Simulated Trading: A Beginner’s Guide to Risk-Free Practice

Simulated Trading: A Beginner’s Guide to Risk-Free Practice

Most traders struggle because they don’t have a structured way to practice. Reading about strategies isn’t enough. On paper, a plan looks simple. In practice, the pressure of real money changes decisions. Small mistakes add up, and what should be a repeatable process quickly turns into guesswork.

Simulated trading is how you bridge that gap. It gives you a controlled space to test strategies, refine execution, and measure consistency, without the noise of financial stress. The point isn’t to “win” in simulation. The point is to train discipline and decision-making so they hold up when it matters.

In this post, I’ll walk through a practical framework for getting value out of simulated trading: how to design sessions with intention, what to track beyond profit and loss, and how to translate lessons into live performance.

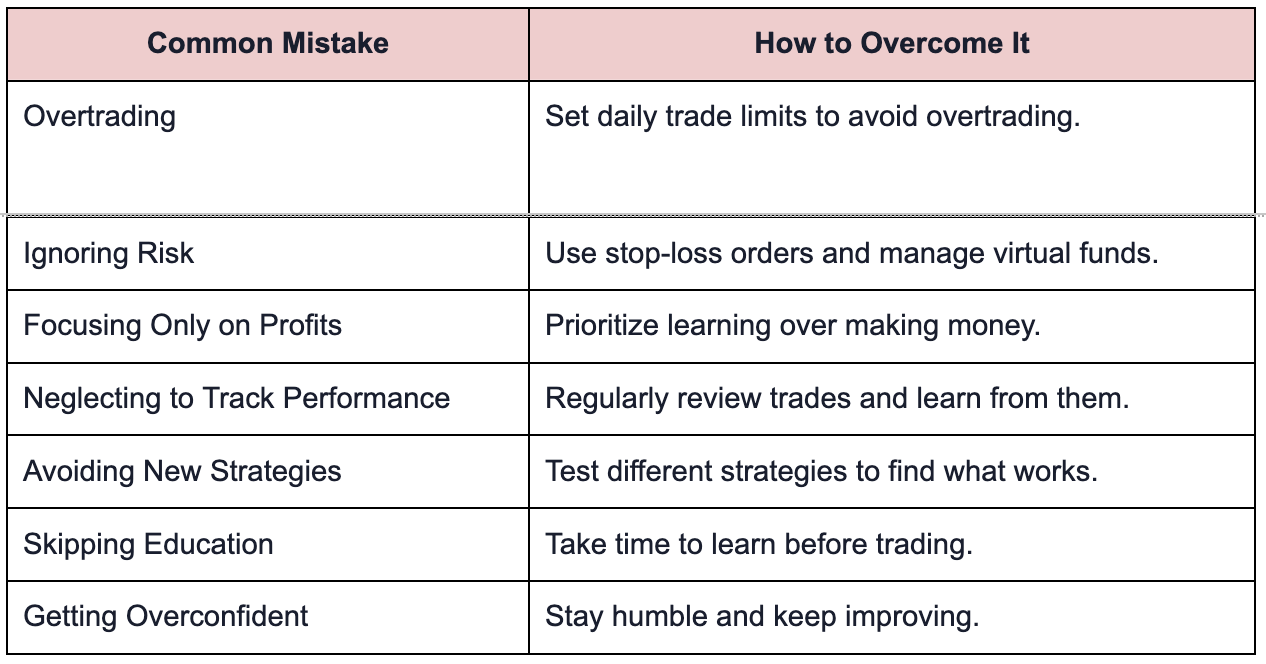

Next, we’ll look at the most common mistakes traders make in simulation—and how to avoid them.

| Key Summary: Simulated trading, also known as paper or virtual trading, is a risk-free method to practice buying and selling assets like stocks or options using virtual funds. It lets beginners and experienced traders learn trading mechanics, refine execution, and test strategies in a platform that mimics real market conditions. The main benefit is skill development, discipline, decision-making, and confidence, without risking actual money. Overall, simulated trading provides a safe environment to gain market knowledge and prepare for live trading with structure and intent. |

What is Simulated Trading?

Simulated trading (also called paper trading) is a practice tool that lets you buy and sell stocks or other assets in a virtual environment, just like in the real market. However, you use a simulated trading account with a fake balance instead of real money.

This allows you to try different strategies, such as simulated forex or options trading, and familiarize yourself with price charts, support and resistance levels, and chart patterns without risking your own funds. It’s a great way to practice before jumping into actual trading, especially when exploring various simulated trading platforms.

