Summer Vacation Trading Strategy: How Low Volume Creates Profit Opportunities

Summer Vacation Trading Strategy: How Low Volume Creates Profit Opportunities

While Wall Street empties for summer vacation, creating the year’s thinnest trading volumes, smart traders recognize this seasonal shift as an opportunity to capitalize on amplified price movements, reduced competition, and overlooked earnings surprises. Summer trading presents a dramatically altered market landscape as trading volumes routinely drop 20-40% from peak levels between Memorial Day and Labor Day, creating what traders call the “summer volume drought.” This drought is driven by institutional money managers on vacation, European market slowdowns during the August holidays, and reduced retail participation as investors focus on leisure activities rather than portfolio management.

This reduced participation creates a dual-edged environment where risks multiply through wider bid-ask spreads, amplified price movements from small orders, and increased gap risk during extended weekends. The key to summer trading success lies not in avoiding the market entirely but in becoming more selective about timing, position sizing, and stock selection. At the same time, traders must maintain a heightened awareness of how reduced liquidity fundamentally changes risk-reward dynamics and learn to adapt their strategies accordingly. This article explains how traders can capitalize on the unique conditions that define vacation season trading rather than fighting against the inevitable volume reduction.

Understanding Summer Market Dynamics

The summer trading period follows predictable volume patterns where daily NYSE volume drops from winter peaks of 4-5 billion shares to summer troughs of 2.5-3 billion shares. The most dramatic reductions tend to occur during the final two weeks of August, when European markets experienced near-complete shutdowns and U.S. institutional participation reaches annual lows. This volume decline creates cascading liquidity constraints, which manifest as significantly wider bid-ask spreads and increased volatility, where smaller orders can move prices dramatically.

Additionally, the algorithmic dominance during thin summer trading often creates artificial price movements, flash spikes, and sudden reversals disconnected from fundamental news. This can make traditional technical indicators less reliable, requiring traders to adjust their strategies to account for machine-driven price action rather than human sentiment and institutional flow. Small-cap stocks, biotech names, and niche sectors become particularly vulnerable to liquidity traps as their daily volumes can be cut in half or more compared to normal trading periods.

Why Selectivity Becomes Critical

Summer’s thin trading environment demands a fundamental shift to a quality-over-quantity approach where traders focus exclusively on high-conviction trades backed by strong fundamental catalysts, solid technical setups, and sufficient liquidity to handle position entries and exits without significant market impact. Speculative plays that might work during normal volume periods, such as momentum chasing, low-float breakouts, or biotech lottery tickets, become virtually untradeable during the summer months, as reduced liquidity can trap traders in positions they cannot exit. Smart summer traders, therefore, concentrate their capital on fewer, higher-quality opportunities in large-cap liquid names where they can build meaningful positions without moving the market and exit cleanly when their thesis plays out or proves incorrect.

