TradeWave 7-Day Implementation Plan for Summer Trading

TradeWave 7-Day Implementation Plan for Summer Trading

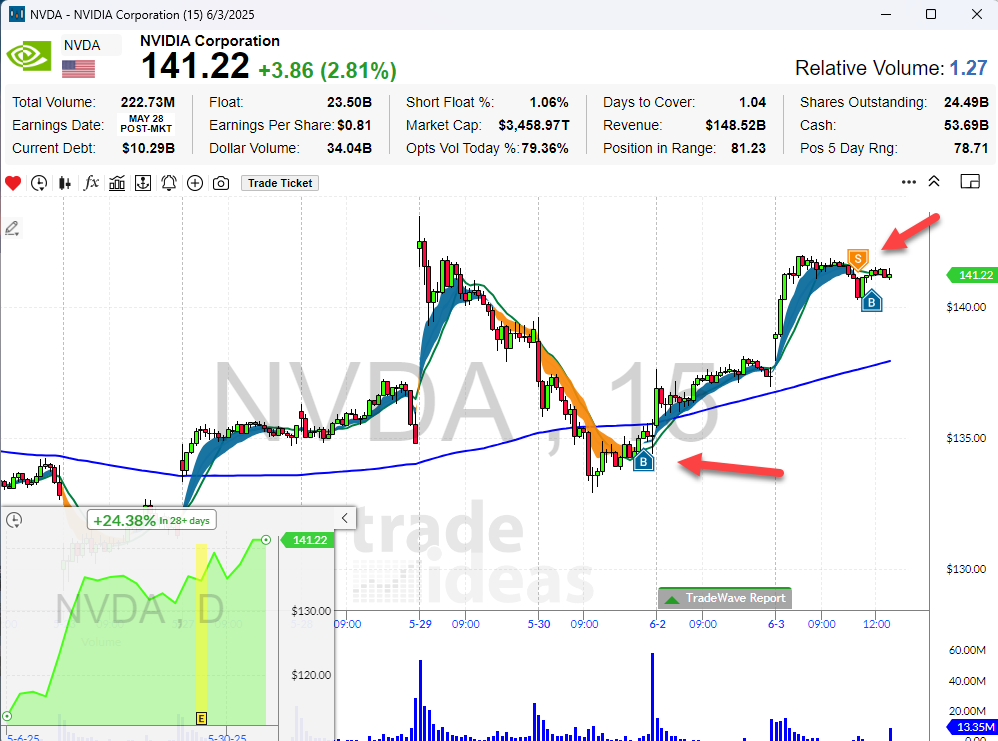

TradeWave is one of Trade Ideas’ most valuable innovations to date and only has continued to evolve into the ultimate “Money Machine.” This summer could be your most lucrative one yet for traders who take just one week to learn how to use TradeWave. TradeWave represents a breakthrough trading methodology that combines technical analysis with systematic signal recognition to identify high-probability market opportunities. Unlike traditional indicators that lag behind price action, its forward-looking approach positions traders ahead of significant moves, making it an invaluable tool for both day traders and swing traders.

The beauty of TradeWave lies not just in its signal accuracy but in how it fundamentally changes your relationship with the markets. No longer will you second-guess entries or hold losing positions too long out of hope. Instead, you’ll operate with the clarity that comes from following a proven system backed by objective data and clear rules. But how can traders start using it to maximize their portfolio profits this summer? Following the structured implementation plan below, traders can master this methodology in just seven days, progressing from paper trading to live market execution with confidence.

