Why a 90% Win Rate Isn’t the Flex You Think It Is: The Real Metrics That Matter in Trading

Why a 90% Win Rate Isn’t the Flex You Think It Is: The Real Metrics That Matter in Trading

Sep 13, 2025

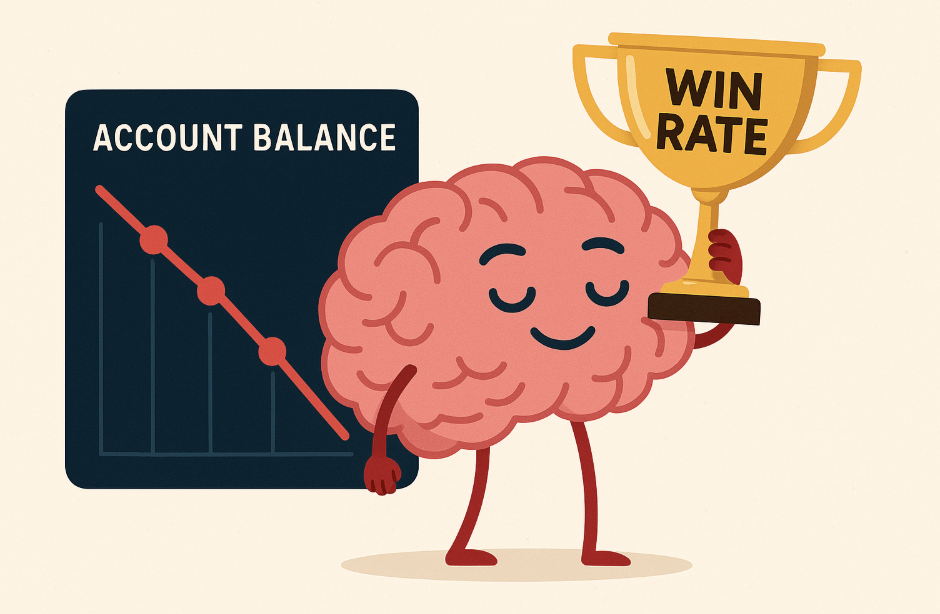

That trader bragging about their 90% win rate on social media? They might actually be losing money. While they’re busy posting screenshots of their “winning streak,” their account balance could be bleeding red.

Traders have been conditioned to worship at the altar of win rates, especially nowadays, where our sole focus is immediate gratification. High win percentages get the likes, the follows, and the envious comments. But here’s the uncomfortable truth that most retail traders refuse to accept: win rate is one of the least important metrics for long-term trading success. In fact, obsessing over it is probably costing you money.

Some of the best trend-following strategies in history have win rates below 40%. Not to mention, some of the most successful traders (including legendary traders like Paul Tudor Jones and Ed Seykota) built their fortunes with win rates well below 60%. How is this possible? Because they understand a fundamental principle that escapes most amateur traders: it’s not about being right, it’s about being profitable. The metric that separates winners from losers isn’t how often you win, but how much you make when you win versus how much you lose when you’re wrong.

The Win Rate Illusion

The psychological appeal of being “right” or being a “winner” is fleeting, yet it drives most trading decisions. We’re hardwired to seek validation, and nothing feeds the ego quite like a string of winning trades. Social media has amplified this craving tenfold – platforms are flooded with traders posting their win rate statistics like digital trophies, each screenshot designed to showcase their supposed superiority. For beginners, especially, this creates a dangerous misconception that trading success is measured by how often one is right rather than how much money is actually made.

But here’s where the illusion becomes expensive. High win rate strategies are often the most dangerous because they seem so effective in the moment, while quietly eroding accounts over time. These approaches typically involve grabbing small profits at the first sign of a move in your favor (offering that instant gratification of being “right”) while stubbornly holding onto losing positions, hoping they’ll turn around.

Many traders also use tight stop-losses that get triggered frequently, turning what could be winning setups into small losses in the name of maintaining a precious win percentage. Once we realize that winning individual trades is not what creates sustainable trading success, we can finally shift our perspective toward the metrics that actually matter.

The Math That Matters: Risk-Reward Ratio

That said, let’s focus on the numbers that actually determine whether you’ll make money or go broke. The formula for trading expectancy is beautifully simple: (Win Rate × Average Win) – ((1 – Win Rate) × Average Loss). This single equation will tell you more about a trading strategy’s viability than any win rate statistic ever could.

