October Effect: Trading Volatility Season Smart

October Effect: Trading Volatility Season Smart

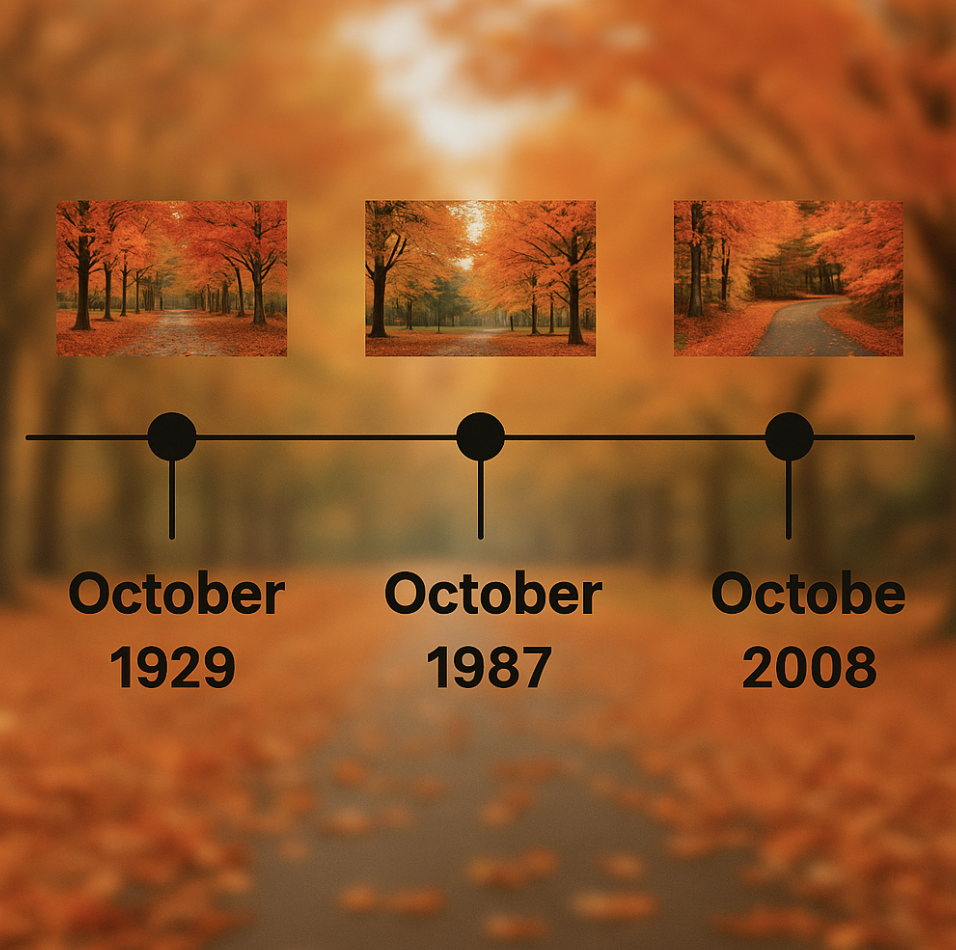

October carries a notorious reputation in financial markets as the month when portfolios can disappear overnight, etched into trader psychology by the crashes of 1929, 1987, and 2008. While retail investors often view October with dread, experienced traders recognize this volatility as the market’s annual wealth transfer mechanism. October is a time when systematic, prepared strategies can capitalize on the panic and uncertainty that drive less disciplined participants to make costly emotional decisions. The October Effect isn’t just about historical crashes; it represents a predictable pattern of institutional repositioning, seasonal psychology, and technical setups that create some of the year’s most profitable trading opportunities.

Understanding these dynamics allows sophisticated traders to position themselves strategically for the volatility season, using October’s reputation for chaos as the foundation for systematic year-end profits. Rather than avoiding October’s storms, smart traders learn to navigate them with proper preparation, risk management, and a systematic approach that turns market fear into consistent opportunities.

The Data Behind October Volatility

Over the past two decades, October has consistently delivered 40% higher average daily volatility than the summer months, with the VIX typically spiking above 25 during October periods compared to sub-20 readings in July and August. Statistical analysis reveals that while October accounts for only 8.3% of trading days annually, it has generated nearly 15% of the year’s most significant single-day market moves, both positive and negative. Sector-specific data indicate that technology and financial stocks experience their greatest volatility during October, while defensive sectors, such as utilities and consumer staples, often bottom out mid-month before initiating sustained rallies. The “October Bottom” phenomenon has proven remarkably persistent, with major market lows occurring in October during 14 of the past 20 years, often triggered by institutional rebalancing as fund managers adjust portfolios ahead of year-end reporting requirements.

