How Momentum Trading Works: A Beginner’s Guide

How Momentum Trading Works: A Beginner’s Guide

Most traders struggle with one thing: knowing when to act. Buy too early, and you sit through dead time. Buy too late, you get caught at the top.

Momentum trading solves that by focusing only on stocks that are already moving with strength. The idea isn’t to predict, it’s to participate while the move lasts, then step out before it fades.

In this post, we’ll walk through how momentum trading works, the tools that matter, and the principles that keep you from turning profits into losses.

By the end, you’ll have a simple framework to understand and apply momentum without second-guessing.

What is Momentum Trading?

Momentum trading is a trading approach where you focus on assets that are already moving strongly in one direction, either up or down, with the goal of profiting from that continued movement.

Rather than seeking undervalued opportunities, momentum traders capitalize on strength by buying assets in upward trends and selling those showing weakness.

The logic is simple: strong price trends tend to attract more traders and investors, which fuels further movement. By identifying and joining these trends early, momentum traders aim to ride the move and exit before it slows or reverses.

In short, Momentum trading is about capitalizing on speed and direction in the market, using discipline and risk management to avoid being caught when the trend turns.

Core Principles of Momentum Trading

Momentum trading is built on a few key principles that guide how traders identify opportunities, manage entries, and protect their capital. Each principle works together to create a disciplined framework for trading.

- Analyze the Trend

Momentum trading is built on the principle of following the prevailing price direction. Traders buy assets that are strengthening and sell assets that are weakening, seeking to capture profits from the continuation of established moves.

- Market Sentiment

Price momentum is often driven by collective psychology, earnings releases, economic data, and news events influence sentiment, creating conditions where buying or selling pressure accelerates existing trends.

- Entry and Exit

Precise timing is critical. Positions are initiated once momentum is confirmed through technical signals such as breakouts or volume surges, and exited promptly when indicators suggest a loss of strength.

- Risk Management

Because momentum can shift abruptly, strict risk controls are essential. Defined stop-loss levels, careful position sizing, and consistent adherence to trading rules protect capital and support long-term performance.

How Momentum Trading Works (Step-by-Step)

Momentum trading may sound complex, but the process can be broken down into clear, repeatable steps. By following a structured approach, beginners can learn how to spot strong moves, confirm signals, and trade with confidence.

Let’s walk through the process step by step.

Identify Opportunities

Look for stocks that are already showing strong movement in one direction. This could be a stock breaking above a resistance level, trading on unusually high volume, or trending strongly after earnings or news. Strong price action is the foundation of a momentum trade.

Confirm the Signals

Don’t rely on price alone. Check technical confirmations such as chart patterns, moving averages, or support and resistance levels. These filters help you avoid false breakouts.

Time Your Entry

Enter once momentum is clear. Often, strong moves follow earnings reports, major news, or other market-moving events. Entering too late reduces your profit potential and increases risk.

Manage the Trade

Set a stop-loss before you enter. Define your position size so that one trade doesn’t risk too much of your capital. Momentum can reverse quickly, so risk controls are non-negotiable.

Exit with Discipline

Momentum doesn’t last forever. Watch for slowing volume, reversal signals, or failure to make new highs/lows. Exiting at the right time protects your profits and prevents giving back gains.

It’s important to have the right foundation. Tools and indicators act like your compass in the markets; they don’t guarantee profits, but they help you make smarter, more informed decisions.

