From Film to Pharma: Kodak’s Billion-Dollar Transformation Under Trump’s Manufacturing Plan

From Film to Pharma: Kodak’s Billion-Dollar Transformation Under Trump’s Manufacturing Plan

Five years after COVID-19 first shook the world, its ripple effects still strain America’s healthcare system. Hospitals and pharmacies struggle with shortages of antibiotics, penicillin, chlorine, and other basic drugs, essentials that once seemed guaranteed.

Much of this crisis traces back to a single dependency: America’s reliance on China for essential medical supplies.

The pandemic exposed the risks of that reliance, leading many to rethink what’s in their medicine, who controls its production, and why it’s still made overseas.

This concern has sparked a crucial question: why aren’t we manufacturing these essential products domestically?

During his presidency, Donald Trump and his administration aimed to restore public trust and restructure the healthcare system, particularly in pharmaceutical resourcing.

In this article, we will explore how his administration reshaped the healthcare and pharmaceuticals industry, and why one particular stock stands to benefit as the nation moves beyond the pandemic.

How COVID-19 Affected the U.S Healthcare System

What Went Wrong?

The pandemic exposed critical vulnerabilities in America’s supply chain, especially in essential healthcare and pharmaceutical manufacturing.

Several long-standing issues came together to create this crisis:

- Offshore dependence: Over decades, production of essential drugs and ingredients moved overseas in pursuit of lower costs.

- Fragile supply chains: Just-in-time inventory systems left no buffer when borders closed and exports stalled.

- Lack of domestic investment: Limited U.S. manufacturing capacity for pharmaceuticals and chemicals meant there were few fallback options.

Together, these factors turned a health emergency into a supply-chain disaster.

Impact on Healthcare

As supply lines collapsed, hospitals faced severe shortages of basic antibiotics, anesthesia drugs, and chemical components critical to making generics.

Some facilities were forced to delay or alter treatments, and prices for many medications surged.

Meanwhile, gaps in chemical production left the nation scrambling for key pharmaceutical ingredients, making the problem worse.

A National Security Wake-Up Call

These weaknesses extended far beyond healthcare. China’s dominance in pharmaceutical and chemical manufacturing raised serious concerns about:

- Quality control and contamination risks.

- Limited regulatory oversight of foreign facilities.

- Over-reliance on single-country sourcing.

The inability to produce essential medicines domestically exposed a national security vulnerability. Policymakers from both parties began calling for urgent reshoring of critical manufacturing to U.S. soil.

Realization

By 2025, it had become clear that foreign dependency wasn’t just an economic issue; it was a matter of national survival.

Although progress has been made, there are still about 270 active drug shortages across the U.S., only slightly lower than the 2024 peak, a clear sign that vulnerabilities remain.

The pandemic permanently changed how America views healthcare resilience.

What began as a supply-chain problem has now evolved into a strategic priority, shaping policies, investments, and market opportunities aimed at restoring U.S. manufacturing strength.

Trump’s Domestic Manufacturing Initiative

Trump’s plan to reshore U.S. manufacturing has been in development for some time, and his administration is now to roll out large-scale implementation.

The initiative represents one of the most significant industrial shifts in recent decades, driven by a clear goal to

“bring home production that America has long outsourced overseas.”

Key Pillars of Trump’s Manufacturing Strategy

The administration’s policy framework is built around three core pillars designed to accelerate domestic production and attract U.S.-based investment:

- Tax Incentives:

Substantial tax credits and deductions for companies that relocate or expand their manufacturing operations within the United States. - Regulatory Streamlining:

Simplified approval processes and reduced bureaucratic delays to help domestic producers scale faster. - Protective Tariffs:

Strategic tariffs on imported goods that directly compete with U.S.-made products encourage companies to produce locally rather than abroad.

The initiative focuses on critical industries such as pharmaceutical manufacturing, medical supplies, semiconductor production, and essential chemical manufacturing. Kodak is positioned as an early participant in this reshoring movement.

