Posts Tagged ‘trading’

October Effect: Trading Volatility Season Smart

By: Katie Gomez October carries a notorious reputation in financial markets as the month when portfolios can disappear overnight, etched into trader psychology by the crashes of 1929, 1987, and 2008. While retail investors often view October with dread, experienced traders recognize this volatility as the market’s annual wealth transfer mechanism. October is a time…

Read MoreYou Can’t Turn Your Back on the (Money) Machine: Updates from Internal Testing

By: Katie Gomez Automated trading programs have completely transformed the market and how we trade, but we can’t turn our back on the machine entirely. Living in a generation that offers immediate gratification on a silver platter (Amazon Prime, ChatGPT, Uber Eats) has made it increasingly difficult to hold onto our grit. When all our…

Read MoreTrade Ideas’ Money Machine: A New Era in Automated Trading

By: Shane Neagle Automated trading has advanced to far beyond basic scripts and static algos. Today’s traders are looking for tools that do much more than send alerts, they want automation with intelligence, responsiveness, and ensuring it is aligned with their strategy. That is where Trade Ideas continues to take the leading role: Trade Ideas…

Read MoreSimulated Trading: A Beginner’s Guide to Risk-Free Practice

Most traders struggle because they don’t have a structured way to practice. Reading about strategies isn’t enough. On paper, a plan looks simple. In practice, the pressure of real money changes decisions. Small mistakes add up, and what should be a repeatable process quickly turns into guesswork. Simulated trading is how you bridge that gap.…

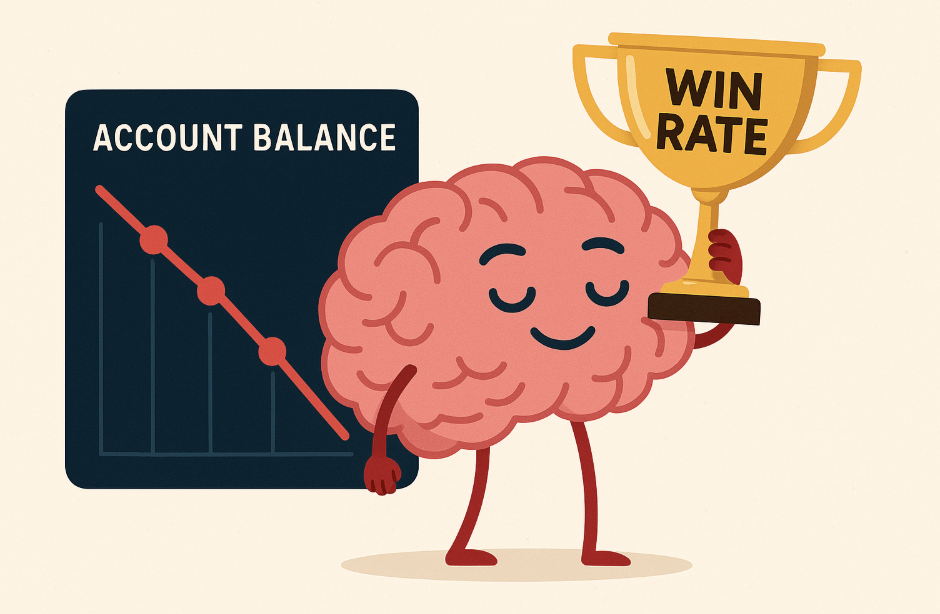

Read MoreWhy a 90% Win Rate Isn’t the Flex You Think It Is: The Real Metrics That Matter in Trading

By: Katie Gomez That trader bragging about their 90% win rate on social media? They might actually be losing money. While they’re busy posting screenshots of their “winning streak,” their account balance could be bleeding red. Traders have been conditioned to worship at the altar of win rates, especially nowadays, where our sole focus is…

Read MoreTrump’s External Revenue Revolution: How Tariffs Are Building America’s Parallel Economy

By: Katie Gomez For the first time since 1913, America is shifting from taxing its own citizens to having foreign competitors fund its government—and it’s creating opportunities that most traders have yet to recognize. What we’re witnessing isn’t just another policy adjustment; it’s a fundamental restructuring of how the United States generates revenue, moving away…

Read MoreCash is King: Why Going Liquid Beats Forced Investing in Volatile Markets

By: Katie Gomez In the relentless world of trading, there’s unspoken pressure that whispers constantly: you must always be invested, always have skin in the game – as if stepping aside somehow makes you less of a trader. This toxic mindset has destroyed more trading accounts than any market crash, especially when volatility spikes and…

Read MoreMarket Overbought Alert: Historical Analysis Shows Caution Warranted in Current Environment

By: Katie Gomez Today’s market sits in territory that would have seemed like pure fantasy just half a decade ago. We’re witnessing major indices trade at valuations that have historically signaled significant corrections. Yet, there’s an almost eerie sense of complacency among investors—as if the mathematical reality of mean reversion has somehow been suspended. Historical…

Read MoreTrading Economic Data in an Era of Political Interference: Can We Trust the Numbers Again?

By: Katie Gomez Traders have always harbored distrust when it comes to information accuracy. Between government politics and wealth inequalities, there are constant revisions to economic data, leaving traders in the dark about the truth behind the numbers. This reality hits hardest every first Friday of the month, when traders around the world hold their…

Read More10+ Ways to Use Chart Patterns to Predict Stock Moves

Chart patterns are one of the most reliable ways to read market behavior. They show you, in real time, how buyers and sellers are positioned and where the balance of power may shift next. They are not only a technical indication; they often reflect the actions of large institutions, their market manipulation, entry and exit…

Read More