Posts Tagged ‘stocks’

Foreign Factory Boom: How Tariffs Are Bringing Manufacturing Back to America

By: Katie Gomez A quiet revolution is reshaping American manufacturing as foreign companies invest billions of dollars in building factories on U.S. soil, not out of patriotic sentiment but as a calculated strategy to circumvent the complex web of tariffs that has defined trade policy over the past decade. This “tariff dodge” phenomenon has unleashed…

Read MoreTrump’s $96B Middle East Win: Why Boeing Could Soar to $275

By: Katie Gomez President Trump’s ambitious Middle East diplomatic tour in May 2025 has already proven to be one of the most economically significant international trips of his second term, with the administration securing an unprecedented $96 billion in trade deals across multiple sectors that could fundamentally reshape American manufacturing and aerospace industries. The centerpiece…

Read MoreJuneteenth 2025: A Stock Trader’s Guide to Black-Owned Companies and Diversity Investing

By: Katie Gomez Today, as we commemorate Juneteenth 2025, we recognize that while legal freedom was achieved over 150 years ago, economic freedom remains an ongoing battle that requires intentional action and strategic investment. The significance of Juneteenth extends far beyond historical remembrance – it represents the continuing pursuit of economic empowerment that can break…

Read MoreThe Ultimate Father’s Day Guide: Market Dos and Don’ts From Three Generations of Traders

By: Katie Gomez Happy Father’s Day Traders! In honor of the man who first taught me how to trade – who also learned from his father – I’m sharing some of the best lessons passed down through generations. Whether or not your parents taught you about the markets, this guide offers timeless fatherly advice to…

Read MoreHow to Swing Trade with Effective Risk Management and Position Sizing

Swing trading is a powerful strategy for capturing short to medium-term price movements in the financial markets. By holding positions for a few days to weeks, swing traders aim to profit from price swings while avoiding the problem of day trading. However, success in swing trading hinges on two critical pillars: effective risk management and…

Read MoreWhen Windfall Becomes Downfall: Protecting Your Competitive Edge in Trading and Golf

By: Katie Gomez People say money is the root of all evil, but is it rather our relationship to it that is our downfall? Money can incentivize us to become the best, most talented, ambitious, and hard-working versions of ourselves, but it can also bring out the worst in us, stripping away our drive. Stock…

Read More4 Ways AI Is Changing the Game for Day Traders

By: Shane Neagle Over the past few years, artificial intelligence has quickly accelerated from the edge of institutional finance into the hands of individual traders. What used to be an edge reserved for hedge funds and high-frequency trading firms is now starting to open up to retail day traders, via AI power, application, and analysis.…

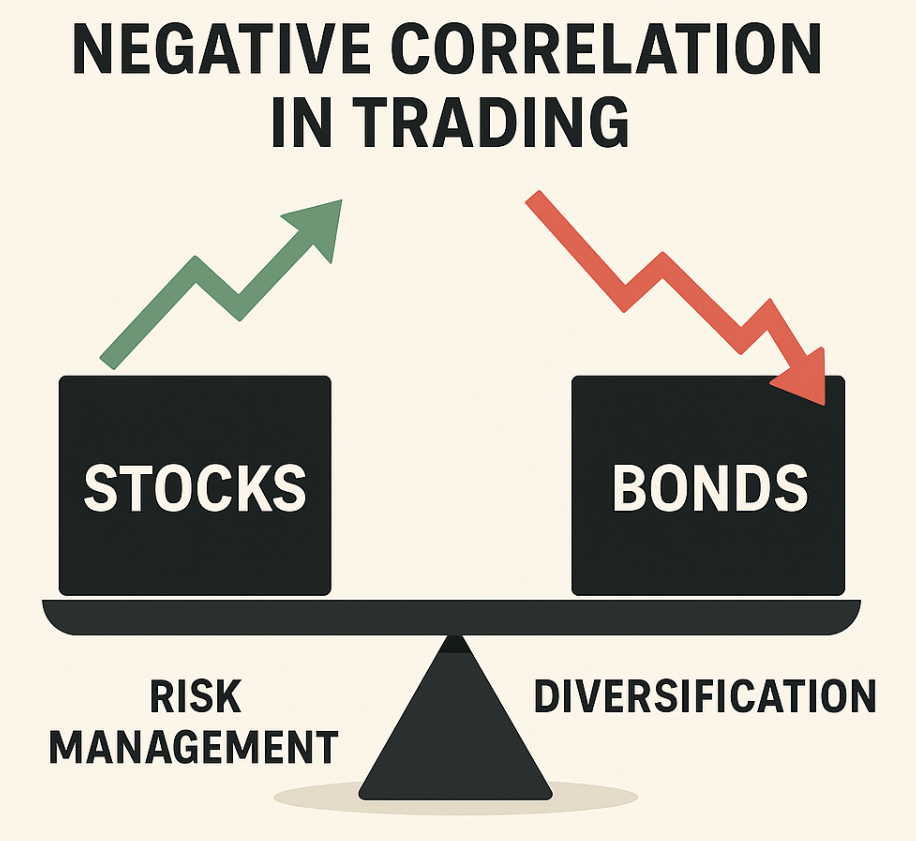

Read MoreNegative Correlation in Trading: How Stocks and Bonds Balance Your Portfolio

Fed up with market swings taking away your investment returns? Understanding negative correlation in trading can help you balance your portfolio and manage risk effectively. By combining assets like stocks and bonds, which often move in opposite directions, you’ll build a more stable, resilient investment strategy. In this article, we’ll break down what negative correlation…

Read MoreThe Trump Trade Playbook: How Trump’s Announcements Create 72-Hour Profit Windows

By: Katie Gomez Despite President Trump’s age, people underestimate how savvy he is, especially when it comes to garnering the public’s attention. Though his means can be controversial, everyone (no matter the party) was glued to their phones last week when Trump announced via social media that he would announce something so “earth-shattering” that it…

Read MoreThe Memorial Day Effect: How Traders Can Navigate the Holiday Weekend

By: Katie Gomez As traders prepare for the 2025 Memorial Day weekend, understanding the “Memorial Day Effect” becomes crucial for navigating this seasonal market phenomenon. This effect refers to the distinctive trading patterns that historically emerge around the last Monday of May when U.S. markets close in observance of the holiday. The holiday significantly impacts…

Read More