4 Advanced Charting Techniques for Day Traders

4 Advanced Charting Techniques for Day Traders

By: Shane Neagle

Day traders are constantly trying to stay one step ahead in fast markets. Basic chart patterns aren’t enough anymore. In-depth analysis using advanced charting techniques will provide traders with additional insight into price behavior. This can help traders fine-tune their entries, exits and strategies.

The fundamentals of technical analysis will always be important; however, many platforms, like Trade Ideas, have taken technical to an entirely new level and encompass features way beyond a foundation of basic charts. Understanding how to use these advanced components will not only allow traders to make decisions quicker when markets move, it will also assist the trader in filtering out noise and increasing the precision in their decision making.

Anchored VWAP

Anchored VWAP (Volume Weighted Average Price) takes standard VWAP to another level by letting traders choose an anchor – an earnings announcement, swing high, major news event, and not the beginning of the day’s trading session. The advantage of Anchored VWAP is the ability to see how price action has progressed since an insinuated moment in time, thus providing a more contextualized perspective on support and resistance.

Unlike standard VWAP, which resets daily and gives a moving average from the day’s pricing, Anchored VWAP ties price to an anchor point in an event in its timeline. This is very useful in measuring the effects of institutional purchases or identifying potential price levels where buyers or sellers may re-engage. When price returns to an Anchored VWAP level above or below, traders can use that level as a reference point for either confirmation or possible reversal.

For example, consider a stock that gapped up after a strong earnings report. Anchoring the VWAP to that earnings date will show to traders the average price that has been paid since the news event. If the price retraces back to that anchored level with lower volume it could provide a reasonable point of support and a nice entry point. If price breaks below with volume that is increasing, that could denote a change in sentiment and traders can plan accordingly.

Trade Ideas has built Anchored VWAP so day traders can plot these levels directly on their charts to help with real-time analysis and managing trade plans. When traders anchor to significant turning points, they have a better view of price consensus, which can help them time entries and exits, and save them from chasing extended moves.

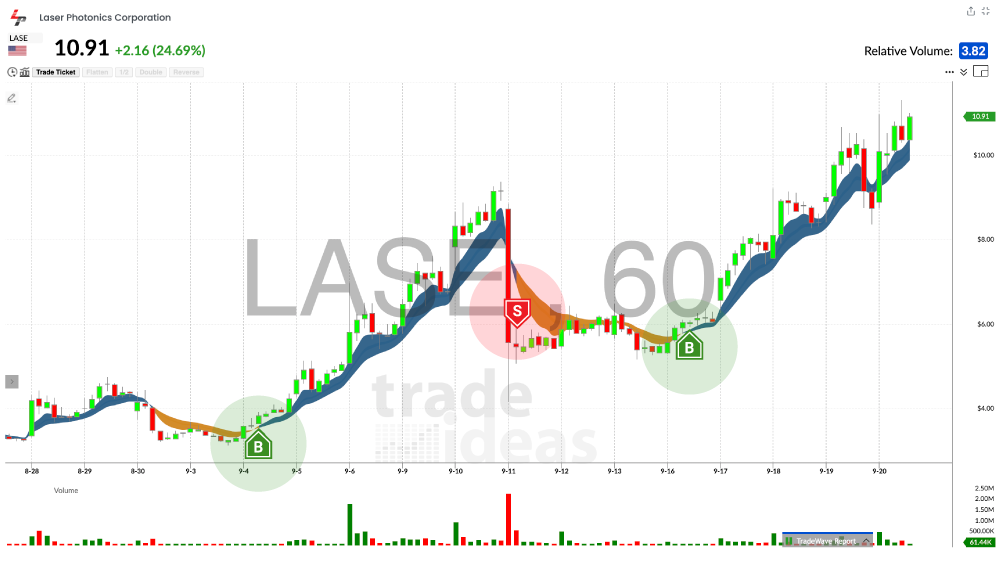

TradeWave

TradeWave is Trade Ideas’ proprietary trade visualization tool powered by AI to assist traders in identifying actionable opportunities informed by real-time market activity. Rather than relying on charts with static patterns or lagging indicators, TradeWave processes live data to find trading opportunities that present high-probability set-ups congruent with price behavior.

TradeWave’s strength is in identifying and bringing relevant opportunities into view using advanced pattern recognition. TradeWave watches HOW price, volume, and momentum interact under live conditions, identifies setups that meet pre-established profitable criteria and brings them to the forefront. In doing so, TradeWave eliminates much of the uncertainty that a trader goes through in manually scanning charts and gives them an opportunity to simply execute trades where the data suggests there is opportunity.

When we consider TradeWave’s utility for day-traders, it’s an intelligent assistant that cuts through the background noise of intraday price movement to focus on what has the potential to matter. Regardless if traders are trading breakouts, pullbacks, or THE WRAP, TradeWave helps traders to identify relevant set-ups faster and with better timing. Furthermore, as market conditions shift, TradeWave’s strength allows it to uncover set-ups to provide the trader with an edge during volatile sessions.

