Posts Tagged ‘stock market’

Trade Ideas’ Money Machine: A New Era in Automated Trading

By: Shane Neagle Automated trading has advanced to far beyond basic scripts and static algos. Today’s traders are looking for tools that do much more than send alerts, they want automation with intelligence, responsiveness, and ensuring it is aligned with their strategy. That is where Trade Ideas continues to take the leading role: Trade Ideas…

Read MoreWhy a 90% Win Rate Isn’t the Flex You Think It Is: The Real Metrics That Matter in Trading

By: Katie Gomez That trader bragging about their 90% win rate on social media? They might actually be losing money. While they’re busy posting screenshots of their “winning streak,” their account balance could be bleeding red. Traders have been conditioned to worship at the altar of win rates, especially nowadays, where our sole focus is…

Read MoreTrading Economic Data in an Era of Political Interference: Can We Trust the Numbers Again?

By: Katie Gomez Traders have always harbored distrust when it comes to information accuracy. Between government politics and wealth inequalities, there are constant revisions to economic data, leaving traders in the dark about the truth behind the numbers. This reality hits hardest every first Friday of the month, when traders around the world hold their…

Read MoreHow Labor Day Affects the Stock Market: What Traders Can Expect

By: Katie Gomez As grills fire up across America and summer begins its inevitable fade, savvy traders are asking a different question than most holiday revelers: How will Labor Day weekend affect my portfolio? Labor Day marks far more than just the unofficial end of summer; it’s a critical transition point for financial markets that…

Read More10+ Ways to Use Chart Patterns to Predict Stock Moves

Chart patterns are one of the most reliable ways to read market behavior. They show you, in real time, how buyers and sellers are positioned and where the balance of power may shift next. They are not only a technical indication; they often reflect the actions of large institutions, their market manipulation, entry and exit…

Read MoreSummer Vacation Trading Strategy: How Low Volume Creates Profit Opportunities

By: Katie Gomez While Wall Street empties for summer vacation, creating the year’s thinnest trading volumes, smart traders recognize this seasonal shift as an opportunity to capitalize on amplified price movements, reduced competition, and overlooked earnings surprises. Summer trading presents a dramatically altered market landscape as trading volumes routinely drop 20-40% from peak levels between…

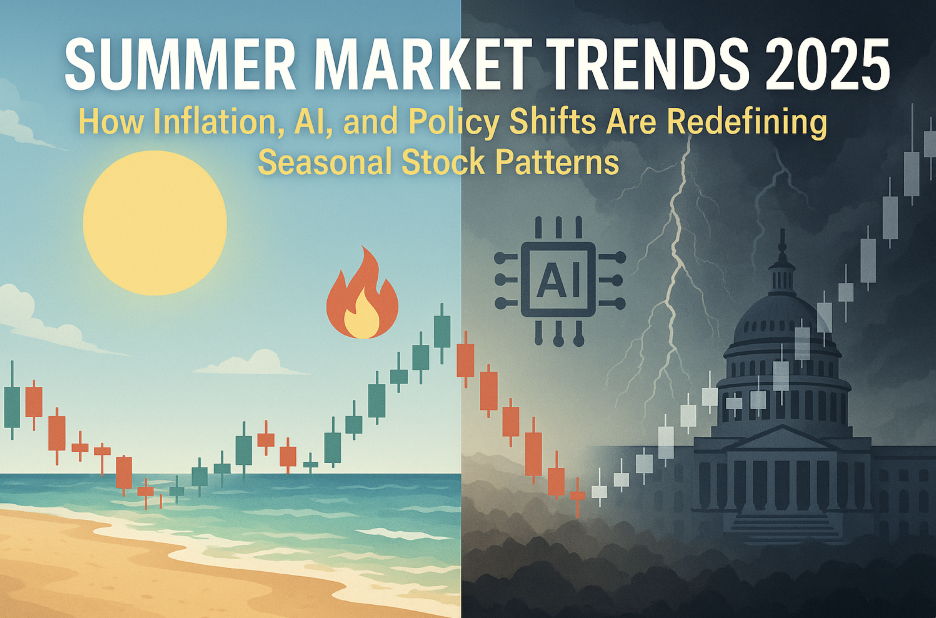

Read MoreSummer Market Trends 2025:How Inflation, AI, and Policy Shifts Are Redefining Seasonal Stock Patterns

By: Katie Gomez The lazy summer trading days that once defined Wall Street have undergone a profound transformation in recent years, challenging the conventional wisdom that has guided investors for generations. While the classic adage “Sell in May and go away” once offered a reliable roadmap for navigating the seasonal doldrums between Memorial Day and…

Read MoreThe Perfect Storm: How Trump, RFK Jr., and VA Research Are Revolutionizing MindMed’s 2025 Prospects

By: Katie Gomez Richard Nixon is probably rolling over in his grave right now, as his war on drugs has evolved into war veterans taking drugs. Following the Fourth Turning Theory (link to other blog), we are in a crucial period of awakening and change, and one of those changes has been an increasing rise…

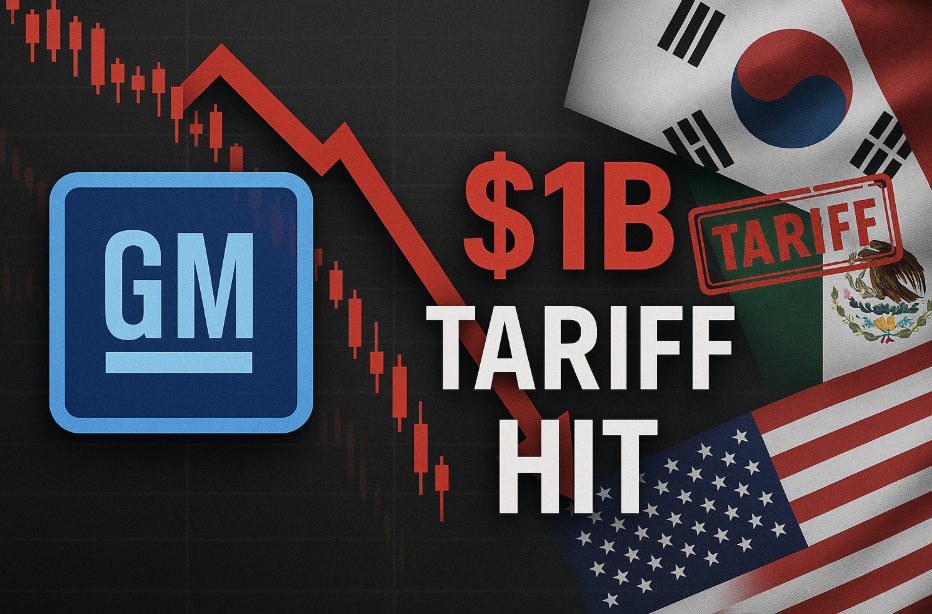

Read MoreGM’s $1B Tariff Hit: How Smart Traders Can Navigate Auto Sector Volatility

By: Katie Gomez The automotive sector just got a reality check that sent shockwaves through Wall Street. General Motors’ shares crashed 8% Tuesday after the company revealed that Trump’s tariffs slammed their second-quarter earnings with a devastating $1.1 billion hit – and warned that the pain is only getting worse, with up to $5 billion…

Read MoreBack-to-School Stock Rally: Retail and Education Plays for Late Summer

By: Katie Gomez While it may seem like summer has only just begun, the retail market is already preparing its stores for the back-to-school shopping season. For stock traders, this is an essential time of year to prepare portfolios, as back-to-school is the second-largest retail season, trailing only the November-January holidays, which generated over $126…

Read More