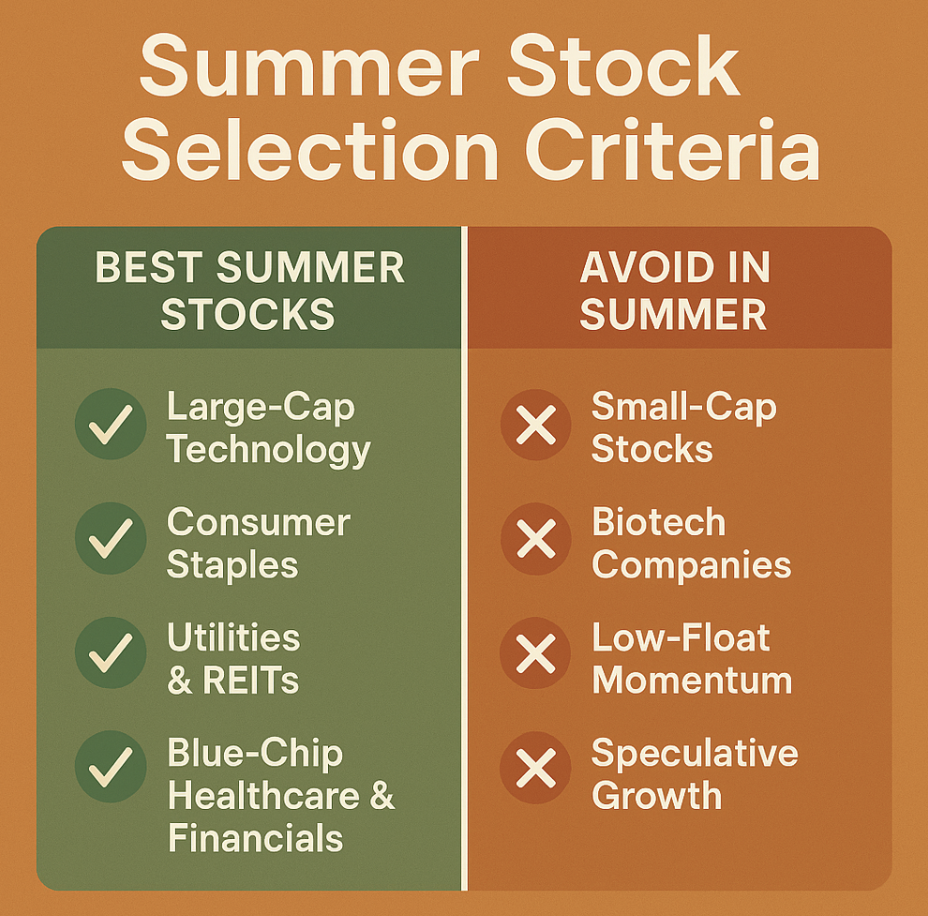

Summer Stock Selection Criteria

Successful summer trading requires strict adherence to liquidity-based selection criteria, starting with a minimum threshold of 500,000+ daily volume and $1 billion+ market capitalization to ensure positions can be entered and exited without significant market impact.

Preferred Sectors for Summer Trading:

- Large-cap technology stocks (maintain institutional interest year-round)

- Consumer staples companies (consistent trading volumes, defensive characteristics)

- Utilities and REITs (attract income-focused investors during summer)

- Established blue-chip healthcare and financial names (fundamental analysis remains relevant)

Stocks to Completely Avoid:

- Small-cap stocks (volume can drop 50-75% during summer)

- Biotech companies (vulnerable to binary news events in thin markets)

- Low-float momentum plays (depend on heavy retail participation)

- Speculative growth names (reduced institutional coverage creates dramatic swings.

This disciplined approach to stock selection acts as the first line of defense against summer trading pitfalls, ensuring that even if market conditions deteriorate further, it provides reasonable exit opportunities when strategies need adjustment.

Timing and Risk Management Strategies

Summer trading success depends on precise timing and aggressive risk management adjustments that account for the unique characteristics of low-volume markets. The optimal trading window occurs during the first hour after the market opens (9:30-10:30 AM) when overnight news and pre-market activity create the most reliable volume and price discovery. On the other hand, traders can avoid the lunch period doldrums (11:30 AM – 2:00 PM) as volume can drop to dangerous levels and spreads widen significantly.

Position sizing must be reduced by 25-50% from normal allocations to account for increased volatility and reduced liquidity during summer price amplifications. Stop-loss orders require significant modification, with traders setting stops 50-100% wider than normal to avoid getting shaken out by the random volatility and algorithm-driven spikes that characterize thin markets. Also, consider time-based exits rather than purely price-based stops to account for the unpredictable nature of summer trading. These risk management adjustments may seem overly conservative, but they’re essential for navigating the unique challenges of the vacation season while positioning for September.

Summer Opportunities

Despite the challenges of reduced summer volume, astute traders can capitalize on several high-probability opportunities that emerge specifically because of the thin trading environment. Earnings surprises are dramatically amplified during the summer months, creating exceptional risk-reward scenarios for traders who thoroughly research under-followed summer earnings. Technical breakout opportunities become particularly compelling when accompanied by volume confirmation, as the reduced resistance from lighter institutional selling can allow quality setups to achieve much larger percentage gains than similar patterns during peak trading seasons.

Mean reversion plays offer perhaps the most consistent summer profits, as high-quality large-cap stocks often become oversold during vacation-driven selling sprees. These provide attractive entry points for patient traders willing to accumulate positions in fundamentally sound companies that will likely recover when institutional buying returns in September. The key to capturing these opportunities lies in maintaining strict quality standards, focusing on liquid, well-established companies with strong fundamentals while providing the upside potential that makes summer’s increased risks worthwhile.

Mastering Vacation Trading

Implementing a successful summer trading strategy begins with building a carefully curated watchlist that prioritizes liquidity metrics such as:

- Minimum 500,000 daily volume and $1 billion market capitalization,

- Strong balance sheets

- Consistent earnings

- Established market positions that can withstand the volatility amplification of thin trading environments.

Essential technology tools include setting up volume alerts to identify unusual activity that might signal genuine opportunities versus algorithmic noise. Employ sophisticated order management systems to break large orders into smaller pieces and minimize market impact. This allows traders to utilize limit orders rather than market orders to avoid the wider spreads that characterize summer trading. By combining these practical elements, traders can navigate the unique challenges of summer while positioning themselves to capitalize on the legitimate opportunities that emerge from reduced market participation. For more on navigating summer doldrums, join Trade Ideas today.