Strategy is modified. Only the running up intermediate alert remains and the Min Current Volume filter’s new setting is 9x. Here is the new strategy: Gap Above Previous Day’s Highs – market hours (the original strategy appears…

Read MoreQ & A with the Odds Maker: Beta Release Scheduled for late August

More on the “Odds Maker”: In the alpha-version, currently undergoing internal tests, the “Odds Maker” is really living up to what we think will be the next big breakthough in the Active Trading space. We know it sounds very boastful but the results we see really make us excited. So let’s share more of our…

Read MorePreview of Trade-Ideas Pro v2.0

A colleague’s wise words recently described our efforts this summer: “Most highly successful people across a variety of fields—from arts to athletics and science—succeed by maximizing their strengths, not by focusing efforts on their weaknesses.” The ability to translate trader preferences into features is a major strength of Trade-Ideas. Our small firm is built to…

Read MoreIs Your Trading in Tune with this Market? It Will Be

There’s a great installment of StockTickr’s ‘One Question Interview’ series. Dave poses the following question to each interviewee: What trading lesson(s) have you learned from the downtrend that started in May? Dr. Brett Steenbarger, of TraderFeed, provides a cogent, informed answer. What caught my attention was his last statement: “The lesson since May is that…

Read MoreTrading Tools to Get a Boost

That’s the headline in the Personal Journal section of the Wall Street Journal today. The article is only a handful of paragraphs in length and it quickly surveys the landscape of sophisticated trading tools now offered investors. Mentioned in the article is E*Trade and their new “conditional order” capabilites that automatically execute trades if certain…

Read MoreStock Sellers May Be Overreacting

The Wall Street Journal suggests today there may be some overracting to the latest increase in Middle East tension. The article, “Keeping Cool Amid Global Strife” in the Money & Investing section, quotes an old British maxim from a banker during the Napoleanic Wars: Buy to the sound of cannons, sell to the sound of…

Read MoreBe audaciously selective

There’s an interesting discussion on the use of real-time scanners that got my attention. The post appears on Uglychart‘s blog (a good, well written blog with an entertaining edge to it). The post and several comments stress the usefulness of real-time scanners for generating ideas but offer the caveat that it’s the number of ideas…

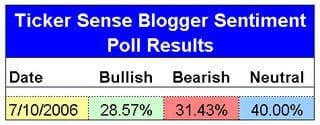

Read MoreTickerSense BS Poll Results

TickerSense debuted a interesting sentiment indicator called the Blogger Sentiment Poll (could they be serious about keeping the name as the ‘BS’ Poll?) which seeks to take the pulse of the blogosphere’s growing independent market analysis. They do this by polling a select group of Who’s Who among analysts on the overal health of the…

Read More