Trade Ideas’ Money Machine: A New Era in Automated Trading

Trade Ideas’ Money Machine: A New Era in Automated Trading

By: Shane Neagle

Automated trading has advanced to far beyond basic scripts and static algos. Today’s traders are looking for tools that do much more than send alerts, they want automation with intelligence, responsiveness, and ensuring it is aligned with their strategy. That is where Trade Ideas continues to take the leading role: Trade Ideas is able to provide traders, not only data and signals, but also hands-off execution that is a reality in today’s fast-paced markets.

The Money Machine is the most recent evolution of that aim: a fully-capable, end-to-end trading engine built directly into the Trade Ideas ecosystem. The aim is for traders who want more consistency, speed, and control to be able to fully automate signal identification, order execution, and risk management; without writing a single line of code.

In this article we will talk about how the Money Machine works, how traders can train with it in Simulation Mode, and then transition to full automation through supported broker integrations. We will also provide tips in an effort to improve performance, reduce risk, and how even dividend type investors can automate to meet their long-term income objectives.

What is the Money Machine?

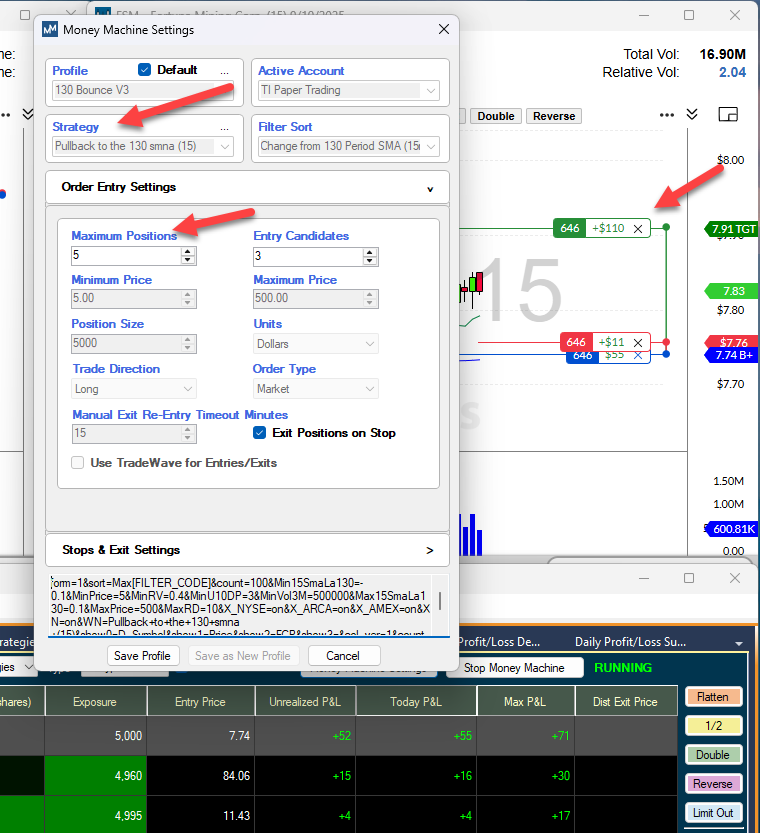

The Money Machine is Trade Ideas’ completely integrated, end-to-end automated trading engine. It allows traders to implement their entire trading strategies from identifying signals all the way through order routing and risk management, with no manual involvement. The Money Machine is an automated trading engine residing within the Trade Ideas platform, providing a bridge from generating ideas to real-world execution with speed, accuracy, and scalability.

The Money Machine’s major differentiation is its seamless integration with Trade Ideas artificial intelligence strategies, custom filters, and the Brokerage Plus module. Brokerage Plus connects directly with supported brokers (Interactive Brokers, E*TRADE, etc…) to place live orders based upon pre-set rules. It doesn’t matter if you are executing AI driven strategies from the platform (Holly and Holly Grail) or your own custom configurations, Money Machine can execute in the background free of human interaction, from entry to exit.

The Money Machine automates risk management elements such as position sizing, stop-loss, profit objectives, and exit timing, prior to the trade. The Money Machine executes trades instantaneously based on trade triggers, without delay or hesitation–its a cadence advantage when a matter of a few seconds in a trade can make a difference.

Equally important, the Money Machine extracts the emotion that commonly creates problems for traders. There is no panic selling, no over trading, and no adopting impulsive decisions. Every step follows your logic, and is done exactly how you would like. This offers both discipline and consistency, which are two pillars of successful trading.

In summary, the Money Machine takes the Trade Ideas platform and builds a fully-fledged trading ecosystem around it. With smart automation and integration into the broker, it allows traders to stay fast, focused, and systematic. No coding needed!

Simulation Mode: Training Without Risk

One of the most valuable features of Trade Ideas’ Money Machine is the Simulation Mode that allows traders to try their automated strategies with simulated capital – without risking any real money. This is an essential learning environment for improving both strategy logic and execution behavior in real-time market conditions.

Unlike backtesting, which uses historical data, Simulation Mode runs during live market hours. The Money Machine is doing the same automated logic that would be followed in a real account: it scans for trade setups, places simulated orders, keeps track of and manages positions, and enforces risk that the trader has predetermined prior to execution. By using the Simulation Mode, traders can see how the system is executing in the current market and make adjustments based on performance.

