4 Advanced Order Types Every Day Trader Must Master

4 Advanced Order Types Every Day Trader Must Master

By: Shane Neagle

Have you ever thought about what makes experienced traders stand out from inexperienced day traders? It’s their strategic application of sophisticated trading instruments that masterfully navigate the quicksilver changes of the market.

Keeping abreast in the day trading arena demands an in-depth understanding of advanced order types. Far from being just ordinary tools, these are the strategic essentials for implementing precise strategies, ensuring risk is well-managed, and seizing fleeting opportunities in the market. Understanding of stop-loss orders, limit orders, conditional orders, and trailing stop orders can significantly enhance a trader’s performance.

This knowledge is far from just being advantageous—it’s imperative. In a market scenario where sentiments can flip at a moment’s notice, being adept with these advanced order types gives traders an unparalleled advantage, positioning them to respond with decisiveness. Let’s dive into how mastering these advanced instruments can transform your day trading strategy, steering you with certainty and insight through the market’s complex dynamics.

Stop-Loss Orders

Stop-loss orders are an essential tool for day traders, serving as a crucial mechanism to limit potential losses on their investments. Essentially, these orders instruct your broker to sell off a security when it hits a specified price point, acting as a safeguard against unfavorable market shifts. This setup is invaluable for traders who cannot, or prefer not to, watch the market’s every move, offering a layer of protection that helps manage financial exposure.

When it comes to employing stop-loss orders effectively, the strategy behind their placement can significantly impact risk management outcomes. A popular method involves setting these orders at a predetermined percentage below the purchase price. This approach provides a clear, quantifiable method to cap losses, with many traders favoring a threshold somewhere between 2% and 5% beneath their entry point. This percentage is chosen based on the individual’s risk tolerance and the volatility of the particular asset, offering a balance between potential reward and risk.

On the other hand, using technical indicators to determine stop-loss positions introduces a tailored strategy that takes into account the market’s technical signals. This method might involve setting stop-loss levels just below key support lines or within certain patterns indicated by moving averages or Bollinger Bands. This technique requires a deeper dive into market analytics, aiming to place stop-loss orders in spots that are informed by the asset’s historical behavior and current market trends.

Choosing between a fixed percentage method or a technical analysis approach depends largely on the trader’s individual style, risk preference, and the nature of the securities in question. Regardless of the chosen method, the primary aim of a stop-loss order remains the same: to provide traders with peace of mind through a planned exit strategy, enabling them to participate in the market with a well-defined safety net for their trades.

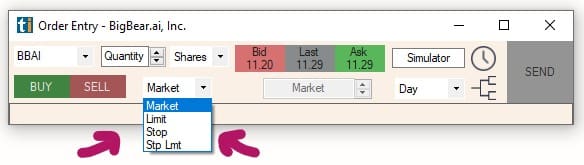

Limit Orders

Limit orders are the unsung heroes for day traders looking to dial in their trade executions with laser precision. Imagine setting a trap where your trade automatically triggers at the price you’ve eyed, without having to glue yourself to the screen. That’s the prowess of limit orders for you. They’re giving traders the ability to set the price at which you’re willing to purchase or sell, putting you in control of your trading.

Assume you’re putting a purchase limit order at a price that is somewhat lower than the market’s current rate. When the price falls (as it frequently does in the volatile world of trading), your order kicks in, and you’ve caught a deal. The same goes for sell limit orders. Set one above the current price, and when the market climbs, your stock sells at your ideal price point, potentially padding your profits.

The strategic edge of limit orders doesn’t stop there. They’re your best bet in sidestepping slippage, ensuring you’re not caught off-guard by market volatility. They’re about making informed, calculated moves, setting up buy and sell points based on your thorough market analysis and not just a hunch. And when you pair limit orders with stop-loss orders, you’re essentially mapping out your trading strategy’s risk and reward, laying down a clear plan for where you’ll cut losses and take profits.

In essence, mastering limit orders is akin to mastering the art of patience and precision in trading. They empower you to execute your trades on your terms, offering a blend of control and strategic foresight that’s critical for navigating the markets successfully. It’s about making the market work for you, on your schedule and according to your plan.

