Posts Tagged ‘trade ideas’

Musk’s 30-Month Space AI Prediction: Which Stocks Win the Final Frontier

By: Katie Gomez Elon Musk just dropped a bombshell prediction on X that could reshape the entire AI industry: within 30 months, space will become the most economically compelling location for artificial intelligence operations, making Earth-based data centers look like expensive relics of a bygone era. His technical reasoning is compelling – solar panels deliver…

Read MoreHEDERA: The Trust Layer the Digital World Desperately Needs

By: Katie Gomez What if the internet had a built-in trust layer? In a world plagued by hacking, leaks, and AI scams, Hedera (HBAR) aims to make our digital lives safer. Unlike speculative cryptocurrencies, Hedera prioritizes real-world change through technological innovation. As advisor Monique Morrow notes: “Hedera has never been a love story, it’s a…

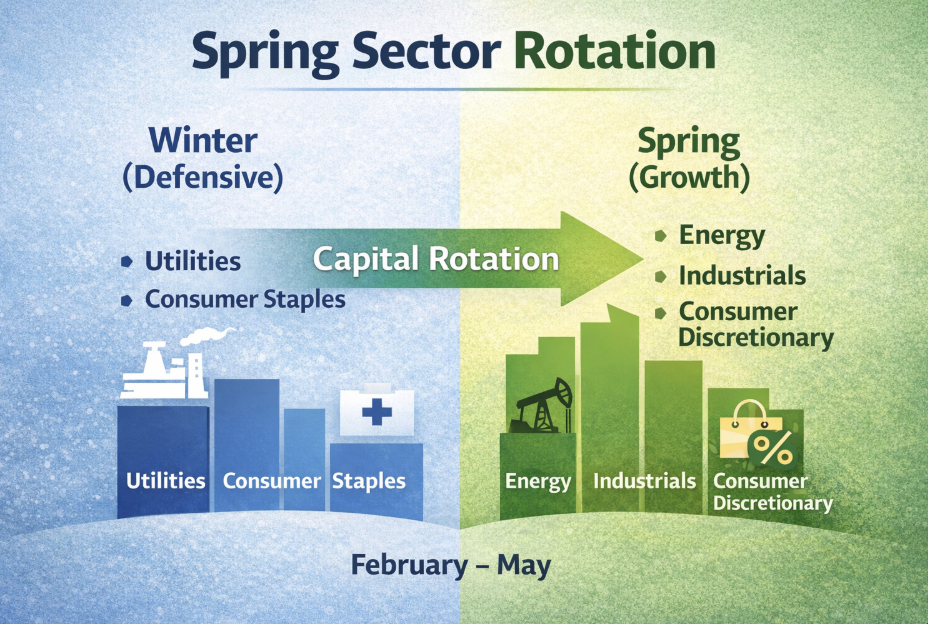

Read MoreSpring Sector Rotation: Where Money Flows From Winter to Summer

By: Katie Gomez Spring sector rotation represents one of the most predictable and statistically reliable patterns in equity markets, offering traders a systematic edge based on decades of consistent historical data rather than hopeful speculation. As winter’s defensive positioning gives way to spring’s growth-oriented optimism, institutional money flows create identifiable trends that careful observers can…

Read MoreSpring Break Stocks: How Traders should Play the Travel Sector

By: Katie Gomez Spring break 2026 marks a pivotal moment for travel sector investors to capitalize on American’s wanderlust coming out of winter. This isn’t just another travel season – it’s being redefined by a generation that spends differently, travels smarter, and shares everything: Gen Z. This demographic shift is reshaping the entire travel ecosystem,…

Read MoreThe $12.5 Billion Fraud Crisis: How AI and Social Media Are Fueling Financial Crime

By: Katie Gomez American consumers lost $12.5 billion to fraud in 2024-2025, a 25% increase signaling a rapid escalation in financial crime fueled by AI, social media, and fast payment systems. As 60% of financial institutions face rising attacks, traditional defenses cannot keep pace with AI-driven threats and the vast reach of social media. Meta’s…

Read MoreTrade Like a Card Counter: Why the Best Traders Know When to Walk Away

By: Katie Gomez It’s not uncommon for people to associate trading with gambling, and while they’re fundamentally different pursuits, there’s one powerful lesson traders can steal directly from the poker table: card counting. The casino card counter analogy is perfect for trading because both require the same fundamental discipline – waiting patiently for favorable conditions,…

Read More5 Signs You’re Overtrading & How Trade Ideas can Help

By: Katie Gomez Overtrading is the silent account killer that ruins more trading careers than bad analysis or lack of capital. In today’s world of overstimulation and overconsumption, most traders are unaware it exists, believing constant activity means productivity and equating busyness with professionalism. This addiction to market action arises from FOMO, social media pressures,…

Read MoreHow to Profit from Activist Investor Campaigns: The Elliott/LSEG Playbook

By: Katie Gomez When news broke that Elliott Investment Management had built a stake in London Stock Exchange Group (LSEG), shares jumped 8% in early trading. This is a textbook example of how activist investor campaigns create immediate, predictable, and highly tradable market reactions. Elliott’s involvement isn’t random: the legendary activist fund has forced strategic…

Read MoreWhat are XRP and XLM tokens, and why do you want to own them?

By: Katie Gomez If you’ve spent any time around crypto, you’ve probably heard XRP and XLM mentioned in the same breath. That’s not by accident. Both were designed to make moving money faster and cheaper than traditional systems, but they go about it in different ways, for different audiences. This guide breaks down what XRP…

Read MoreCrossed Above Resistance vs False Breakouts: How to Find the Difference

One of the most common moments in trading happens when the price finally pushes above resistance. Alerts fire, momentum looks strong, and traders rush in, only to watch the move stall or reverse. This is where the difference between a crossed above resistance move and a false breakout matters. While both start the same way,…

Read More