Let’s say a trader is using Trade Ideas’ AI signals and rules to build a breakout strategy. If the trader uses Simulation Mode, the trader is now able to see the system running during the entire trading day – automatically entering and exiting trades, managing size, managing stops, and handling everything simply observing the whole process in real-time. The trader may discover that the breakout strategy has different results in the first hour of the day and mid-day lulls. This allows the trader to improve the strategy logic and limit trades during those lower-volume times.

The real power of Simulation Mode is the feedback loop. Traders can look at full trade logs, performance metrics, and equity curves to recognize weakness and make data-driven improvements. Trade Ideas even offers filters to capture strategy performance under various market conditions so you can fine tune your strategy even deeper.

Before putting real capital to work, it is highly recommended to run your automation in Sim Mode for several weeks. This builds trust in the system, gets out any surprises before going live, and assures employees that deploying live is not in the name of hope and guess work, but deployed logic proven in simulated trades.

Transitioning to Full Automation

Once a trader has validated a strategy in Simulation Mode, it is time to switch gears to live execution from the Brokerage Plus platform for Trade Ideas. Brokerage Plus provides seamless connectivity between Trade Ideas’ automation engine and several brokerage accounts, allowing for complete automation with capital at risk.

Brokerage Plus currently allows for direct connectivity to major brokerage accounts including Interactive Brokers, E*Trade and others. Once connected, traders are able to deploy the same logic and order routing from Simulation Mode, with little changes to their process, to fund in live-money trades. Traders have full control over all elements within the execution including what strategies they have, how capital is allocated and the type of risk tolerance levels that navigate their execution.

In order to offer some protections to the traders during the live deployment, Brokerage Plus has implemented a full range of risk management functionality all configurable to the users needs. This includes daily loss limits, position size controls, pause/resume functionality that can automatically stop trading activity when they meet certain conditions. The risk management features are designed to reduce larger losses and maintain trader discipline during chaotic times.

It’s worth pointing out that the Money Machine is not a “set it and forget it” plan. Rather, it is a systematic way to automate, giving you speed and consistency, but a degree of care and attention is required on your part. Traders should be aware they are monitoring trades in real time (or near real time); checking logs on a daily basis, and adjusting parameters as corresponding markets move and adjust.

This combination of automation and your control is the major reason why Trade Ideas is so different. Traders can leverage AI and automation to effectively execute trades, while keeping their discretion as to whether to adjust to their strategy or stop trading altogether. Adding extra capacity for traders who are already in real Money Mode is now easier and comes with guaranteed risk-sample infrastructure, and a comprehensive view of what they’re doing in real-time.

Tips for Getting the Most from Money Machine

To make the most of Trade Ideas’ Money Machine, traders should first test out verified strategies. Trade Ideas has a library of AI-generated strategies, many of which have historically performed consistently in all types of market environments. These strategies will provide a good launching point for the user and allow them to feel more confident leveraging automation from day one.

Even longer-term traders—like dividend investors—may also leverage automation if the user can build or modify a strategy intended to identify stocks with proper dividends. By building a system that uses technical entry logic and includes filters that target the fundamentals of stocks such as yield or payout history, dividend investors can automate the entry of high-quality dividend stocks while enjoying the precision of short-term traders with the anticipated low risk of the long-term dividend income trade.

Typically one of the least effective things to do is to start from scratch. In other words, there is no need to recreate the wheel starting with a completely new strategy; instead, modify strategies already built by other users. The user can easily change the existing filters, position sizing, or entry conditions to suit their risk tolerance or trading style. For example, they can modify a momentum strategy to leave out low-float stocks or only include S&P 500 stocks with stable earnings profiles.

When automation is running, either Simulation Mode or live, your ability to observe performance logs and metrics is imperative. Trade Ideas provides great insight that allows traders to establish what worked in their strategy and what needs to be improved. What’s more, the introduction of advanced stats allows the platform to play the role of a flagger, and let traders know if their moves are data-based or not

Traders should always spend substantial time in Sim Mode testing before they go live. Spending time in Sim helps lessen mistakes, get more familiar with the system, and provides time to pivot.

Lastly, the Trade Ideas real-time alerting systems allow users to be connected to their automation—ideally receiving updates or warnings on mobile or desktop—so they are always in control of their automation at any time or place.

Conclusion

The Money Machine by Trade Ideas is a giant leap forward in the automated trading process. With an AI trade execution strategy, full brokerage integration, risk controls tailored to you in real time, and operational capacity that allows for quick manipulation, Traders can act uniformly and without emotion—traits that are hard to maintain with manual execution.

Simulation Mode allows every trader a no-risk environment to learn how to give them the practice, and you are only one click away with Brokerage Plus from giving it full throttle. You can really hone your strategies with extensive strategies to see which is better in a live trading environment.

When time is short and discipline is long, the Money Machine allows traders to be fast, but more importantly disciplined. As we all come together around automation, it is important that tools exist that allow independent traders to keep pace with modern trading, advancing technology, and the demands of modern trading.