Posts Tagged ‘trade ideas’

Trade Ideas Podcast Episode 4 – January 13 2017

Waiting for the DOW to hit 20,000? Tune in for a conversation between Dan Mirkin and Jamie Hodge from Trade Ideas about this week in investing and trading. Find out why this is the best time ever to be an individual investor. Listen or download using the embed on this page, Subscribe to our Podcast…

Read MoreWatch Jane Gallina (Airplane Jane) speak at Empowering Women Investors

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] We had a great time hosting the inspirational Empowering Women Investors live seminar in Carlsbad, CA on December 4th. Although women are over 50% of the population, they’re very much underrepresented in guiding financial decisions. We invited Jane Gallina (a.k.a. AirPlaneJane), Stephanie Clark Burke, and…

Read MoreWatch Stephanie Clark Burke’s talk at Empowering Women Investors 2016

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] We really enjoyed Stephanie Clark Burke’s talk with Dan Mirkin at our Empowering Women Investors seminar last Sunday, December 4th, 2016 at the Cape rey Hilton in sunny Carlsbad, CA. Although women are over half of the population in the USA, they’re very much underrepresented…

Read MoreWatch the recording of “Empowering Women Investors 2016”

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] Empowering Women Investors 2016 We had an outstanding time hosting Empowering Women Investors on Sunday, December 4th, 2016 at the Cape Rey Hilton in beautiful Carlsbad, CA. The idea for the event came about because although Women account for over 50% of the population, they…

Read More“Wait for the 8” Leads 6 Algos, 1 Short: Holly Morning Huddle Report

Good morning. Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Thursday, November 17, 2016, the return from my trading performance since January 1 stands at +98.0 accumulated profit points vs the benchmark SPY’s performance of +11.7 points over the same…

Read MoreReview (daytradingz.com): Trade Ideas has the Fastest Artificial Intelligence Engine for Retail Investors

This entire review was originally published on daytradingz.com in September 2016. Below, we’re reprinting a portion of the review summary. Please read the entire review here. Trade Ideas Review:Products & services Trade Ideas Pro is a trading platform and real-time stock market scanner. It is an interactive tool that allows its users to scan market data to make trade decisions during…

Read MoreOops I did it Again

Another day another stellar winning summary! I have to sometimes scratch my eyes to make sure I am seeing what I am seeing. Holly is performing in a way that literally could change the whole concept of investing. Many factors are congealing to help us become the premier provider of information in Finance. Our good…

Read MoreTest Drive Day One Overview

Test Drive Day One Overview (8 out of 9) The 1st day of our Summer Test Drive is a success, thanks to all of you who signed up! Over600 people in our live Trading Room participated and watched as our Artificial Intelligence Engine “Holly Grail” put on an virtual exhibition of capturing high probability investments. Today we started with the basics. What is…

Read MoreWebinar replay: Get the most out of your workspace with Trade Ideas on Lightspeed! (July 16, 2014)

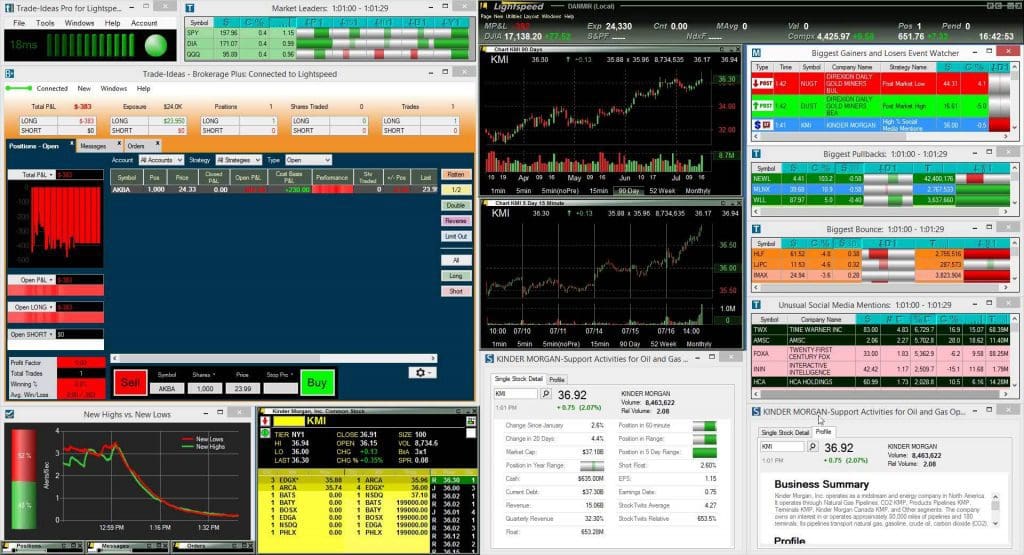

Workspaces are the incubators where information and action are translated into productivity and good trading decisions. The environment we trade in has a considerable impact on both our level of wellbeing, our productivity, and even our bottom line. The design and layout of our office or, workspace, can have an effect on our work productivity,…

Read MoreUsing Trade Ideas with Lightspeed Trading

Brad Williams gave a great webinar yesterday on Trade Ideas with Lightspeed Trading!If you missed it, we’ve made it available on our YouTube channel:

Read More