Swing Trading Strategies: Identifying High-Reward, Low-Risk Setups with Trade Ideas

Swing Trading Strategies: Identifying High-Reward, Low-Risk Setups with Trade Ideas

Are you interested in swing trading but unsure how to identify the best setups? In this blog post, we’ll explore the strategies Andy, a seasoned trader with 25 years of experience, uses the powerful Trade Ideas software to find high-reward, low-risk trading opportunities.

Andy dedicates approximately an hour to meticulously analyzing several scans within the Trade Ideas platform every morning. His primary objective is to identify stocks with the potential for substantial upside moves while presenting limited downside risk. By leveraging the software’s extensive filters and customizable settings, Andy can craft bespoke scans tailored to his unique trading style and preferences.

These scans allow him to quickly sift through vast amounts of market data and pinpoint specific chart patterns, technical indicators, and price actions that align with his predefined criteria. This targeted approach enables Andy to focus on the most promising opportunities, saving time and effort.

Through years of experience and refinement, Andy has developed a keen eye for identifying essential setups that offer an attractive reward-to-risk ratio. He carefully assesses factors such as trend direction, momentum, volume, and support/resistance levels to determine the viability of each potential trade. By combining the power of Trade Ideas’ cutting-edge technology with his own market insights and risk management strategies, Andy can consistently uncover high-quality swing trading opportunities that less experienced traders may overlook.

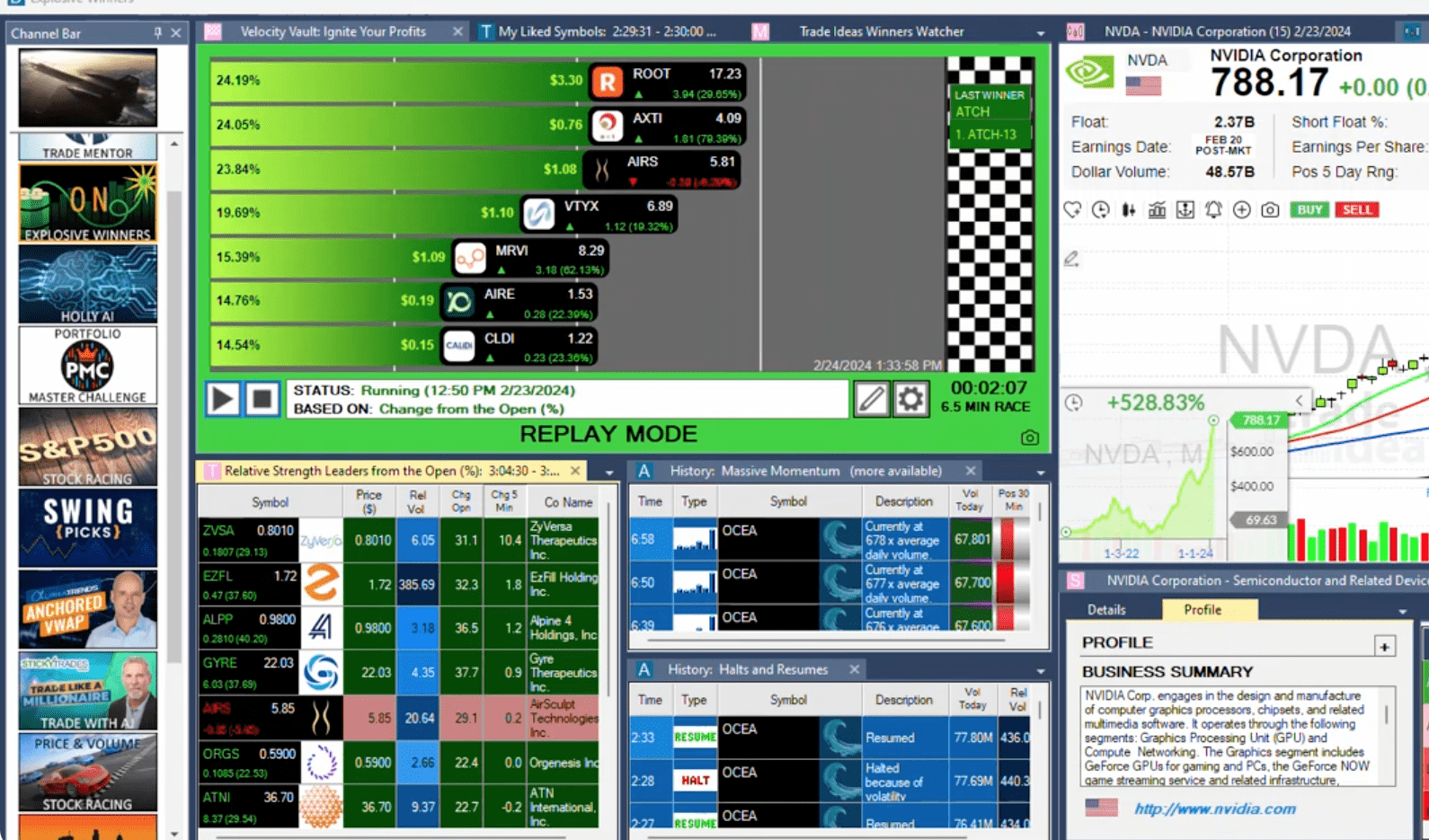

After compiling his list of potential trades, Andy shares them with subscribers through the Trade Ideas platform. The “Ti Trader eye curated swing ideas” channel allows users to view these handpicked stocks in various formats, such as a race, top list, or tree map. Additionally, Andy posts a video on the Trade Ideas LLC Twitter channel, highlighting four or five of his favorite setups from the list.

A few examples of some High-Potential Setups include:

- Nvidia (NVDA): On January 5th, Nvidia appeared on Andy’s “sweetness” scan at $491, indicating a potential move higher. The stock subsequently experienced a significant upward trend.

- IBM: On January 11th, IBM showed up on the “nice setup” scan, displaying a wedge pattern. After a brief consolidation period, the stock continued its upward trajectory.

- Twilio (TWLO): Despite a significant gap up after earnings, Twilio has been pulling back while finding support at its 10-period moving average. A break above the recent high could signal a potential move higher.

- Clorox (CLX): After a post-earnings gap up, Clorox has been consolidating. A move above the $154.20 level could indicate a continuation of the uptrend.

With powerful tools and customizable scans within Trade Ideas, swing traders can identify high-potential setups with favorable reward-to-risk ratios. Andy’s approach, which involves daily analysis and sharing his findings with the trading community, demonstrates the effectiveness of this strategy. As you develop your own swing trading methodology, consider incorporating the techniques discussed in this blog post to help refine your stock selection process.