Swing Trading Watchlist: Applying Scans to Find High Reward Setups

Swing Trading Watchlist: Applying Scans to Find High Reward Setups

By Andy Lindloff

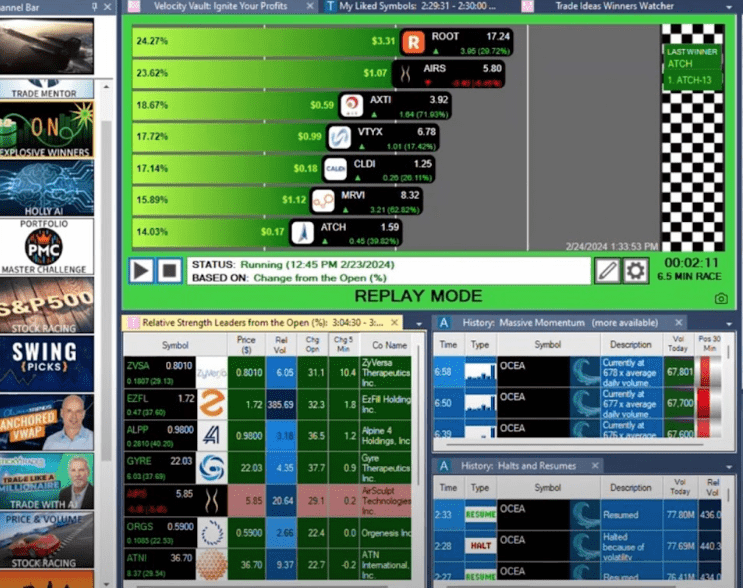

As an experienced trader and long-time user of Trade Ideas software, I spend extensive time each morning reviewing targeted scans for stocks, setting up favorably for swing trades. In this blog, I will share my process for curating a dynamic watchlist of names with strong technical setups and asymmetrical reward-risk ratios.

The key is leveraging Trade Idea’s robust filtering capabilities to build scans isolating specific chart pattern characteristics. Whether a bull flag continuation setup, consolidation under key moving averages, or retests of prior support, I can screen for stocks exhibiting the exact formations that often lead to higher significant moves.

I then compile my best prospects into a single Global Watchlist via the TI Trader – Curated Swing Ideas channel. This allows traders to monitor these hand-picked ideas using dynamic market data.

As past examples, both Nvidia and IBM appeared on my scans in early January, displaying constructive price action and signaling upside potential. Had traders bought as suggested, they would have captured a massive run as each broke out over the following weeks.

The setups stocks that typically share common traits:

- Defined chart pattern with catalysts like earnings or technical trigger

- Clear range or support level to define initial stop loss risk

- Favorable risk/reward potential if pattern triggers

My favorite Trade Ideas scan for locating these prospects is called “Poised” – it explicitly targets names that have pulled back to key moving averages or prior breakout areas after strong momentum moves. These often possess the power to rebound sharply as buyers regain conviction.

A few names on my radar currently include Toast, Fulgent Genetics, Gates Industrial, and Clorox. Each display chart formations that suggest upside potential is building. By applying defined scans, I can identify similar high-probability swing setups systematically.

I will plan to publish more examples and insights each week. Be sure to join my watchlist to get real-time email alerts whenever a new trade idea triggers entry. Leveraging technology to enhance precise technical analysis with favorable risk management is the key to profitable swing trading.