The Super Bowl Indicator: Should Traders Actually Care?

The Super Bowl Indicator: Should Traders Actually Care?

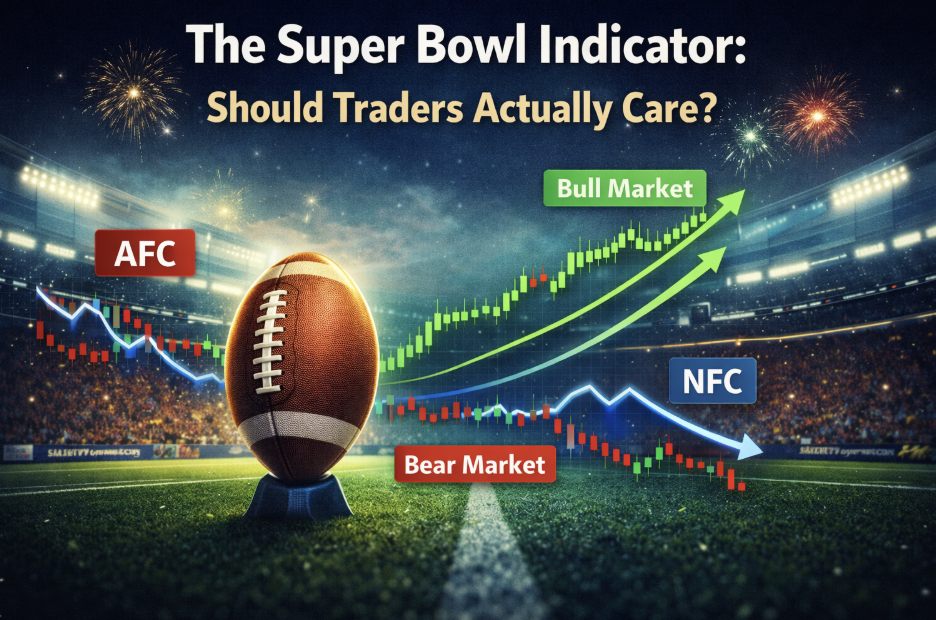

With another Super Bowl around the corner, traders should be mindful of what the results might mean for the market—or at least, what Wall Street folklore claims they should. Every year, as millions gather for wings, commercials, and the big game, a peculiar group watches with a different agenda: they’re predicting the stock market based on who wins. Welcome to the Super Bowl Indicator, one of Wall Street’s oldest and strangest superstitions. The claim is simple: if an NFC team wins, expect a bull market for the year; if an AFC team wins, brace for a bear market. The intrigue? It’s worked with shocking accuracy over decades… until it hasn’t. This year’s matchup will once again put the indicator to the test, and according to this quirky metric, your portfolio’s fate supposedly hangs in the balance. What follows is an exploration of the indicator’s history, why it seems to work, the psychology behind why traders track it, and whether you should actually care.

What Is the Super Bowl Indicator?

This quirky metric was first observed by Leonard Koppett, a sportswriter, in 1978 as a joke—he was satirizing analysts who found patterns in random data, poking fun at the human tendency to see meaning where none exists. The punchline? It actually started working with eerie consistency. The indicator typically tracks the S&P 500’s performance for the calendar year, measuring whether the market closes higher or lower than it opened on January 1, though some versions track from Super Bowl to Super Bowl instead. For purists, the original NFL/AFL distinction matters: pre-1970 merger teams that were part of the NFL (now mostly in the NFC) signal bull markets, while original AFL teams (now mostly in the AFC) signal bear markets. Three teams—the Steelers, Colts, and Browns—switched conferences post-merger, muddying the waters and giving believers convenient excuses when the indicator inevitably fails.

The Track Record: Surprisingly High (Until It Isn’t)

Through 2023, the Super Bowl Indicator has been correct approximately 40 out of 57 times, roughly 70% accuracy, which is legitimately better than many professional analysts manage. From 1978 to 1997, it posted an astonishing 17 out of 20 years correct (85% accuracy), a streak that caught people’s attention and gave the indicator pop culture legitimacy. But the 21st century has been far more sporadic:

- 2008: Giants (NFC) won, and the market crashed -38%

- 2018: Eagles (NFC) won, and the market dropped -6%

- 2021: Bucs (NFC) won, and the market climbed 27% (as predicted)

- 2022: Rams (NFC) won, and the market fell 19%

- 2023: Chiefs (AFC) won, yet the market surged 24%—the exact opposite of the prediction.

