Posts Tagged ‘trade ideas’

How to Swing Trade with Effective Risk Management and Position Sizing

Swing trading is a powerful strategy for capturing short to medium-term price movements in the financial markets. By holding positions for a few days to weeks, swing traders aim to profit from price swings while avoiding the problem of day trading. However, success in swing trading hinges on two critical pillars: effective risk management and…

Read MoreDiscover How Day Trading Supercharges Your Long-Term Investing with Trade Ideas

By Dan Mirkin Discover the secret that elite traders use to dominate the markets: short-term day trading isn’t just a fast-paced game — it’s the key to unlocking confident, high-return long-term investments. In this blog, we’ll reveal how smart traders leverage day trading and long-term investing together, using Trade Ideas software to ride momentum waves…

Read MoreWhen Windfall Becomes Downfall: Protecting Your Competitive Edge in Trading and Golf

By: Katie Gomez People say money is the root of all evil, but is it rather our relationship to it that is our downfall? Money can incentivize us to become the best, most talented, ambitious, and hard-working versions of ourselves, but it can also bring out the worst in us, stripping away our drive. Stock…

Read More4 Ways AI Is Changing the Game for Day Traders

By: Shane Neagle Over the past few years, artificial intelligence has quickly accelerated from the edge of institutional finance into the hands of individual traders. What used to be an edge reserved for hedge funds and high-frequency trading firms is now starting to open up to retail day traders, via AI power, application, and analysis.…

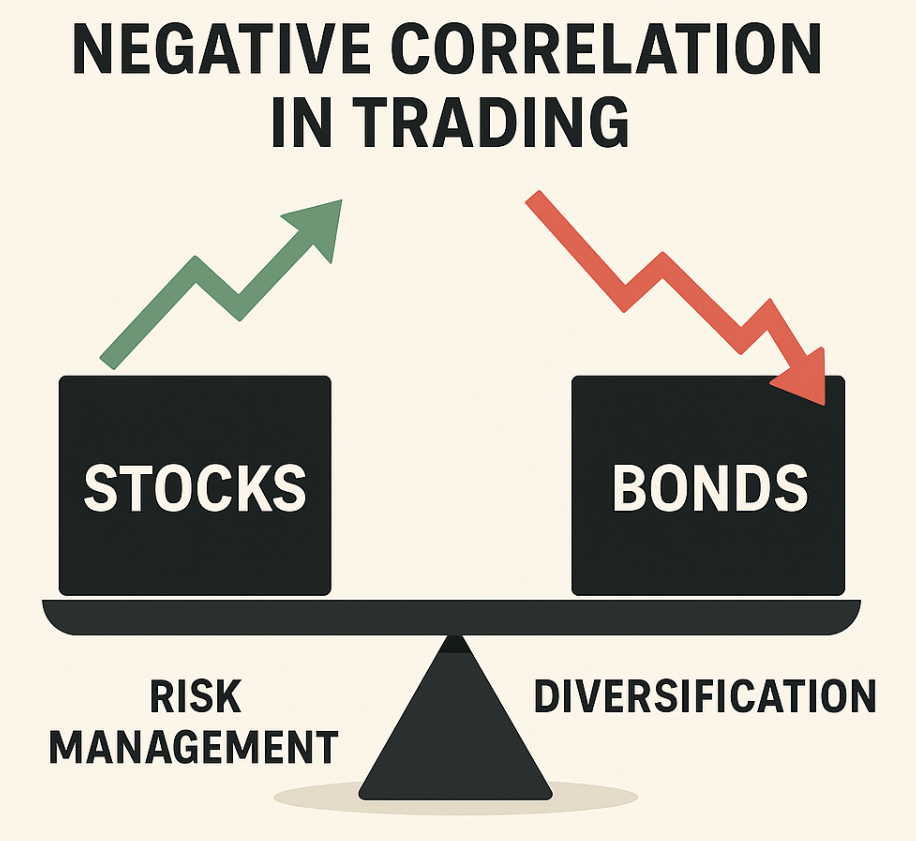

Read MoreNegative Correlation in Trading: How Stocks and Bonds Balance Your Portfolio

Fed up with market swings taking away your investment returns? Understanding negative correlation in trading can help you balance your portfolio and manage risk effectively. By combining assets like stocks and bonds, which often move in opposite directions, you’ll build a more stable, resilient investment strategy. In this article, we’ll break down what negative correlation…

