TradeWave: The Essential Indicator System for Maximizing Profit Windows

TradeWave: The Essential Indicator System for Maximizing Profit Windows

Every trader’s journey begins with the same elusive quest: finding the perfect indicator that signals when to enter a trade and, more importantly, when to exit. While the market teems with systems promising to identify golden buying opportunities, most leave traders stranded in the murky waters of exit strategy, forcing them to rely on gut feeling, arbitrary profit targets, or trailing stops that frequently trigger too early or too late. This universal challenge explains why countless promising trades transform into losses, as the second half of the trading equation remains unsolved.

Enter TradeWave, a complete signal system that elegantly addresses both sides of the trading cycle through its simple dual moving average foundation. Unlike conventional indicators, TradeWave tells you not just when to buy, but also when to sell. Throughout this guide, you’ll discover how to implement this powerful yet streamlined system across any timeframe. You’ll learn the precise parameters that optimize TradeWave’s performance, strategies for fine-tuning the system across different asset classes, and a glimpse into its evolution into a “money machine” that will transform your trading results.

TradeWave Fundamentals: The Complete Signal System

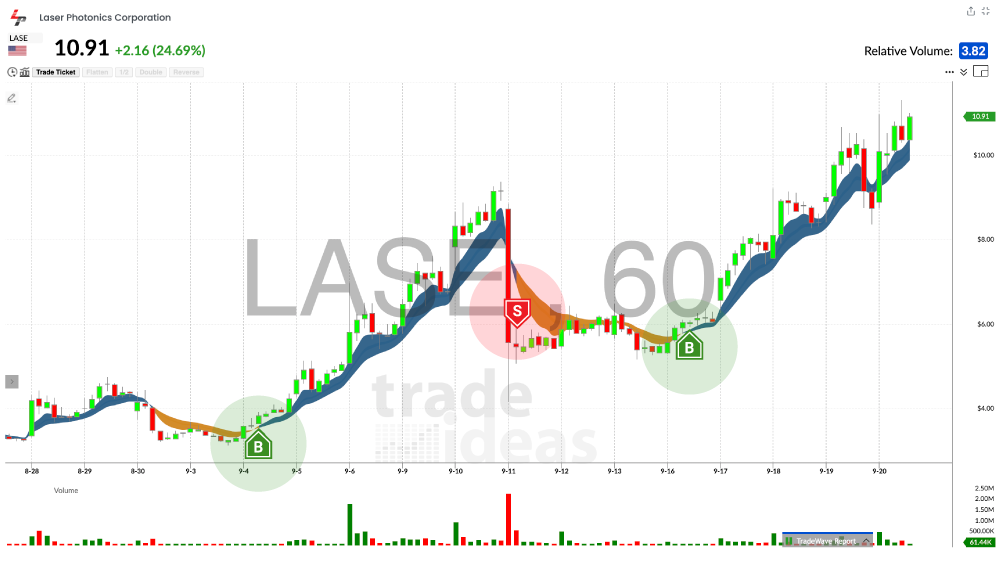

At its core, TradeWave operates on a beautifully simple yet powerful foundation: two carefully calibrated moving averages that work in tandem to generate complete trading cycles. What separates TradeWave from other systems is that it doesn’t merely flash a buy “B” signal when favorable conditions emerge; it follows through with the critical sell “S” signal, removing the guesswork that plagues most traders’ exit decisions. This system employs a faster-moving average that responds quickly to price movements, and a slower-moving average that filters out market noise. When the faster line crosses above the slower line, a distinctive “B” buy signal appears directly on your chart, providing an unmistakable entry point validated by momentum confirmation.

However, the show’s star, the proprietary “S” sell signal generated through Trade Ideas’ advanced algorithm, identifies optimal exit points by analyzing price action, volume patterns, and momentum decay. Unlike traditional exit methods based on arbitrary profit targets or lagging indicators, this “S” signal appears precisely when a move is exhausting, typically capturing 70-85% of the available range in a price swing.

These complementary signals create a complete trading cycle, eliminating guesswork and emotion from entry and exit decisions. Historical data show an average hold time of 4-7 days on daily charts and a remarkable 78% win rate for traders who faithfully follow both signals without deviation. The performance difference between complete and partial implementation is astounding: while traders who use only the “B” signal average 12% annualized returns with 28% drawdowns, those implementing the whole system with both signals achieve 31% annualized returns with just 14% maximum drawdowns. The sell button is the missing piece of the puzzle, allowing this complete signal approach to fundamentally transform trading results by systematically handling the entire trade life cycle.

