Relative Volume

Table of Contents

- Understanding the Relative Volume Filter

- Relative Volume Filter Settings

- Using Relative Volume in Trading

- FAQs about Relative Volume

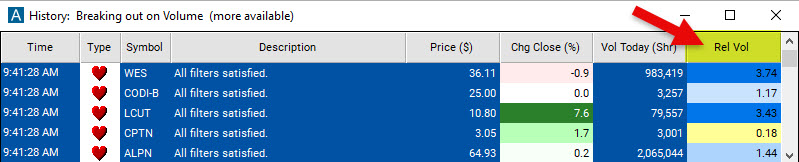

Understanding the Relative Volume Filter

Relative Volume is crucial for any trader looking to get a complete picture of the market's mood. It's not just about identifying stocks that are trading on high or low volume, it's about understanding the market context in which these volumes are taking place.

The Relative Volume Filter compares the current volume of a stock to its average volume for the same time of day and returns a ratio. It uses standard volume numbers that are reset every night at midnight.

Please note that the Relative Volume Filter does not calculate during the premarket. If you set a minimum value greater than 1 in the Windows Specific Filters Tab, you won't receive any alerts before the market opens, and your Top Lists will be blank.

The look-back period of the Relative Volume Filter can vary depending on the trading activity of the specific stock. Here is how it works:

-

The algorithm gathers 30 days' worth of data. Instead of strictly looking back 30 trading days, the algorithm considers the equivalent number of 1-minute bars. So for symbols that don’t trade every minute it will be looking farther back.

-

Next, it analyzes each day within the 30-day period and determines the average volume for each 15-minute interval.

-

This average volume becomes the benchmark for comparison.

The Relative Volume Filters is similar to the High Relative Volume Alert. Both compare Today’s Volume to recent historical volume at the same time of day. There are, however, several important differences:

- The High Relative Volume Alert only looks at volume near the time of the alert. The Relative Volume Filter, on the other hand, looks at all volume between midnight and the time of the alert.

- The High Relative Volume Alert attempts to find volume spikes. The Relative Volume Filter smooths out the volume.

- The High Relative Volume Alert is only good for high volume, there is no corresponding Low Volume Alert. The Relative Volume Filter, on the other hand, works well with any volume range.

Relative Volume Filter Settings

Activating the Relative Volume Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window. You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

The Relative Volume filter provides a ratio.

Here are some example settings:

-

If you set the minimum field in the Windows Specific Filters Tab to 1, you will only see symbols which are trading on higher than average volume.

-

If you set the maximum field in the Windows Specific Filters Tab to 1, you will only see symbols that are trading at lower than average volume.

-

If you set the minimum field in the Windows Specific Filters Tab to 2.5, you will only see symbols which are trading on at least two and a half times their normal volume.

-

If you set maximum field in the Windows Specific Filters Tab to 0.9, you will only see symbols which are trading on less than 90% of their normal volume.

Using Relative Volume in Trading

Here are a few setups that can be spotted using the Relative Volume filter (in combination with other alerts and filters):

- Identifying Breakouts: The Relative Volume Filter can be a key component in identifying breakouts. Breakouts often occur when there is a significant increase in trading volume compared to the stock's average volume. When you set the minimum field in the Windows Specific Filters Tab to a value greater than 1, you're pinpointing stocks with higher than average trading volumes. These could be potential breakout opportunities. But remember, high volume itself doesn't guarantee a breakout, it merely serves as an indication. You should also look for other technical signs like bullish patterns or a strong uptrend.

- Analyzing the Bottoms: Just as the Relative Volume Filter can assist in spotting potential breakouts, it can also aid in identifying potential bottoms. When a stock is trading at lower than its average volume, it could be an indication of decreased selling pressure. If you set the maximum field in the Windows Specific Filters Tab to a value less than 1, you're seeking out stocks that are trading at lower than average volumes. Combine this with other indicators like bullish divergences on momentum oscillators or price support levels, and you may have a good case for a potential bottom formation.

- Capturing Volatility: One of the key applications of the Relative Volume Filter is to capture stocks with high volatility. Traders who focus on short-term trading strategies often seek out stocks that are experiencing substantial shifts in trading volumes. If you set the minimum field in the Windows Specific Filters Tab to a high value like 2.5 or more, you are essentially looking for stocks that are trading at least two and a half times their normal volume. This could indicate increased volatility, offering opportunities for short-term trades.

- Avoiding Illiquid Stocks: The Relative Volume Filter can also be an effective tool for avoiding illiquid stocks. If a stock is consistently trading on less than 90% of its normal volume (setting the maximum field in the Windows Specific Filters Tab to 0.9), it could suggest low liquidity. Trading in illiquid stocks can be risky due to high bid-ask spreads and price slippage. Therefore, having a way to filter out these stocks can help to manage risk.

FAQs about Relative Volume

If a stock is trading on above average volume, is it always a positive sign?

Not necessarily. High relative volume means that there's a significant amount of trading activity, but it doesn't provide information on the direction of the price movement. High volume could accompany both upward breakouts and downward price plunges. Thus, while high relative volume does mean that something significant is happening, traders need to use other indicators or analysis techniques to determine whether it's bullish or bearish.

Are there any specific time frames that work best with the Relative Volume Filter?

The Relative Volume Filter is designed to work throughout the trading day as it compares the current volume to its average volume for the same time of day. However, trading volumes are typically higher at the start and end of the trading day. So, you might observe more significant deviations from the average volume during these periods. Please note that the Relative Volume Filter does not work in premarket trading.

How does the Relative Volume Filter handle data anomalies? For example, if there was a day with extremely high volume due to news events, would that skew the average?

