How to Use AI for Day Trading (8 Best Ways Included)

How to Use AI for Day Trading (8 Best Ways Included)

You know that feeling when you’ve spent hours watching chart patterns, convinced you’ve finally “cracked” the pattern… only for the market to do the exact opposite five minutes later? Every day trader has been there: staring at the screen, caffeine in hand, wondering if the charts are mocking you.

Here’s the thing: it’s not that you’re bad at reading trends. It’s that the market moves faster than human decisions can react. That’s where AI quietly comes in, not as some Wall Street robot ready to replace you, but as a partner that helps you see what your eyes miss.

AI can process thousands of data points while you’re still deciding whether to hit “buy” or “wait a second.” It’s like having a co-pilot who doesn’t panic when the graph dips. And the best part? You don’t need to be a coder or a quant to use it effectively; you just need to know how to make it work for you.

In this blog, we’ll walk through eight practical ways to use AI for day trading: tools, techniques, and strategies that help you trade smarter without losing money (or your time).

Let’s dig in and make sense of this whole AI-meets-trading thing, one step at a time.

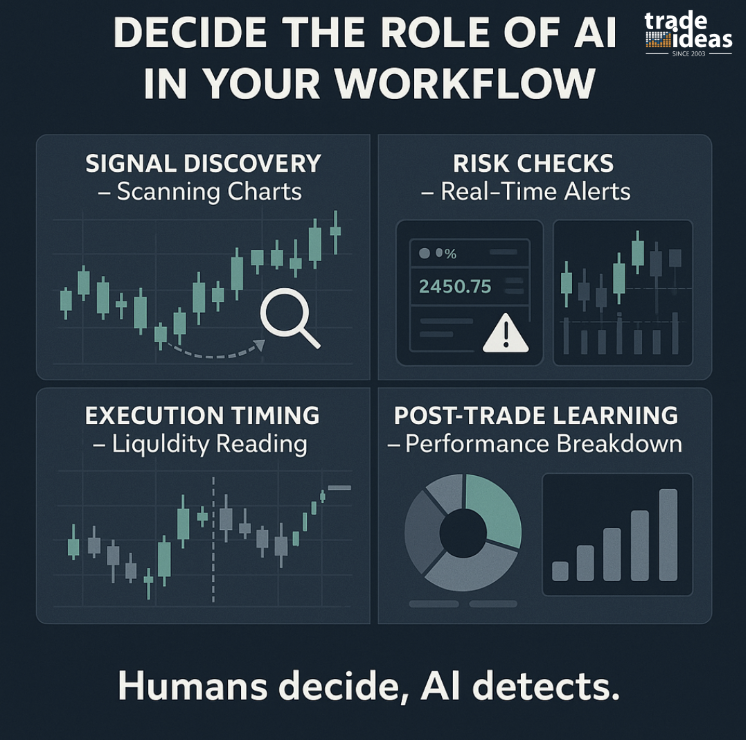

Decide the Role of AI in Your Workflow

AI can give you a real trading edge, but only when applied with precision. Leverage its strengths where speed, data scale, and pattern recognition outperform human capabilities:

- Signal discovery: Use AI to scan hundreds of charts for specific triggers, breakouts, volume imbalances, or momentum shifts. It’s fast, objective, and never fatigues.

- Risk checks: Let AI handle real-time alerts for drawdowns, oversized positions, or overexposure to correlated names. This keeps your risk tight without constant manual oversight.

- Execution timing: AI can read order flow and volume shifts faster than you can blink. Use it to time entries when liquidity aligns.

- Post-trade learning: AI breaks down trade history to show which setups actually deliver. No bias. Just data.

Set Hard Human Boundaries:

Interpreting breaking news, managing halts, and reading illiquid price action still require trader intuition. These are judgment calls, AI can’t (and shouldn’t) replace them.

Also Read: Swing Trading vs. Day Trading: Understanding the Differences and Benefits

Stick with the Best Supporting Strategy

AI delivers best when paired with fast, repeatable setups. Build your signal stack around three proven day trading edges:

- Momentum bursts on range breaks

- Mean-reversion snaps after exhaustion

- News or volume shocks are driving sudden liquidity shifts

Feed your signals data like relative strength vs. sector, float/liquidity screens, premarket range, opening drive behavior, and microstructure cues (spread, depth, bid/ask shifts).

Keep signals modular, test one variable at a time. Use rolling windows and walk-forward splits to avoid look-ahead bias and validate performance in real market conditions.

AI handles the scanning and filtering. You focus on execution.

Backtesting Mindfully

A backtest is only useful if it reflects real market conditions. Many traders unknowingly fool themselves, especially when using AI. Here’s how to keep your testing honest:

Use chronological splits only, never shuffle time. You’re trading forward, not guessing backwards. Set your entry and exit rules first, then optimize one variable at a time. Don’t move the goalposts mid-test.