The following scenarios illustrate how dramatically different reality can be from perception:

Scenario A: The social media hero: A boisterous 90% win rate with $5 average wins and $50 average losses. The math is brutal: (0.90 × $5) – (0.10 × $50) = $4.50 – $5.00 = -$0.50 per trade. This trader is actually losing money despite being “right” 90% of the time.

Scenario B The Modest Trader: A more realistic 60% win rate with $20 average wins and $10 average losses. The calculation: (0.60 × $20) – (0.40 × $10) = $12 – $4 = +$8 per trade. This trader earns 16 times more money per trade than the high win rate trader loses, simply by focusing on the right metrics.

Scenario C: The Impressive Underdog. This trader has a mere 40% win rate, averaging $30 wins and $10 losses. Despite being wrong more often than right, the expectancy is (0.40 × $30) – (0.60 × $10) = $12 – $6 = +$6 per trade. This trader is building wealth while being “wrong” 60% of the time.

Professional traders commonly operate in the 45-60% win rate range without batting an eye, because they understand that sustainable profits come from letting winners run while cutting losses short (a classic asymmetric risk-reward approach). A professional might risk $100 to make $300, accepting that they’ll be wrong more often but knowing that when they’re right, it more than compensates for the losses. This mindset shift from seeking validation through high win rates to seeking profit through innovative risk management is what separates amateur traders from professionals building generational wealth.

What Successful Traders Actually Focus On

It isn’t a coincidence that the majority of consistently profitable traders hover around a 60% win rate; it is the natural result of prioritizing the right metrics. These professionals have learned to suppress their ego’s need to be “right” and instead focus obsessively on risk management, proper position sizing, and maintaining a positive expectancy per trade. They play the long game, thinking in terms of long-term statistical edge rather than short-term validation. They understand the big picture, knowing that one individual trade is just one measly data point.

While amateur traders celebrate their win streaks on social media, professionals are tracking entirely different metrics. Their dashboards focus on:

- Profit Factor: the ratio of total profits to total losses, where anything above 1.5 is considered solid.

- Expectancy: monitored religiously, calculating the average amount expected to be made or lost per trade based on historical performance.

- Maximum Drawdown: receives careful attention because it reveals how much pain a strategy can inflict during rough patches, helping traders size positions appropriately.

- Risk-Adjusted Returns: measuring how much profit they generate relative to the risk they’re taking – because making 20% while risking 30% isn’t impressive, but making 15% while risking 5% absolutely is.

Breaking Free from the Win Rate Trap

Understanding why we fall into the win rate trap is the first step to escaping it. We’re evolutionarily wired for immediate gratification – those frequent small wins trigger dopamine hits that feel incredible in the moment but cloud our judgment about long-term profitability. Our brains are more afraid of being wrong than losing money, which creates the perfect storm for poor trading decisions. The solution isn’t to fight human nature, but to redirect it toward metrics that actually matter.

The shift from ego-driven trading to profit-driven trading requires embracing three uncomfortable truths:

- Calculated losses are not failures but necessary costs of doing business.

- Uncertainty is your friend rather than your enemy.

- Being wrong frequently can still lead to wealth.

Once you understand and can adapt to these universal truths, you can create your practical framework for sustainable success:

- Calculate your risk-reward ratio before every trade – aim for at least 1:2, meaning you risk $1 to make $2 potentially.

- Maintain consistent position sizing by risking the same percentage (typically 1-2%) on each trade, adjusting your position size rather than your risk amount.

- Track trade expectancy diligently, reviewing your expected value per trade monthly or quarterly, rather than daily.

- Backtest your strategies focusing on expectancy rather than win rate.

- Journal your trades with emphasis on whether you followed your process, not whether individual trades won or lost.

- Set realistic expectations aligned with professional standards.

Trading success isn’t about feeding your ego or being right – it’s about mathematical precision and emotional discipline. The best traders in the world are wrong almost half the time, but they sleep perfectly well at night knowing the only number that matters is the one at the bottom of their monthly P&L statement. Trade Ideas has all the tools you need, as well as our team of experienced traders to help you shift your strategy. Stop chasing the fool’s gold of high win percentages and start building your legacy with Trade Ideas today.