How a 13-Year-Old Turned $5K into $13K: The LFS Trade That Proves Discipline Beats Experience

How a 13-Year-Old Turned $5K into $13K: The LFS Trade That Proves Discipline Beats Experience

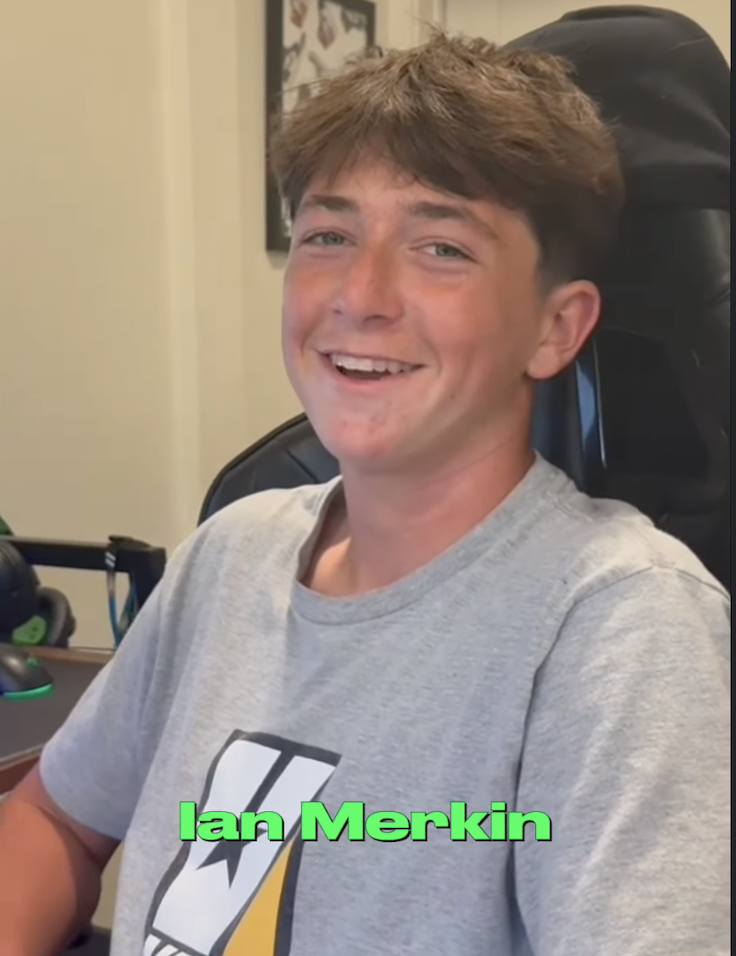

Meet Ian: 13 years old, son of Trade Ideas founder Dan Mirkin and now an unlikely case study in proper trade execution. Mirkin gave his son $5,000 to start learning the markets, and with guidance from the Trade Ideas team, Ian steadily built his portfolio to over $13,000. But his most recent win on Veterans Day? That was all him—and it was nothing short of a masterclass in discipline over experience.

While most traders slept in on the holiday morning, this 7th grader fired up the Trade Ideas scanner, found an explosive mover called LFS, waited patiently for a pullback to $2, set a hard stop loss at $1.80, took partial profits at $3, then went to football practice. When he returned home, LFS had spiked to $14. His response? “Cool, that worked.” No overthinking, no panic, no emotion—just execution.Ian’s LFS trade proves that successful trading isn’t about complex strategies, decades of experience, or sophisticated analysis. It’s about childlike simplicity: see the setup, take the shot, set your risk, and don’t overthink it. Kids fall down, get back up, and move to the next play without dwelling on mistakes. They live in the moment. They don’t carry emotional baggage from yesterday’s losses or paralyze themselves worrying about tomorrow’s opportunities. If a 13-year-old can execute this level of discipline while juggling homework and football practice, any trader can—the question is, will you?

