4 Steps to Effective Capital Allocation in Day Trading

4 Steps to Effective Capital Allocation in Day Trading

By: Shane Neagle

Gaining proficiency in capital allocation is essential to a trader’s success in the fast-paced world of day trading, where snap decisions can have significant financial repercussions. This is really about developing a methodical approach to risk management, not merely about seeking the most rewards. Effective capital allocation is likened to a complex game of chess, in which every move is meant to secure not just a temporary advantage but also the long-term development and safeguarding of one’s trade capital.

At the heart of day trading lies the potential for swift profit generation through astute, well-timed actions. Yet, without a robust framework for capital allocation, traders risk being swayed by market volatility, seeing their funds dwindle due to poorly thought-out choices rather than well-informed strategies. This introduction to the principles of capital allocation is not merely an overview; it serves as a gateway to a deeper understanding of how to manage trading resources effectively. It champions a strategy that allocates every dollar purposefully, takes risks based on clear insights, and views every transaction as a building block toward enduring success.

Assess Your Risk Tolerance

Understanding your comfort with risk is crucial for making smart capital allocation choices in the world of day trading. This process goes beyond simply knowing how much risk you can handle on a personal level. It’s about recognizing the wider market risks that can influence all your investments. These broad concerns, such as changes in the global economy, changes in interest rates, or events in politics, that might have an impact on the market as a whole are covered by systematic risk. Developing a better understanding of these variables will help traders adjust their short- and long-term investing plans to reflect the current status of the market.

Examine your prior trading experiences and financial goals more closely to ascertain your level of risk tolerance. Consider this: Are you pursuing short-term success or long-term development? Think back to your previous transactions. How did you handle losses, and when did the market’s volatility begin to impair your judgment? This isn’t about setting boundaries but about understanding the playing field where you’re most comfortable and effective.

You are managing the market with strategy and purpose as opposed to merely responding to its ups and downs by evaluating both systematic risk and individual risk tolerance. This method assists traders in creating a well-thought-out plan for their day trading operations, protecting them from unforeseen market volatility, and helping them aim for maximum returns.

Diversify Your Trades

Reducing risk in the fast-paced world of day trading requires spreading your assets over a variety of sectors, financial instruments, or trading tactics. One may ensure that earnings in one sector can equal, if not surpass, losses in another by employing a strategy known as diversification. In the erratic world of stock trading, where a single drop in one sector shouldn’t have the ability to collapse your entire trading strategy, this is the old advice of not placing all your eggs in one basket.

To spot the right mix of diversification that matches your trading style and outlook on the market, staying alert to the pulse of the market is crucial. For example, tech stocks might rally on the back of new technological breakthroughs, whereas commodities like gold could gain on market down days, serving as a hedge against volatility. Mixing up your trading playbook to include both short sprints and longer marathons can also tap into different aspects of market behavior, offering a balanced approach to day trading.

Diversifying effectively requires diligent research and a continuous hunt for new opportunities that could shield your portfolio from unexpected shifts. Keeping an eye on financial news, digesting market analysis, and leveraging technical indicators can unveil new paths for spreading your capital. Looking beyond your home market to include international stocks can also add a layer of diversification, as global markets often move independently of each other.

Ultimately, smart diversification is about more than just defense against risk—it’s an active strategy that enhances your trading portfolio’s robustness. By intentionally choosing a diverse set of trades that support each other, traders can forge a portfolio that’s not only resilient to market swings but also primed for seizing a wide range of opportunities.

Set Clear Budgeting Rules

Crafting precise budgeting guidelines is crucial for day traders striving to effectively navigate through market volatility. This involves deciding the exact amount of capital you’re prepared to invest in each trade to avoid undue risk on any single position. Such a methodical approach ensures a balanced portfolio, protecting your total trading funds from substantial downturns.

Begin by assessing the potential profit of each trade. Your willingness to risk should be proportionate to the expected gains. For higher potential returns, you might choose to allocate a bit more of your capital. Yet, it’s important to temper enthusiasm with a dose of caution, making sure your investment accurately reflects both the opportunity’s promise and its associated risks.

The size of your overall trading budget is also a key factor. Establishing a maximum proportion of your total money that you are willing to risk on a single deal is a good idea. Experienced traders typically advise limiting this risk to one to two percent of their overall trading funds for each deal. This approach ensures that a series of losses won’t critically deplete your resources, leaving you with the capacity to bounce back over time.

Furthermore, in today’s digital trading environment, the agility to promptly adapt investment strategies and respond to market shifts is invaluable. The use of electronic signature technology streamlines the process of quickly updating trading agreements and budgeting plans. This tool enables traders to execute necessary documents efficiently, ensuring that their capital allocation strategies remain agile and responsive to the ever-evolving market conditions.

