Day Trade like a Pro: Opening Range Breakout

Day Trade like a Pro: Opening Range Breakout

As an active trader, I always seek stocks poised to make big moves. One of my favorite strategies is identifying high-quality breakout setups that allow me to get in early on emerging trends. I will review how I identify high-probability breakout setups with limited risk.

I’ll share two recent breakout trades I spotted that delivered outsized rewards with minimal complex risk. I’ll also explain my process for finding these kinds of low-risk, high-reward trading opportunities.

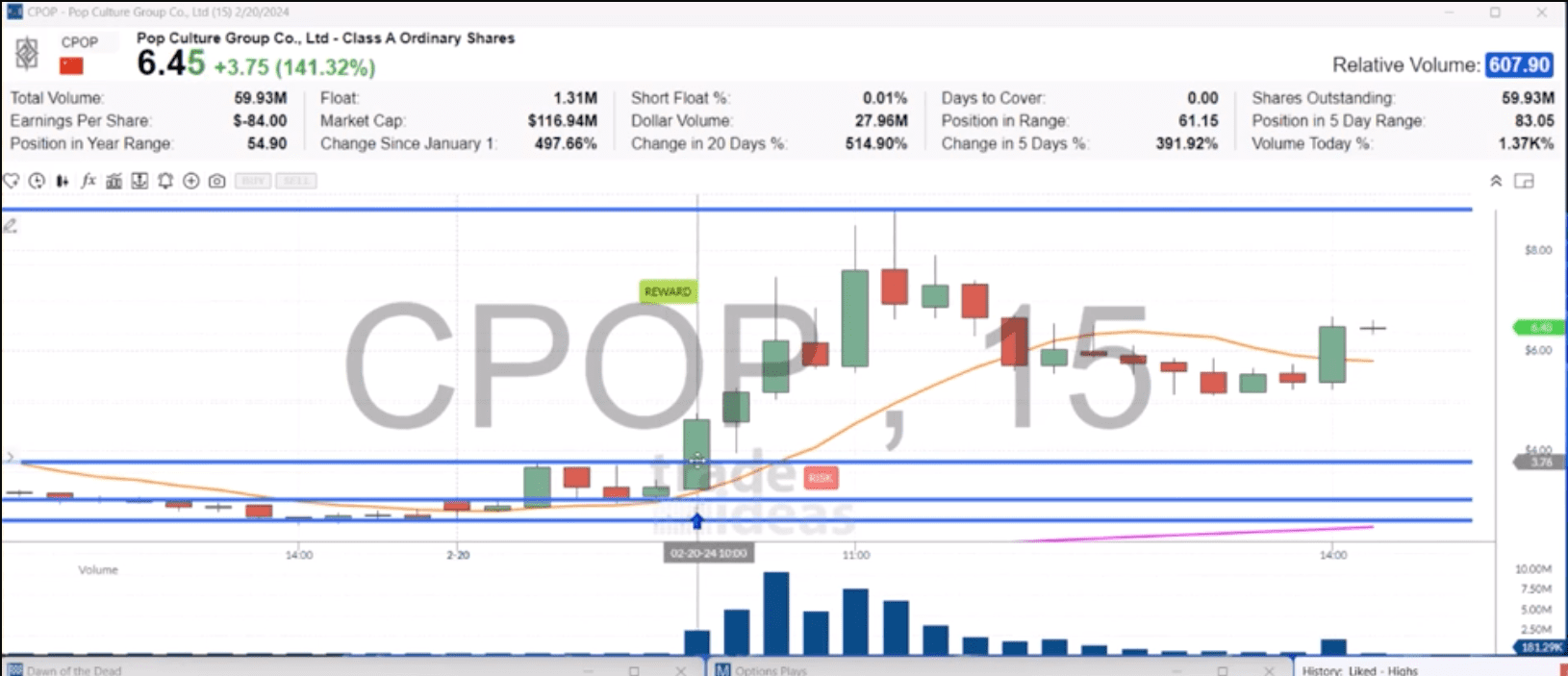

The first example is CPOP, a micro float stock with just 1.31 million shares in its float. The key ingredients were there – a low float name capable of big moves on increased volume.