Why Simulated Trading is Perfect for Beginners?

Simulated trading is perfect for beginners who want to learn the basics without financial risk. It helps you understand how to read market trends, evaluate market sentiment, and see how different moves can affect your portfolio. Even for experienced traders, it’s a useful way to test strategies, whether based on price action or fundamental analysis, in a risk-free setting.

Simulated trading works best for beginners when they are training and learning about trading. Here’s how it helps you build real skills:

Learn Without Losing Money

- Place trades using virtual funds instead of cash.

- Example: Buy 10 shares of Apple at market open and track how a $1 move up or down changes your profit/loss.

- Mistakes cost you nothing but show you exactly how they affect your portfolio.

Practice With Real Market Conditions

- Prices update in real time, so you can react to earnings reports, news, or sudden volatility.

- Example: During a Fed interest rate announcement, watch how your simulated positions move. This teaches you how events impact markets.

Build Confidence and Habits

- Repetition matters: place 20–30 trades to get comfortable with order types (market, limit, stop-loss).

- Force yourself to write down a trade plan before entering and review afterward. This builds the discipline you’ll need with real money.

Test and Compare Strategies

Use the simulator to run small experiments. Example:

- Week 1: Trade only breakouts.

- Week 2: Trade only moving-average crossovers.

Compare results side by side and see which style suits you.

6 Benefits of Simulated Trading for Beginners

Simulated trading offers a practical, risk-free way to dive into the trading world. It comes with several benefits that can help beginners build a strong foundation for success. Here’s how it can support your learning journey:

- Risk-Free Learning

With simulated trading, you can experiment with buying and selling assets without the fear of losing money. This allows you to make and learn from mistakes, improving your trading skills without real-world consequences.

- Familiarity with Market Dynamics

Simulated trading platforms replicate live market conditions, allowing beginners to experience how stock prices move and react to global events. This teaches how to identify trends, news, and other factors that affect asset prices in real-time. Platforms replicate market-moving events, helping you see how news or earnings reports impact asset prices.

- Skill Development

From understanding charts and technical analysis to learning how to set stop-loss orders, you can practice these techniques without worrying about real financial stakes. Practice reading price charts, identifying support and resistance levels, and testing strategies.

- Building Confidence

Repeated practice makes beginners feel more comfortable in making decisions. Confidence is important in trading, and simulated trading is a safe space to build it without risking real money.

- Experimentation with Strategies

Simulated trading allows beginners to try different strategies to see what works for them. You can explore various approaches and learn from your successes or mistakes. This helps them refine their strategies before applying them to live trading. Test chart patterns, breakout strategies, or moving averages, and refine your best setups.

- Better Decision Making

The ability to practice in a risk-free environment helps you learn how to make quick, informed decisions in real-time market conditions. As you face simulated market fluctuations, you’ll develop critical thinking and problem-solving skills that improve your decision-making abilities when it counts. Practice reacting to market sentiment shifts in real-time to sharpen your judgment.

Now that you understand the key benefits of simulated trading, let’s explore some strategies to ensure your success as you begin practicing and refining your trading skills.

How to Start Simulated Trading as a Beginner

Simulated trading can be approached in many ways, but the most effective use is structured practice. By focusing on learning how to place orders, test strategies, and review outcomes, you’ll turn your demo account into a real training ground.

Getting started with simulated trading is easy. Here’s a simple guide to help you start practicing immediately.

Choose the Right Platform

Start by selecting the best simulated trading platform. This platform should offer various trading features, like real-time market data, a user-friendly interface, and useful analytics tools. Platforms like Trade Ideas provide free simulated trading with demo accounts, allowing you to practice without risking real money.

Set Up Your Virtual Account

Once you’ve selected a platform, create a simulated trading account. This process usually involves filling out some basic information. After completing this step, you’ll be given virtual funds or paper money for simulated trading. This allows you to practice trading in a simulated environment with no financial risk.

Familiarize Yourself with the Platform

Before you dive into trading, take some time to explore the platform’s features. Learn how to place different trades, use charts, and interpret market data. Understanding the platform’s layout and features will help you navigate your simulated trading account with ease. Many platforms offer additional tools, such as simulated trading software, to enhance your experience.

Set Realistic Goals

Setting clear goals is essential when starting with simulated day trading or any other simulated trading experience. Whether it’s practicing a specific strategy, such as futures simulated trading, or learning how to read market trends, having achievable goals will keep you focused on improvement.