Veterans Day Morning: A Child’s Eye View

On Veterans Day morning—markets open, schools closed—Ian fired up his Trade Ideas Docked Channel Bar scanner with one simple rule: watch, don’t predict. The scanner flagged LFS as an explosive mover, showing unusual volume and breaking into new highs. Everything screamed “chase this now!” But here’s where Ian’s youth became his edge. Kids don’t overthink—they observe and act with clarity that adults often lose. While LFS spiked, Ian resisted the magnetic pull to chase. Instead, he waited patiently for a pullback to around $2, a level that already showed volume and felt like safer entry terrain. No complex analysis, no paralysis—just simple pattern recognition. He entered 500 shares and immediately set a hard stop at $1.80, risking just $100 to see if he was right. No hope, no “I’ll watch it”—just mechanical execution. This 13-year-old had just demonstrated more discipline than most adult traders before his trade even began.

The Trade: Quarterback Instinct Meets Trading Discipline

As LFS pushed through $3, Ian consulted with the Trade Ideas team at his dad’s company. Their advice was simple: sell 100 shares immediately. He did, locking in approximately $100 in profit—exactly covering his stop-loss risk. Now his remaining 400 shares were pure house money, and the pressure evaporated. Then came the magic: he left. While most traders would sit glued to their screens, obsessing over every tick, Ian had to go to quarterback practice. And while he was out practicing, living in the moment, LFS silently exploded from $3 to $14.

This is where his dual identity as quarterback and trader converged perfectly. On the field, you make the read, execute, and move to the next snap. No “what ifs,” no overthinking, just presence. While Ian ran drills, his 400 remaining shares climbed $12 each from his $2 entry—$4,800 in unrealized gains he knew nothing about because he was too busy being 13.

When he returned home and checked his position, LFS had hit $14. He exited with several thousand dollars in profit on a trade that risked just $100. His response? “Cool, that worked.” Adults carry baggage from previous trades, worry about being right, and paralyze themselves with analysis. Ian just executed and moved on, proving that childlike presence beats adult anxiety every time.

What Ian Did Right (And What Most Adults Do Wrong)

Ian’s winning formula was deceptively simple:

- He let Trade Ideas find the mover instead of trying to predict it, waited patiently for the $2 pullback instead of chasing the spike.

- Set a non-negotiable stop loss at $1.80 the moment he entered.

- Sized appropriately with 500 shares on his $13K account so he could afford to be wrong

- Took partial profits at $3 to lock gains and remove pressure, let his winners run by literally going to football practice.

- Stayed completely unemotional throughout the process (quarterback mentality)—make the read, execute, next play.

Compare this to what most adults do: they chase breakouts with no patience, buying tops the moment alerts fire. They skip stop losses entirely, they size wrong, they panic-sell at the first sign of profit or ride winners all the way back down, and they overthink everything. They carry emotional baggage that prevents them from walking away, staying glued to screens in a state of constant stress and reactivity.

Ian’s advantage? Being 13. No bad habits to unlearn, no ego demanding he be “right,” childlike resilience that treats losses like falling down on the playground—just get up and run the next play. He lives in the moment, unburdened by yesterday’s losses or tomorrow’s anxieties. The uncomfortable truth: Ian has no MBA, no decades of experience, no six-figure account—yet he executed better than most professionals. Simple execution beats complex overthinking every single time.

The Real Lesson: If a 13-Year-Old Can Do This, What’s Your Excuse?

Let’s be clear: not every alert goes from $2 to $14. LFS was exceptional—that’s precisely why it’s a case study. Most trades hit stops or deliver small wins, and that’s perfectly fine. What’s repeatable isn’t the outcome; it’s the process:

- Using scanners to find setups, waiting for pullbacks instead of chasing, setting hard stop losses immediately

- Taking partial profits to reduce stress

- Letting winners run without micromanaging

- Staying unemotional and present.

LFS shows what’s possible with proper execution. One home-run winner can make your year—but only if you’re still in the game with capital preserved. Ian’s discipline positions him to make these trades. Most traders blow up before their “LFS” ever arrives. What made Ian successful wasn’t intelligence, experience, or account size. It was childlike simplicity: see it, take it, set your risk, don’t overthink. Quarterback instinct: make the read, execute, next play. Resilience: fall down, get back up, no dwelling. Trading isn’t complicated, but adults make it complicated. Ian proved on Veterans Day that simple execution, childlike wonder, and quarterback discipline beat experience and overthinking every time. If the owner’s 13-year-old son can turn $5K into $13K by following basic rules, so can you. Visit Trade Ideas today to relearn trading, the simple way.