Posts Tagged ‘trade ideas’

5 Signs You’re Overtrading & How to Stop Using Trade Ideas

By: Katie Gomez Overtrading is the silent account killer that ruins more trading careers than bad analysis or lack of capital. In today’s world of overstimulation and overconsumption, most traders are unaware it exists, believing constant activity means productivity and equating busyness with professionalism. This addiction to market action arises from FOMO, social media pressures,…

Read MoreHow to Profit from Activist Investor Campaigns: The Elliott/LSEG Playbook

By: Katie Gomez When news broke that Elliott Investment Management had built a stake in London Stock Exchange Group (LSEG), shares jumped 8% in early trading. This is a textbook example of how activist investor campaigns create immediate, predictable, and highly tradable market reactions. Elliott’s involvement isn’t random: the legendary activist fund has forced strategic…

Read MoreWhat are XRP and XLM tokens, and why do you want to own them?

By: Katie Gomez If you’ve spent any time around crypto, you’ve probably heard XRP and XLM mentioned in the same breath. That’s not by accident. Both were designed to make moving money faster and cheaper than traditional systems, but they go about it in different ways, for different audiences. This guide breaks down what XRP…

Read MoreCrossed Above Resistance vs False Breakouts: How to Find the Difference

One of the most common moments in trading happens when the price finally pushes above resistance. Alerts fire, momentum looks strong, and traders rush in, only to watch the move stall or reverse. This is where the difference between a crossed above resistance move and a false breakout matters. While both start the same way,…

Read MoreGameStop Earnings Date: What Traders Watch Before, During, and After the Report

Earnings season is one of the most emotionally charged periods in the market, and few stocks attract as much attention as GameStop. With GME’s next earnings estimated between March 24 and March 31, 2026, traders expect sharp price swings, high volatility, and intense market reactions. For traders, the real opportunity and risk are not just…

Read MoreThe Trump Accounts: How $6.25 Billion in Forced Market Inflows Could Reshape American Investing

By: Katie Gomez In what could be the most significant philanthropic market event in history, Michael and Susan Dell have pledged $6.25 billion to seed “Trump Accounts”—tax-deferred investment vehicles for up to 25 million American children from lower-income families. Launching July 4, 2026, these accounts combine government seed money with corporate matches. For traders, the…

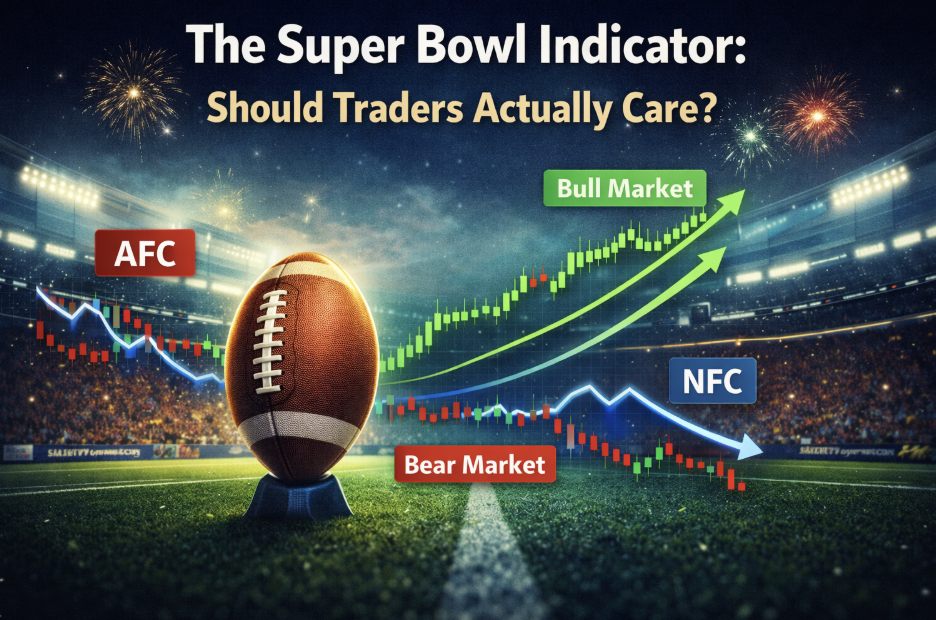

Read MoreThe Super Bowl Indicator: Should Traders Actually Care?

By: Katie Gomez With another Super Bowl around the corner, traders should be mindful of what the results might mean for the market—or at least, what Wall Street folklore claims they should. Every year, as millions gather for wings, commercials, and the big game, a peculiar group watches with a different agenda: they’re predicting the…

Read MoreSmall Caps Lead the Charge: Why IWM and Russell 2000 Are Dominating 2026

By: Katie Gomez Wall Street’s biggest surprise of 2026 isn’t coming from the Magnificent 7 tech giants; it’s the explosive outperformance of small-cap stocks that has caught even seasoned analysts off guard. While the mega-cap-heavy Nasdaq and S&P 500 grind through modest single-digit gains, the Russell 2000 and its flagship ETF, IWM, are charging ahead…

Read MoreReading the Mountain, Reading the Market: How Snow Conditions Mirror Market Sentiment

By: Katie Gomez Standing at the summit, a seasoned skier pauses before the first turn, eyes scanning the slope below. Is that fresh powder or wind-blown crust? Are those tracks from this morning or yesterday? Where’s the sun hitting hardest, and which runs are still in shade? This moment of assessment—reading the mountain before committing—mirrors…

Read MoreRed Flags in Trading You Shouldn’t Ignore (Just Like in Dating)

By: Katie Gomez We’ve all known someone who stayed too long in a toxic relationship, ignoring every warning sign: unanswered texts, broken promises, constant excuses. Yet they stay, hoping things will magically improve. Traders do the same with poor positions and risky habits. With Valentine’s Day approaching, it’s time to assess what deserves your commitment—in…

Read More