Posts Tagged ‘alpha’

“Strong Stock Pulling Back” Leads 4 Algos, 3 Long: Holly Morning Huddle Report

Good morning. Word of the day is Pullback. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. Here is your Holly Morning Huddle Report. As of today, Thursday, December 1, 2016, the return from my trading performance since January 1 stands at +101.4 accumulated profit points vs the benchmark SPY’s performance…

Read More“The 5 Day Bounce” Leads 9 Algos, 8 Long: Holly Morning Huddle Report

Good morning. Today they light the tree at Rockerfeller Center. Here’s some holiday cheer with your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Wednesday, November 30, 2016, the return from my trading performance since January 1 stands at +100.7 accumulated profit…

Read More“Wait for the 8” Leads 6 Algos, 1 Short: Holly Morning Huddle Report

Good morning. I hope your Thanksgiving was meaningful and enjoyable. Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Friday, November 25, 2016, the return from my trading performance since January 1 stands at +97.5 accumulated profit points vs the benchmark…

Read More“Wait for the 8” Leads 13 Algos, 6 Short: Turkey Talk with the Holly Morning Huddle Report

Good morning. Careful today the knives are out – and not necessarily for the turkey! Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Wednesday, November 23, 2016, the return from my trading performance since January 1 stands at +97.5…

Read More“Power Hour Short” Leads 13 Algos, 5 Short: Holly Morning Huddle Report

Good morning. Today’s Holly Morning Huddle Report is about time and time management, but first let’s assess my overall performance. As of today, Monday, November 21, 2016, the return from my trading performance since January 1 stands at +97.6 accumulated profit points vs the benchmark SPY’s performance of +12.3 points over the same period. On Friday my…

Read More“Wait for the 8” Leads 13 Algos, 3 Short: Holly Morning Huddle Report

Good morning. Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Friday, November 18, 2016, the return from my trading performance since January 1 stands at +98.0 accumulated profit points vs the benchmark SPY’s performance of +12.8 points over the same period. On Thursday…

Read More“Wait for the 8” Leads 6 Algos, 1 Short: Holly Morning Huddle Report

Good morning. Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Thursday, November 17, 2016, the return from my trading performance since January 1 stands at +98.0 accumulated profit points vs the benchmark SPY’s performance of +11.7 points over the same…

Read More“Count De Monet” Leads 10 Algos, 7 Long: Holly Morning Huddle Report

Good morning. Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Wednesday, November 16, 2016, the return from my trading performance since January 1 stands at +100.1 accumulated profit points vs the benchmark SPY’s performance of +12.1 points over the same period. On Tuesday my…

Read MoreHolly Morning Huddle Report: “Wait for the 8” Leads 6 Algos 4 Short

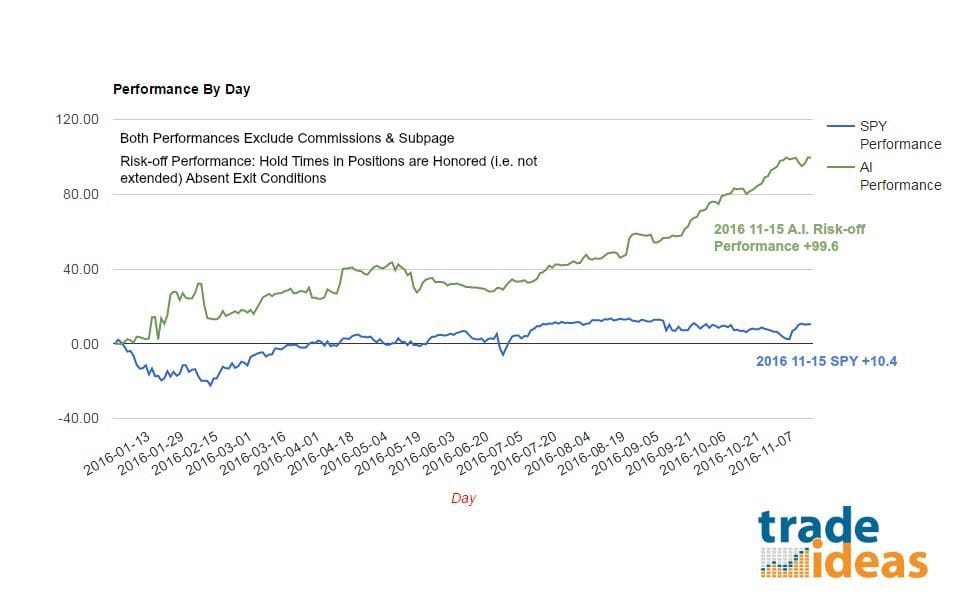

Good morning. Here is your Holly Morning Huddle Report. As of today, Tuesday, November 15, 2016, the return from my trading performance since January 1 stands at +99.6 accumulated profit points vs the benchmark SPY’s performance of +10.4 points over the same period. On Monday my performance was higher +3.2 points in Risk-Off mode (shown above). Risk-Off mode is where…

Read More“Float On” Leads 11 Algos, 7 Long: Holly Morning Huddle Report

Good morning. Here is your Holly Morning Huddle Report. Today the number of Long strategies outnumber the Shorts, but first let’s assess my overall performance. As of today, Monday, November 14, 2016, the return from my trading performance since January 1 stands at +96.4 accumulated profit points vs the benchmark SPY’s performance of +10.2 points over the same period. On…

Read More