When the indicator works, believers celebrate vindication; when it fails, they manufacture explanations (“the Steelers were originally NFL, not AFL”). The accuracy rate has declined notably post-2000, and recent decades strongly suggest the correlation is weakening or, more likely, was always a pure coincidence.

Why Does It “Work”? Correlation vs. Causation

The Super Bowl Indicator’s psychological appeal is rooted in what humans do best: find patterns, even where none exist. We’re pattern-recognition machines desperate to impose order on chaos, and the market feels terrifyingly random while football feels knowable and controllable. If we can predict markets with a football game, we regain a sense of control—or at least the comforting illusion of it. But here’s the fundamental problem: correlation is not causation.

The Super Bowl result has zero actual impact on corporate earnings, Federal Reserve policy, employment data, GDP growth, geopolitical events, or any of the real market drivers that actually matter. Football and markets are completely independent systems. So why the early accuracy? Pure statistical luck over a small sample size. With a 50/50 proposition like “market up or down,” random chance should hit 50% accuracy—posting 70-85% over 20 years feels impressive but isn’t statistically significant enough to prove causation. Flip a coin 20 times, and you might get 14 heads; that doesn’t make the coin magic. We remember the hits and conveniently forget the misses, a classic case of survivorship bias. Dozens of other quirky “indicators” have been tried and abandoned—the Super Bowl Indicator survives not because it’s accurate, but because it’s memorable and fun.

Should You Actually Trade Based on It? Absolutely Not

There’s no fundamental connection between football and markets; declining recent accuracy proves the correlation was always random, and making portfolio decisions based on a game is gambling, not investing. Consider the opportunity cost: go to cash because the AFC wins and you miss gains; go all-in because the NFC wins and you’re exposed if markets tank. Real decisions should be based on risk tolerance, time horizon, and financial goals—not on who wins the Super Bowl. The only acceptable exception is tiny novelty bets with friends or using it as party banter, clearly separated from your actual strategy. What actually matters? Diversification, regular contributions, low-cost index funds, appropriate risk management, and emotional discipline.

Since we’re here, here are some other famous “indicators” Wall Street has entertained over the years, you shouldn’t be basing your trades on:

The Hemline Indicator: Short skirts signal bull markets (consumer confidence, showing leg), while long skirts predict bear markets (conservatism, covering up).

The Lipstick Indicator: Lipstick sales rise during recessions, driven by the “affordable luxury effect”—women buy small indulgences when they can’t afford big ones.

The Skyscraper Indicator: Record-breaking skyscrapers coincide with market peaks—the Empire State Building opened in 1931 during the Great Depression, and the Burj Khalifa opened in 2010 shortly after the 2008 crash.

The Sports Illustrated Swimsuit Issue Indicator: The cover model’s nationality supposedly predicts which region’s market will outperform—zero evidence, endlessly entertaining.

Why do silly indicators exist? Because markets are tough to predict, and we prefer comforting patterns to uncertainty. Blaming hemlines or football is easier than admitting we can’t predict markets. Accepting uncertainty is the honest approach to investing.

Enjoy the Game, Focus on What Actually Works

The Super Bowl Indicator is delightful Wall Street folklore—nothing more. Its early success was statistical noise, not market insight, and recent failures confirm what we always knew: football doesn’t move markets. Should you watch the Super Bowl, thinking about your portfolio? Only if it makes the commercials more entertaining. The real lesson here is to be skeptical of any market prediction that seems too easy or too fun: sound investing is boring, built on diversification, discipline, and long time horizons. This Super Bowl, enjoy the incredible athleticism, the creative commercials, and the halftime show. But when Monday morning comes, make your investment decisions based on fundamentals, not footballs.

If you’re looking for actual market insights that go beyond superstition—real-time alerts, proven scanning tools, and a community of serious traders who base decisions on data rather than game outcomes—that’s exactly what Trade Ideas delivers. While others watch the scoreboard for stock predictions, our AI-driven platform analyzes actual market movements, identifies genuine opportunities, and helps traders execute with precision. Skip the folklore and trade with intelligence. Learn more about Trade Ideas and start your free trial today!