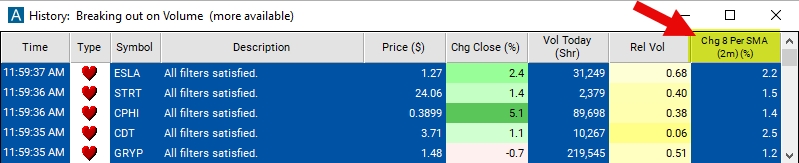

Change From 8 Period SMA (2m)

Table of Contents

- Understanding the Change From 8 Period SMA 2m Filter

- Change From 8 Period SMA 2m Filter Settings

- Using the Change From 8 Period SMA 2m Filter

- FAQs

Understanding the Change From 8 Period SMA 2m Filter

The "Change From 8 Period SMA 2m Filter" is an indicator that looks at the current price of a stock relative to its 8-period Simple Moving Average (SMA) on a 2-minute chart. It is tailored for short-term, intraday trading by highlighting immediate price trends. Here’s a breakdown of its components:

Simple Moving Average (SMA)

8-Period SMA on a 2-Minute Chart: This SMA calculates the average closing price of a stock over the last 8 two-minute periods, giving a total span of 16 minutes. It serves to smooth out price fluctuations on a very short-term basis.

Calculation: The values entered for this filter are percentage (%). The formula is (Percent Change) = ((Last Price) - (SMA)) / (SMA) * 100.

A positive number means that the current price is above the moving average. A negative number means the current price is below the moving average.

Change From 8 Period SMA 2m Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

-

Set the min value to 1 to see only stocks in which the current price is above their 8 period SMA on a 2 minute chart.

-

Set the max value to -1 to see only stocks in which the current price is below their 8 period SMA on a 2 minute chart.

Using the Change From 8 Period SMA 2m Filter

Several trading strategies can be employed with the Change From 8 Period SMA 2m filter. Here are a few examples:

Momentum Trading: Traders might look for a significant positive change as an entry signal for a long position, interpreting it as upward price momentum. Conversely, a significant negative change might signal a potential short opportunity.

Reversion to Mean Strategies: If the stock price deviates notably from the 8-period SMA, some traders may expect the price to revert to the mean (the SMA) and trade accordingly.

Scalping: Because the filter reflects very short-term changes, it's useful for scalping strategies where traders seek to profit from small price changes, quickly entering and exiting trades.

Stop Loss and Take Profit: The 8-period SMA can serve as a dynamic level to manage stop loss and take profit orders, adjusting them in real-time with the moving average.

FAQs

What does the "Change From 8 Period SMA 2m" indicate in a stock's price action?

- It shows how the current price compares to the average price over the last 16 minutes. A positive change suggests recent upward momentum, while a negative change points to downward momentum.

Can I rely on the "Change From 8 Period SMA 2m" as a standalone indicator for trading?

- While the "Change From 8 Period SMA 2m" can provide quick insight into price momentum, it's advisable to use it in conjunction with other indicators and market analysis to confirm signals and build a more robust trading strategy.

Is the "Change From 8 Period SMA 2m" filter useful for all types of stocks?

- The filter can be applied to any stock, but its effectiveness may vary depending on the stock's liquidity and volatility. Highly traded stocks tend to provide more reliable signals with this type of short-term indicator.

Filter Info for Change From 8 Period SMA (2m) [2SmaLa8]

- description = Change from 8 Period SMA (2m)

- keywords = Fixed Time Frame Moving Average

- units = %

- format = 1

- toplistable = 1

- parent_code =

Change from 8 Period SMA (5m) [5SmaLa8]

Change from 8 Period SMA (5m) [5SmaLa8] Change from 8 Period SMA (15m) [15SmaLa8]

Change from 8 Period SMA (15m) [15SmaLa8] Change from 8 Period SMA (60m) [60SmaLa8]

Change from 8 Period SMA (60m) [60SmaLa8]