Monitor and Adjust Regularly

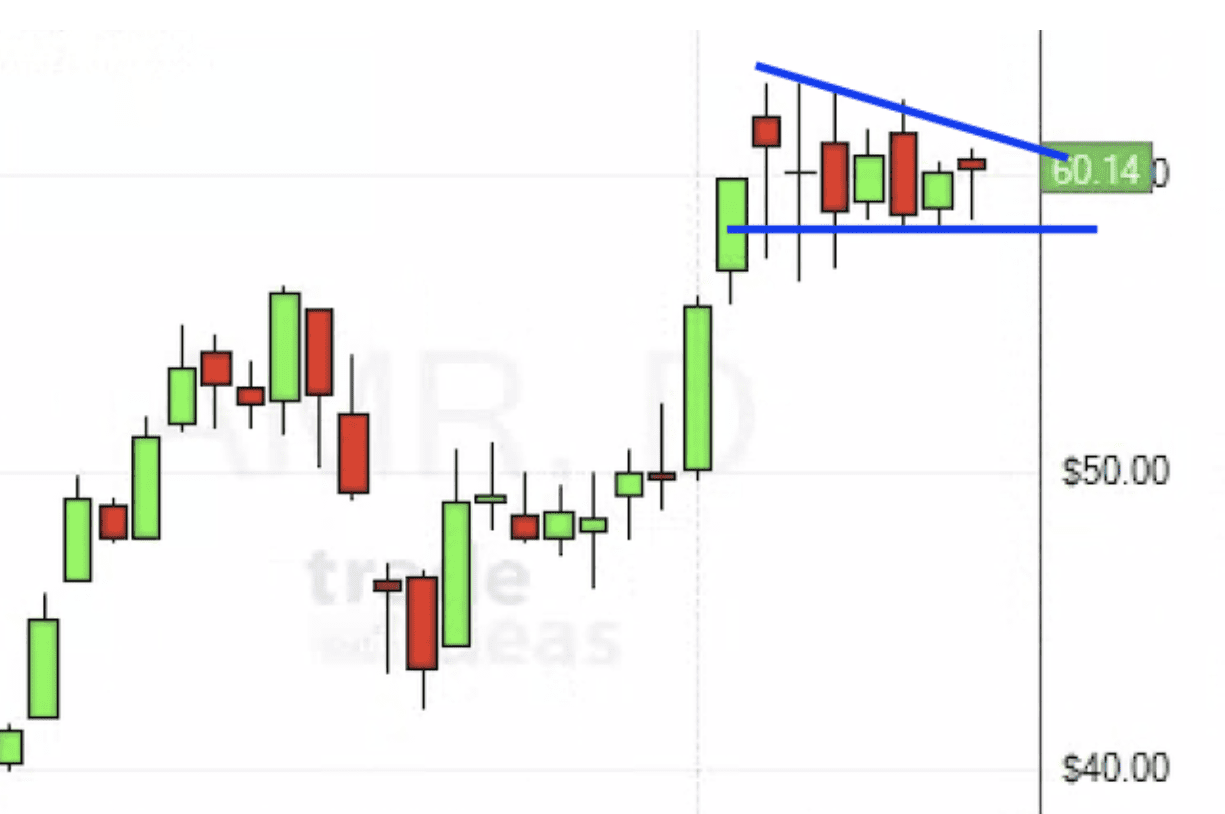

The dynamic nature of day trading necessitates maintaining vigilance and adaptability in your investing approach. Variations in economic indicators and happenings on a worldwide scale are only two of the many elements that impact the financial markets, which are not static. Hence, being prepared to adjust your capital distribution in response to market dynamics is key. Conducting routine assessments of how your investments are performing allows you to discern which strategies are hitting the mark and which might require a rethink.

Such periodic evaluations are critical. They illuminate the performance of various aspects of your portfolio, signaling when it might be wise to shift your focus or double down on successful areas. For instance, noticing a trend of underperformance in specific sectors could suggest the need for reallocating resources, while identifying consistent gains in others might indicate opportunities for increased investment.

Moreover, these regular check-ins serve as an opportunity to realign your trading approach with the prevailing market conditions. The trading landscape can dramatically change due to economic news, policy changes, or unforeseen global events, affecting overall market behavior and possibly your trading outcomes.

In essence, the practice of diligently monitoring and potentially revising your approach to capital allocation forms an integral part of successful day trading. It requires a dedication to remaining current with market trends and exhibiting flexibility in your approach. By means of this continuous process of evaluation and modification, traders may augment their capacity to endure market fluctuations, leverage nascent prospects, and finally raise their trading efficacy. This proactive, flexible approach to investment management emphasizes how crucial a dynamic strategy is to long-term success in the erratic world of day trading.

Conclusion

Gaining proficiency in capital allocation is essential in the fast-paced world of day trading and is the first step toward success. Through careful evaluation of risk tolerance, maintaining a diversified portfolio, following stringent budgetary restrictions, and continuously adjusting tactics in response to market input, traders arm themselves with a powerful toolset for navigating the constantly shifting dynamics of the stock market. With this all-inclusive strategy, traders may efficiently protect their money from the unpredictability of day trading while pursuing maximum returns.

Embracing a structured method for managing capital offers traders the flexibility needed to swiftly adapt to new market information, seizing profitable opportunities while keeping potential losses at bay. The essence of this strategy lies in its forward-looking perspective, always anticipating market trends and adjusting plans to stay ahead. Staying true to a strategy that emphasizes diversification, risk awareness, and dynamic adjustments lays the groundwork for a durable trading operation.

Essentially, the ability to manage funds properly and make rapid, educated decisions are the keys to success in day trading. By adhering to these rules and taking a proactive approach to market swings, traders may turn day trading into a calculated, strategic endeavor, opening the door to long-term success and stability in the fast-paced world of trading.