Dan Mirkin and the Making of Trade Ideas

Dan Mirkin and the Making of Trade Ideas

By: Kyle Vallans

Editor’s Note: This article was originally published by SaveOnTrading and is republished here with permission. The interview reflects the words.

Who are you and what did you build?

My name is Dan Mirkin, and I am the founder and CEO of Trade Ideas. Trade Ideas is a real-time market scanning and idea generation platform built for active traders. It is designed to help traders identify opportunities as they develop, not after the move has already happened. From the beginning, the product has been built around streaming market data, speed, and automation. Those things matter if you are trying to trade actively.

What problem were you trying to solve when you started the company?

When we started Trade Ideas back in 2002, it was surprisingly difficult for traders to see when a stock was actually starting to move in real time. Charts existed, but quotes often required manually refreshing pages, and there was no reliable way for retail traders to continuously scan the market and surface opportunities as they were developing. I wanted what I described as a “surf report” for momentum. If something started to move, I wanted to know immediately and understand whether the move actually mattered. There were no tools that could do that at the time, so we built the entire technology stack from scratch.

How has Trade Ideas evolved since those early days?

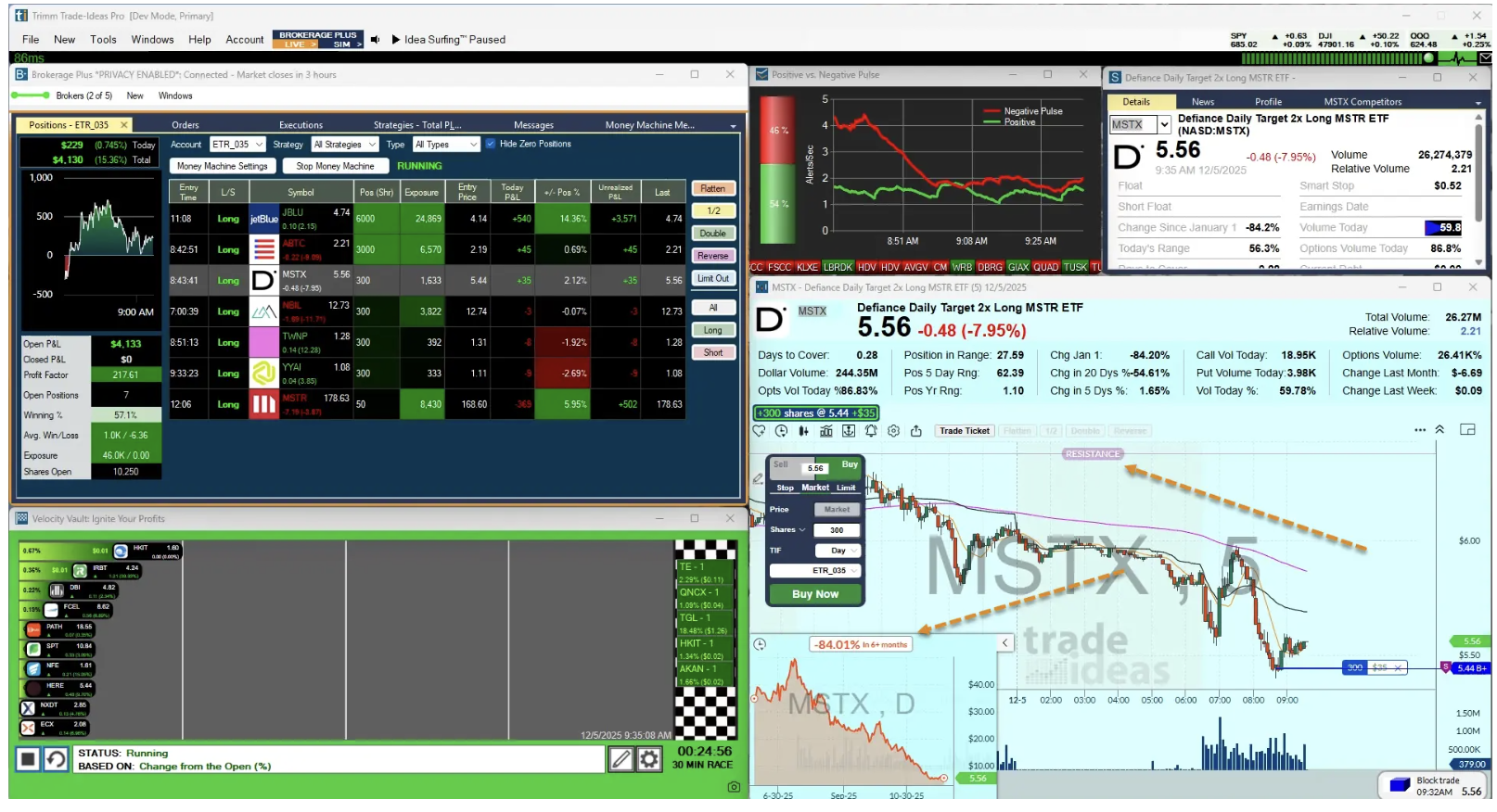

At its core, Trade Ideas remains a real-time scanning platform built for serious active traders. Instead of relying on static screeners, traders can monitor the market as it unfolds, from pre-market movers, stocks trading on elevated volume, volatility halts, strong closes for overnight momentum, parabolic small caps for shorts, large mean-reversion opportunities and so much more. If a strategy can be defined using simple if-then logic, it can be built directly into Trade Ideas and alerted in real time, with both custom scans and simpler screeners available.

As markets evolved and technology improved, the platform expanded well beyond scanning. Today, Trade Ideas includes custom charting, AI-powered backtesting, real-time idea generation, simulated trading, and automated trading, all built around streaming market data. It is designed for active traders who view speed as a structural edge. For investors focused purely on long-term fundamental analysis, it is probably not the right tool.

A lot of people say trading is just gambling. How do you think about that?

I really dislike that framing. It is often used to stigmatize self-directed traders. The goal of trading is not to mindlessly scalp in and out of names all day. For most traders, it is about identifying opportunities early and managing risk intelligently. Trading is about finding asymmetric opportunities where the risk and reward are clearly defined. One personal example that stands out is a position I identified in NBIS around $22 using one of my custom filters. The stock is now trading near $90, and I remain involved in the position today. That is what trading is really about to me. Identifying opportunities early, managing risk, and letting winners work.