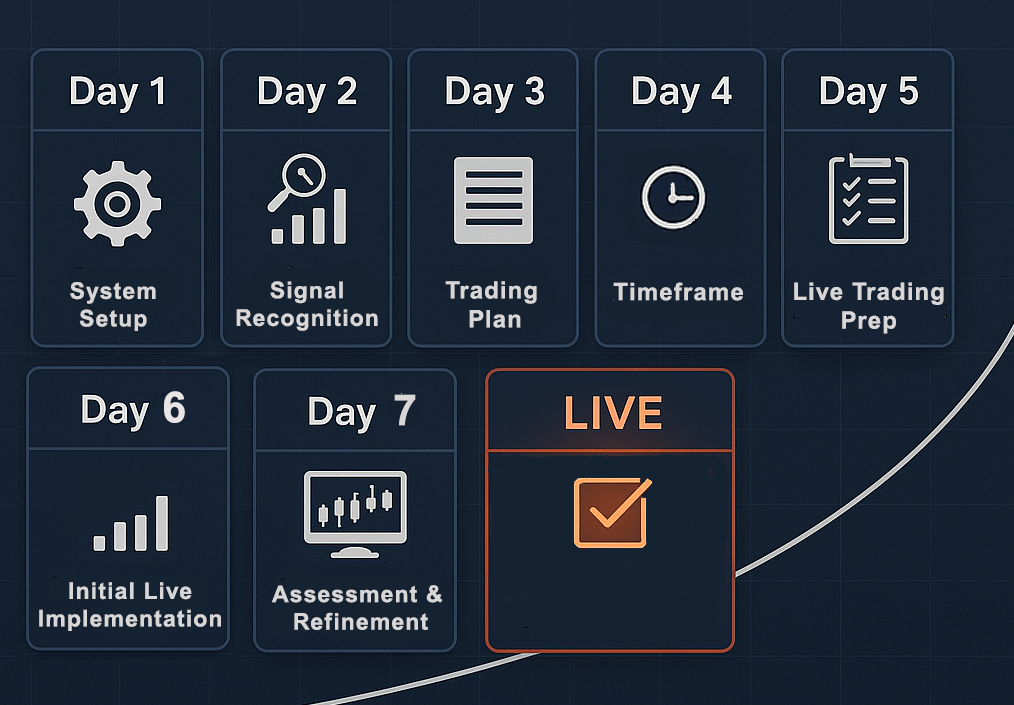

Read MoreTradeWave 7-Day Implementation Plan for Summer Trading

By: Katie Gomez TradeWave is one of Trade Ideas’ most valuable innovations to date and only has continued to evolve into the ultimate “Money Machine.” This summer could be your most lucrative one yet for traders who take just one week to learn how to use TradeWave. TradeWave represents a breakthrough trading methodology that combines…

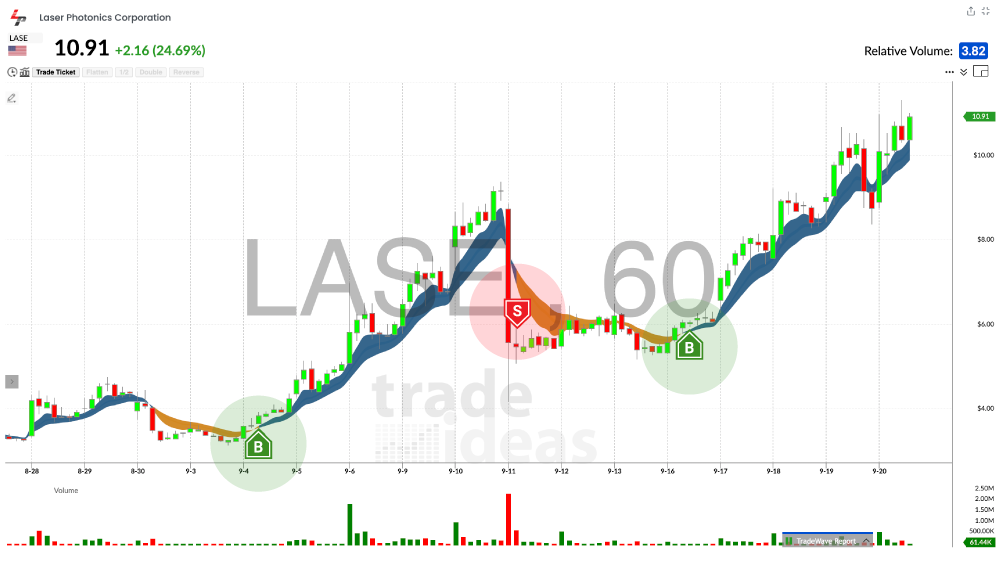

Read MoreTradeWave: The Essential Indicator System for Maximizing Profit Windows

By: Katie Gomez Every trader’s journey begins with the same elusive quest: finding the perfect indicator that signals when to enter a trade and, more importantly, when to exit. While the market teems with systems promising to identify golden buying opportunities, most leave traders stranded in the murky waters of exit strategy, forcing them to…

Read MoreThe Trump Trade Playbook: How Trump’s Announcements Create 72-Hour Profit Windows

By: Katie Gomez Despite President Trump’s age, people underestimate how savvy he is, especially when it comes to garnering the public’s attention. Though his means can be controversial, everyone (no matter the party) was glued to their phones last week when Trump announced via social media that he would announce something so “earth-shattering” that it…

Read MoreTrade Ideas Named Best Stock Screener for Day Trading and Live Trading Ideas by Investopedia

We’re thrilled to share some exciting news: Trade Ideas has once again earned top honors from Investopedia, being named the Best Stock Screener for Day Trading and Live Trading Ideas in their Best Stock Screeners for May 2025 review! This recognition reflects what thousands of traders already know: Trade Ideas is more than a screener…

Read MoreNegative Correlation in Trading: How Stocks and Bonds Balance Your Portfolio

Fed up with market swings taking away your investment returns? Understanding negative correlation in trading can help you balance your portfolio and manage risk effectively. By combining assets like stocks and bonds, which often move in opposite directions, you’ll build a more stable, resilient investment strategy. In this article, we’ll break down what negative correlation…

Read More