The Cross and the Candlestick: Exploring the Intersection of Faith and Finance on Good Friday

The Cross and the Candlestick: Exploring the Intersection of Faith and Finance on Good Friday

By Katie Gomez

Good Friday is upon us, and even if you don’t celebrate, it is still an important day for traders, as it is one of the select few holidays where the stock market is closed. This holy day, which falls on the Friday before Easter Sunday, is a time for reflection, prayer, and remembrance. Many Christians and Catholics attend church services, participate in processions, or observe a period of fasting and meditation. The somber tone of Good Friday stands in stark contrast to the joyous celebration of Easter Sunday, which marks the resurrection of Christ and the triumph of life over death.

While Good Friday holds deep spiritual meaning for the Christian faithful, it also has a notable impact on finance and trading. In the United States, the stock market has traditionally closed on Good Friday, with the New York Stock Exchange (NYSE) and Nasdaq observing the holiday since the late 19th century. This closure is one of the few non-federal holidays recognized by the stock market, underlining the cultural significance of Good Friday in American society.

In this article, we will delve deeper into the intersection of faith and finance on Good Friday, exploring the historical and cultural context of the market closure and the strategies and considerations traders should consider when approaching this significant day on the financial calendar.

Preparing for Good Friday Market Closures

The Good Friday market closure affects traders and investors in several ways. For one, it decreases liquidity and trading volume, as many market participants are away from their desks. This can lead to increased volatility in the days leading up to and following the holiday as traders adjust their positions and manage risk in anticipation of the closure. Moreover, the absence of U.S. market activity on Good Friday can impact global markets, as investors worldwide react to news and events without participating in the world’s largest economy.

Navigating this market closure requires careful planning and preparation for traders, factoring in the potential for increased volatility. By understanding the implications of the Good Friday closure and taking proactive steps to mitigate risk, traders can ensure that their portfolios remain resilient and well-positioned for the holiday and beyond.

Market-closing holidays are essential for traders because they force them to take a break from active trading and focus on reflection, emotional control, and planning for what’s to come next instead of trading on impulse.

