Smart Risk Control: Day Trading Risk Management Strategies

Smart Risk Control: Day Trading Risk Management Strategies

“I have my rules written down, but executing them when money is involved is the hard part.”

That line, shared by a trader online, says it all. Risk management sounds simple, but it’s the toughest skill to master.

It’s even tougher when you’re trading with a small account. Many new traders start with around $2,000, facing limits like the PDT rule and the pressure to prove themselves fast. That’s exactly when emotions take over and rules start to slip.

In moments like these, one principle matters more than any strategy: protect your capital first.

This guide walks you through clear, practical ways to manage risk, stay disciplined, and build lasting consistency in your trading journey.

10 Key Risk Management Strategies for Day Traders

Every trade is a test of discipline. The goal isn’t perfection, it’s control.

Day trading rewards those who know how to stay steady when the market isn’t.

Below are ten focused approaches that help traders stay balanced, protect their capital, and trade with purpose even when the screen turns red.

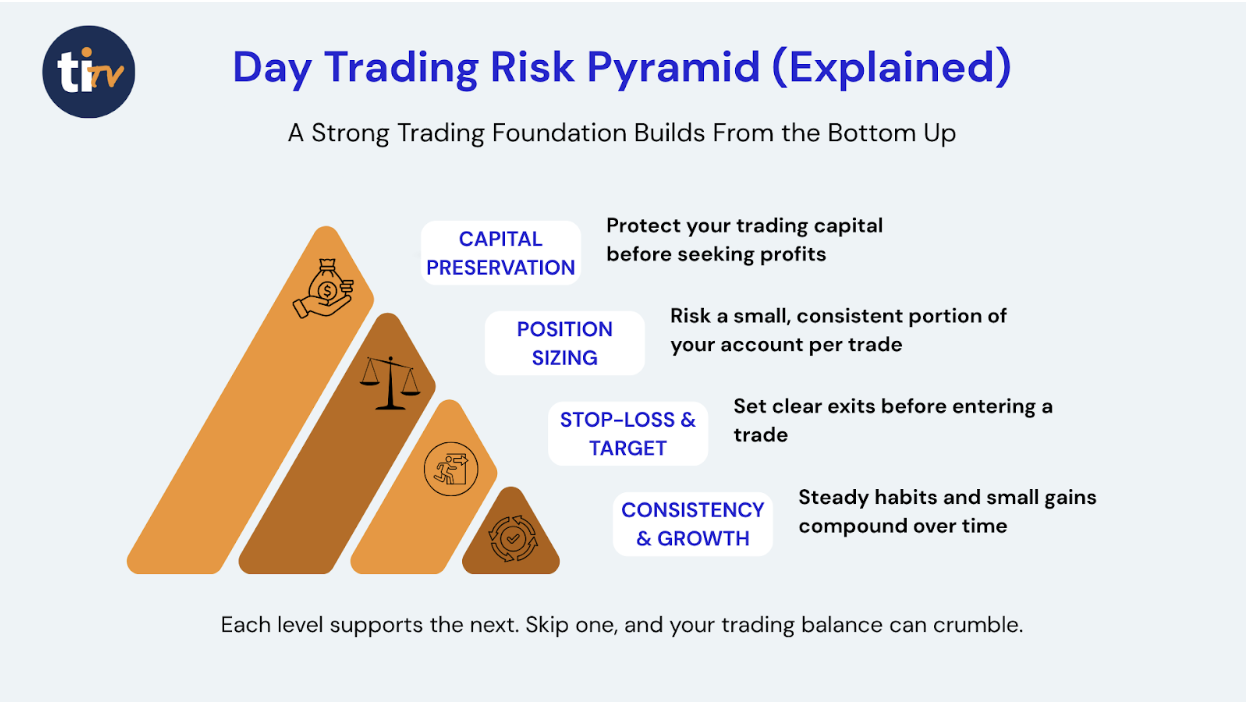

This pyramid shows how each layer of trading discipline supports the next, from protecting capital to achieving consistent growth.

1. Determine Your Risk Beforehand

Before entering any trade, ask yourself one question:

“How much am I willing to lose if this trade fails?”

That number defines your survival, not your profit target. Too many traders focus only on potential gains and ignore the downside. Smart traders reverse that mindset.

Set a maximum dollar or percentage risk per trade before you even click “buy”. Many professionals stick to 1% or less of their account balance per position.

Then go a step further:

Can you emotionally live with the total loss from your worst losing streak?

Understanding your personal pain threshold is essential. If ten consecutive losses would devastate you, you’re risking too much. Adjust until the potential drawdown feels tolerable; that’s your real comfort zone.

2. Control Risk with Position Sizing

Position sizing is how you translate your risk tolerance into real trade size.

If you risk 1% on a $10,000 account, your maximum loss per trade is $100.

If your stop loss is $1 away from entry, you can buy 100 shares.

That’s it; simple math protecting your capital.

Position sizing helps prevent emotional trading because you already know your worst-case scenario. It also evens out results across winning and losing streaks. Whether you’re winning or losing, your exposure stays consistent, not dictated by emotion or impulse.

3. Set Your Maximum Daily and Trade Risk

Day trading is fast and emotional. You need rules that protect you from yourself.

