What are XRP and XLM tokens, and why do you want to own them?

What are XRP and XLM tokens, and why do you want to own them?

By: Katie Gomez

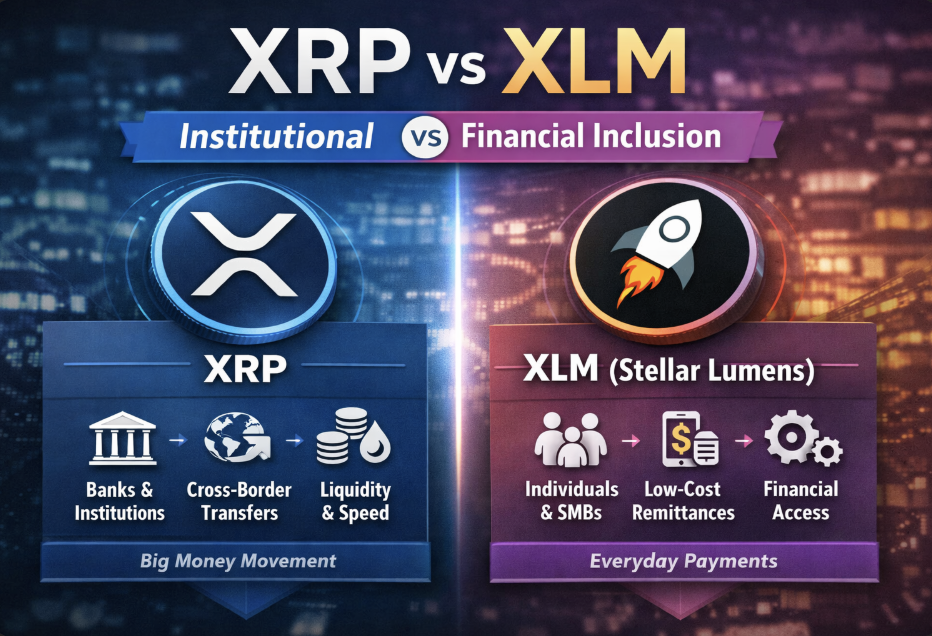

If you’ve spent any time around crypto, you’ve probably heard XRP and XLM mentioned in the same breath. That’s not by accident. Both were designed to make moving money faster and cheaper than traditional systems, but they go about it in different ways, for different audiences.

This guide breaks down what XRP and XLM actually are, how they differ, why people invest in them, and most importantly, when one might make more sense than the other. No hype, no unnecessary jargon. Just a clear comparison so you can understand what role (if any) they might play.

What Is XRP?

XRP is a digital asset designed to move value quickly and efficiently across borders. It runs on the XRP Ledger (XRPL), an open-source blockchain built specifically for payments.

At a high level, XRP’s purpose is simple:

make cross-border transfers faster, cheaper, and more reliable, especially for financial institutions.

What XRP Is Used For

- Acting as a bridge currency between different fiat currencies

- Reducing the cost and time of international money transfers

- Providing liquidity for payment providers and financial institutions

Unlike Bitcoin, which was designed primarily as a decentralized alternative to money, XRP was built with payments infrastructure in mind from day one.

How the XRP Ledger Works (Plain English)

The XRP Ledger doesn’t rely on mining. Instead, it uses a consensus mechanism where trusted validators agree on transactions. This allows the network to process transactions in seconds with very low fees.

That design choice makes XRPL:

- Fast

- Energy-efficient

- Well-suited for high transaction volume

Who XRP Is For

XRP’s ecosystem is largely focused on:

- Banks and financial institutions

- Payment processors

- Enterprises that move large amounts of money across borders

A common misconception is that XRP and Ripple are the same thing. They’re not. Ripple is a company that builds payment products and uses XRP in some of its solutions, but the XRP Ledger itself is open-source and exists independently.

Key takeaway: XRP is optimized for institutional-grade, cross-border payments where speed, liquidity, and cost matter.

What Is XLM (Stellar Lumens)?