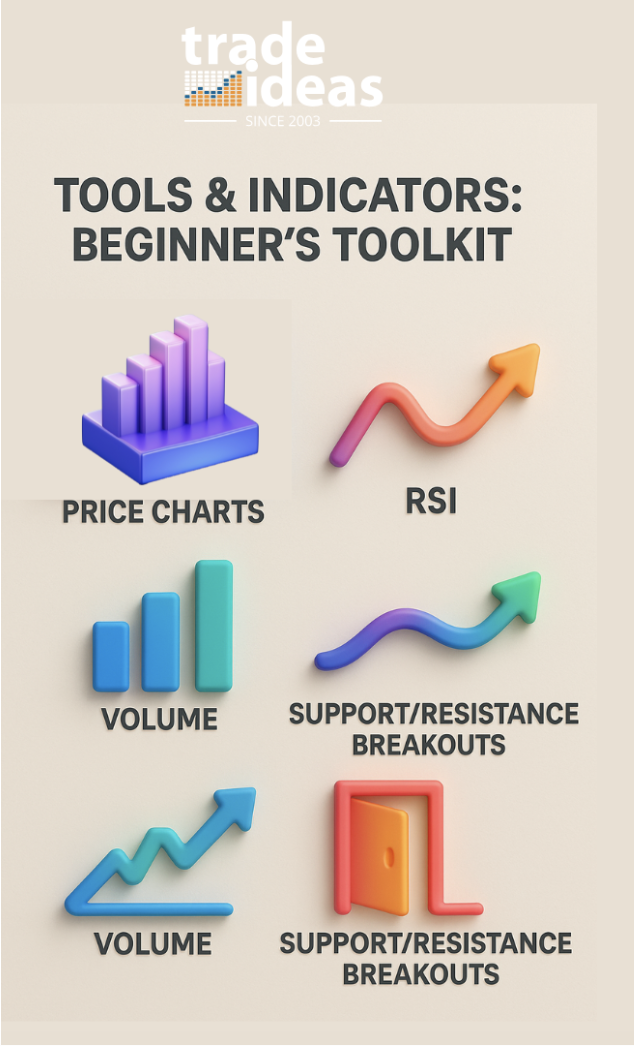

Tools and Indicators for Momentum Trading

To trade momentum effectively, you need the right tools to spot strong moves and confirm that they are real. These indicators help you understand when momentum is building, how strong it is, and when it may be running out of steam. Below are the key tools every beginner should learn to use.

- Price Charts and Candlestick Patterns

Charts show you how a stock’s price has moved over time. Candlestick patterns make it easier to spot momentum shifts, such as strong bullish candles during an uptrend or reversal patterns that warn of a slowdown.

- Volume and Volatility Analysis

Rising prices with strong volume confirm that momentum is real and supported by demand. Volatility helps you judge how fast and how far a stock might move, which is key for setting entry and exit points.

- Relative Strength Index (RSI)

RSI measures whether a stock is overbought or oversold. Momentum traders use it to spot when a stock has strong buying pressure or when it might be due for a pullback.

- Moving Averages and Crossovers

Moving averages smooth out price data and highlight trends. A short-term average crossing above a long-term average often signals new momentum, while the opposite may warn of weakness.

- Support and Resistance Breakouts

When a stock breaks above resistance or below support with volume, it often signals the start of a momentum move. These breakouts are common entry points for traders.

Benefits of Momentum Trading

- Momentum trading can generate strong returns in a short period, as traders capture powerful moves in price without waiting months or years.

- Clear signals from price charts, volume, and breakouts make it easier to define precise entry and exit points, reducing guesswork.

- The strategy works in both rising and falling markets, giving traders flexibility to profit on either side of the trend.

- Market-moving events such as earnings, news, or upgrades often spark momentum, creating repeatable opportunities to trade.

- Because trends can reverse quickly, momentum trading encourages strict discipline with stop-losses and position sizing.

- Practicing momentum trading improves essential skills like chart reading, timing trades, and managing risk effectively.

Final Thoughts on Momentum Trading

Momentum trading is not about predicting the future; it’s about recognizing strength in the market and acting with discipline. By focusing on stocks that are already moving, you avoid dead time and position yourself where the action is.

The real advantage comes from following a structured process: identify opportunities, confirm signals, manage risk, and exit with control. While the potential rewards are attractive, the key to lasting success is consistency and risk management.

If you’re new, start small, practice with clear rules, and treat each trade as a lesson. With patience and discipline, momentum trading can become a practical strategy to grow your skills and confidence in the market.

Related Reads

FAQs on Momentum Trading

Is momentum trading a good strategy?

Momentum trading can be a profitable strategy, but it is not suitable for everyone. It works best for traders who can monitor markets closely, follow rules with discipline, and apply strict risk management. The potential for quick gains is real, but so are the risks of sudden reversals. Success depends on consistency, not chasing every move.

What is the 3-5-7 rule in trading?

The “3-5-7 rule” is more of a trading guideline than a universal rule. It suggests limiting your focus to 3 setups, selecting 5 high-quality trades per day or week, and aiming for a risk-to-reward ratio around 1:7. The purpose is to encourage selectivity, discipline, and proper risk management, rather than overtrading.

What is swing trading vs momentum trading?

- Swing trading: Positions are held for several days to weeks, aiming to capture medium-term price swings within broader trends. It often combines technical analysis with fundamentals.

- Momentum trading: Focuses on assets already moving strongly in one direction, with trades lasting from minutes to weeks. The goal is to profit from price acceleration rather than broader cycles.

In short, swing trading is slower and trend-focused, while momentum trading is faster and driven by short-term strength.

What is the best time frame for momentum trading?

The best time frame depends on your style and availability:

- Day traders often use 1-minute, 5-minute, or 15-minute charts to capture intraday momentum.

- Swing or short-term momentum traders commonly use 1-hour, 4-hour, or daily charts to ride moves lasting days or weeks.

There is no “one-size-fits-all.” The right time frame is the one that matches your trading plan, risk tolerance, and ability to monitor positions.