Create a daily maximum loss limit, a point where you stop trading, no matter what. For example, if you risk 1% per trade, you might set a daily cap of 3% of your account.

Once that’s hit, walk away. The market will be there tomorrow.

This rule keeps one bad day from turning into a disaster. It’s also a mental reset. The best traders know: sometimes, not trading is the best trade.

Plan for the worst before it happens.

Imagine a streak of losses; can your account and your mind survive it? That’s smart risk control.

4. Use Stop-Losses with Discipline

A stop-loss is your automatic exit; your first line of defense against large losses.

Set your stop based on market structure, not emotion.

- Below support if you’re long.

- Above resistance if you’re short.

Once it’s placed, don’t move it further away, hoping the trade will turn around. That’s no longer risk management; that’s denial.

Traders who treat stops like seatbelts survive. Those who remove them because “this time is different” don’t.

5. Lock In Profits and Manage Winners Wisely

Protecting profits is as important as limiting losses.

Use tools like trailing stops or partial profit-taking to secure gains without cutting off potential upside.

Avoid the opposite trap: exiting too early out of fear. If your plan says your target is $3 per share, don’t bail out at $1 just because the price hesitated.

Good trading risk management means controlling your downside and letting your upside develop.

6. Cut Losses Quickly and Move On

It sounds simple, but it’s the rule most traders break.

Human emotion pushes us to hold on to losing trades (“it’ll come back”) and sell winning ones too early (“don’t lose the gain”).

The fix is structure:

- Always predefine your stop and target.

- Follow your plan even when emotions argue otherwise.

- Use alerts or automation to help you stay disciplined.

Remember: your long-term results depend more on how you manage losers than on how often you win.

Also read: 10 Reasons Why Automated Trading Systems Will Dominate the Next Bull Market

7. Manage Emotional and Psychological Risk

Trading isn’t just charts and numbers; it’s mindset and emotion.

After a series of losses, many traders panic, abandon their system, and jump to another. This “strategy hopping” destroys consistency.

Losses don’t mean your strategy is broken; they’re part of the statistical cycle. If your system is backtested and proven, stick to it through the drawdown.

To stay grounded:

- Take breaks after big losses.

- Keep a trading journal to identify emotional patterns.

- Review your mindset before each session.

Your mental resilience is your edge. Smart trading risk management starts in your head, not your chart.

8. Backtest and Simulate Before You Trade Live

Before risking real money, you must experience losing streaks in a safe environment.

Backtesting and paper trading let you see how your system behaves through wins and losses. More importantly, it teaches you what it feels like to endure a drawdown.

Run your strategy for months and not weeks before going live.

Track every trade, note the longest losing streak, the biggest drawdown, and your average win/loss ratio.

When you move to live trading, there will be no surprises, just execution and discipline.

9. Set Operational Safeguards

Sometimes the biggest risk isn’t the market, it’s your setup.

Have protection plans in place for:

- Platform crashes: Keep broker phone numbers handy.

- Internet outages: Backup connections or mobile hotspots.

- Order entry mistakes: Double-check quantity and direction before confirming.

- Over-leverage: Avoid excessive margin; it magnifies both profit and pain.

These operational safeguards ensure that technical errors don’t become financial disasters.

10. Build Your Personal Trading Risk Management Plan

No two traders are the same. Your risk plan should reflect your psychology, account size, and lifestyle.

Here’s a simple structure:

- Define your risk per trade (e.g., 0.5%–1%).

- Set a daily loss cap (e.g., 3% max per day).

- Establish your stop-loss and target ratio (minimum 1:2 or 1:3).

- Create emotional triggers (e.g., stop trading after 3 losses).

- Review weekly, adjust based on results and comfort level.

Write it down. Follow it daily. That written plan becomes your trading constitution.

Final Thoughts: Trade Smart, Protect Your Capital

The secret of consistent trading isn’t prediction; it’s protection.

Losses are unavoidable, but devastation is optional. The best traders accept small losses, manage risk with precision, and let time compound their edge.

Remember this rule:

The goal isn’t to avoid losing, it’s to make sure no single loss can take you out of the game.

Trade smart. Respect risk. Stay disciplined. Because in trading, control is profit.

Related Reads

How AI Day Trading Improves Your Trading Success

Swing Trading vs. Day Trading: Understanding the Differences and Benefits

Common Questions Answered About Day Trading Risk Management

How do you stay disciplined when it’s hard to follow your risk plan?

Print your trading rules and keep them visible. Reading them before every session reinforces discipline and helps you follow your plan even when emotions rise during live trading.

How long should I wait before trading again after a loss?

Take a minimum 15–60 minute break after a losing trade. This “cool-off rule” prevents emotional decisions and helps you reset your mindset before re-entering the market.

What should I do if I keep revenge trading?

Pause immediately after any emotional loss. Reduce your position size or switch to paper trading temporarily. Revenge trades come from emotion, not logic. Stepping back helps protect your capital.

How can I reduce anxiety while trading?

Set price alerts and stop-losses in advance, then avoid staring at charts. Overwatching creates stress and impulsive reactions. Let automation handle monitoring so you can trade calmly and objectively.

How do I track emotions in my trading journal?

Along with trade details, note how you felt before and after each trade: anxious, confident, angry, etc. Over time, patterns reveal which emotions lead to mistakes or better decisions.