Start Trading

Once you feel confident with the platform, start trading with simple actions like buying and selling stocks, or try more advanced options like simulated options trading. The goal is to familiarize yourself with the trading process without worrying about profits or losses at this stage.

Track Your Progress

Most simulated trading platforms offer tools to track your trades, profits, and losses. By monitoring your performance, you can pinpoint what strategies work best for you and which ones need more refinement. You can even review your trading history and improve over time.

Experiment and Learn

One of the greatest advantages of simulated trading accounts is the ability to experiment with new strategies and ideas. Whether you’re testing trading ideas or diving into more complex scenarios, learn and adjust your approach without the risk of financial loss. This hands-on experience is essential to building your trading skills and confidence.

By now, you know how to set up your account, place trades, and experiment with strategies. But to truly benefit from simulated trading, you need to avoid beginner mistakes and track your progress with intention. Here’s what to focus on as you continue your journey.

Simulated Trading Mistakes and Key Metrics to Track

Mistakes in simulated trading are almost universal; new traders overtrade, skip risk controls, or chase profits because there’s no money on the line. The problem is that those habits stick, and they resurface when real capital is at risk. That’s why treating mistakes seriously in simulation is just as important as tracking your wins.

Once you’ve set up your simulated trading account and are ready to dive in, watch out for these common mistakes that can impact your growth and trading experience.

While avoiding common mistakes is essential for trading success, tracking the right metrics is equally important to refine your strategy and ensure long-term profitability.

Master Trading Skills with Simulated Trading

Simulated trading offers beginners a risk-free environment to practice and refine their skills. It helps you build confidence, learn trade market dynamics, and test trading strategies without the pressure of real money losses. With real-time data and the ability to track your progress, it’s the perfect way to start your trading journey.

Ready to start? Sign up for a free trading simulator today and take the first step toward mastering the markets!

Related Reads:

- Should Beginners Use a Trading Room? A Simple 2025 Guide

- Is AI Trading a Good Option for Beginners in 2025?

- Silver Trading Trends for 2025: Is Now the Time to Invest in Silver?

FAQs on Simulated Trading

Are trading simulators free?

Many trading simulators, such as free simulated trading options offered by different platforms, are free. Some platforms also provide access to paper money simulated trading, letting you practice without cost.

How to simulate trading strategies?

To simulate trading strategies, choose a simulated trading app or platform and start applying your strategies, like simulated options trading or simulated day trading. You can practice buying, selling, and testing your decisions with virtual funds to see what works best for you.

What is the most profitable trading strategy of all time?

While there’s no single “most profitable” strategy, popular ones include trend following and day trading. You can test these strategies on a simulated trading platform or explore futures simulated trading to determine which suits your trading style and risk tolerance.

How do you practice dummy trading?

Dummy trading involves using a simulated trading account to place trades using virtual funds. You can practice using simulated stock trading or simulated crypto trading and analyze the results to improve your skills without any financial risk.

What is a simulated trading account?

A simulated trading account is a practice account where you use virtual money to simulate real trading. This account lets you experiment with different asset types, including options and stocks, on various simulated trading platforms without any financial risk.

What is a simulated trade?

A simulated trade is a practice trade placed in a virtual trading environment using real-time market data but without real money. It allows you to test strategies and gain experience without financial risk.

What is the 3-5-7 rule in trading?

The 3-5-7 rule is a trading guideline that suggests limiting trades to three key setups, focusing on five high-quality trades per day or week, and aiming for a risk-to-reward ratio of around 1:7. It’s designed to encourage discipline and selectivity. (Note: interpretations vary across trading communities.)

How to win a trading simulation?

You “win” a trading simulation by treating it like real trading:

- Stick to a defined strategy.

- Control risk with stop-losses.

- Review trades and learn from mistakes.

The goal isn’t just to show profits, but to build consistent and repeatable decision-making.

What are the four types of trading?

The four common types are:

- Day Trading – Buying and selling within the same day.

- Swing Trading – Holding positions for several days or weeks.

- Position Trading – Long-term trading based on fundamentals or big trends.

- Scalping – Making many quick trades to capture small price movements.

What is the most profitable trading method?

There’s no universally “most profitable” method; profitability depends on skill, discipline, and market conditions. However, widely used methods include trend following, momentum trading, and swing trading, all of which can be profitable if applied consistently with proper risk management.