Change From 8 Period SMA (15m)

Table of Contents

- Understanding the Change From 8 Period SMA 15m Filter

- Change From 8 Period SMA 15m Filter Settings

- Using the Change From 8 Period SMA 15m Filter

- FAQs

Understanding the Change From 8 Period SMA 15m Filter

The "Change From 8 Period SMA 15m Filter" is an essential tool for traders focusing on short to mid-term price movements. It compares the current stock price to its 8-period Simple Moving Average (SMA) on a 15-minute chart, offering insights into the stock's momentum within the last 2 hours. Here’s how it works:

Simple Moving Average (SMA)

8-Period SMA on a 15-Minute Chart: Calculates the average closing price over the last 8 fifteen-minute periods. This method helps smooth short-term price volatility, providing a clearer view of the trend.

Calculation: This filter's values are presented as a percentage (%). The formula used is: Percent Change = ((Last Price - SMA) / SMA) * 100

A positive value indicates the current price is above the moving average, signaling upward momentum. Conversely, a negative value suggests the current price is below the average, indicating downward momentum.

Change From 8 Period SMA 15m Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

-

To focus on stocks currently above their 8-period SMA on a 15-minute chart, set the minimum value to 1.

-

To focus on stocks currently below their 8-period SMA on a 15-minute chart, set the maximum value to -1.

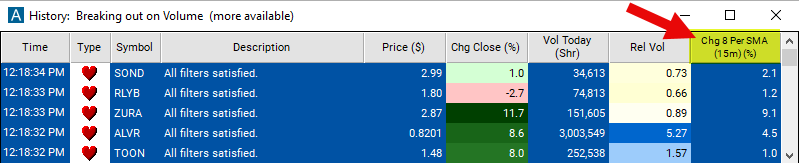

Using the Change From 8 Period SMA 15m Filter

Several trading strategies can be employed with the Change From 8 Period SMA 15m filter. Here are a few examples:

Momentum Trading: A significant positive change can serve as a cue to initiate long positions, tapping into upward momentum. A notable negative change might indicate a short-selling opportunity.

Reversion to Mean Strategies: Notable deviations from the 8-period SMA may suggest a potential price correction towards the SMA, offering trading opportunities in the opposite direction of the deviation.

Scalping: The filter is useful for scalping, allowing traders to capitalize on small, rapid price changes by entering and exiting positions swiftly.

Dynamic Stop Loss and Take Profit: Adjust stop loss and take profit orders in alignment with the 8-period SMA, accommodating the stock's current volatility.

FAQs

How does the "Change From 8 Period SMA (15m)" compare to the 5-minute version?

- The 15-minute version covers a broader timeframe, reducing noise and offering a more stabilized view of price trends compared to the 5-minute version. It's less reactive but can provide stronger signals for mid-term trading decisions.

Is the "Change From 8 Period SMA (15m)" suitable for all traders?

- It's particularly valuable for day traders and those looking at slightly longer timeframes within a single trading day. Its effectiveness can vary based on individual trading styles and strategies.

What does a consistent positive or negative change indicate?

- Consistent positive changes suggest strong upward momentum, potentially signaling buy opportunities. Persistent negative changes indicate downward momentum, which might signal selling or shorting opportunities. Verification from other indicators is recommended for confirmation.

How to adjust the filter for different stock volatilities?

- For more volatile stocks, consider incorporating a higher percentage change threshold to filter out noise and focus on significant movements.

Filter Info for Change From 8 Period SMA (15m) [15SmaLa8]

- description = Change from 8 Period SMA (15m)

- keywords = Fixed Time Frame Moving Average

- units = %

- format = 1

- toplistable = 1

- parent_code = 2SmaLa8