The Relative Volume Filter uses a 30-day look-back period and determines the average volume for each 15-minute interval, providing a robust and comprehensive understanding of a stock's usual volume profile. While a single day of extremely high volume might influence the average, the impact would be lessened due to the broader look-back period. This way, the Relative Volume Filter smooths out the volume to provide a more accurate and consistent comparison.

How does the Relative Volume Filter help me if I'm a long-term investor, not a short-term trader?

While short-term traders often use the Relative Volume Filter to spot potential breakout, bottom-reversal opportunities, and volatility, it can also be beneficial for long-term investors. The filter can help identify periods of unusual trading activity which may correspond with key events or changes in fundamentals that long-term investors might want to be aware of. For instance, a surge in relative volume might indicate a significant news event or a change in market sentiment toward the stock.

Can I adjust the look-back period of the Relative Volume Filter to cater to my specific trading strategy?

As it stands, our Relative Volume Filter algorithm is designed with a 30-day look-back period, which considers the equivalent number of 1-minute bars for the stocks. This period has been optimized to provide a balance between recent relevance and avoiding noise from daily anomalies, it cannot currently be customized.

Does the Relative Volume Filter help with after-hours trading?

The Relative Volume Filter does compare a stock's volume to its average volume for the same time of day, so in theory, it can provide insights into after-hours trading activity as well. However, the liquidity in after-hours sessions is typically much lower than during the regular trading hours, leading to wider spreads and higher price volatility. Therefore, while you can certainly use the Relative Volume Filter during after-hours, keep in mind that volume spikes could be due to fewer participants, and thus may not always reflect a broader market consensus. The Relative Volume Filter uses standard volume numbers that reset every night at midnight and does not calculate during the premarket.

Which volume filters can I use in my pre-market scans to compare volume?

Our Relative Volume Filter does not work during the early trading hours, but you can use the following comparative volume filters (amongst others) for the pre-opening session.

Volume Today %, Volume 1 Minute %, Volume 5 Minute %, Volume 10 Minute %, Volume 15 Minute %, Volume 30 Minute %

What is the difference between the Volume Today % Filter and the Relative Volume Filter?

The Volume Today % Filter and the Relative Volume filter are two distinct tools for analyzing the trading volume of stocks, each with its own strengths and applications. Here's a comparison between the two:

- Volume Today % Filter

The Volume Today % filter compares the current trading volume of a stock to its average full-day trading volume over the last 10 days. It provides a percentage that represents the ratio of the current volume to the average volume. This filter is operational during the premarket and will continue to provide readings as the trading day progresses. As more shares are traded throughout the day, the percentage provided by the Volume Today % filter will naturally increase because the current day's volume is growing while the 10-day average full-day volume remains constant. This helps traders understand how a stock's activity for the current day is stacking up against its recent trading history.

Pros:

Simple and easy to understand.

Useful for identifying stocks that are seeing significant trading activity compared to their typical full-day volume.

Works during the premarket, allowing for early insights.

Cons:

Less precise than the Relative Volume filter as it doesn't consider the specific time of day.

Though the percentage increases as the day progresses, this increase is solely due to more shares being traded and doesn't necessarily indicate a significant change in trading behavior.

-Relative Volume Filter

The Relative Volume filter, on the other hand, provides a more nuanced analysis. It compares the current volume of a stock to its average volume for the same time of day, returning a ratio. The algorithm analyzes 30 days' worth of data, determining the average volume for each 15-minute interval to serve as the benchmark for comparison. As a result, the Relative Volume filter ratio can increase or decrease throughout the trading day depending on whether the stock's current volume is higher or lower than its historical average at that time.

Pros:

More precise than the Volume Today % filter as it considers the specific time of day.

Automatically adjusts throughout the day, removing the need for manual adjustment.

Can provide insight into both high-volume and low-volume situations.

Cons:

More complex than the Volume Today % filter, which might be intimidating for beginners.

Does not calculate during the premarket, which might limit its usefulness for traders who act on premarket data.

In summary, the Volume Today % filter offers a simple snapshot of a stock's current volume compared to its average full-day volume over the last 10 days, increasing as the day progresses. The Relative Volume filter, meanwhile, delivers a more sophisticated insight by comparing the stock's volume to its historical average at the same time of day, with the ratio potentially fluctuating throughout the day.

Does the Relative Volume Filter work well with all types of stocks?

The Relative Volume Filter is a versatile tool that can be used across various types of stocks. However, the liquidity and trading characteristics of the stock may impact the effectiveness of the filter. For instance, for very liquid stocks with consistent trading activity, the Relative Volume Filter can be a very effective tool. But for illiquid stocks or stocks with sporadic trading activity, the relative volume might be less useful or may need to be interpreted differently.

I noticed a stock with consistently high relative volume over several days. What could this imply?

Sustained high relative volume over multiple days could suggest a significant market reevaluation of a stock's value. This could be due to factors such as a recent earnings announcement, product launch, or a news event. As always, it's important to combine relative volume data with other analysis methods to understand the bigger picture.

Can the Relative Volume Filter be used with other filters or indicators?

Yes, definitely! The Relative Volume Filter is an effective tool on its own, but its utility increases when used in conjunction with other filters or technical indicators. This allows you to develop more robust and comprehensive trading strategies. For example, you might combine relative volume with price filters to find high volume movers in specific price ranges, or with technical indicators to find stocks that are in overbought or oversold conditions with high volume.

Filter Info for Relative Volume [RV]

- description = Relative Volume

- keywords =

- units = Ratio

- format = 2

- toplistable = 1

- parent_code =