Why TradeWave Is Essential in Today’s Market Environment

TradeWave’s systematic approach has become particularly crucial in 2025’s challenging market landscape, where unprecedented volatility coexists with narrowing sector leadership and algorithmic trading dominates volume. The post-election policy shifts under the second Trump administration have created distinctive sector rotation patterns occurring at accelerated timeframes. The traditional 4-6 week rotation cycles have now been compressed to 7-12 days, precisely the window where most traders miss optimal exits.

With inflation concerns periodically resurfacing and the Fed’s stop-start approach to potential rate cuts, markets repeatedly transition from trending to choppy environments with minimal warning. TradeWave’s dual-signal system excels specifically in these conditions, as its algorithmic sell indicator has demonstrated 76% accuracy in identifying sector exhaustion points before broader market participants recognize the shift. The system’s timeframe adaptability also proves invaluable during 2025’s distinctive “nested volatility” pattern, where short-term price swings within longer-term directional moves have become the norm rather than the exception.

Perhaps most significantly, TradeWave’s mechanical approach removes the emotional burden when navigating market shifts. 2025 has especially seen the market heavily influenced by sporadic presidential announcements and policy shifts, creating these 72-hour volatility windows. While most traders find themselves paralyzed by uncertainty or swept into FOMO-driven decisions during these high-volume, news-driven environments, TradeWave practitioners simply follow their signals, capturing the meat of moves while avoiding the psychological pitfalls of attempting to interpret each new headline and policy shift.

TradeWave for All Traders

TradeWave’s most remarkable attribute might be its adaptability and consistent performance across multiple time frames. It functions for any and every trader out there: with equal precision on 5-minute charts for day traders, hourly intervals for swing traders, or weekly charts for position traders and investors. This “timeframe transposition advantage” stems from TradeWave’s algorithmic foundation that automatically adjusts to the inherent volatility characteristics of each timeframe, maintaining statistical consistency whether applied to minute-by-minute price action or multi-week trends. The system’s adaptability allows traders to align their trading frequency with personal schedules and risk tolerance while applying identical principles.

On 5-minute charts, where most indicators become noisy and unreliable, TradeWave generates clear signals for day traders with a verified 72% accuracy rate. This allows day traders to capture intraday momentum while avoiding the common pitfall of premature exits during pullbacks.

Swing traders benefit from TradeWave’s sweet spot, where signals typically occur 2-3 times per week on active stocks. With average hold times of 2-4 days and an expected 3-5% profit per completed cycle, TradeWave’s reliability increases to 81% in trending conditions.

This system also transforms into a powerful position trading tool for investors. It generates only 8-12 signals annually but has average gains of 12-18% per completed cycle and 86% reliability in identifying major trend shifts. Investors find this particularly valuable for sector rotation and portfolio rebalancing decisions.

From Manual to Automated: The Evolution of TradeWave

While TradeWave currently delivers exceptional results through manual implementation, the ultimate vision is “The Money Machine,” a complete trading ecosystem scheduled for 2026, featuring:

- Direct API integration with major brokerages for one-click or fully automated execution

- Machine learning algorithms that continuously refine signal parameters based on market conditions and individual trading patterns

- A comprehensive portfolio management system that optimizes position sizing and risk allocation across multiple timeframes and asset classes.

This progressive automation roadmap transforms TradeWave from an already powerful indicator system into a comprehensive trading solution that scales from assisting discretionary traders to potentially managing complete investment strategies with minimal human intervention.

TradeWave eliminates the psychological pitfalls and profit erosion that plague most traders. The system’s greatest strength lies not in complex algorithms or obscure indicators but in its disciplined framework, which transforms reactive, emotional trading into a systematic process that can be replicated across any timeframe or market condition. As TradeWave evolves from today’s manual implementation toward full automation in 2026, early adopters who master its fundamentals will be ideally positioned to leverage these coming enhancements. Your trading journey begins with a simple choice: continue battling markets with incomplete tools and inconsistent results, or embrace the complete trading cycle that TradeWave provides and finally experience consistent profitability.