How did your own trading background influence how Trade Ideas was built?

A lot. I was one of the original SOES bandits in the early and mid-1990s. That experience taught me two things early on. Markets can be beaten, but only with the right tools and the right approach. Speed and technology matter. Trade Ideas is essentially decades of active trading experience translated into software. One mistake I see traders make all the time is paralysis by analysis. Too many traders search endlessly for a perfect indicator that works all the time. It doesn’t exist. At some point, you have to develop feel. I often compare trading to putting in golf. You can understand the mechanics, but sinking putts still requires intuition and trust. That’s also why simulated trading plays such a big role in the Trade Ideas ecosystem. Traders can practice ideas repeatedly in real market conditions without risking real capital. That repetition builds intuition and shortens the learning curve dramatically for traders who are willing to put in the time.

How did Trade Ideas grow, and what keeps it different today?

In the early days, there was no flashy marketing. The first users found Trade Ideas through forums, word of mouth, and SEO. Traders were actively searching for answers, discovered the platform, and subscribed. Even today, with affiliates and email campaigns in the mix, the product is still its own best advocate. When people actually use it and invest the time to learn it, it sells itself.

The trading software space has become far more crowded over the years. There are plenty of solid tools available. What makes Trade Ideas different is that it’s built around real-time streaming, not static screening. It’s designed to surface opportunity as it develops, not after the fact. I often use this analogy: there’s nothing wrong with a Toyota. It’s reliable and gets the job done. But a Porsche is built for a very different experience. Trade Ideas is a Porsche for active traders.

Trade Ideas has never raised outside capital. The company is completely bootstrapped. We built it ourselves, without big money, and that alignment shows up in how we think about our users. Our subscribers are self-directed traders, and the company is self-directed too.

The business started with about $100,000 in self-funded capital back in 2002. Today, the team is roughly 25 people across technology, marketing, and leadership. Many of the executives are people I’ve known since the 1990s. Our CTO and I have known each other since high school, and my wife serves as CFO. That continuity has helped us avoid the kind of internal friction that often derails growing companies.

What does the future look like for Trade Ideas?

We’re focused on fully automated, AI-powered momentum trading. The long-term vision is full autopilot. A system that identifies opportunities, manages risk, exits positions, and rotates into new trades automatically. It’s a natural evolution for a platform that has always been built by traders, for traders, solving real problems in real time.