XLM, also known as Stellar Lumens, powers the Stellar network, a blockchain created to make financial services more accessible, especially for individuals and smaller organizations.

While XRP looks outward to institutions, Stellar looks downward and outward: toward people, small businesses, and underserved markets.

What XLM Is Used For

- Low-cost remittances

- Micropayments

- Tokenizing assets (like stablecoins or digital representations of value)

- Connecting traditional financial systems to blockchain rails

XLM acts as the “fuel” that keeps transactions on the Stellar network running smoothly.

How Stellar Works (Plain English)

Stellar uses its own consensus mechanism that allows participants to agree on transactions without mining. The result is:

- Fast settlement

- Extremely low fees

- Accessibility, even for very small transactions

Who XLM Is For

Stellar’s ecosystem is focused on:

- Individuals sending money across borders

- Small and medium-sized businesses

- Financial inclusion initiatives

- Developers building payment and asset-transfer tools

The network is guided by the Stellar Development Foundation, a nonprofit organization, which shapes its mission around accessibility and real-world utility.

Key takeaway: XLM is designed for everyday payments, remittances, and building accessible financial tools.

Key Differences Explained

1. Mission and Audience

XRP focuses on upgrading how money moves between banks and financial institutions.

XLM focuses on making money movement accessible to anyone, anywhere.

2. Ecosystem Direction

XRP’s ecosystem tends to center on enterprise partnerships and financial infrastructure.

Stellar’s ecosystem emphasizes open access, developers, and real-world payment tools.

3. Governance Perception

XRP is often seen as more institution-aligned, which brings both credibility and scrutiny.

XLM benefits from nonprofit stewardship but moves more slowly by design.

4. Token Utility

XRP is often used as a bridge asset for liquidity.

XLM is required for transaction fees and account functions on the Stellar network.

These differences don’t make one “better”; they make them different tools for different problems.

Side-by-Side Comparison

| Feature | XRP | XLM |

| Primary focus | Institutional payments | Individuals, SMBs, financial inclusion |

| Network | XRP Ledger | Stellar Network |

| Typical use cases | Cross-border settlement, liquidity | Remittances, micropayments, tokenization |

| Governance style | Enterprise-influenced ecosystem | Nonprofit-led foundation |

| Transaction speed | Seconds | Seconds |

| Transaction cost | Very low | Very low |

| Target users | Banks, payment providers | Individuals, developers, NGOs |

Quick takeaway:

- XRP is built for moving large sums efficiently through institutions.

- XLM is built for making financial access easier and cheaper at the ground level.

The Potential Impact on Global Finance

The adoption of technologies like those behind XRP and XLM could have far-reaching implications for global finance:

- Faster Transactions: International money transfers could become nearly instantaneous, improving cash flow for businesses and individuals alike.

- Lower Costs: International transactions could decrease significantly by eliminating intermediaries and reducing processing time.

- Financial Inclusion: Easier, cheaper international transactions could bring more people into the global financial system, especially in developing countries.

- Tokenization of Assets: As more assets become tokenized on these blockchains, we could see a shift in how we think about and trade value.

- Disruption of Traditional Banking: Banks may need to adapt to remain competitive, potentially leading to improved consumer services across the board.

Why Invest in XRP and XLM?

Given their potential to disrupt and improve global financial systems, XRP and XLM present interesting investment opportunities. Here’s why you might consider adding them to your portfolio:

- Real-World Utility: Unlike many cryptocurrencies, XRP and XLM have clear use cases in the financial world, potentially leading to more stable long-term value.

- Institutional Adoption: Especially for XRP, the growing number of partnerships with financial institutions suggests increasing real-world application.

- Potential for Growth: As these technologies are adopted more widely, the value of the tokens could increase significantly.

- Diversification: XRP and XLM offer exposure to a different market segment than store-of-value coins like Bitcoin for those already invested in cryptocurrencies.

- Early Adoption Opportunity: While these technologies are gaining traction, they’re still in relatively early stages, potentially offering significant upside for early investors.

Investment Considerations

People consider XRP and XLM for different reasons, but usually around the same theme: payments infrastructure.