How Trade Ideas can help you navigate it

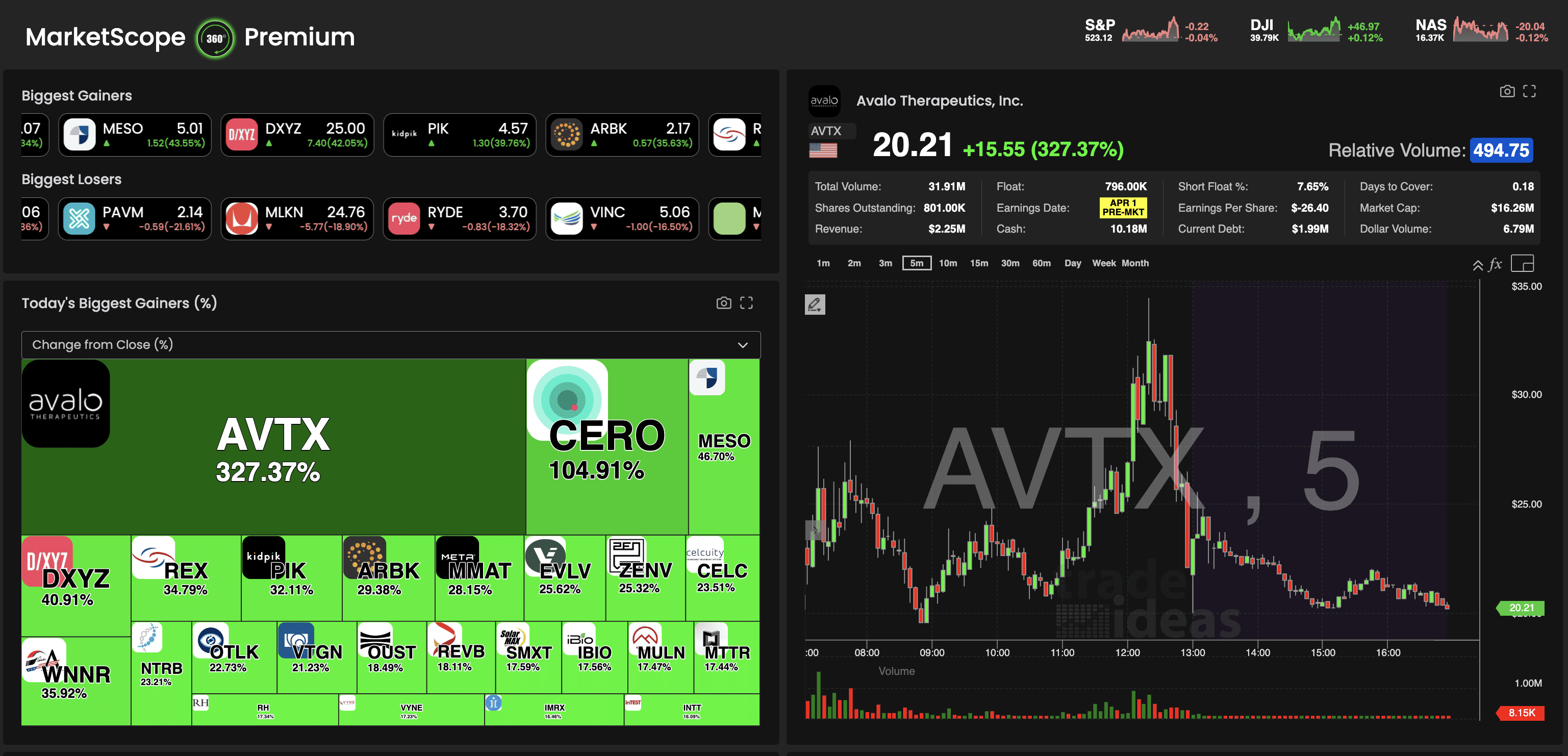

As traders prepare for the unique challenges and opportunities presented by the Good Friday market closure, the Trade Ideas platform emerges as a powerful tool for managing risk, identifying potential trades, and staying ahead of the curve. Trade Ideas is a comprehensive market intelligence and analysis software that empowers traders with real-time data, advanced analytics, and custom alerting capabilities.

One of Trade Ideas’ key advantages is its ability to help traders quickly identify and capitalize on potential trading opportunities, even in the face of market closures and volatility. The platform’s advanced scanning algorithms and real-time data feeds allow users to monitor various markets and asset classes, spotting trends and anomalies other traders may overlook. During this time, Trade Ideas can help traders by:

Identifying pre-holiday momentum: By setting up custom scans and alerts, traders can spot stocks and sectors experiencing strong momentum in the days before Good Friday’s closure. This helps traders make informed trading decisions and manage their positions ahead of the holiday.

Monitoring global markets: Trade Ideas’ global market coverage allows traders to monitor international markets that remain open on Good Friday, potentially capitalizing on opportunities or hedging risk as needed.

Backtesting and strategy optimization: Our backtesting capabilities allow traders to test and refine their strategies based on historical data, including previous Good Friday market closures. This can help traders identify patterns, optimize entry and exit points, and develop robust trading plans.

Risk management and position sizing: Trade Ideas’ risk management tools, such as the OddsMaker and RiskSwimLane, can help traders assess the probability of success for potential trades and manage their positions accordingly. This is especially important in the context of increased volatility around market closures.

By leveraging Trade Ideas’ powerful features and insights, traders can approach the Good Friday market closure with greater confidence and preparedness. The platform’s real-time analytics, custom alerting, and risk management tools can help traders stay agile and informed, even in the face of unique market conditions.

As traders navigate Good Friday’s intersection of faith and finance, the Trade Ideas platform is a valuable ally, offering cutting-edge tools and insights to help traders prepare for market closures, manage risk, and seize opportunities. By leveraging the power of Trade Ideas, traders can approach Good Friday and every trading day with greater confidence, discipline, and success.

Beyond the specific context of Good Friday, Trade Ideas is committed to empowering traders with the tools and knowledge they need to achieve consistent success in the market. Through educational resources such as webinars, tutorials, and a vibrant user community, we provide ongoing support and guidance for traders at all experience levels. For more information, visit Trade Ideas today, and use my code KATIE15 for 15% to find the program best suited to you.