This institutional activity creates a predictable pattern where October’s initial volatility and selling pressure typically transition into November’s seasonal strength, as the same institutions that drove October weakness begin positioning for the historically strong November-December period. Understanding this data-driven progression allows experienced traders to anticipate both the timing and magnitude of October’s volatility while positioning strategically for the subsequent seasonal rally that often follows the month’s chaotic reputation.

Sector Rotation Strategies for Autumn Markets

October’s sector rotation patterns follow predictable institutional flows that savvy traders can anticipate and exploit. Healthcare, utilities, and consumer staples typically outperform during October’s initial volatility as investors seek defensive positioning, while energy stocks often exhibit unique strength due to winter heating demand forecasts and seasonal refinery maintenance cycles that affect supply dynamics. The technology sector’s behavior presents the most complex October pattern: initial weakness as growth stocks are hammered during volatility spikes, followed by an aggressive recovery as institutional buyers recognize oversold conditions in quality names.

Financial sector positioning becomes critical ahead of year-end reporting, with banks and brokers often underperforming early in October due to interest rate concerns before rallying on earnings expectations and year-end trading volume increases. The small-cap versus large-cap divergence reaches its annual peak in October, with small caps typically underperforming during the month’s volatility before leading the market higher in November, when the seasonal strength period takes hold.

International market correlations spike during October volatility, often exceeding 0.8 as global risk-off sentiment dominates, but these correlations typically break down by month-end as regional factors reassert themselves. Understanding these rotation patterns allows traders to position defensively during October’s chaos while preparing for the sector leadership changes that typically emerge as the month progresses toward November’s traditionally strong seasonal period.

Advanced Scanning and Risk Management for October Markets

October’s heightened volatility demands sophisticated scanning strategies combined with enhanced risk controls to capitalize on opportunities while protecting capital. Volatility-based scans should focus on stocks experiencing 2-3 standard deviation moves from their 20-day average, as these often represent oversold bounce candidates during October selloffs when institutional selling creates temporary mispricings in quality names. Momentum scanning becomes crucial for identifying post-correction breakouts, particularly using relative strength analysis to find stocks that hold up better than their sectors during October weakness—these often become the leaders when markets recover. Volume-based filters prove essential for detecting institutional accumulation, with particular attention to unusual volume spikes combined with price stability, indicating smart money positioning during market chaos.

Multi-timeframe scanning helps identify October reversal patterns by confirming daily oversold conditions with weekly support levels, creating higher-probability setups for contrarian plays. However, these opportunities require significantly adjusted risk management parameters to account for the unpredictable nature of October. Position sizing must be reduced by 30-50% during peak volatility periods, as normal position sizes can create devastating losses when October’s outsized moves occur. Stop-loss modifications become critical—traditional 8% stops often get triggered by normal October volatility, so wider 12-15% stops or volatility-adjusted stops using ATR measurements help avoid premature exits.

Money Machine Adaptations for October Markets

October’s extreme volatility requires fundamental adjustments to Money Machine parameters that extend far beyond typical seasonal tweaks. Automation settings must be recalibrated for 40% higher daily volatility, meaning stop-loss parameters need to be widened from typical 8-10% levels to 12-15% to avoid premature exits from normal October price swings. Meanwhile, position sizing should be automatically reduced by 30-50% to account for the potential for outsized moves. Enhanced risk controls become non-negotiable during October, including:

- Daily loss limits that pause automation when reached

- Correlation filters that prevent over-concentration in sectors moving together during stress periods

- Volume confirmation requirements are doubled to ensure institutional participation rather than retail panic-driven moves.

Seasonal strategy modifications within automated systems should shift from momentum-chasing approaches that work in calmer months toward mean-reversion strategies that capitalize on October’s tendency for oversold bounces and false breakdowns. However, October demands significantly more active Money Machine oversight than other months—the “set it and forget it” mentality that might work in stable periods becomes dangerous when October’s unpredictable reversals can trigger multiple false signals within hours.

Turning October Uncertainty into Opportunity

October represents the market’s annual wealth transfer from unprepared traders who panic during volatility spikes to systematic traders who understand that chaos creates opportunity. While emotional participants flee at the worst possible moments, disciplined traders armed with proper tools and strategies position themselves to capitalize on the predictable patterns within October’s apparent madness. Trade Ideas’ sophisticated scanning capabilities and Money Machine automation provide the systematic framework necessary to identify and execute these opportunities while managing the heightened risks that destroy undisciplined approaches. However, success requires more than just deploying advanced technology—October demands active oversight, parameter adjustments, and the kind of strategic thinking that transforms powerful tools into profitable outcomes.

The traders who master October’s complexities using systematic approaches don’t just survive the month’s volatility; they use it as the foundation for year-end profits that compound their success. For those ready to move beyond emotional trading toward systematic opportunity capture, October’s challenges become the proving ground where sophisticated tools and disciplined execution separate long-term winners from the crowd that consistently buys high and sells low during the market’s most predictable wealth transfer period.