Some potential reasons investors look at these assets:

- Exposure to real-world payment use cases

- Long-standing networks with proven uptime

- Fast, low-cost transaction design

- High liquidity compared to many smaller crypto assets

It’s also worth noting that XRP and XLM often move together in the market because traders group them under the same “payments” narrative, even though their fundamentals differ.

That correlation can be useful for traders, but long-term investors usually want to understand why they’re holding one or the other.

Important note: Owning a token doesn’t automatically mean you benefit from network adoption. Understanding how each token captures value is critical before investing.

When It Makes Sense to Choose One Over the Other

You Might Lean Toward XRP If:

- You believe institutional blockchain adoption will continue to grow

- You want exposure to enterprise payment infrastructure

- You’re comfortable with higher regulatory and headline risk

You Might Lean Toward XLM If:

- You prefer a financial inclusion or remittance-focused thesis

- You’re interested in tokenization and developer-driven ecosystems

- You value nonprofit governance and grassroots adoption

When Holding Both Can Make Sense

Some investors choose to hold both XRP and XLM to gain exposure to two different approaches to solving global payment problems, one top-down, one bottom-up.

That only makes sense if you clearly understand the role each plays.

Risks and Considerations

XRP and XLM address real problems in global payments, but like all cryptocurrency assets, they come with meaningful risks that should be understood before committing capital.

Regulatory and Legal Uncertainty

Cryptocurrency regulation continues to evolve across jurisdictions. Changes in how digital assets are classified, taxed, or restricted could impact both adoption and market sentiment. XRP has faced heightened regulatory scrutiny in the past, highlighting how legal developments can influence price behavior and institutional participation.

Adoption vs. Value Risk

Network usage does not always translate directly into token value. Even if payment networks grow, the economic benefit to token holders depends on how the asset is used within the system. Investors should understand how XRP and XLM capture value, not just how often their networks are used.

Competition and Industry Pressure

Both projects operate in a highly competitive environment. Traditional financial rails, stablecoins, fintech platforms, and other blockchain networks are all pursuing faster and cheaper payment solutions. Sustained relevance depends on continued integration, partnerships, and real-world usage.

Market Volatility and Liquidity Dynamics

XRP and XLM are relatively liquid compared to smaller cryptocurrencies, but they remain subject to sharp price swings driven by market sentiment, macroeconomic trends, and regulatory news. Short-term price movements often have little connection to fundamentals.

Governance and Centralization Perception

While both networks are decentralized at a technical level, perceptions of influence from organizations or foundations can affect investor confidence. These governance dynamics are worth monitoring over time.

Key takeaway: XRP and XLM offer compelling use cases, but they are not low-risk assets. Understanding their regulatory exposure, competitive landscape, and value mechanics is essential for informed decision-making.

Conclusion

XRP and XLM both aim to make money move faster and cheaper, but they’re built for different situations: XRP leans more toward institutional payment flows, while XLM is often discussed in the context of everyday transfers and broader access. If you’re looking at either token, the smartest next step is to watch how they actually trade: momentum, volume, news reactions, and key levels matter.

If you want help turning that into clear, repeatable decisions, Trade Ideas gives you real-time scans, alerts, and AI support so you can spot setups and act sooner, without spending hours staring at charts.

Frequently Asked Questions

Why buy XRP or XLM?

Buy XRP if you want exposure to payment infrastructure and bank-led cross-border settlement. Buy XLM if you prefer a remittance and financial-access focus for individuals and small businesses. Both aim for fast, low-cost transfers, but target different users.

Is XRP the next millionaire maker?

Probably not in the “turn a small stake into millions” sense. XRP already has a large market value, so 100x moves are less likely. It can still rise, but outcomes depend on adoption, regulation, and competition; high-risk, not guaranteed.

Does XLM have a future?

Yes, XLM likely has a future if Stellar keeps growing real-world payment use, tokenized assets, and its smart-contract ecosystem. That said, price isn’t guaranteed; its long-term outlook depends on adoption, developer activity, and staying competitive against other networks.