One thing that is especially nice about TradeWave is how it combines automation with trader choice. The system identifies and visualizes interesting potential trade possibilities, but you control the filtering, confirming, and taking action. You can take back control of how you intend to act on quality day trading patterns that occur in real-time—such as the bull flag pattern—while effectively eliminating unimportant false signals and repetitive alerts commonly put out by other systems.

The combination of real-time data and intelligent filtering will help make the decision recipe more effective for a more active trading group. It can also be a much more favorable tool for those who trade multiple tickers or systems, or for those who want a developed, decision-based rules-based approach to pattern identification. With Intelligent Decision Making, this continuing evolution of Artificial Neural Network Decision Making, in place, we have a useful example of machine learning that will help increase clarity, speed audited consistency at the moment of Uniform Intraday Entry Alerts.

Price Alerts with Integrated Charting

One of the most useful features for day traders using Trade Ideas is having the ability to set dynamic price alerts with defined price levels with a charting component built-in. Marking levels on a chart where and the price point where you want to get a notification. The best feature here is that this allows you to take a passive method of analyzing a chart and turn it into an active component of your decision support system in real-time.

Most investors have used alerts, either a multi-functional platform or even with a proprietary relationship with the brokerage, sending an alert after you just sold into a position. Using the Trade Ideas system, you can have all the price triggers visualized on the charting component instead of relying on a third party, and delayed interpretation to assess market liquidity. The benefit is this allows the trader to have visual markers in real-time on the chart, to support advance planning on how to buy or sell based on clear conditions without emotion or even guessing.

For day traders that are managing multiple tickers but or moving pieces intraday, this is a great advantage. Rather than staring and focusing on several charts throughout the day, you can make a connection time with critical areas of technical reference, which include support and resistance, breakout, moving averages, or specific points of interest. The alerts built into the Trade Ideas system will let the trader know when they need to act on a price execution without revealing trader fatigue or being distracted with beliefs at knowing and making rapid assessments using multiple trading entries.

This kind of precision is especially advantageous for scalpers. Intraday price action commonly develops quickly, so having an alert preset eliminates hesitation on entering or exiting trades. Whether you are preparing for a bounce off a VWAP level or a breakout above a high-of-day pivot, an alert can automate the signal and reduce your response time to it.

In summary, integrated price alerts will improve execution efficiency and discipline. Alerts assist traders with being a little less involved in tracking price as they stay with their strategy rather than micromanaging every tick. By incorporating alerts directly into chart views, Trade Ideas provides traders a simple and direct way to stay connected to the market—on their own terms.

Go No Go Trend Indicator (CMT Pro Tool)

The Go No Go Trend Indicator as an optional upgrade to Trade Ideas provides an easy way to grasp trend(s) without forcing traders to sift through multiple indicators. Instead of having to figure out where the trend is through multiple indicators for charts, the Go No Go compiles everything into one indicator with colours that communicate market direction. The Go No Go indicator allows traders to participate within trending markets, while eliminating the haze of multiple indicators on traditional chart overlays.

The Go No Go indicator collects data from multiple sources, including, momentum, volume, volatility, and trend following. The power of the indicator comes from integrating these into one visualization. Different colours communicate trend direction and its strength. Blue and aqua signals indicate bullish trends, and purple and pink signals indicate bearish trends. Amber, as seen in amber alerts, indicates uncertainty which represents cautionary guarding against potential reversals and/or consolidations. By consolidating everything and presenting it to traders in an uncomplicated way, decision making can take place faster and charts get cleaned up.

For professional and active traders, understanding market state of trends can be a great benefit. In rapidly changing volatile markets an investor could have to lose their funding, which is costly and should be avoided if it is not necessary. Finally, if a trader must toggle from moving averages to MACD and back to RSI levels, then using one consistent item such as the Go No Go indicator shows how this could vastly accelerate their decision making on trend direction and strength.

This information is especially beneficial for those executing momentum based strategies and/or managing multiple positions simultaneously. The indicator alleviates much of the uncertainty associated with trend confirmations, enabling a trader to devote more time to trading execution and ensuring positions are placed with proper risk management. The indicator also integrates seamlessly across the multiple tools offered on Trade Ideas platform including Anchored VWAP and TradeWave, thus increasing its utility as part of an overall strategy.

The Go No Go Trend Indicator enhances traders’ ability to minimize analysis time while providing increased clarity about trend direction—allowing them to take the next planned action on the chart, develop a plan,maintain discipline and resist the urge to second guess or scramble following the ultimate setups or signals—characteristics which are critical to being professional trader in today’s market.

Conclusion

Acquiring advanced charting techniques will improve a day trader’s ability to assess price action and make faster, more informed decisions. Almost all platforms will provide either Anchored VWAP or TradeWave or both, which allow for deeper visualization of price action. Including dynamic price alerts and the Go No Go indicator streamlines execution and trend confirmation.

Working with these tools improves traders’ ability to eliminate noise, concentrate on what’s probable, and manage risk in nearly real-time. Traders must learn how to employ these tools effectively as a part of a structured trading strategy, not just rely on their availability.

With platforms continuing to modernize like Trade Ideas, the professional caliber of detailed analysis is more accessible than ever. If traders prioritize learning these tools and applying them effectively, they will have better odds in an ever-more data-driven marketplace.