Posts Tagged ‘trading’

4 Strategies for Trading Low-Volume Summer Stocks

By: Shane Neagle Trading in the summer presents unique problems for the active trader. With fewer institutional participants with retail volume lower, liquidity typically dried up, leading to wider spreads, thinner order books, and more volatile prices. For traders who are looking for momentum, technical setups, and playing technical analysis and price confirmation, the summer…

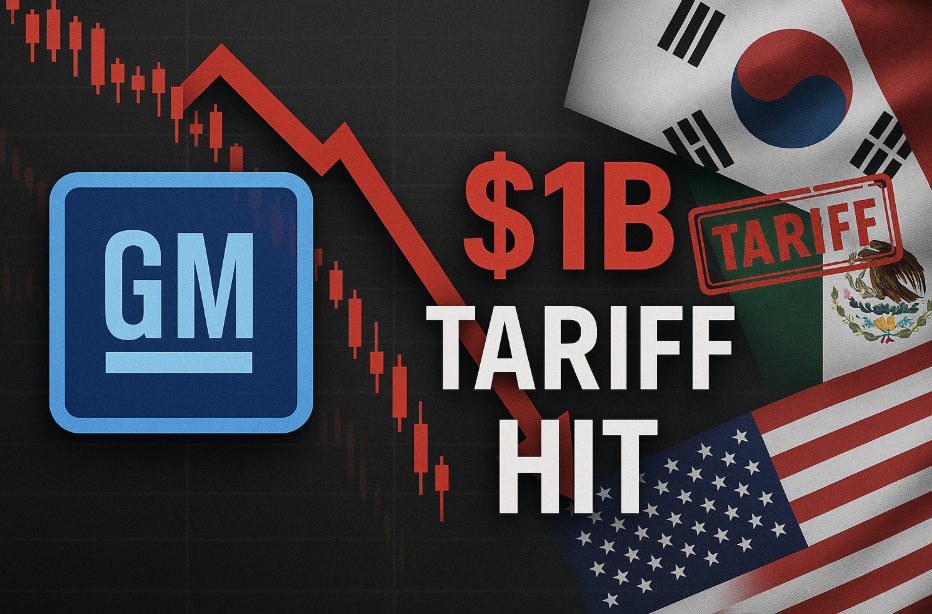

Read MoreGM’s $1B Tariff Hit: How Smart Traders Can Navigate Auto Sector Volatility

By: Katie Gomez The automotive sector just got a reality check that sent shockwaves through Wall Street. General Motors’ shares crashed 8% Tuesday after the company revealed that Trump’s tariffs slammed their second-quarter earnings with a devastating $1.1 billion hit – and warned that the pain is only getting worse, with up to $5 billion…

Read MoreBack-to-School Stock Rally: Retail and Education Plays for Late Summer

By: Katie Gomez While it may seem like summer has only just begun, the retail market is already preparing its stores for the back-to-school shopping season. For stock traders, this is an essential time of year to prepare portfolios, as back-to-school is the second-largest retail season, trailing only the November-January holidays, which generated over $126…

Read More10 Reasons Why Automated Trading Systems Will Dominate the Next Bull Market

Ever missed a good trade because you were brewing coffee or doom-scrolling the headlines? Algorithms do not need caffeine or pep talks; they just hunt opportunities every millisecond. What used to be the secret sauce of Wall Street quants is now open to the public, who can connect to the API by clicking “connect” with…

Read MoreThe 3 AM Test: Why Your Best Trading Decisions Happen When Markets Are Closed

By: Katie Gomez Imagine it’s 3:17 AM, the world is asleep, and the stock market won’t open for another six hours—yet you’re making what will become your most profitable trading decision of the month. While other traders will wake up in a few hours to chase green candles and panic-sell red ones, you’re calmly mapping…

Read MoreTrade Wave: The Essential Indicator System for Maximizing Profit Windows

By: Katie Gome Every trader’s journey begins with the same elusive quest: finding the perfect indicator that signals when to enter a trade and, more importantly, when to exit. While the market teems with systems promising to identify golden buying opportunities, most leave traders stranded in the murky waters of exit strategy, forcing them to…

Read MoreTesla’s Robo-Taxi Austin Success

How Autonomous Vehicle Breakthroughs Could Reshape TSLA Stock and the Market By: Katie Gomez The Austin Robo-Taxi Milestone Tesla has quickly become a transformational company in the eyes of the stock market over the last decade. However, the recent successful deployment of autonomous robo-taxis in Austin represents a watershed moment for both the company and…

Read MoreDiscover How Day Trading Supercharges Your Long-Term Investing with Trade Ideas

By Dan Mirkin Discover the secret that elite traders use to dominate the markets: short-term day trading isn’t just a fast-paced game — it’s the key to unlocking confident, high-return long-term investments. In this blog, we’ll reveal how smart traders leverage day trading and long-term investing together, using Trade Ideas software to ride momentum waves…

Read MoreWhen Windfall Becomes Downfall: Protecting Your Competitive Edge in Trading and Golf

By: Katie Gomez People say money is the root of all evil, but is it rather our relationship to it that is our downfall? Money can incentivize us to become the best, most talented, ambitious, and hard-working versions of ourselves, but it can also bring out the worst in us, stripping away our drive. Stock…

Read More4 Ways AI Is Changing the Game for Day Traders

By: Shane Neagle Over the past few years, artificial intelligence has quickly accelerated from the edge of institutional finance into the hands of individual traders. What used to be an edge reserved for hedge funds and high-frequency trading firms is now starting to open up to retail day traders, via AI power, application, and analysis.…

Read More