Conditional Orders

Conditional orders serve as your personal trading lieutenant, ensuring that your strategies are executed in accordance with the exact rules you’ve established. Consider creating a trading game plan that works on autopilot, according to your specified parameters without requiring your continual attention. Given that many of these modern trading platforms are cloud-based, it is critical to implement effective cloud security measures to defend against unwanted access and data breaches, therefore securing your trading activities and sensitive financial information.

Consider the OCO (One Cancels the Other) order, a strategic maneuver that lets you place two orders at once, knowing that the execution of one will automatically cancel the other. It’s like setting up a plan to buy a stock if it hits a certain high or sell it off to cut losses if it dips, all in one fell swoop. Say the stock soars; your buy order kicks in while the sell order bows out, locking you into a promising position. If the stock takes a nosedive instead, the sell order activates, and the buy order steps back, safeguarding your investment from further decline.

Then there’s the clever use of conditional orders for trailing stops, which adjust in real-time with market shifts. You can set up your stop-loss to trail the market by a certain percentage or dollar figure, allowing you to secure gains or minimize losses as prices fluctuate.

These tools offer traders a blend of confidence and control, knowing their strategy is in motion 24/7, ready to jump on opportunities or dodge pitfalls as they come. Conditional orders not only make trading more streamlined but also enforce a level of discipline vital for trading success. They ensure your market moves are calculated and based on solid strategy rather than fleeting emotions. By embracing these sophisticated order types, traders can boost their market presence, executing precise, condition-based trades that align perfectly with their trading blueprint.

Trailing Stop Orders

Trailing stop orders inject a dynamic layer into traditional stop-loss strategies, offering traders a smarter way to shield their profits and cut losses in sync with market movements. This type of order cleverly adjusts itself as stock prices climb, ensuring that traders can hold onto their gains and minimize potential losses without the hassle of manually updating their stop positions.

Here’s the beauty of it: When you set a trailing stop, you decide on a specific percentage or dollar distance below the current market price. As the price moves up, the trailing stop creeps up too, always maintaining that predetermined gap from the highest price reached. If prices take a downturn, the trailing stop holds its ground, activating a sell if the price dips to the trailing stop level, thus protecting your investment from significant loss.

This approach shines in unpredictable markets, swiftly locking in profits before they can vanish. Trailing stops serve as an automatic guard, giving traders the freedom to let their successful positions flourish without sweating over every market fluctuation. It’s a way to ensure a part of your profits is always under protection, providing peace of mind.

Additionally, trailing stops streamline the trading experience. They adopt a “set it and forget it” philosophy, minimizing the need for constant market vigilance. This automated adjustment of stop levels allows traders to focus on the bigger picture, ensuring exit strategies are not swayed by short-term market noise but are instead part of a calculated, disciplined trading approach.

Ultimately, trailing stop orders are a critical tool for anyone looking to balance the act between securing hard-earned gains and leaving room for potential growth. They encapsulate a proactive risk management strategy, essential for navigating the twists and turns of the trading landscape with confidence.

Conclusion

Diving deep into the nuances of stop-loss, limit, conditional, and trailing stop orders isn’t just about honing a skill; it’s about crafting a resilient strategy that guards your investments and amplifies your chances for gains. These advanced order types are the very essence of strategic trading, providing traders with the sharp tools needed to slice through the market’s noise, aligning every move with their strategic vision and appetite for risk. In the ever-shifting sands of the financial markets, the relevance of these tools doesn’t wane; rather, it forms the cornerstone of savvy trading approaches.

Incorporating these refined order types into their strategy arsenal, traders find themselves well-equipped to strike a delicate balance between guarding against risks and chasing growth. Such equilibrium is vital in the whirlwind realm of day trading, where fortunes can turn on a dime, and markets often move with bewildering speed. Armed with these advanced orders, traders gain the upper hand, poised to make calculated moves based on set rules and automated protocols.

Wrapping up, the path to day trading mastery is paved with understanding and utilizing a suite of sophisticated trading tools. Among these, advanced order types stand out, offering the agility, command, and strategic depth essential for navigating today’s volatile markets. As traders continue to wield these tools with finesse and strategic insight, they lay the groundwork for a disciplined, streamlined, and, quite possibly, more fruitful trading journey.