Track useful performance stats: Look at:

- Win rate (how often you win)

- Profit factor (total profits vs. total losses)

- Expectancy (average gain/loss per trade)

- Time in trade (how long you’re exposed to risk)

- Max adverse excursion (how far a trade moves against you before it works)

- Slippage-adjusted P&L (profit after accounting for real fill prices)

Include all trading costs, such as slippage, spread, commissions, and market impact. Day trading margins are tight; ignoring costs makes your results meaningless.

Volatility & Regime Filters

Signal performance is highly dependent on market conditions. Apply volatility and time-based filters to control when a strategy is active.

- Segment the day into regimes: Open, midday, and closing hour, each with distinct behavior and liquidity profiles.

- Classify volatility states (e.g., calm vs. expansion) using rolling ATR, range statistics, or implied vol metrics.

Use regime-specific rules to prevent signal crossover—momentum setups, for example, often degrade during low-volatility periods.

Review results by regime. If a strategy underperforms in certain conditions, reduce exposure or deactivate. AI can assist in detecting regime shifts, but execution logic must remain conditional and context-aware. This keeps your system adaptive, not overfit.

News & NLP the Right Way

Natural Language Processing (NLP) should be used to extract context and assess directional risk, not to generate naive buy or sell signals. Apply it to identify events with potential to trigger volatility: earnings surprises, guidance revisions, downgrades, or macroeconomic prints.

Analyze sentiment polarity and headline strength, then map them to volatility regimes and risk parameters. Ensure your NLP models align with your trading timeframe — most edge from news decays rapidly.

If your system cannot act within the defined latency window, the signal is no longer valid. Focus on event classification and impact mapping, not raw text classification. Open-source models like FinBERT are useful starting points but require rigorous customization to produce actionable insights.

Entry, Exit, and Position Sizing Rules

A robust trade execution framework prioritizes consistency, clarity, and real-time reliability over complex logic.

- Entry conditions should include both signal confirmation and market quality filters such as spread thresholds, order book depth, and real liquidity.

- Exit logic should combine level-based stops (e.g., 1.5R or technical invalidation) with time-based exits to limit exposure in low-conviction environments.

- For position sizing, fixed-fractional methods (e.g., risking 0.5% of equity per trade) help maintain account stability. Introduce dynamic throttling after drawdown thresholds (e.g., post 2R loss).

Continuously monitor realized slippage versus modeled expectations, and adjust order sizing or execution style when degradation is detected.

Realistic Execution: Slippage, Queue, and Market Impact

Execution assumptions must be stress-tested under real market conditions. Expect fill degradation during high-activity periods, especially the first five minutes after the open or immediately following economic news releases.

Measure slippage across key dimensions: execution venue, time-of-day, and spread percentile. Monitor queue position versus displayed liquidity to evaluate fill quality.

Update execution cost models frequently to account for market structure shifts. Recognize that as trade frequency and order size increase, so does market impact, compressing profit margins. AI models must account not only for price direction but also for expected execution cost. If projected slippage exceeds forecast edge, the trade should be disqualified.

Controls, Risk Safeguards, and Audit Protocols

- Automated and AI-assisted trading systems require embedded safeguards to manage operational and financial risk.

- Implement hard risk limits at the account level, including absolute dollar loss caps and drawdown-based kill-switches that pause trading after a predefined sequence of losses or abnormal volatility events.

- Maintain a detailed log of every parameter change, strategy deployment, and model adjustment, with time-stamped documentation.

- Tie each trade to a strategy ID to enable post-trade analysis, audit compliance, and system-level attribution.

Final Thoughts: Precision Over Automation

AI can strengthen day trading when applied with discipline and clear purpose. Use it where it provides a measurable advantage: signal generation, risk monitoring, execution precision, and post-trade analysis. Every component should be tested in live market conditions and measured against real trading costs.

Do not overcomplicate the process. Prioritize what improves edge and protects capital. Keep your models focused, your logic transparent, and your risk controls strict.

AI is a tool to support the trader, not replace critical thinking or market awareness. The edge comes from combining automation with experience, structure, and control.

Related Reads

- Understanding Stock Market Fluctuation and Opportunities

- Ways to Use Chart Patterns to Predict Stock Moves

FAQs

What is the 3-5-7 Rule in Trading?

It is a profit-taking strategy where you scale out at predefined reward levels:

- Take partial profits at 3R and 5R

- Let the rest run toward 7R or more

This balances risk and reward, helping you lock gains while still capturing bigger moves.

What is the 90% Rule in Trading?

Roughly 90% of traders lose money because they lack a real edge, risk discipline, or a repeatable process. This rule is a reminder that without structure, the odds are against you.

What is the $25,000 Rule for Day Trading?

U.S. traders with margin accounts must maintain a minimum balance of $25,000 to place more than 3 day trades in 5 days. Falling below this restricts further day trading.

Why Does 99% Fail in Trading?

Most fail due to poor risk management, emotional decisions, overtrading, and unrealistic expectations. Without a tested edge and discipline, long-term success is unlikely.