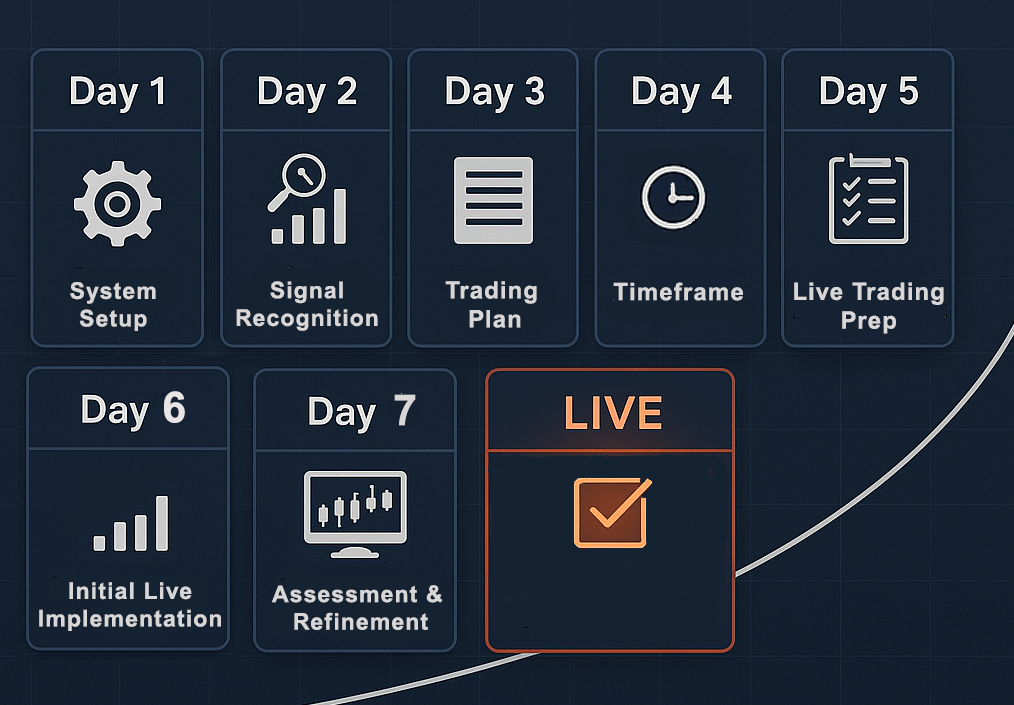

Day 1: System Setup

Begin your TradeWave journey by installing and configuring the essential moving averages on your preferred trading platform: 20 EMA, 50 SMA, and 200 SMA. These form the backbone of the system. Next, watch the TradeWave training video series, covering Modules 1-2, to understand the fundamental concepts and signal recognition patterns. Then, set up your Trade Ideas scanner with specific criteria to ensure you capture the right opportunities.

Configure your chart layouts with the proper moving averages and timeframes, then save these as workspace templates for consistency across all your trading sessions. Test your platform connectivity and data feeds to ensure everything functions smoothly before proceeding. Finally, begin paper trading your first 3 identified TradeWave signals, practicing the system’s execution while building confidence in signal recognition and timing.

Day 2: Signal Recognition Training

Day 2 is about further developing your signal recognition expertise through comprehensive historical analysis and continued practice. Begin by reviewing historical charts to identify past TradeWave signals, training your eye to recognize the patterns and setups that precede profitable moves. Document at least 20 historical TradeWave cycles with detailed screenshots, creating a visual reference library that will serve as your pattern recognition guide. For each documented cycle, calculate the theoretical profit and loss outcomes to understand the system’s historical performance and develop realistic expectations for future trades. Reinforce your learning by completing the signal recognition quiz included in the training module, which tests your ability to identify valid signals versus false positives.

Day 3: Trading Plan Integration

Day 3 centers on integrating TradeWave into a comprehensive trading plan that will govern your decision-making and risk management. Create a specific trading plan outlining clear rules for when to take signals, when to avoid them, and how to handle various market conditions. Determine your position sizing formula, with the recommended approach of risking no more than 1% of your account per trade to preserve capital and ensure market longevity.

Establish a detailed record-keeping system for TradeWave signals, tracking entry/exit points, timeframes, profit/loss outcomes, and market condition observations. Define exact entry and exit procedures, including trade triggers, stop-loss placement, and profit-taking strategies to eliminate hesitation during live trading. Continue paper trading new signals throughout the day, applying your established rules and procedures to ensure seamless execution before risking real money.