As I was checking my portfolio at market opening, I was stalking this name and saw signs of accumulation occurring after the first hour of trading. As the morning progressed, CPOP carved out a tight trading range, coiling like a spring ready to pop.

Around 10 AM, the stock pushed above the previous hour’s high. This break of resistance triggered my buy order at $3.80 with a tight stop loss set under the prior 15-minute candle’s low at $3. My total risk was 80 cents compared to a potential reward of over $5, as the stock had room to run to the $9 level.

Sure enough, CPOP broke out with force on a significant volume. The trading range tightened up right before the move, which gave me confidence it would follow through. My planned trade worked flawlessly – CPOP soared 150% higher in just under an hour!

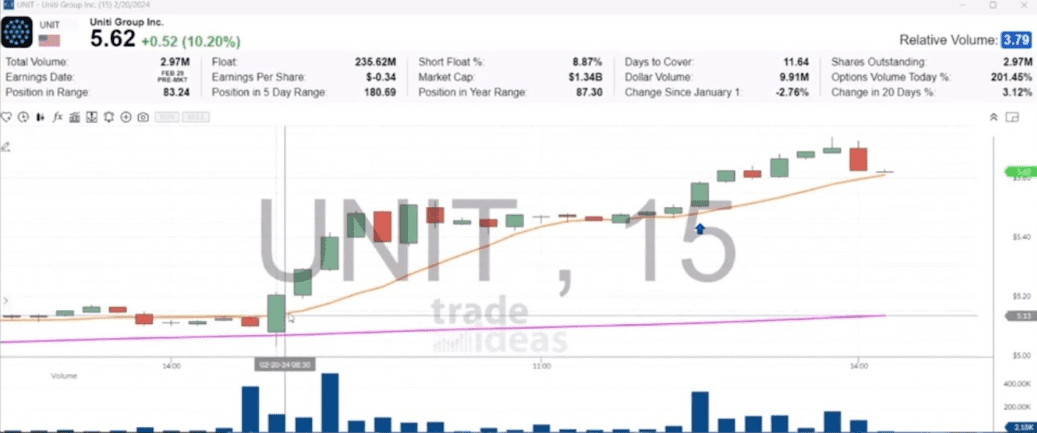

The second example I’ll cover is UNIT, which has a more giant 235 million share float. While not quite as explosive as the tiny float CPOP, the technical setup was just as sound.

UNIT traded primarily flat during the first hour of the session – not uncommon, while traders established the extremes of the trading range. As the morning progressed, UNIT carved out a tight price consolidation, showing bulls and bears were in equilibrium.

This back-and-forth action created a low-risk entry with a stop loss under the recent swing low. After 4 hours of choppy trade, UNIT finally pushed up through resistance, which I used as a buy trigger at $5.53. My stop was less than a dime under the prior 15-minute low.

UNIT went on to gain over 20 cents from my entry in short order – more than two times my risk allowance. The key ingredients also came together for this trade: a tight range leading up to the breakout and an adequately placed stop-loss order below logical support.

In both cases, I could identify high-probability breakout setups with predefined points of risk built in. This identification allows me to limit any losses if the trades don’t work out as planned while giving the upside room to run if the breakout move gains momentum.

By studying volume patterns and price action context, I am better equipped to spot emerging trends early on. Proper trade planning, execution, and risk control are crucial to succeed in this fast-paced environment. Breakout trading offers tremendous profit potential for those focused on risk first.

Click here to watch the video explaining this post: https://www.youtube.com/watch?v=py1zdjIA7wU

Try Trade Ideas for yourself today! Use code TRADEIDEAS15 for 15% off your subscription purchase.