Unlocking the Power of Low Float Opening Range Breakouts: A High-Quality Trading Setup

Unlocking the Power of Low Float Opening Range Breakouts: A High-Quality Trading Setup

By Jamie Hodge

Are you looking for a reliable and potentially lucrative trading setup? Look no further than the low float opening range breakout. This post explores a real-world example of identifying and trading this powerful setup using the Trade Ideas platform. By the end of this article, you’ll have a solid understanding of what makes this setup so effective and how you can incorporate it into your own trading strategy.

What is a Low Float Opening Range Breakout?

A low float opening range breakout occurs when a stock with a few shares available for trading (typically under 3 million) breaks above the high or below the low of its opening range. The opening range is the price range a stock trades within during a specified period after the market opens, usually 60 minutes.

Identifying the Setup with Trade Ideas

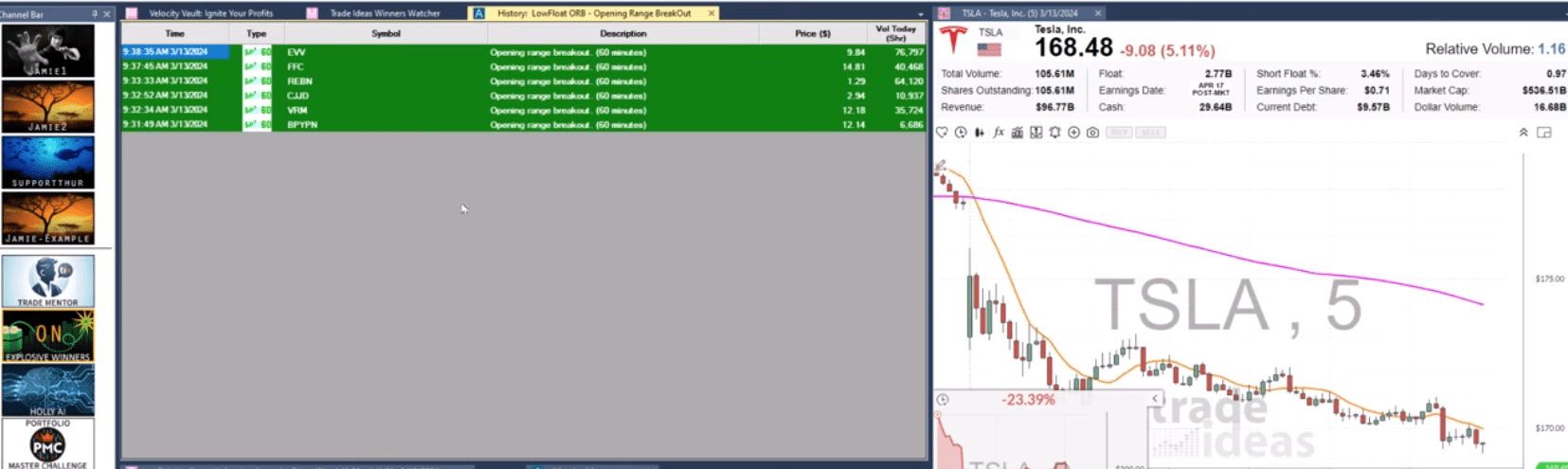

We can easily create a custom alert window to identify low float opening range breakouts using the Trade Ideas platform. The critical components of this alert include:

- Price range: Minimum price of $1 and maximum price of $15

- Relative volume: At least 1.2 times average volume

- Float: Less than 3 million shares

- Time filter: Alerts only during the first hour of trading

By setting up this alert, we can quickly scan the market for stocks meeting these criteria, saving valuable time and effort.

Analyzing the Candidates

Once the alert window populates with potential setups, analyzing each candidate carefully is crucial. Not every stock that triggers the alert will be a high-quality setup. Look for the following characteristics:

- Clean, tight price action before the breakout

- Clear breakout above the opening range high or below the opening range low

- Strong relative volume

In this video’s example, VRM stood out as a high-quality setup. It had a tight opening range and a clear breakout on strong volume.

Managing Risk and Potential Reward

Before entering a trade, it’s essential to assess your risk. A common method is to look at the prior 15 minutes of the price action (not including the breakout candle) and set your stop loss just below the low of that range. In the VRM example, this would have meant risking about $0.50 per share.

The potential reward for these setups can be substantial. In the case of VRM, the stock rose from around $12.20 at the breakout to nearly $22, offering a potential 20R return (20 times the initial risk).

Low-float opening range breakouts offer traders a robust and repeatable setup for identifying stocks with potential significant moves. By scanning the market using tools like Trade Ideas and applying a disciplined approach to risk management, traders can unlock the power of these setups and potentially enhance their trading results.

Remember, not every breakout will be a winner, but focusing on high-quality setups and managing risk carefully can tilt the odds in your favor. Incorporate this strategy into your trading plan, and with practice and persistence, you may find it a valuable addition to your trading toolbox.