Day 4: Multi-Timeframe Application

Day 4 expands your TradeWave proficiency by incorporating multi-timeframe analysis to enhance signal accuracy and timing precision. Configure your charts to monitor three key timeframes simultaneously—daily, hourly, and 15-minute intervals—creating a comprehensive view of market momentum across different time horizons. Practice identifying alignment and divergence patterns across these timeframes, learning to recognize when all timeframes confirm a signal versus when they present conflicting information.

Develop specific rules for handling timeframe conflicts, establishing clear criteria for which timeframe takes priority and how to proceed when signals don’t align perfectly. Document current market signals across all three timeframes, creating a real-time snapshot of TradeWave opportunities. Continue paper trading throughout the day, now incorporating multi-timeframe confirmation into your signal selection process.

Day 5: Live Trading Preparation

Day 5 marks your transition from simulation to live trading, facilitated by a comprehensive review and system optimization. Begin by thoroughly reviewing your paper trading results from at least five completed TradeWave cycles to establish a performance baseline and identify execution patterns. Adjust your trading plan based on these insights, refining entry and exit procedures, position sizing rules, and signal selection criteria to address weaknesses and capitalize on strengths.

Set up broker integration for efficient execution, ensuring seamless connectivity between Trade Ideas and your online brokerage account to minimize slippage and delays. Prepare a dedicated trading journal with templates capturing signal strength, timeframe alignment, market conditions, and emotional state for each trade. Finally, identify 3-5 current potential setups across various markets, analyzing them through your multi-timeframe approach to prepare for your first live executions.

Day 6: Initial Live Implementation

Day 6 represents your crucial transition from paper trading to live market execution, beginning with the careful implementation of your first real TradeWave signal. Execute your first live TradeWave signal using a significantly reduced position size to minimize risk while gaining confidence in real-money execution and experiencing how emotions may differ from paper trading. Document your exact entry with screenshots and comprehensive notes, capturing the technical setup, emotional state, market conditions, and reasoning behind the trade selection.

Monitor your position without manual interference, trusting the system you’ve developed. Update your trading journal with detailed observations throughout the trade lifecycle, noting:

- Differences between live and paper trading

- Unexpected market reactions

- Insights for future improvement.

Day 7: System Assessment & Refinement

This final day completes your TradeWave implementation, including a system assessment and the establishment of long-term success habits. Review your first live trades and execution quality, analyzing both technical outcomes and emotional responses to identify differences from your paper trading experience. Identify procedural improvements needed based on real-world execution, refining entry and exit processes, signal selection criteria, or risk management protocols to address any discovered gaps. Gradually increase position size toward your target risk level as confidence and consistency improve, ensuring each increment aligns with successful execution rather than rushing to full sizes.

Your Trading Transformation Begins Now

Completing this 7-day TradeWave implementation plan marks the beginning of your journey toward systematic trading success. From here: schedule weekly performance reviews to maintain accountability and continuous improvement, creating a systematic approach to analyzing results and adjusting strategy. Establish a daily routine for scanning TradeWave signals to ensure consistent opportunity identification. Finally, join the TradeWave community forum for ongoing support, connecting with other traders to share insights, troubleshoot challenges, and stay updated on system enhancements.

By following this structured approach, you’ve built a solid foundation that transforms you from a reactive trader into a methodical strategist who capitalizes on market cycles with precision and confidence. Remember that mastery comes through consistent application and continuous refinement. The paper trading phase isn’t just practice—it’s your laboratory for understanding how TradeWave performs across different market conditions. Use this data to fine-tune your approach before committing significant capital.

Stay committed to the process, trust the system you’ve learned to implement, and let TradeWave guide you toward the consistent profitability that has made it one of Trade Ideas’ most celebrated innovations.

Begin your journey today at Trade Ideas to await the Money Machine waiting for you.