Is Kodak a Prime Candidate for Pharma Manufacturing?

The administration has introduced significant economic incentives to encourage companies to bring production back to the United States. These include:

- Tax credits covering up to 40% of relocation costs.

- Accelerated depreciation allowances for new manufacturing equipment.

- Preferential treatment in government contracts.

This initiative is set to roll out from 2025 to 2027, with an initial focus on the reshoring of medical supplies and pharmaceutical ingredients.

Companies with ready manufacturing capacity and strong financial positions, like Kodak, stand to benefit early as demand for domestic production surges.

Kodak’s Transformation and Strategic Position

Kodak’s transformation from a photography giant to a cutting-edge chemical manufacturer represents one of the most strategic pivots in American industry. Since divesting from its traditional film business, Kodak has quietly built robust chemical manufacturing capabilities while maintaining pharmaceutical production infrastructure from its film-making days.

With a recently improved balance sheet and strong liquidity, Kodak is well-positioned to lead the resurgence of critical manufacturing in the U.S. The company has FDA-approved facilities and decades of expertise in precise chemical processes, making it an ideal candidate for retooling operations to produce essential drugs and chemicals.

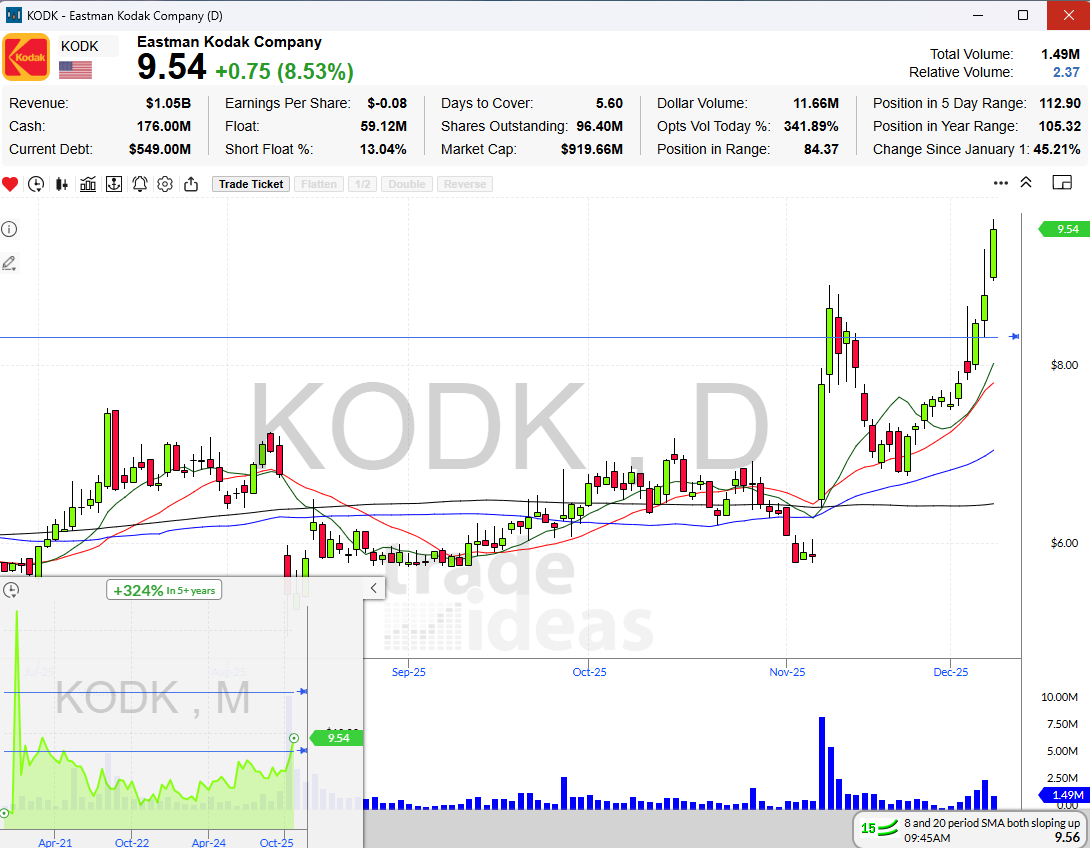

The Chart Confirms the Story

While traders should approach speculation cautiously, Kodak’s stock performance supports this narrative. The stock has surged over 50% following the election, driven by heightened institutional interest in domestic manufacturing plays.

Technical analysis reveals a strong upward trend with multiple higher lows, while trading volume has significantly increased, indicating growing institutional accumulation. Major investment firms have initiated coverage, citing Kodak’s potential role in pharmaceutical manufacturing independence as a key growth driver. Analysts project a potential revenue expansion of 200-300% over the next three years as domestic manufacturing capabilities come online.

Industry-Wide Implications

The reshoring of chemical and pharmaceutical manufacturing under the Trump administration is expected to have widespread economic ripple effects.

As domestic production expands, the initiative could strengthen U.S. supply chains, reduce foreign dependency, and trigger growth across multiple sectors, marking a pivotal shift in America’s industrial landscape.

Economic and Job Growth Outlook

The chemical manufacturing sector alone is projected to add 50,000-75,000 high-skilled jobs in the first phase, while pharmaceutical production reshoring could create an additional 100,000 positions across the supply chain.

Beyond direct employment, this manufacturing renaissance is expected to generate significant economic multiplier effects:

- Each manufacturing job is estimated to support 3.4 additional positions in related industries such as logistics, support services, and infrastructure development.

- The concentration of new production facilities in traditional manufacturing regions could revitalize local economies and stimulate regional growth.

- When accounting for direct and downstream effects, the overall annual economic impact is projected to exceed $50 billion.

Key Investment Opportunities

What does this mean for traders? The domestic manufacturing initiative presents multiple investment opportunities beyond direct plays like Kodak. Key beneficiaries include:

- Logistics providers supporting manufacturing expansion.

- Automation technology firms are enhancing production efficiency.

- Industrial real estate investment trusts (REITs) are benefiting from increased demand for manufacturing facilities.

- Construction, utilities, and specialized equipment manufacturers supporting infrastructure development.

Savvy investors are building diversified portfolios across this ecosystem, with a focus on companies with established capabilities in pharmaceutical and chemical manufacturing support services.

Strategic Market Outlook

The U.S. manufacturing revival continues to gain traction through late 2025, supported by new federal incentives, infrastructure investment, and reshoring initiatives.

Industries like pharmaceuticals, semiconductors, and advanced materials remain at the center of this growth wave, creating steady opportunities for investors.

Positioning Strategy

- Focus on proven players: Companies already expanding or retooling U.S. facilities offer early exposure to the reshoring trend.

- Add support sectors: Infrastructure, automation, and logistics firms are expected to benefit as domestic capacity scales.

- Maintain flexibility: Keep a portion of cash available for entry during policy announcements or project milestones. (Verify allocations based on individual risk tolerance.)

Risks to Watch

- Possible delays or cost overruns on major projects.

- Shifts in tariff or tax policies.

- Short-term valuation spikes in popular reshoring stocks.

Final Thoughts

As America moves toward a domestic manufacturing renaissance, several factors will determine the success of this ambitious reshoring initiative. While policy execution may face challenges from international trade tensions and supply chain restructuring, companies like Kodak are well-positioned to lead this transition with their infrastructure and financial strength.

Investors should take a balanced approach, focusing on established manufacturers while remaining alert to opportunities in supporting industries. Navigating policy risks and market adaptation challenges will be key, but the potential rewards for investors and the future of American manufacturing independence appear substantial.

To stay ahead of these emerging opportunities and track breakout stocks like Kodak, visit Trade Ideas today. Our Stock Races feature helps identify leading companies in this manufacturing renaissance, while our real-time scanning and AI-powered analytics help you spot opportunities before they make headlines.